News

Porsche admits EV investment to take on Tesla is an “enormous burden”

It’s no secret that Porsche is looking to soak up market share away from Tesla when the automaker releases its long range, all-electric Mission E in 2019. Arguably one of Tesla’s strongest potential competitors, with decades of manufacturing expertise and support from parent company Volkswagen AG, the German automaker specializing in high performance vehicles is preparing to face financial headwinds as it aims to electrify its fleet.

Porsche’s CFO, Lutz Meschke, recently spoke with Automotive News Europe about the company’s plan to stay profitable as it invests billions into its electric vehicle program.

“Today Porsche packs 8,000 to 10,000 euros in added content into an electrified vehicle, but those costs cannot be passed on via the price. The customer won’t accept it, just the opposite, in some parts of the world there’s a certain hesitation,” said Meschke in his interview with Automotive News Europe.

As Porsche looks to invest more than 3 billion euros ($3.5 billion USD) into the development of EVs and plug-ins, the automaker will continue to build internal combustion engine vehicles in parallel and implement company-wide cost-cutting measures to retain its profit margin. “That’s an enormous burden for a company of our size.” says Meschke.

“To protect your margin, you have to look at substantial fixed cost cuts, but there’s only so much potential since the biggest chunks are personnel and development. As sales shift toward EVs, a temporary drop in profitability in the midterm may be expected.”

For context, Porsche’s investment into its EV program amounts to roughly 70% of what Tesla’s Gigafactory will cost when complete. It’s a massive undertaking that Porsche admits will require company restructuring along with financial incentives to its workforce. “We need to structure the company so that it is in position to sustainably achieve that. There can always be years when it might drop to below 15 percent due to exchange rates or an economic crisis, but every worker has to know we are not letting up.” says Porsche’s CFO. “There’s even a pension component.”

By setting a fixed margin target of 15% on a company-wide basis, Porsche’s entire workforce is able to work towards a single goal as looks to maintain a steady CapEx and R&D ratio. “It’s better for Porsche to work with a fixed margin target. It’s really an internal steering instrument. That’s why everyone in the company from the manager to the assembly line worker knows the goal is 15 percent. If we work with a range, that effect is diluted.”

When asked by Automotive News Europe on whether Porsche will need to implement a deep cost-cutting program to maintain the company’s high margins, Meschke responded “Under our Porsche Improvement Process, we aim for annual savings of at least 3 percent in indirect areas and 6 percent in direct ones.” Moreover, Porsche’s exec notes that the company performs a cross-department review each year to see if they were able to maintain a 10% savings. “There can always be a time when we need to pull on all levers, but identifying and extracting efficiencies is our everyday business. That way we don’t have to resort to major savings programs at the slightest headwind.”

Maximizing efficiencies across the organization is something Tesla CEO Elon Musk has long talked about. By “building the machine that builds the machine“, Tesla looks to utilize an army of manufacturing robots to achieve mass volume production of its product line that consists of vehicles, solar products and battery storage solutions. It’s the company’s key differentiator over other manufacturers that largely have robots augmenting human personnel as opposed to replacing them.

The goal to achieve full automation is Tesla’s biggest strength, yet also the company’s weakest link, as made evident when Musk announced that production of its mass market-intent Model 3 vehicle was facing issues. The downside to implementing a highly automated production line is the need to have robots that work in perfect harmony with one another. Any misconfiguration or general issue around a specific machine in the process becomes amplified across all other machines that rely on it. There’s less tolerance for errors in an automated process, explained Musk during the company’s third-quarter earnings call.

Porsche’s strategic entry into a market that’s been largely dominated by Tesla is an interesting match up that pits David versus Goliath. With two very different approaches to reaching mass volume production from two very distinct companies, it’s anyone’s guess who’ll come out ahead in the race to electric mobility. Regardless, competition helps stimulate innovation, productivity and growth prospects in the electric car sector, and that can only be a good thing.

News

Tesla China breaks 8-month slump by selling 71,599 vehicles wholesale in June

Tesla China’s June numbers were released by the China Passenger Car Association (CPCA) on Tuesday.

Tesla China was able to sell 71,599 vehicles wholesale in June 2025, reversing eight consecutive months of year-over-year declines. The figure marks a 0.83% increase from the 71,599 vehicles sold wholesale in June 2024 and a 16.1% jump compared to the 61,662 vehicles sold wholesale in May.

Tesla China’s June numbers were released by the China Passenger Car Association (CPCA) on Tuesday.

Tesla China’s June results in focus

Tesla produces both the Model 3 and Model Y at its Shanghai Gigafactory, which serves as the company’s primary vehicle export hub. Earlier this year, Tesla initiated a changeover for its best-selling vehicle, the Model Y, resulting in a drop in vehicle sales during the first and second quarters.

Tesla’s second-quarter China sales totaled 191,720 units including exports. While these numbers represent a 6.8% year-over-year decline for Tesla China, Q2 did show sequential improvement, rising about 11% from Q1 2025, as noted in a CNEV Post report.

For the first half of the year, Tesla sold 364,474 vehicles wholesale. This represents a 14.6% drop compared to the 426,623 units sold wholesale in the first half of 2024.

China’s competitive local EV market

Tesla’s position in China is notable, especially as the new Model Y is gaining ground in the country’s BEV segment. That being said, Tesla is also facing competition from impressive local brands such as Xiaomi, whose new YU7 electric SUV is larger and more affordable than the Model Y.

The momentum of the YU7 is impressive, as the vehicle was able to secure 200,000 firm orders within three minutes and over 240,000 locked-in orders within 18 hours. Xiaomi’s previous model, the SU7 electric sedan, which is aimed at the Tesla Model 3, also remains popular, with June deliveries surpassing 25,000 units for the ninth straight month.

While China’s EV market is getting more competitive, Tesla’s new Model Y is also ramping its production and deliveries. Needless to say, Tesla China’s results for the remaining two quarters of 2025 will be very interesting.

Elon Musk

Tesla reveals it is using AI to make factories more sustainable: here’s how

Tesla is using AI in its Gigafactory Nevada factory to improve HVAC efficiency.

Tesla has revealed in its Extended Impact Report for 2024 that it is using Artificial Intelligence (AI) to enable its factories to be more sustainable. One example it used was its achievement of managing “the majority of the HVAC infrastructure at Gigafactory Nevada is now AI-controlled” last year.

In a commitment to becoming more efficient and making its production as eco-friendly as possible, Tesla has been working for years to find solutions to reduce energy consumption in its factories.

For example, in 2023, Tesla implemented optimization controls in the plastics and paint shops located at Gigafactory Texas, which increased the efficiency of natural gas consumption. Tesla plans to phase out natural gas use across its factories eventually, but for now, it prioritizes work to reduce emissions from that energy source specifically.

It also uses Hygrometric Control Logic for Air Handling Units at Giafactory Berlin, resulting in 17,000 MWh in energy savings each year. At Gigafactory Nevada, Tesla saves 9.5 GWh of energy through the use of N-Methylpyrrolidone refineries when extracting critical raw material.

Perhaps the most interesting way Tesla is conserving energy is through the use of AI at Gigafactory Nevada, as it describes its use of AI to reduce energy demand:

“In 2023, AI Control for HVAC was expanded from Nevada and Texas to now include our Berlin-Brandenburg and Fremont factories. AI Control policy enables HVAC systems within each factory to work together to process sensor data, model factory dynamics, and apply control actions that safely minimize the energy required to support production. In 2024, this system achieved two milestones: the majority of HVAC infrastructure at Gigafactory Nevada is now AI-controlled, reducing fan and thermal energy demand; and the AI algorithm was extended to manage entire chiller plants, creating a closed-loop control system that optimizes both chilled water consumption and the energy required for its generation, all while maintaining factory conditions.”

Tesla utilizes AI Control “primarily on systems that heat or cool critical factory production spaces and equipment.” AI Control communicates with the preexisting standard control logic of each system, and any issues can be resolved by quickly reverting back to standard control. There were none in 2024.

Tesla says that it is utilizing AI to drive impact at its factories, and it has proven to be a valuable tool in reducing energy consumption at one of its facilities.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

-

Elon Musk2 days ago

Elon Musk2 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News7 days ago

News7 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

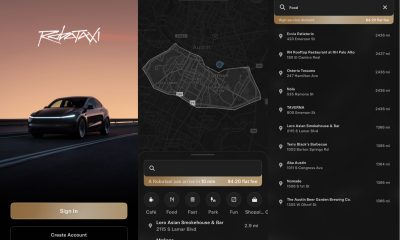

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more