SpaceX

SpaceX calls ULA NASA launch contract “vastly” overpriced in official protest

SpaceX has filed an official protest with the US Government Accountability Office (GAO) after NASA awarded competitor United Launch Alliance a launch contract for Lucy, an interplanetary probe meant to explore a belt of unique asteroids clustered around Jupiter’s orbital swath.

Announced on January 31st, SpaceX believes that NASA made a decision counter to the best interests of the agency and US taxpayers by rewarding ULA the Lucy launch contract at a cost of $148M, a price that the company deemed “vastly more [expensive]” than the bid it submitted for the competition.

Updated our story on SpaceX’s GAO protest of a NASA launch contract with comments from both NASA and ULA. https://t.co/qqCsnNatu0

— Jeff Foust (@jeff_foust) February 14, 2019

With performance roughly equivalent to SpaceX’s Falcon 9 Block 5 rocket in a reusable configuration when launching from low Earth orbit (LEO) up to geostationary transfer orbit (GTO), ULA’s Atlas V 401 variant is the simplest version of the rocket family with the lowest relative performance, featuring no solid rocket boosters. According to the company’s “RocketBuilder” tool, Atlas V 401 was listed with a base price of $109M in 2017. SpaceX’s Falcon 9 is listed with a base price of $62M for a mission with booster recovery, while the rocket’s highest-value expendable launch (for a USAF GPS III satellite worth ~$530 million) was awarded at a cost of $83M, with three subsequent GPS III launch contracts later awarded for ~$97M apiece.

Relative to almost any conceivable near-term launch contract on the horizon, SpaceX’s GPS III launch contracts act as a sort of worst-case price tag for Falcon 9, where the customer requires extraordinary mission assurance and the entire rocket has to be expended during the launch. Put in another way, NASA would likely be able to get the reliability, performance, and mission assurance it wants/needs from Falcon 9 for perhaps $50M less than the cost of ULA’s proposed launch, equivalent to cutting more than a third off the price tag. Part of NASA’s Discovery Program, the Lucy spacecraft will be capped at $450M excluding launch costs, meaning that choosing SpaceX over ULA could singlehandedly cut the mission’s total cost by a minimum of 8-10%.

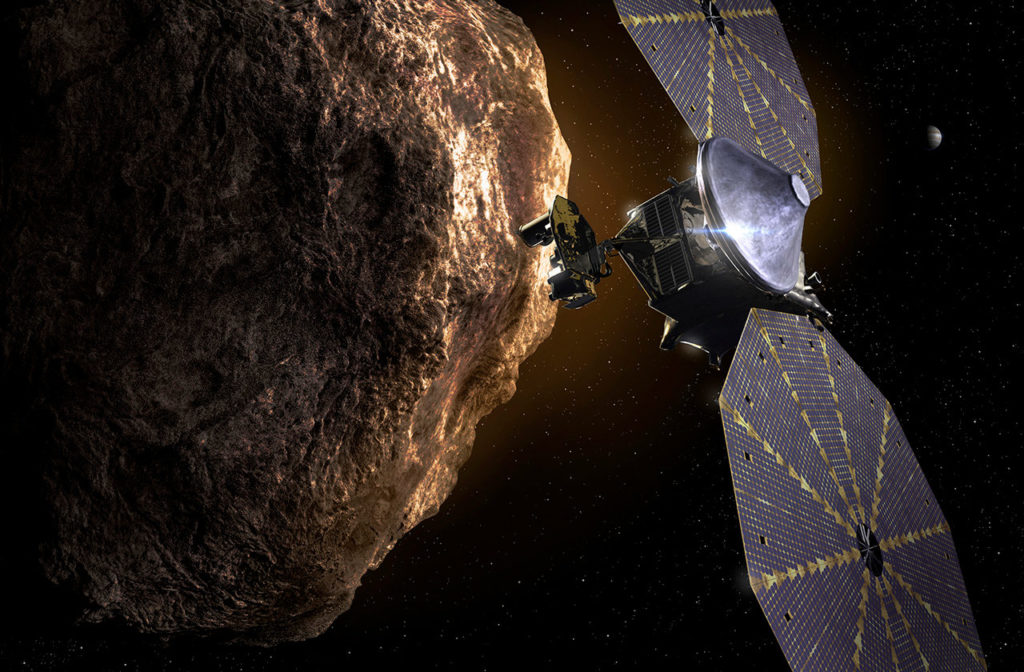

- A mockup of NASA’s proposed Lucy spacecraft. (NASA)

- NASA’s InSight lifts off atop Atlas V 401, March 2018. (Pauline Acalin)

- A panorama of Atlas V 401, March 2018. (Pauline Acalin)

- SpaceX and NASA’s most recent science spacecraft launch, TESS. (SpaceX)

- After launching in April 2018, B1045 landed on OCISLY and is being refurbished for a second launch in just 5 days, on June 29. (Tom Cross)

“Since SpaceX has started launching missions for NASA, this is the first time the company has challenged one of the agency’s award decisions. SpaceX offered a solution with extraordinarily high confidence of mission success at a price dramatically lower than the award amount, so we believe the decision to pay vastly more to Boeing and Lockheed for the same mission was therefore not in the best interest of the agency or the American taxpayers.” – SpaceX, February 13th, 2019

The fact remains that the Lucy mission does face a uniquely challenging launch trajectory, offering just a single launch window of roughly three weeks, after which the mission as designed effectively becomes impossible. Missing that window could thus end up costing NASA hundreds of millions of dollars in rework and delays, if not triggering the mission’s outright cancellation. NASA and ULA thus couched the launch contract award and ~50% premium in terms of what ULA argues is Atlas V’s “world-leading schedule certainty”. Excluding ULA’s other rocket, Delta IV, Atlas V does have a respectable track record of staying true to its contracted launch targets. However, SpaceX’s Falcon 9 “schedule certainty” continues to improve as the launch vehicle matures.

Admittedly, while Falcon 9 has gotten far better at reliably launching within 5-10 days of its on-pad static fire test, SpaceX has continued to struggle to launch payloads within a week or two of customer targets. Regardless, October 2021 is more than two and a half years away, giving SpaceX an inordinate amount of time and dozens upon dozens of manifested Falcon 9 launches to reach a level of operational maturity and design stability comparable to Atlas V, a rocket that has changed minimally over the course of 16+ years and 79 launches.

- An Atlas V 401 rocket lifts off in 2017. (ULA)

- Falcon 9 B1046 prepares for its third launch and recovery, December 2018. (SpaceX)

- Falcon 9 B1046 is pictured here landing after its third successful launch in December 2018 – the first SpaceX rocket to cross that reusability milestone. (SpaceX)

In October 2010, NASA awarded ULA a contract valued at $187M to launch its MAVEN Mars orbiter on Atlas V 401. In December 2013, ULA won a $163M contract to launch NASA’s InSight Mars lander on Atlas V 401. In January 2019, ULA was awarded a contract for NASA’s Lucy spacecraft, priced at $148.3M for a 2021 Atlas V 401 launch. Put simply, barring ULA using a dartboard and blindfold to determine launch contract pricing or aggressive reverse-inflation, SpaceX’s very existence already stokes the flames of competition, particularly when launch contracts are directly competed by their parent agencies or companies.

Whether or not SpaceX’s protest is entirely warranted or ends up amounting to anything, it can be guaranteed that the fact that SpaceX was there to compete with ULA at all forced the company to slash anywhere from $20-40M from the price it would have otherwise gladly charged NASA. Another ~$50M saved would certainly not be the worst thing to happen to the US taxpayer, but it’s also not the end of the world.

Check out Teslarati’s newsletters for prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket launch and recovery processes!

News

SpaceX President Gwynne Shotwell details xAI power pledge at White House event

The commitment was announced during an event with United States President Donald Trump.

SpaceX President Gwynne Shotwell stated that xAI will develop 1.2 gigawatts of power at its Memphis-area AI supercomputer site as part of the White House’s new “Ratepayer Protection Pledge.”

The commitment was announced during an event with United States President Donald Trump.

During the White House event, Shotwell stated that xAI’s AI data center near Memphis would include a major energy installation designed to support the facility’s power needs.

“As you know, xAI builds huge supercomputers and data centers and we build them fast. Currently, we’re building one on the Tennessee-Mississippi state line. As part of today’s commitment, we will take extensive additional steps to continue to reduce the costs of electricity for our neighbors…

“xAI will therefore commit to develop 1.2 GW of power as our supercomputer’s primary power source. That will be for every additional data center as well. We will expand what is already the largest global Megapack power installation in the world,” Shotwell said.

She added that the system would provide significant backup power capacity.

“The installation will provide enough backup power to power the city of Memphis, and more than sufficient energy to power the town of Southaven, Mississippi where the data center resides. We will build new substations and invest in electrical infrastructure to provide stability to the area’s grid.”

Shotwell also noted that xAI will be supporting the area’s water supply as well.

“We haven’t talked about it yet, but this is actually quite important. We will build state-of-the-art water recycling plants that will protect approximately 4.7 billion gallons of water from the Memphis aquifer each year. And we will employ thousands of American workers from around the city of Memphis on both sides of the TN-MS border,” she noted.

The Ratepayer Protection Pledge was introduced as part of the federal government’s effort to address concerns about rising electricity costs tied to large AI data centers, as noted in an Insider report. Under the agreement, companies developing major AI infrastructure projects committed to covering their own power generation needs and avoiding additional costs for local ratepayers.

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.

Elon Musk

Starlink V2 to bring satellite-to-phone service to Deutsche Telekom in Europe

Starlink stated that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Starlink is partnering with Deutsche Telekom to roll out satellite-to-mobile connectivity across Europe, extending coverage to more than 140 million subscribers across 10 countries.

The service, planned for launch in 2028 in several Telekom markets, including Germany, will use Starlink’s next-generation V2 satellites and Mobile Satellite Service (MSS) spectrum to enable direct-to-device connectivity.

In a post on X, the official Starlink account stated that the agreement will be the first in Europe to deploy its V2 next-generation satellite-to-mobile technology using new MSS spectrum. The company added that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Abdu Mudesir, Board Member for Product and Technology at Deutsche Telekom, shared his excitement for the partnership in a press release. “We provide our customers with the best mobile network. And we continue to invest heavily in expanding our infrastructure. At the same time, there are regions where expansion is especially complex due to topographical conditions or official constraints,” he said.

“We want to ensure reliable connectivity for our customers in those areas as well. That is why we are strategically complementing our network with satellite-to-mobile connectivity. For us, it is clear: connectivity creates security and trust. And we deliver. Everywhere.”

Under the partnership, compatible smartphones will automatically switch to Starlink’s satellite network when terrestrial coverage is unavailable, enabling access to data, voice, video, and messaging services.

Telekom reports 5G geographic coverage approaching 90% in Germany, with LTE exceeding 92% and voice coverage reaching up to 99%. Starlink’s satellite layer is intended to extend connectivity beyond those terrestrial limits, particularly in topographically challenging or infrastructure-constrained areas.

Stephanie Bednarek, VP of Starlink Sales, also shared her thoughts on the partnership. “We’re so pleased to bring reliable satellite-to-mobile connectivity to millions of people across 10 countries in partnership with Deutsche Telekom. This agreement will be the first-of-its-kind in Europe to launch Starlink’s V2 next-generation technology that will expand on data, voice and messaging by providing broadband directly to mobile phones,” she said.

Starlink’s V2 constellation is designed to expand bandwidth and capacity compared to its predecessor. If implemented as outlined, the 2028 launch would mark one of the first large-scale European deployments of integrated satellite-to-phone connectivity by a major telecom operator.