News

SpaceX urges Congress to expedite commercial spaceflight regulation reforms

Speaking in a Congressional hearing on the morning of June 26th, SpaceX Director of Government Affairs Caryn Schenewerk reaffirmed the company’s commitment to conducting “more than 25 [launches]” in 2018, a feat that will require a ~50% increase in launch frequency over the second half of the year.

Related to the focus of this particular hearing, namely regulatory reform, Representative Rick Larsen (WA-2) appeared to speak for everyone when he mirrored the four panelists’ sense of urgency for beginning the process of reforming federal space launch regulations by asking for an informal meeting outside the doors of the chamber once the session concluded, stating that “it’s that urgent.” In order for companies like SpaceX (and eventually Blue Origin) to be able to sustainably and reliably reach cadences of one launch per week in the near future, the currently cumbersome and dated launch licensing apparatus will almost invariably require significant reforms.

Pressure to remove artificial bottlenecks growing

Two primary problems were identified by the Air Line Pilots Association (ALPA), ULA, Blue Origin, and SpaceX officials present before the Congressional committee: the extreme sluggishness of licensing and the similarly obtuse brute-force integration of launch vehicle operations with the federal systems of air traffic control tasked with safely orchestrating tens of thousands of aircraft flights daily.

Whereas nominal orbital rocket launches result in vehicles like SpaceX’s Falcon 9 spending less than 90 seconds of real time within the bounds of that controlled airspace, the massive and disruptive “keep-out zones” currently required by the FAA for rocket launches frequently disrupt air traffic for more than 100 times as long. According to Ms. Schenewerk, SpaceX believes it already possesses the capabilities to integrate live Falcon 9 and Heavy telemetry with air traffic control, allowing those keep out zones to be dramatically compressed and highly responsive to actual launch operations, similar to how aircraft traffic is dealt with today.

- Falcon 9 1046’s Block 5 upper stage shown on its May 11 debut launch with Bangabandhu-1. SpaceX’s rockets already provide rich telemetry live to the company’s launch controllers. (SpaceX)

- After CRS-15, all orbital launches will be use Block 5 boosters and upper stages. The upgraded rocket’s next launch is NET July 20. (Tom Cross)

On the specific launch licensing side of this regulatory coin, SpaceX, Blue Origin, and ULA all expressed distaste for current standards, in which a worst-case scenario could see a launch provider forced to wait more than 200 days (up to eight full months) from the moment of filing to a launch license grant. Worse, even slight adjustments to a granted launch license require launch providers to resubmit themselves to that 200+ day process, effectively making timely modifications undependable exceptions to the rule.

Old rules, new rockets

The real barrier to these common-sense regulatory reforms is quite simply the extraordinary sluggishness of the FAA and those tasked with updating its guidelines and regulatory structures. Rep. Larsen was not exaggerating when he stated that he foresaw Congress choosing to delay those reforms by another 5+ years if given the opportunity, and it was thus likely a relief for the panel of witnesses (PDF) to hear him agree that these reforms must be pursued with the utmost urgency. In its current state, the FAA’s launch licensing is liable to be utterly swamped by the imminent introduction of multiple new smallsat launch providers on top of the already lofty launch cadence ambitions of SpaceX, ULA, and Blue Origin, as well as Orbital ATK to a lesser extent.

With SpaceX leading the charge, the American launch industry is already a year or more into a true renaissance of American spaceflight, and the FAA is simply not equipped to handle it. If reforms can be completed with haste rarely seen in Congress, the federal government can at a minimum ensure that it does not become a wholly artificial and preventable bottleneck for that explosion of domestic spaceflight activity.

- SpaceX’s Demo Mission-1 Crew Dragon seen preparing for vacuum tests at a NASA-run facility, June 2018. (SpaceX)

- A Falcon 9 fairing during encapsulation, when a launch payload is sealed inside the fairing’s two halves. This small satellite is NASA’s TESS, launched in April 2018. (NASA)

- A combination of scientific satellites and five Iridium NEXT communications satellites preparing for launch in May 2018. (NASA)

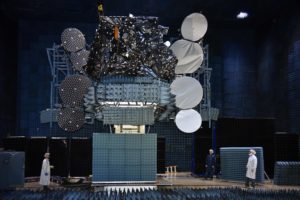

- Telesat’s SSL-built Telstar 19V conducts testing in an anechoic chamber before launch, currently NET July 19. (SSL)

Speaking of that activity, SpaceX is scheduled to begin its H2 2018 manifest push with as many as six Falcon 9 launches (five with Block 5 boosters) over the next ~60 days. Barring an abrupt increase in rocket booster production speeds, sources have confirmed that those 2-3 summer months will likely also feature one of the first rapid Falcon 9 Block 5 reuses, potentially seeing one of SpaceX’s highly-reusable rockets complete two orbital launches in approximately one month (30-50 days). That will, of course, depend upon both customer agreeability and the availability of rockets and launch facilities, but the goal of a rapid Block 5 reuse before summer’s end still stands, at least for now.

Up next is CRS-15, which will see the last orbital Block 4 Falcon 9 launch a flight-proven Cargo Dragon to the ISS with several thousand pounds of supplies in tow, with liftoff scheduled for NET 5:42 am EDT, June 29.

Follow us for live updates, peeks behind the scenes, and photos from Teslarati’s East and West Coast photographers.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.