News

Tesla Semi truck’s battery pack and overall weight explored

The big question on everyone’s mind–at least on the minds of those who understand the freight transportation industry–is how much the Tesla Semi might weigh. If Tesla’s all-electric semi truck is to be competitive at all, it must be capable of carrying the same loads as current-use semi-trucks in the Class 8 field do.

A big point of contention from nay-sayers and those in the trucking industry who understand logistics was the lack of announcement of the Tesla Semi’s actual weight. Plenty of press was given to the much-touted “80,000-pound capacity” number bandied around by CEO Elon Musk during the truck’s unveiling late last year. That number, however, refers only to the gross vehicle weight (GVW) of the Tesla Semi and is, in fact, exactly the same number used by every Class 8 truck on the road. They’re called Class 8s, in fact, because the 8 refers to that 80,000-pound total vehicle capacity.

What wasn’t given by Tesla was the gross vehicle tare weight (GVTW) of the Semi. This is a far more important number. Where the GVW gives the total capacity of the truck in terms of how much its freight plus the truck itself can weigh, the GVTW gives just the weight of the truck, sans trailer and freight. This number tells logistics experts how much actual freight and trailer the truck can haul legally.

For example, a typical “day cab” configuration 18-wheeler with a diesel engine weighs roughly 32,000 pounds with a relatively lightweight box trailer attached and full fuel tanks. That leaves about 48,000 pounds of freight capacity for the truck. That’s important because, although the truck won’t be loaded to capacity every time, it will be expected to be capable of carrying up to about that weight. Most big rigs on the road are capable of hauling 44,000 or more pounds worth of freight, depending on configuration and trailer type.

Having experience with driving commercial trucks in the past, once hauling a refrigerated trailer that had a freight capacity of 44,500 pounds, I learned that some industries count on freight capacity as part of their logistics costs and will literally fill a truck to its maximum in order to minimize those costs.

In logistics, weight and total freight capacity are highly important metrics in the overall scheme.

What We Know

Thinking about that, then, let’s look at what we know of the Tesla Semi and its potential weight. We know that the truck uses four independent electric motors that are derived from the Model 3, that it has an energy consumption of less than 2 kWh per mile, and that it can be charged to up to 400 miles in about half an hour. We also know that Elon promised 300 to 500 miles of range in total. On that latter point, it’s pretty clear that a “lower range, cheaper option” will be offered as has been done with most of Tesla’s vehicles to-date. So we can assume a 300-mile version and a 500-mile version will be forthcoming for the Semi.

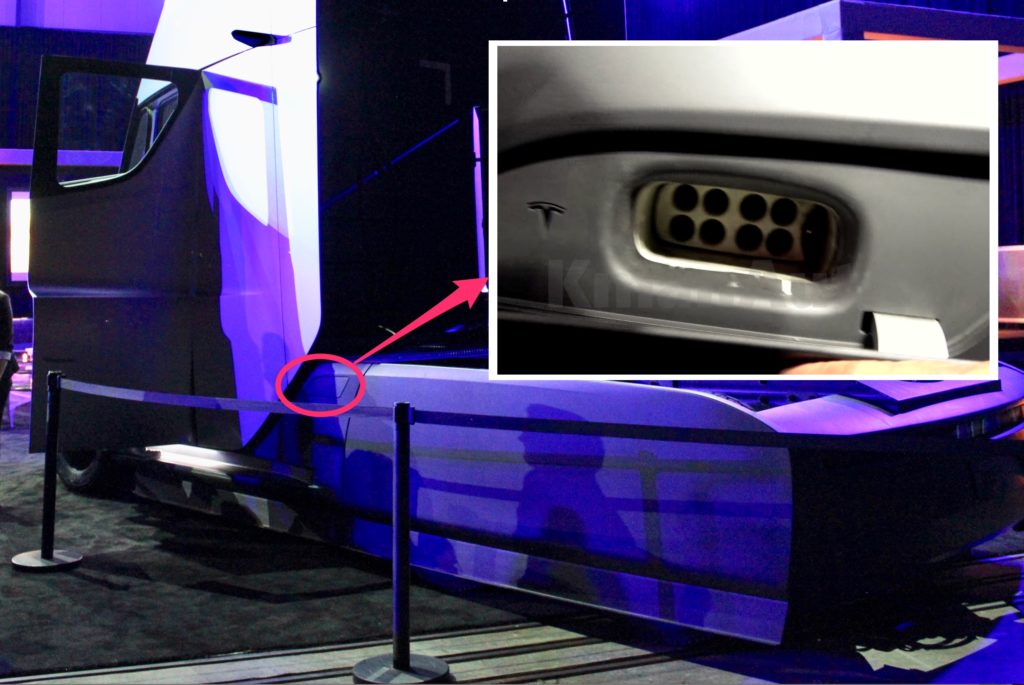

We also know that the Tesla Semi had eight ports in its charging plug array. We saw this at the unveil in some close-up photos.

It’s clear to us that even if the Tesla Semi isn’t to become a big player in the trucking industry, the idea behind it will change things forever.

What We Don’t Know

What we don’t know is whether Musk and Co have something up their sleeves for the batteries. Much of the speculation regarding the Tesla Semi has been in regards to Tesla Semi’s massive battery pack.

In actuality, having a huge battery breakthrough on a vehicle like the Tesla Semi would not necessarily be a good thing for business. If there is a huge breakthrough, then all bets are off and most of our speculation in this article is moot. That would, however, mean that the sales potential of the Semi would be far lower than it would be otherwise because one thing that logistics companies and fleet managers aren’t interested in are flashy new, breakthrough, and (most importantly) untested, unproven technologies.

To a fleet manager, those phrases mean “breaks often, expensive to fix” and the potential positives will be ignored because of that. No one who wants to keep a job as a fleet manager or logistics purchaser will gamble on something unproven. Like new battery technology for a truck whose primary cost will be in its batteries. Likewise, unless there is a clear benefit in some terms other than pure business (like marketing or potential tax breaks), no board of directors will risk shareholder wrath on new tech either.

Close-up look at Tesla Semi’s drivetrain from underneath

We can say, as a side note, that most of the orders that have been placed for the Tesla Semi thus far are from corporations and companies who are doing business in areas where the marketing bonanza and potential tax incentives for laying down those relatively low-cost deposits are immense. Most of the companies involved have already invested heavily (and very publicly) in alternative fuel options outside of Tesla over the past few years. We also note the timing of both the Tesla Semi’s announcement (and order-taking) and the before-2018 rush by potential customers to put in deposits.

We reiterate that our not knowing if Tesla has some kind of big battery breakthrough announcement is a big “if” in our analysis here.

What People Smarter Than Us Have Said

Some people who know more than we do about things like math and engineering science have crunched the numbers on the Tesla Semi’s battery potentials. Over at Engineering.com, John Ewbank broke the results down into layman format. Here’s the gist.

If the Tesla Semi uses 2 kWh to travel a mile, then a 500-mile range means 1,000 kWh of power. That is not the actual size of the battery, though, as the charging requirement would preclude a huge pack.

In order to get 400 miles in thirty minutes of charging, Ewbank notes, the charger would have to be 1.6MW to achieve the 800kWh of promised charge in only 30 minutes. Charging at that rate is not possible because the result would be arching in the pack, which would surely be akin to the next Boring Company Flamethrower meme when Semi trucks begin to explode in flames during charging as a regular event. So the charging has to be split up.

Tesla Semi Megacharger port could support 1 MW of power.

The answer is simple, of course, and may explain the strange layout of the eight-port charging hub shown on the Semi at its unveil: there are four battery packs.

Instead of one big pack, four smaller packs (one for each motor, even) are used and are thus charging separately from one another, but simultaneously. Based on Tesla Semi’s Megacharger port configuration, this would likely mean that four of them are positive sides and the other four are grounds. Allowing for a single, huge wire to be plugged into each. The controls for the charging system interface may be plugged in separately (perhaps the oval-shaped black thing to the side?).

What This Adds Up To

We add up that bit of information plus what we know about the truck and get an estimated weight. Using the current weight of a Tesla Model S battery pack at 540kg per 90 kWh, we can do some simple math to estimate the Semi’s batteries would weigh about 6,000 kg. We aren’t sure about the new battery weights for the upcoming battery updates, but we can assume a 10-15 percent reduction from several factors (storage density, improvements in chemistry, packaging lightening) without being too aggressive or overly optimistic. Going with the fifteen percent reduction, that 6,000 kg drops to 5,100 kg. That’s about 11,244 pounds.

A conventional tractor, as we’ve said, has a tare weight of around 32,000 pounds when fully fueled and with a lightweight box trailer in place. Remove the trailer and the truck itself is about 22,500 pounds. It’s difficult to then go to just the weight of the powertrain components and fuel, but they’re considerably less than 11,000 pounds in all.

Tesla Semi spotted doing a tire-shredding acceleration run down in the wild

Looking at the shipping weight for a crated engine and transmission for a Class 8 truck, we can see that they weigh about 8,000 pounds on average. Add in fuel and other components and another 1,500 pounds (at most) are put on the truck. We then assume that the rest of the truck (framing, braking systems, air compressor, etc) are about the same for the Tesla Semi in order for it to meet Class 8 standards. So we call those a wash.

That means that the Semi, under our estimates, is roughly two tons heavier than would be a standard day cab big truck in the Class 8 category. This means the Semi would be that much less capable in terms of freight hauling that’s offset by its unprecedented all-electric performance. That amount, however, is probably not enough to stop the primary buyers of a day cab truck like this from balking at a purchase. The weight difference alone would be repaid in potential fuel savings, tax incentives, green marketing, and maintenance costs.

The trouble will come with cost differences. If the ROI is not there, most logistics buyers won’t write any purchase orders. But at least we can say that as far as we can tell, the weight differences of the Tesla Semi alone aren’t going to be a huge bar against entry into the trucking industry.

News

Tesla seeks approval to test FSD Supervised in new Swedish city

Tesla has applied to conduct local Full Self-Driving (Supervised) testing in the city of Jönköping, Sweden.

Tesla has applied to conduct local Full Self-Driving (Supervised) testing in the city of Jönköping, Sweden.

As per local outlet Jönköpings-Posten, Tesla has contacted the municipality with a request to begin FSD (Supervised) tests in the city. The company has already received approval to test its Full Self-Driving (Supervised) software in several Swedish municipalities, as well as on the national road network.

Sofia Bennerstål, Tesla’s Head of Public Policy for Northern Europe, confirmed that an application has been submitted for FSD’s potential tests in Jönköping.

“I can confirm that we have submitted an application, but I cannot say much more about it,” Bennerstål told the news outlet. She also stated that Tesla is “satisfied with the tests” in the region so far.

The planned tests in Jönköping would involve a limited number of Tesla-owned vehicles. Trained Tesla safety drivers would remain behind the wheel and be prepared to intervene if necessary.

Tesla previously began testing in Nacka municipality after receiving local approval. At the time, the company stated that cooperation between authorities, municipalities, and industry enables technological progress and helps integrate future transport systems into real-world traffic conditions, as noted in an Allt Om Elbil report.

If approved, Jönköping would become the latest Swedish municipality to allow local Full Self-Driving (Supervised) testing.

Tesla’s Swedish testing program is part of the company’s efforts to validate its supervised autonomous driving software in everyday traffic environments. Municipal approvals allow Tesla to gather data in urban settings that include roundabouts, complex intersections, and mixed traffic conditions.

Sweden has become an increasingly active testing ground for Tesla’s driver-assistance software in Europe, with regulatory coordination between local authorities and national agencies enabling structured pilot programs.

Elon Musk

Microsoft partners with Starlink to expand rural internet access worldwide

The update was shared ahead of Mobile World Congress.

Microsoft has announced a new collaboration with Starlink as part of its expanding digital access strategy, following the company’s claim that it has extended internet connectivity coverage to more than 299 million people worldwide.

The update was shared ahead of Mobile World Congress, where Microsoft detailed how it surpassed its original goal of bringing internet access to 250 million people by the end of 2025.

In a blog post, Microsoft confirmed that it is now working with Starlink to expand connectivity in rural and hard-to-reach regions.

“Through our collaboration with Starlink, Microsoft is combining low-Earth orbit satellite connectivity with community-based deployment models and local ecosystem partnerships,” the company wrote.

The partnership is designed to complement Microsoft’s existing work with local internet providers and infrastructure companies across Africa, Latin America, and India, among other areas. Microsoft noted that traditional infrastructure alone cannot meet demand in some regions, making low-Earth orbit satellite connectivity an important addition.

Kenya was cited as an early example. Working with Starlink and local provider Mawingu Networks, Microsoft is supporting connectivity for 450 community hubs in rural and underserved areas. These hubs include farmer cooperatives, aggregation centers, and digital access facilities intended to support agricultural productivity and AI-enabled services.

Microsoft stated that 2.2 billion people globally remain offline, and that connectivity gaps risk widening as AI adoption accelerates.

Starlink’s expanding constellation, now numbering more than 9,700 satellites in orbit, provides near-global coverage, making it one of the few systems capable of delivering broadband to remote regions without relying on terrestrial infrastructure.

Starlink is expected to grow even more in the coming years as well, especially as SpaceX transitions its fleet to Starship, which is capable of carrying significantly larger payloads compared to its current workhorse, the Falcon 9.

Elon Musk

Tesla expands US LFP battery supply with LG Energy Solution deal: report

The report was initially published by TheElec, citing industry sources.

LG Energy Solution (LGES) will manufacture lithium iron phosphate (LFP) energy storage system (ESS) batteries for Tesla at its Lansing, Michigan facility.

The report was initially published by TheElec, citing industry sources.

LG Energy Solution’s Lansing plant, formerly known as Ultium Cells 3, was previously operated as a joint venture with General Motors. LGES acquired GM’s stake in May 2025 and now fully owns the site. With a production capacity of 50 GWh per year, it is one of the company’s largest facilities in North America.

LG Energy Solution is converting part of the Lansing factory to produce LFP batteries for energy storage systems. Equipment orders for the new lines have already been placed, and mass production is reportedly expected to begin in the second half of next year.

Last July, LG Energy Solution disclosed a 5.94 trillion won battery supply agreement running from August 2027 to July 2030. While the company did not name the customer, industry sources pointed to Tesla as the buyer.

Tesla has primarily used CATL’s prismatic batteries for its Megapack systems. The move to source prismatic LFP cells from LG Energy Solution’s U.S. plant could then be seen as part of Tesla’s efforts to bolster its North American supply base for its energy storage business.

For the Lansing conversion, LG Energy Solution reportedly plans to use electrode equipment originally ordered under its Ultium Cells venture with General Motors. Suppliers reportedly include CIS and Hirano Tecseed for electrode systems, TSI for mixing equipment, CK Solution for heat exhaust systems, A-Pro for formation equipment, and Shinjin Mtech for assembly kits.

Tesla currently manufactures energy storage products at facilities in California and Shanghai, though another Megafactory that produces the Megapack is also expected to be built in Texas. As per recent reports, the Texas Megafactory recently advanced with a major property sale.