Investor's Corner

Tesla registers 6,100 new Model 3 VINs amid continued production push

Tesla has registered 6,160 new Model 3 VINs, amid the company’s continued production ramp for the compact electric car. With the latest batch of new vehicle identification numbers, Tesla has filed a total of 62,557 Model 3 to date.

The recent registrations were shared on Twitter by @Model3VINs, a group that tracks Tesla’s filings for the vehicle. According to the group, the latest batch of Model 3 VINs comprised of Long Range RWD cars — a stark contrast to the 2,237 vehicle identification numbers registered by the company last week, which were largely dual motor AWD.

#Tesla registered 6,160 new #Model3 VINs. Highest VIN is 62557. https://t.co/qZjb57aSMM

— Model 3 VINs (@Model3VINs) July 1, 2018

Tesla’s VIN registrations for the Model 3 had seen a meteoric rise since May, when the electric car and energy company started filing large batches of the vehicle identification numbers. In May, for example, Tesla registered more than 17,900 new Model 3 VINs — a figure that took the company until March 23 to accomplish since starting the car’s production last July 2017.

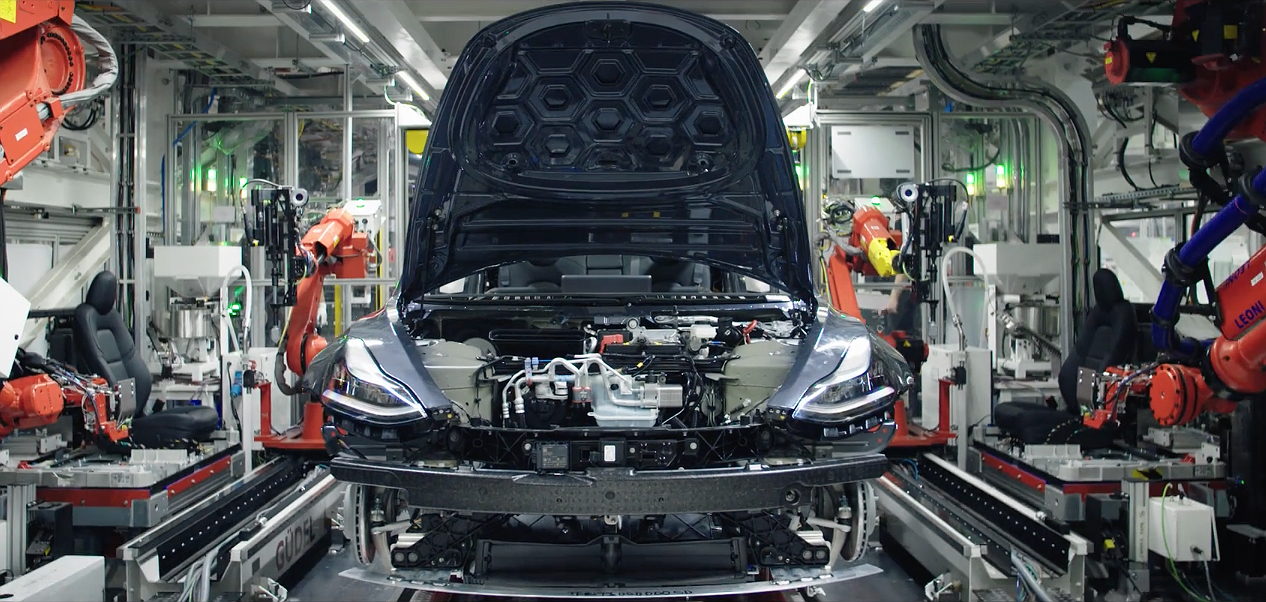

Particularly impressive this past June, however, were VIN batches that corresponded to filings for the dual motor AWD variant of the compact electric car. Earlier this year, Elon Musk announced on Twitter that Tesla would probably start production of the dual motor AWD and Performance Model 3 sometime in July, when the company has attained a steady production rate of 5,000 Model 3 per week. Midway through last month, however, Musk revealed on Twitter that the first Model 3 Performance has rolled off from a newly-built assembly line, which was set up in a sprung structure on the grounds of the Fremont factory.

The latest Model 3 VIN registrations come amid Tesla’s announcement that it has effectively hit a production rate of 5,000 Model 3 per week. The milestone, which has eluded Tesla since the vehicle started production last year, was teased over the last few weeks of June. In the weeks leading up to the end of Q2 2018, for one, sightings of overflow lots filled with Model 3 were shared by Tesla enthusiasts online. Tweets from workers at Fremont and Gigafactory 1 also teased that the company would hit its target by the end of the quarter.

- [Credit: Tesla Daily/Twitter]

- [Credit: The Tesla Life/Twitter]

Even before Elon Musk confirmed the news on Twitter, social media posts from the company’s workers in Fremont teased that the 5,000-a-week Model 3 target had been achieved. Among these was a photograph of a banner being signed by workers at the Fremont factory with the words “Model 3 5K Club” on it. Pictures of workers celebrating at the factory grounds and a Model 3 labeled as “5000th” also made the rounds in social media. Not long after this, Elon Musk himself congratulated the Tesla team on Twitter for producing 7,000 vehicles in one week. A leaked email from Musk later specified that the 7,000-vehicle output was comprised of 5,000 Model 3 and 2,000 Model S and Model X.

7000 cars, 7 days

♥️ Tesla Team ♥️— Elon Musk (@elonmusk) July 1, 2018

The announcement of Tesla’s production milestone for the Model 3 appears to have provided a boost to investors’ sentiments. As of writing, Tesla shares (NASDAQ:TSLA) are trading up 6.28% during pre-market, at $365.44 per share.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.