News

US Air Force awards SpaceX $20m contract to support its biggest spy satellites

Slipping beneath the watchful eye of many skilled defense journalists, the government contracting database FPDS.gov indicates that the US Air Force awarded SpaceX more than $20 million in November 2017 to conduct a design study of vertical integration capabilities (VIC). Describing what exactly this means first requires some background.

Vertical whaaaat?

The flood of acronyms and technical terminology that often follow activities of the Federal government should not detract from the significance of this contract award. First and foremost, what exactly is “vertical integration” and why is significant for SpaceX? Not to be confused with more abstract descriptions of corporate organization (vertical integration describes one such style), integration here describes the literal process of attaching satellite and spacecraft payloads to the rockets tasked with ferrying them to orbit.

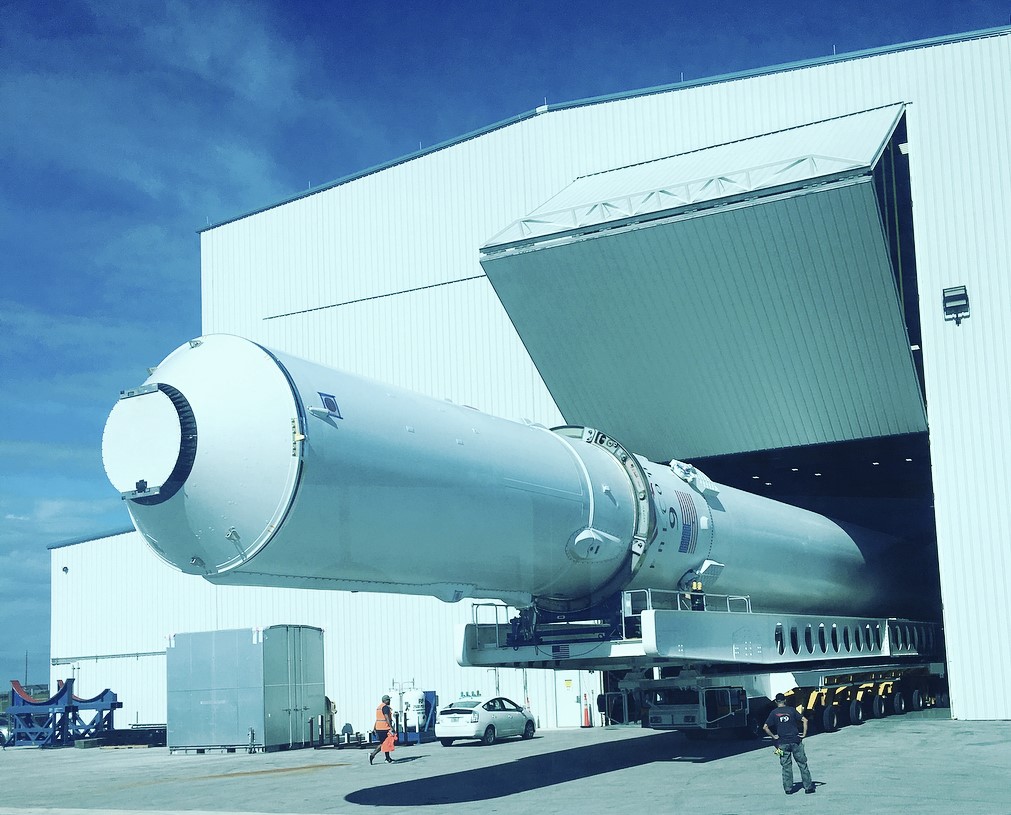

Likely as a result of its relative simplicity, SpaceX has used a system of horizontal integration for as long as they have been in the business of launching rockets, be it Falcon 1, Falcon 9, or Falcon Heavy. In order to integrate payloads to the rocket horizontally, SpaceX has a number of horizontal integration facilities (HIF) directly beside each of their three launch pads – two in Florida, one in California. After being transported from the company’s Hawthorne, CA rocket factory, Falcon 9 and Heavy boosters, second stages, payload fairings, and other miscellaneous components are all brought into a HIF, where they are craned off of their transporters (a semi-trailer in most cases) and placed on horizontal stands inside the building.

- The large, white crawler underneath Falcon 9 is one of several methods of transportation SpaceX uses. (Instagram /u/robhubar)

- Falcon Heavy is composed of a Falcon 9 upper stage and three Falcon 9-class boosters. (SpaceX)

- The fully-integrated Falcon Heavy rolls out to Pad 39A. For vertical integration, think of this… but vertical. (SpaceX)

While in the HIF, all three main components are eventually attached together (integrated). The booster or first stage (S1) has its landing legs and grid fins installed soon after arrival at the launch site, followed by the mating of the first and second stages. Once these two primary components of the rocket are attached, the entire stack – as the mated vehicle is called – is once again lifted up by cranes inside the facility and placed atop what SpaceX calls the strongback (also known as the Transporter/Launcher/Erector, or TEL). A truly massive steel structure, the TEL is tasked with carrying the rocket to the launch pad, typically a short quarter mile trek from the integration facility. Once it reaches the pad, the TEL uses a powerful hydraulic lift system to rotate itself and its rocket payload from horizontal to vertical. It may look underwhelming, but it serves to remember that a complete Falcon 9/Heavy and its TEL are both considerably more than twice as tall as a basketball court is long.

Falcon Heavy goes vertical pic.twitter.com/uG1k0WISv1

— Elon Musk (@elonmusk) January 5, 2018

Once at the pad, the TEL serves as the rocket’s connection to the pad’s many different ground systems. Crucially, it is tasked with loading the rocket with at least four different fuels, fluids, and gases at a broad range of temperatures, as well as holding the rocket down with giant clamps at its base, providing connection points to transmit a flood of data back to SpaceX launch control. SpaceX’s relatively unique TEL technology is to some extent the foundation of the company’s horizontal integration capabilities – such a practice would be impossible without reliable systems and methods that allow the rocket to be easily transported about and connected to pad systems.

Still, after the Amos-6 mishap in September 2016, which saw a customer’s payload entirely destroyed by a launch vehicle anomaly ahead of a static fire test, SpaceX has since changed their procedures, and now conducts those static fire tests with just the first and second stages – the payload is no longer attached until after the test is completed. For such a significant decrease in risk, the tradeoff of an additional day or so of work is minimal to SpaceX and its customers. Once completed, the rocket is brought horizontal and rolled back into the HIF, where the rocket’s payload fairing is finally attached to the vehicle while technicians ensure that the rocket is in good health after a routine test-ignition of its first stage engines.

- Elon Musk’s Roadster seen before being encapsulated in Falcon Heavy’s massive payload fairing. Below the Tesla is the payload adapter, which connects it to the rocket. (SpaceX)

- Imagine this building-sized fairing traveling approximately TWO MILES PER SECOND. (USAF)

- Finally, the fairing is transported vertically to the HIF, where it can be flipped horizontal and attached to its rocket. (Reddit /u/St-Jed-of-Calumet)

Before being connected to the rocket, the payload itself must also go through its own integration process. Recently demonstrated by a flurry of SpaceX images of Falcon Heavy and its Roadster payload, this involves attaching the payload to a payload adapter, tasked with both securing the payload and fairing to the launch vehicle. Thankfully, the fairing is far smaller than the rocket itself, and this means it can be vertically integrated with the payload and adapter. The final act of joining and bolting together the two fairing halves is known as encapsulation – at which point the payload is now snug inside the fairing and ready for launch. Finally, the integrated payload and fairing are lifted up by cranes, rotated horizontally, and connected to the top of the rocket’s second stage, marking the completion of the integration process.

A different way to integrate

Here lies the point at which the Air Force’s $20m contract with SpaceX comes into play. As a result of certain (highly classified) aspects of some of the largest military satellites, the Department of Defense (DoD) and National Reconnaissance Office (NRO) prefer or sometimes outright require that their payloads remain vertical while being attached to a given rocket. The United Launch Alliance (ULA), SpaceX’s only competition for military launches, almost exclusively utilizes vertical integration for all of their launches, signified by the immense buildings (often themselves capable of rolling on tracks) present at their launch pads. SpaceX has no such capability, at present, and this means that they are effectively prevented from competing for certain military launch contracts – contracts that are often the most demanding and thus lucrative.

It’s clear that the Air Force itself is the main impetus pushing SpaceX to develop vertical integration capabilities, a reasonable continuation of the military’s general desire for assured access to orbit in the event of a vehicle failure grounding flights for the indefinite future. For example, if ULA or SpaceX were to suffer a failure and be forced to ground their rockets for months while investigating the incident, the DoD could choose to transfer time-sensitive payload(s) to the unaffected company for the time being. With vertical integration, this rationale could extend to all military satellites, not simply those that support horizontal integration.

- A hop and a skip south of 39A is SpaceX’s LC-40 pad. (SpaceX)

- Like all SpaceX pads, horizontal integration is a central feature. (SpaceX)

- LC-40’s brand new TEL carries a flight-proven Falcon 9 and Dragon out to the pad. (SpaceX)

Fittingly, the ability to vertically integrate satellites is likely a necessity if SpaceX hopes to derive the greatest possible value from its recently and successfully introduced Falcon Heavy rocket, a highly capable vehicle that the government is likely very interested in. Although the specific Air Force contract blandly labels it a “Design Study,” (FPDS.gov account required) its hefty $21 million award may well be far more money than SpaceX needs to design a solution. In fact, knowing SpaceX’s famous ability to develop and operate technologies with exceptional cost efficiency, it would not be shocking to discover that the intrepid launch company has accepted the design study grant and instead jumped head-first into prototyping, if not the construction of an operational solution. More likely than not, SpaceX would choose to take advantage of the fixed tower (known as the Fixed Service Structure, FSS) currently present at Pad 39A, atop which a crane and work platforms could presumably be attached

Intriguingly, it is a real possibility that Fairing 2.0 – its first launch scheduled to occur as early as Feb. 21 – could have been upgraded in part to support present and future needs of the Department of Defense, among numerous other benefits. Fairing 2.0’s larger size may have even been precipitated by physical requirements for competing for and dealing with the largest spysats operating by the DoD and NRO, although CEO Elon Musk’s characterization of that change as a “slightly larger diameter” could suggest otherwise. On the other hand, Musk’s offhand mention of the possibility of significantly lengthening the payload fairing is likely aimed directly at government customers in both the civil and military spheres of space utilization. Time will tell, and it certainly will not hurt SpaceX or its customers if Fairing 2.0 is also considerably easier to recover and reuse.

Under consideration. We’ve already stretched the upper stage once. Easiest part of the rocket to change. Fairing 2, flying soon, also has a slightly larger diameter. Could make fairing much longer if need be & will if BFR takes longer than expected.

— Elon Musk (@elonmusk) February 12, 2018

Ultimately, it should come as no surprise that SpaceX would attempt to leverage this contract and the DoD’s interest in ways that might also facilitate the development of the company’s futuristic BFR rocket, intended to eventually take humans to the Moon, Mars, and beyond. As shown by both 2016 and 2017 iterations of the vehicle, it appears that SpaceX intends to use vertical integration to attach the spaceship (BFS) to the booster (BFR). While it’s unlikely that this Air Force contract will result in the creation of a vertical integration system that could immediately be applied to or replicated for BFS testing, the experience SpaceX would gain in the process of building something similar for the Air Force would be invaluable and essentially kill two birds with one stone.

While now outdated, SpaceX’s 2016 Mars rocket featured a giant crane used for vertical integration. BFR appears to use the same approach. (SpaceX)

Follow along live as I and launch photographers Tom Cross and Pauline Acalin cover these exciting proceedings live and in person.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.

News

Tesla makes latest move to remove Model S and Model X from its lineup

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

Tesla has made its latest move that indicates the Model S and Model X are being removed from the company’s lineup, an action that was confirmed by the company earlier this quarter, that the two flagship vehicles would no longer be produced.

Tesla has ultimately started phasing out the Model S and Model X in several ways, as it recently indicated it had sold out of a paint color for the two vehicles.

Now, the company is making even more moves that show its plans for the two vehicles are being eliminated slowly but surely.

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

The change eliminates the $1,000 referral discount previously available to new buyers of these vehicles. Existing Tesla owners purchasing a new Model S or Model X will now only receive a halved loyalty discount of $500, down from $1,000.

The updates extend beyond the two flagship vehicles. New Cybertruck buyers using a referral code on Premium AWD or Cyberbeast configurations will no longer get $1,000 off. Instead, both referrer and buyer receive three months of Full Self-Driving (Supervised).

The loyalty discount for Cybertruck purchases, excluding the new Dual Motor AWD trim level, has also been cut to $500.

NEWS: Tesla has removed the Model S and Model X from the referral program.

New owners also no longer get a $1,000 referral discount on a new Cybertruck Premium AWD or Cyberbeast. Instead, you now get 3 months of FSD (Supervised).

Additionally, Tesla has reduced the loyalty… pic.twitter.com/IgIY8Hi2WJ

— Sawyer Merritt (@SawyerMerritt) March 6, 2026

These adjustments apply only in the United States, and reflect Tesla’s broader strategy to optimize margins while boosting adoption of its autonomous driving software.

The timing is no coincidence. Tesla confirmed earlier this year that Model S and Model X production will end in the second quarter of 2026, roughly June, as the company reallocates factory capacity toward its Optimus humanoid robot and next-generation vehicles.

With annual sales of the low-volume flagships already declining (just 53,900 units in 2025), incentives are no longer needed to drive demand. Production is winding down, and Tesla expects strong remaining interest without subsidies.

Industry observers see this as the clearest sign yet of an “end-of-life” phase for the vehicles that once defined Tesla’s luxury segment. Community reactions on X range from nostalgia, “Rest in power S and X”, to frustration among long-time owners who feel perks are eroding just as the models approach discontinuation.

Some buyers are rushing orders to lock in final discounts before they vanish entirely.

Doug DeMuro names Tesla Model S the Most Important Car of the last 30 years

For Tesla, the move prioritizes efficiency: fewer discounts on outgoing models, a stronger push for FSD subscriptions, and a focus on high-margin Cybertruck trims amid surging orders.

Loyalists still have a narrow window to purchase a refreshed Plaid or Long Range model with remaining incentives, but the message is clear: Tesla’s lineup is evolving, and the era of the original flagships is drawing to a close.

News

Tesla Australia confirms six-seat Model Y L launch in 2026

Compared with the standard five-seat Model Y, the Model Y L features a longer body and extended wheelbase to accommodate an additional row of seating.

Tesla has confirmed that the larger six-seat Model Y L will launch in Australia and New Zealand in 2026.

The confirmation was shared by techAU through a media release from Tesla Australia and New Zealand.

The Model Y L expands the Model Y lineup by offering additional seating capacity for customers seeking a larger electric SUV. Compared with the standard five-seat Model Y, the Model Y L features a longer body and extended wheelbase to accommodate an additional row of seating.

The Model Y L is already being produced at Tesla’s Gigafactory Shanghai for the Chinese market, though the vehicle will be manufactured in right-hand-drive configuration for markets such as Australia and New Zealand.

Tesla Australia and New Zealand confirmed the vehicle will feature seating for six passengers.

“As shown in pictures from its launch in China, Model Y L will have a new seating configuration providing room for 6 occupants,” Tesla Australia and New Zealand said in comments shared with techAU.

Instead of a traditional seven-seat arrangement, the Model Y L uses a 2-2-2 layout. The middle row features two individual seats, allowing easier access to the third row while providing additional space for passengers.

Tesla Australia and New Zealand also confirmed that the Model Y L will be covered by the company’s updated warranty structure beginning in 2026.

“As with all new Tesla Vehicles from the start of 2026, the Model Y L will come with a 5-year unlimited km vehicle warranty and 8 years for the battery,” the company said.

The updated policy increases Tesla’s vehicle warranty from the previous four-year or 80,000-kilometer coverage.

Battery and drive unit warranties remain unchanged depending on the variant. Rear-wheel-drive models carry an eight-year or 160,000-kilometer warranty, while Long Range and Performance variants are covered for eight years or 192,000 kilometers.

Tesla has not yet announced official pricing or range figures for the Model Y L in Australia.