News

SpaceX’s Falcon 9 may soon have company as Rocket Lab reveals plans for Electron rocket reuse

The most prominent launcher of small carbon composite rockets, Rocket Lab, announced plans on Tuesday to recover the first stage of their Electron rocket and eventually reuse the boosters on future launches.

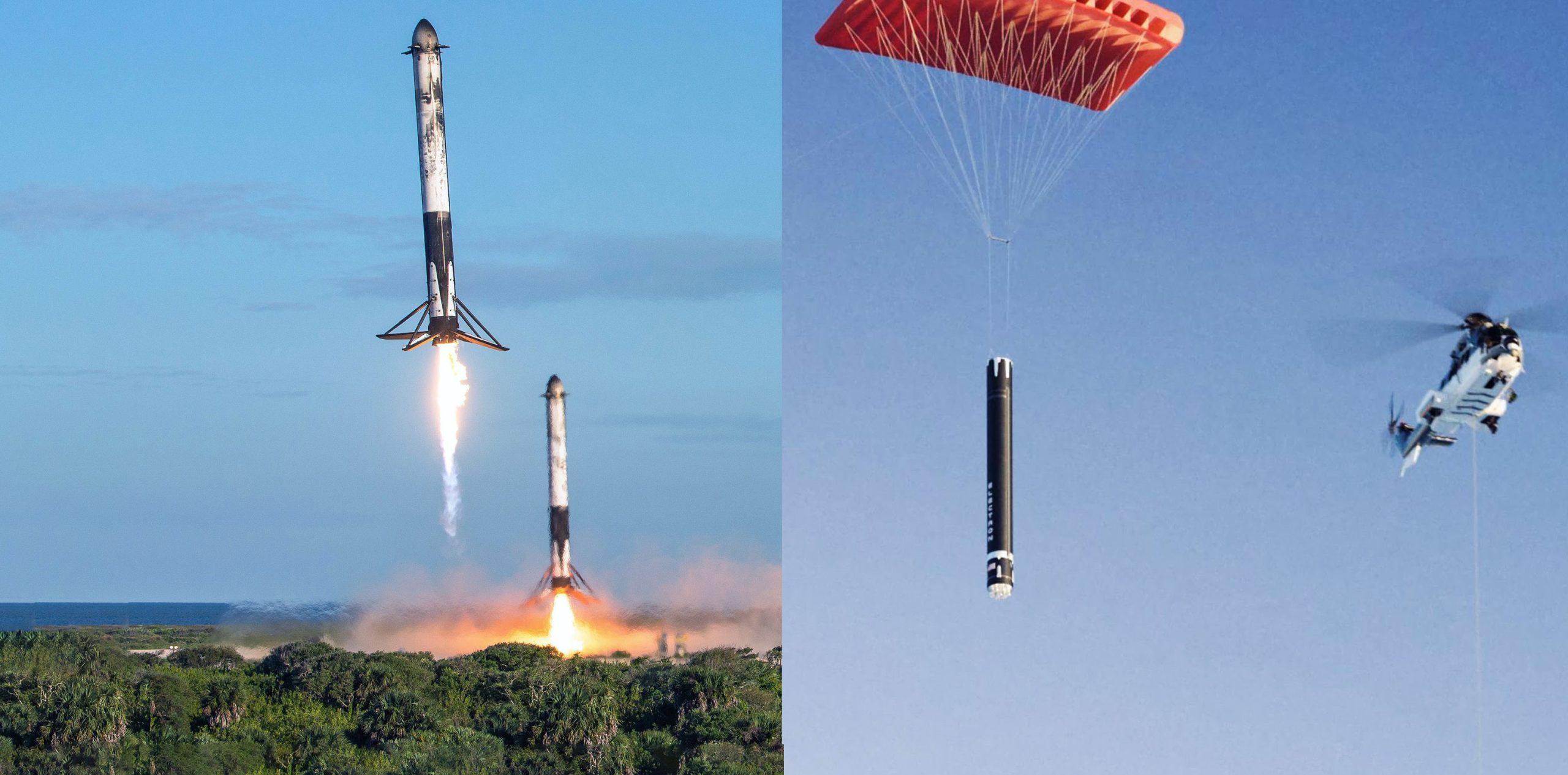

In short, CEO Peter Beck very humbly stated that he would have to eat his hat during the ~30-minute presentation, owing to the fact that he has vocally and repeatedly stated that Rocket Lab would never attempt to reuse Electron. If Rocket Lab makes it happen, the California and New Zealand-based startup will become the second entity on Earth (public or private) to reuse the boost stage of an orbital-class rocket, following SpaceX’s spectacularly successful program of Falcon 9 (and Heavy) recovery and reuse.

What is Rocket Lab?

Rocket Lab – headquartered in Huntington Beach, California – is unique among launch providers because they specialize in constructing and launching small carbon composite rockets that launch from the gorgeous Launch Complex 1 (LC-1) in Mahia, New Zealand. Their production facilities are located in Auckland, New Zealand, where they not only produce their own rockets but also 3D print Rutherford engines, the only orbital-class engine on Earth with an electric turbopump.

Electron’s 1.2-meter (4 ft) diameter body is built out of a super durable, lightweight carbon composite material that relies on custom Rocket Lab-developed coatings and techniques to function as a cryogenic propellant tank. It is powered by 9 liquid kerosene and oxygen (kerolox) Rutherford engines that rely on a unique electric propulsion cycle. The engine is also the only fully 3D-printed orbital-class rocket engine on Earth, with all primary components 3D-printed in-house at Rocket Lab’s Huntington Beach, CA headquarters. Pushed to the limits, a complete Rutherford engine can be printed and assembled in as few as 24 hours.

Currently, Rocket Lab is producing an Electron booster every 20-30 days and flies about once a month out of New Zealand. Since the first operational flight at the end of 2018 Rocket Lab has supported both commercial and government payloads. With a new launch complex (LC-2) coming online in Wallops, Virgina by the end of this year, they look to increase launch frequency, but also widen its market of customers. According to CEO Peter Beck, booster reuse could be a boon for Electron’s launch cadence.

“Electron, but reusable.”

In the world of aerospace, SpaceX is effectively the only private spaceflight company (or entity of any kind) able to launch, land, and reuse orbital-class rockets, although other companies and space agencies have also begun to seriously pursue similar capabilities. Rocket Lab’s announcement certainly brings newfound interest to the private rocket launch community. Reuse of launch vehicle boosters – typically the largest and most expensive portion of any given rocket – is a fundamental multiplier for launch cadence and can theoretically decrease launch costs under the right conditions.

Rocket Lab hopes, more than anything, that recoverability will lead to an increase in their launch frequency and – at a minimum – a doubling of the functional production capacity of the company’s established Electron factory space. This will allow for more innovation and give the company more opportunities to “change the industry and, quite frankly, change the world,” according to founder and CEO Peter Beck.

Unlike like SpaceX’s Falcon 9, propulsive landing is not an option for the small Electron rocket. In fact, cost-effective recovery and reuse of vehicles as small as Electron was believed to be so difficult that Beck long believed (and openly stated) that Rocket Lab would never attempt the feat. Beck claims that in order to land a rocket on its end propulsively – by using engines to slow the booster while it hurdles back to Earth in the way the Falcon 9 booster does – would mean that their small rocket would have to scale up into the medium class of rockets. As Beck stated, “We’re not in the business of building medium-sized launch vehicles. We’re in the business of building small launch vehicles for dedicated customers to get to orbit frequently.”

The main concern that Rocket Lab faces with the daunting task of not using propulsion to land is counteracting the immense amount of energy that the Electron will encounter on its return trip through the atmosphere. In order to return the booster in any sort of reusable condition they will have to decrease the amount of energy that the rocket is encountering which presents in the forms of heat and pressure from ~8 times the speed of sound to around 0.01 times the speed of sound. This decrease also needs to occur in around 70 seconds during re-entry and according to Beck “that’s a really challenging thing to do.” Beck went on further to explain that this really converts into dissipating about 3.5 gigajoules of energy which is enough energy to power ~57,000 homes.

Breaking through “The Wall”

When re-entering the atmosphere the energy that any spacecraft endures creates shockwaves of plasma which must be diverted away in order to protect the integrity of the spacecraft. An example of this can be seen during the re-entry of a SpaceX fairing half. Beck explains that “the plasma around those shockwaves is equal to about half the temperature of the (surface of the) sun” which can reach temperatures as high as 6,000 degrees fahrenheit. It also endures aerodynamic pressure equal to that of three elephants stacked on top of the Electron, according to Beck. His team refers to these challenges as breaking through “The Wall.”Beck explains that they will attempt to solve these problems differently using passive measures and aerodynamic decelerators.

The Wall is something that Beck and his team have been trying to tackle for some time now. Since the Electron began operational flights at the end of 2018 data has been collected to inform the problem solving process. In total Electron has successfully completed 7 flights, with its 8th scheduled to occur within the coming days. Beck explains that flights 6 and 7 featured data collection done through 15,000 different collection channels on board of Electron. The upcoming eighth flight will feature an advanced data recording system nicknamed Brutus. This new recording system will accompany Electron on the descent, but will survive while the booster breaks up as usual. It will then be collected and the data will be evaluated and used to further inform the decision making process for how to best help Electron survive its fall back to Earth.

Catching rockets with helicopters

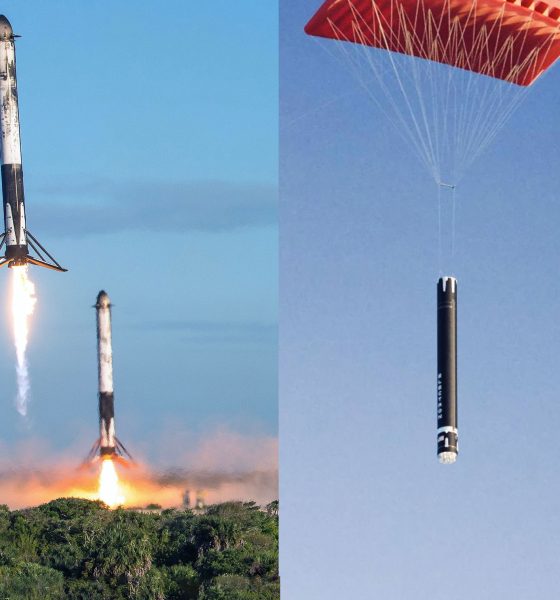

Once Rocket Lab breaks through The Wall and effectively returns Electron without harm, the booster will need to be collected before splashing down into corrosive saltwater. This was demonstrated to be done via helicopter which according to Beck is “super easy.”

An animation depicts a helicopter leaving a dedicated recovery vessel to capture the Electron booster after it deploys a parafoil and begins gliding. The helicopter will intercept the booster’s parachute using a hook and will then carry the booster back to the recovery vessel, where technicians will carefully secure it.

The entire goal of recovering a booster is to be able to reuse it quickly. Beck explains that since Electron is an “electric turbopump vehicle…in theory, we should be able to put it back on the pad, charge the batteries up, and go again.”

Although this goal is ambitious, it is one that – if achieved – will significantly impact the launch community in very positive ways. Not only will the option of rapid reusability open up, but so will opportunity for more agencies to engage in the world of satellite deployment. The Electron currently costs anywhere between $6.5 – 7 million per launch to fly. If the production cost of a new booster is removed space becomes attainable for many more customers.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla influencers argue company’s polarizing Full Self-Driving transfer decision

Tesla maintains it will honor transfers for orders with initial delivery windows before the deadline and offers full deposit refunds otherwise, citing longstanding fine print that the program is “subject to change at any time.”

Tesla’s decision to tighten its Full Self-Driving (FSD) transfer promotion has ignited fierce debate among owners and enthusiasts.

The company quietly updated its terms in late February 2026, changing the eligibility from “order by March 31, 2026” to “take delivery by March 31, 2026.”

What began as a flexible incentive to boost sales, allowing buyers to transfer their paid FSD (Supervised) to a new vehicle, now excludes many, particularly Cybertruck owners facing delivery delays into summer or later.

Tesla maintains it will honor transfers for orders with initial delivery windows before the deadline and offers full deposit refunds otherwise, citing longstanding fine print that the program is “subject to change at any time.”

The reversal has polarized the Tesla community, with accusations of a “bait-and-switch” clashing against defenses of corporate pragmatism. Many owners who placed orders under the original wording feel betrayed, especially as production backlogs and new unsupervised FSD rollout complicate timelines.

However, Tesla has allowed them to cancel their orders and receive a refund.

Critics of the decision argue that the change disadvantages loyal customers who helped fund FSD development, calling it poor communication and a revenue grab as Tesla pivots toward subscriptions.

Popular influencers have amplified the divide. Whole Mars Catalog struck a measured but firm tone, acknowledging the original “order by” language but emphasizing Tesla’s right to adjust terms. He has continued to defend Tesla in this particular issue:

Sad to see so many fans trashing Tesla with such extreme language.

LIARS!!! PATHETIC!!! And if you aren’t as furious and angry as they are they are you’re “worshipping” and saying “they can do no wrong”.

Let’s get real here. They’re not liars. They offered FSD transfer to us… https://t.co/3Ay7vGaVR6

— Whole Mars Catalog (@wholemars) March 3, 2026

He criticized extreme backlash as “dramatization” and “spoiled kids,” noting the unsupervised FSD era and broader sales challenges make blanket transfers financially risky. Whole Mars advocated for polite outreach to CEO Elon Musk over the issue.

Rather than “calling them out”, I would simply say “Hey Elon, really hoped to be able to do FSD transfer on my cybertruck but the terms changed. Would really appreciate if Tesla could extend this to everyone who ordered before the terms changes”

that would probably work

— Whole Mars Catalog (@wholemars) March 3, 2026

In a contrasting perspective, Dirty TesLA voiced sharper frustration, posting that blocking transfers feels “crazy” and distancing himself from “people that want to worship a corporation and say they can do no wrong.” His stance resonated with owners who view the policy flip as disrespectful to early adopters.

Popular Tesla influencer Sawyer Merritt captured the frustration felt by thousands. In a widely shared thread viewed over 700,000 times, Merritt detailed how pre-change Cybertruck orders now risk losing FSD eligibility unless their initial delivery window falls before March 31.

It’s not a contradiction, it’s a change in policy that Tesla just made an hour ago. I am trying to check if the change is retroactive to all existing orders, including Cybertruck AWD orders, because if it is, that sucks big time.

— Sawyer Merritt (@SawyerMerritt) February 28, 2026

The controversy underscores deeper tensions—between Tesla’s need for revenue discipline and owners’ expectations of goodwill. As FSD evolves toward unsupervised capability, the community remains split: some see the change as necessary business, others as a broken promise. Whether Tesla reconsiders under pressure or holds firm remains to be seen, but it does not appear they are planning to budge.

News

Tesla Semi’s latest adoptee will likely encourage more of the same

Public visibility matters. When shoppers see a trusted name like Ralph’s running clean, high-tech trucks on public roads, skepticism fades. Competitors such as Albertsons, which pre-ordered Semis years ago, and other chains chasing ESG targets now have proof that electric autonomy works in real-world grocery fleets.

The latest adoptee of the Tesla Semi will likely encourage more businesses in the same realm to adopt the all-electric Class 8 truck, as a new company utilizing the Semi has been spotted in Southern California.

A sleek, futuristic Tesla Semi truck branded for Ralph’s Supermarkets was spotted cruising a Los Angeles highway in a viral 13-second dashcam video posted March 2, by X user ChargePozitive.

Tesla Semi Truck in the wild pic.twitter.com/SnQY8ShMMJ

— ChargePozitive ⚡️➕ (@ChargePozitive) March 2, 2026

This sighting confirms Kroger’s March 2025 partnership with Tesla to deploy up to 500 autonomous electric Semis.

While the initial announcement targeted Midwest supply chains, the California appearance under the Ralph’s banner shows the program expanding to Kroger’s West Coast operations. Ralph’s, a staple for millions of Southern California shoppers, is now hauling groceries with the Semi, which has zero tailpipe emissions and claims up to 500 miles of range per charge.

Tesla Semi pricing revealed after company uncovers trim levels

The timing could not be better for sustainable logistics. Traditional trucking accounts for a massive share of retail emissions, but Tesla’s Semi slashes fuel and maintenance costs while leveraging full autonomy to ease driver shortages and improve safety.

Tesla’s expanding Megacharger network, including new sites along major freight corridors and partnerships like the recently-announced one with Pilot Travel Centers, is removing range anxiety and making nationwide scaling realistic. There’s still a long way to go, but things are moving in the right direction.

Public visibility matters. When shoppers see a trusted name like Ralph’s running clean, high-tech trucks on public roads, skepticism fades. Competitors such as Albertsons, which pre-ordered Semis years ago, and other chains chasing ESG targets now have proof that electric autonomy works in real-world grocery fleets.

PepsiCo’s successful pilots already demonstrated viability, and Ralph’s sighting adds retail credibility.

As Tesla ramps high-volume Semi production through 2026, this isn’t an isolated curiosity. Instead, it’s a catalyst. More grocers adopting the platform will accelerate industry-wide decarbonization, cut operating expenses, and deliver tangible environmental wins.

The future of sustainable supply chains is already on the highway, and Ralph’s just made it impossible to ignore.

Moving forward, Tesla hopes to expand the Semi program into other regions, including Europe, which CEO Elon Musk recently said is a total possibility next year.

Elon Musk

Tesla ramps Cybercab test manufacturing ahead of mass production

Tesla still has plans for volume production, which remains between four and eight weeks away, aligning with Musk’s statements that early ramps would be deliberately measured given the Cybercab’s novel architecture and full reliance on Tesla’s vision-based Full Self-Driving technology.

Tesla is seemingly ramping Cybercab test manufacturing ahead of mass production, which is scheduled to begin next month, the company said.

At Tesla’s Gigafactory Texas, production of the Cybercab, the company’s groundbreaking purpose-built Robotaxi vehicle, is accelerating markedly. Drone footage from Joe Tegtmeyer captured striking aerial footage today, revealing what appears to be the largest public sighting of Cyebrcabs to date.

A total of 25 units were observed by Tegtmeyer across the Gigafactory Texas property, marking a clear step-up in testing and validation activities as Tesla prepares for a broader output.

Tesla Cybercab production begins: The end of car ownership as we know it?

In the footage, 14 metallic gold Cybercabs were parked in a tight formation outside the factory exit, showcasing their sleek, autonomous-only design with no steering wheels, pedals, or traditional controls. Another 9 units sat at the crash testing facility, likely undergoing structural and safety validations, while two more appeared at the west end-of-line area for final checks.

Big day for Cybercab at Giga Texas today! Actually, yesterday to kick off March, the production line went into a higher volume & today we see 25 at three main locations, and there were several others I observed driving around too!

I think this may be the largest single grouping… pic.twitter.com/HZDMNv57lJ

— Joe Tegtmeyer 🚀 🤠🛸😎 (@JoeTegtmeyer) March 3, 2026

Tegtmeyer noted additional Cybercabs driving around the complex, hinting at active movement and real-world testing beyond static parking.

This surge follows the first production Cybercab rolling off the line in mid-February 2026, several weeks ahead of the originally anticipated April start.

That milestone, celebrated by Tesla employees and confirmed by CEO Elon Musk, kicked off low-volume builds on the dedicated “unboxed” manufacturing line, a modular process designed to slash costs, reduce factory footprint, and enable faster assembly compared to conventional methods.

Industry observers interpret the jump to dozens of visible units in early March as evidence that Tesla has transitioned into higher-volume test manufacturing.

Tesla still has plans for volume production, which remains between four and eight weeks away, aligning with Musk’s statements that early ramps would be deliberately measured given the Cybercab’s novel architecture and full reliance on Tesla’s vision-based Full Self-Driving technology.

The Cybercab, envisioned as a sub-$30,000 autonomous two-seater for robotaxi fleets, represents Tesla’s bold pivot toward scalable autonomy and robotics.

Tesla fans and enthusiasts on X praised the imagery, with many expressing excitement over the visible progress toward deployment. While challenges remain, including software maturity, regulatory hurdles, and supply chain scaling, the increased factory activity underscores Tesla’s momentum in turning the Cybercab vision into reality.

As Giga Texas continues expanding and refining the manufacturing process of the Cybercab, the coming months will prove to be a pivotal time in determining how quickly this revolutionary vehicle reaches roads in the U.S. and internationally.