News

Tesla won’t slow despite Edmunds claim that loss of tax credit will “kill the U.S. EV market”

Edmunds has released a new study that claims the loss of federal tax credits for EV buyers is “likely to kill the U.S. EV market.” It goes on to say, “Without these credits, this market is likely to crash.” Edmunds bases its analysis on what happened when the state of Georgia repealed its EV incentive program in the middle of 2015. Not only did Georgia eliminate its EV incentive, it also imposed new fees on EV drivers designed to offset the loss of revenue the state experienced because cars with electric motors use less gasoline.

Up until then, Georgia gave every qualifying EV buyer a $5,000 credit — the largest in the nation. That was on top of the $7,500 federal tax credit and made buying an EV in Georgia a very attractive proposition. The biggest beneficiary was the Nissan LEAF. In June, 2015 — the last month the incentive was available — 1,008 of them were sold or leased. In July, after the rebate was no longer available, 66 cars were delivered.

Cars eligible for the state incentive accounted for up to 17% of the new car market in Georgia. Following the legislature’s decision to eliminate the credit, they have fallen to about 2% of sales. Note that is still higher than the percentage of EV sales in the US as a whole.

Should Tesla be concerned? Not really says the Motley Fool. Data compiled by IHS Markit and included in the Edmunds analysis shows a drop in sales of the Model S shortly after Georgia repealed its rebate but sales quickly recovered and have since gone on to set new records for the company in the Peachtree State.

The federal tax credit was originally a pump priming exercise intended to help EV manufacturers get started. The assumption Congress made when it first enacted the credit was that once a company had sold 200,000 cars with plugs, economies of scale would begin to kick in, making it possible to build and sell electrified cars profitably without government assistance.

Tesla is getting close to that figure and will surely pass it once the Model 3 gets into production this summer. After that, the federal tax credit for Tesla vehicles will begin to phase out. In addition, many people worry the Trump administration will kill the federal EV tax credit entirely. According to Edmunds, that means Tesla could suffer a dramatic decline in sales — at least in the US. Here’s why that won’t happen according to the Motley Fool.

Not so fast

First, any comparison between a 2015 Nissan LEAF and a 2018 Tesla Model 3 is a lopsided contest. The LEAF is a fine car but it suffers from a serious lack of range. Nor does it have any of the industry leading technology Tesla offers its customers. It relies on the CHAdeMO charging standard, which is rapidly losing ground to the CCS standard and the Tesla Supercharger network.

Red Tesla Model 3 at the vehicle unveiling event on March 31, 2016 from the company’s Hawthorne, CA Design Center.

Second, the base price of the Model 3 is $35,000, which happens to be very near the average selling price of a new passenger vehicle in the US market today. With or without incentives, the Model 3 will be highly competitive. With nearly 400,000 reservations worldwide, demand for the Model 3 is clearly not dependent on government financial incentives.

The real issue here is that electric car sales have not advanced as quickly as electric car advocates predicted. Range anxiety, lack of charging infrastructure, and fear of the unknown have kept many people from buying an electric car, whether from Tesla or any other manufacturer. The “tipping point” when electric cars become the first choice of mainstream car buyers is tantalizingly close but still not here yet.

Reasonable people may disagree about the best way to promote electric cars. Paying people to buy them may not be as beneficial to society as subsidizing the infrastructure needed to charge them. The interstate highway system was a hugely expensive undertaking but it unleashed an unprecedented surge in US economic output. Today it is still the backbone of commerce in America. Putting the money used to fund the federal EV tax credit to work building the nation’s charging infrastructure could be a more efficient use of resources.

By any analysis, the Tesla phenomenon is not dependent on government incentives. It is based on building compelling electric automobiles that outperform the competition. Elon Musk deliberately chose to start at the top of the market to attract those who influence public opinion. That strategy is working and will continue to work even if the federal tax credit is eliminated entirely.

Elon Musk

Tesla investors will be shocked by Jim Cramer’s latest assessment

Jim Cramer is now speaking positively about Tesla, especially in terms of its Robotaxi performance and its perception as a company.

Tesla investors will be shocked by analyst Jim Cramer’s latest assessment of the company.

When it comes to Tesla analysts, many of them are consistent. The bulls usually stay the bulls, and the bears usually stay the bears. The notable analysts on each side are Dan Ives and Adam Jonas for the bulls, and Gordon Johnson for the bears.

Jim Cramer is one analyst who does not necessarily fit this mold. Cramer, who hosts CNBC’s Mad Money, has switched his opinion on Tesla stock (NASDAQ: TSLA) many times.

He has been bullish, like he was when he said the stock was a “sleeping giant” two years ago, and he has been bearish, like he was when he said there was “nothing magnificent” about the company just a few months ago.

Now, he is back to being a bull.

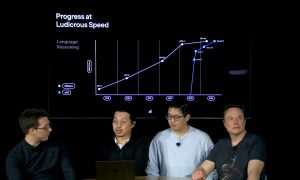

Cramer’s comments were related to two key points: how NVIDIA CEO Jensen Huang describes Tesla after working closely with the Company through their transactions, and how it is not a car company, as well as the recent launch of the Robotaxi fleet.

Jensen Huang’s Tesla Narrative

Cramer says that the narrative on quarterly and annual deliveries is overblown, and those who continue to worry about Tesla’s performance on that metric are misled.

“It’s not a car company,” he said.

He went on to say that people like Huang speak highly of Tesla, and that should be enough to deter any true skepticism:

“I believe what Musk says cause Musk is working with Jensen and Jensen’s telling me what’s happening on the other side is pretty amazing.”

Tesla self-driving development gets huge compliment from NVIDIA CEO

Robotaxi Launch

Many media outlets are being extremely negative regarding the early rollout of Tesla’s Robotaxi platform in Austin, Texas.

There have been a handful of small issues, but nothing significant. Cramer says that humans make mistakes in vehicles too, yet, when Tesla’s test phase of the Robotaxi does it, it’s front page news and needs to be magnified.

He said:

“Look, I mean, drivers make mistakes all the time. Why should we hold Tesla to a standard where there can be no mistakes?”

It’s refreshing to hear Cramer speak logically about the Robotaxi fleet, as Tesla has taken every measure to ensure there are no mishaps. There are safety monitors in the passenger seat, and the area of travel is limited, confined to a small number of people.

Tesla is still improving and hopes to remove teleoperators and safety monitors slowly, as CEO Elon Musk said more freedom could be granted within one or two months.

News

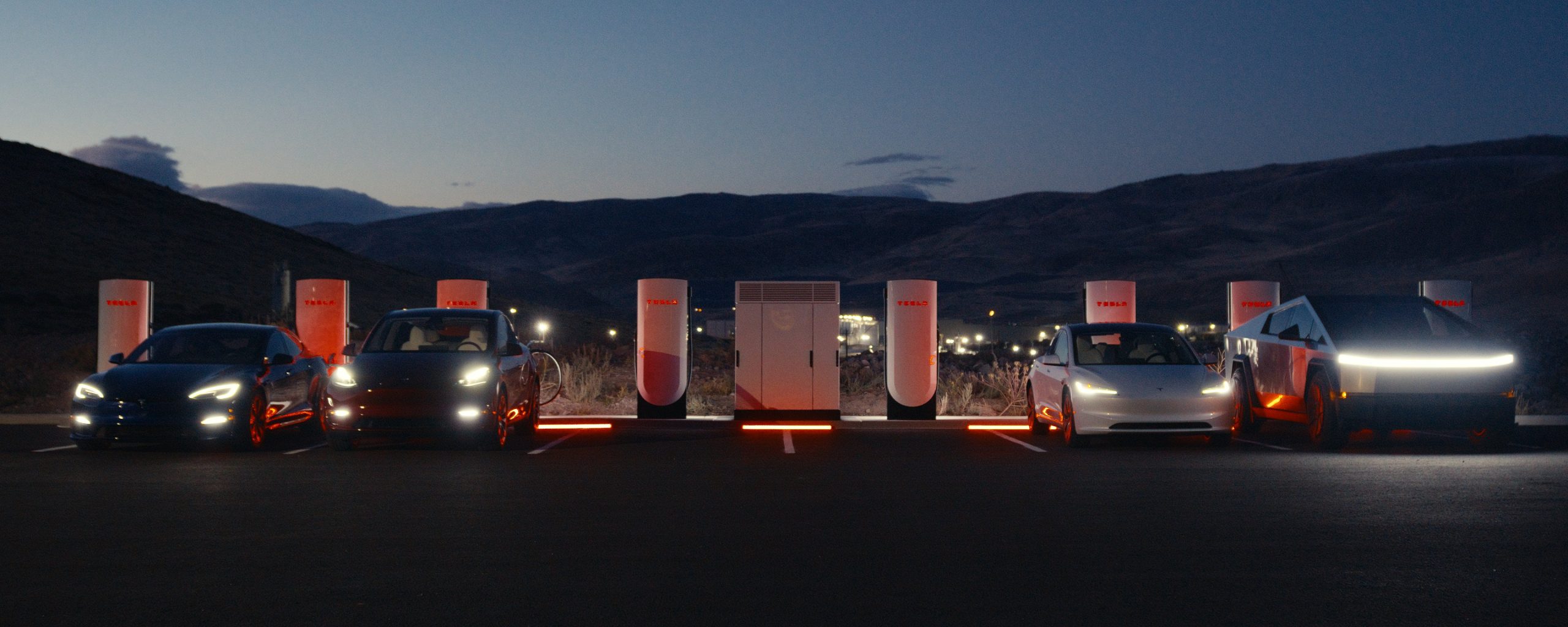

Tesla launches ultra-fast V4 Superchargers in China for the first time

Tesla has V4 Superchargers rolling out in China for the first time.

Tesla already has nearly 12,000 Supercharger piles across mainland China. However, the company just initiated the rollout of the ultra-fast V4 Superchargers in China for the first time, bringing its quick-charging piles to the country for the first time since their launch last year.

The first batch of V4 Superchargers is now officially up and running in China, the company announced in a post on Chinese social media outlet Weibo today.

The company said in the post:

“The first batch of Tesla V4 Superchargers are online. Covering more service areas, high-speed charging is more convenient, and six-layer powerful protection such as rain and waterproof makes charging very safe. Simultaneously open to non-Tesla vehicles, and other brands of vehicles can also be charged. There are more than 70,000 Tesla Superchargers worldwide. The charging network layout covers 100% of the provincial capitals and municipalities in mainland China. More V4 Superchargers will be put into use across the country. Optimize the charging experience and improve energy replenishment efficiency. Tesla will accompany you to the mountains, rivers, lakes, and seas with pure electricity!”

The first V4 Superchargers Tesla installed in China are available in four cities across the country: Shanghai, Zhejiang, Gansu, and Chongqing.

Credit: Tesla China

Tesla has over 70,000 Superchargers worldwide. It is the most expansive and robust EV charging network in the world. It’s the main reason why so many companies have chosen to adopt Tesla’s charging connector in North America and Europe.

In China, some EVs can use Tesla Superchargers as well.

The V4 Supercharger is capable of charging vehicles at speeds of up to 325kW for vehicles in North America. This equates to over 1,000 miles per hour of charging.

Elon Musk

Elon Musk hints at when Tesla could reduce Safety Monitors from Robotaxi

Tesla could be reducing Safety Monitors from Robotaxi within ‘a month or two,’ CEO Elon Musk says.

Elon Musk hinted at when Tesla could begin reducing Safety Monitors from its Robotaxis. Safety Monitors are Tesla employees who sit in the front passenger seat during the driverless rides, and are there to ensure safety for occupants during the earliest rides.

Tesla launched its Robotaxi fleet in Austin last Sunday, and after eight days, videos and reviews from those who have ridden in the driverless vehicles have shown that the suite is safe, accurate, and well coordinated. However, there have been a few hiccups, but nothing that has put anyone’s safety in danger.

A vast majority — close to all of the rides — at least according to those who have ridden in the Robotaxi, have been performed without any real need for human intervention. We reported on what was the first intervention last week, as a Safety Monitor had to step in and stop the vehicle in a strange interaction with a UPS truck.

Watch the first true Tesla Robotaxi intervention by safety monitor

The Tesla and UPS delivery truck were going for the same street parking space, and the Tesla began to turn into it. The UPS driver parallel parked into the spot, which was much smaller than his truck. It seemed to be more of an instance of human error instead of the Robotaxi making the wrong move. This is something that the driverless cars will have to deal with because humans are aggressive and sometimes make moves they should not.

The Safety Monitors have not been too active in the vehicles. After all, we’ve only seen that single instance of an intervention. There was also an issue with the sun, when the Tesla braked abnormally due to the glare, but this was an instance where the car handled the scenario and proceeded normally.

With the Robotaxi fleet operating impressively, some are wondering when Tesla will begin scaling back both the Safety Monitors and Teleoperators that it is using to ensure safety with these early rides.

CEO Elon Musk answered the inquiry by stating, “As soon as we feel it is safe to do so. Probably within a month or two.”

As soon as we feel it is safe to do so.

Probably within a month or two. We continue to improve the Tesla AI with each mile driven.

— Elon Musk (@elonmusk) June 30, 2025

Musk’s response seems to confirm that there will be fewer Teleoperators and Safety Monitors in the coming months, but there will still be some within the fleet to ensure safety. Eventually, that number will get to zero.

Reaching a point where Tesla’s Robotaxi is driverless will be another significant milestone for the company and its path to fully autonomous ride-sharing.

Eventually, Tesla will roll out these capabilities to consumer-owned vehicles, offering them a path to generate revenue as their car operates autonomously and completes rides.

For now, Tesla is focusing on perfecting the area of Austin where it is currently offering driverless rides for just $4.20 to a small group of people.

-

News5 days ago

News5 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla confirms massive hardware change for autonomy improvement

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla features used to flunk 16-year-old’s driver license test

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature