Energy

Tesla Energy, battery storage broke new ground in 2018, and 2019 will be even better

Visionaries like Elon Musk, who are aiming for a world powered by sustainable energy, would be proud of the industry’s progress in 2018. Over the course of the year, investments flowed into research, the prices of batteries declined, governments across the globe supported clean energy solutions, and electric vehicles such as the Tesla Model 3 led the charge in transitioning the transportation sector away from fossil fuels.

A study from Bloomberg New Energy Finance has noted that in 2018, global annual energy storage more than doubled, reaching 9 GWh, and it is currently on pace to rise another 78% this year. In August 2018, the cumulative sales of electric cars passed the 4 million mark as well, and NEF analysts expect the EV industry to surpass 5 million in sales in the first quarter of 2019. Even in the United States, where companies like Tesla are struggling to meet the demand for their residential energy products, deployments on a rated-power basis across the country rose 57% to an estimated 338 KW after three years of flat to negative growth.

At the core of all this growth are the advancements in battery technology. Producers of batteries have ramped their operations to meet increasing demand, from China’s BYD Co. Ltd. to South Korea’s LG Chem to Japan’s Panasonic Corp. and its US partner Tesla. Benchmark Mineral Intelligence notes that by 2028, the combined manufacturing capacity of these battery producers would likely reach at least 1,330 GWh. That’s about ten times greater than the entire’s industry’s total capacity entering 2018.

In an email to S&P Global Market Intelligence, Simon Moores, managing director of Benchmark Mineral Intelligence, mentioned that the scale of recent battery projects signifies a change in the market. Moores also pointed out that while the emergence of electric cars is notable, the rise of energy storage has been impressive as well.

“When you see projects now being planned at over 1 GWh in scale, when only 18 months ago a 300-MWh installation was something to behold, you know you have entered a new era. It has been quite interesting to watch the battery makers’ dilemma of where to send the lithium-ion cells. Of course, they have contracts to honor with automotive producers, but the order inquiries from [energy storage] producers have been incredible,” Moores said.

One thing that is working in favor of renewables today is the falling prices of batteries and clean energy as a whole. Tom Buttgenbach, president and CEO of developer 8minutenergy Renewables LLC, described this in a statement to S&P Global Market Intelligence.

“I can beat a gas peaker anywhere in the country today with a solar-plus-storage power plant. Who in their right mind today would build a new gas peaker? We are a factor of two cheaper,” he said.

Buttgenbach’s statements echo the words of Tesla Chief Technology Officer JB Straubel, who noted last year that the age of fossil fuel powered peaker plants is at an end. Speaking to the San Francisco Chronicle, Straubel stated that batteries, even at their current state, are already starting to prove themselves as superior to conventional energy solutions.

“I think what we’ll see is we won’t build many new peaker plants, if any. Already what we’re seeing happening is the number of new ones being commissioned is drastically lower, and batteries are already outcompeting natural gas peaker plants,” the Tesla CTO said.

While the progress of batteries has been impressive, though, Logan Goldie-Scot, head of energy storage at Bloomberg NEF, has stated that the past year exhibited uneven growth among different regions across the globe. South Korea, for one, saw a rise in energy deployments, while territories like the United Kingdom took a step back. In the United States, extreme demand such as those faced by Tesla Energy for products like the Powerwall 2 also caused delays in installations. Yet, despite these, Goldie-Scot stated that 2018 was a turning point for energy storage nonetheless.

“Even though progress was uneven, there was a much greater consensus in 2018 over the importance of energy storage, even in the near term, in major markets. In 2017, there were still a lot of people talking about how energy storage was not necessarily a competitive solution and was going to be limited. I hear those conversations much less now. Energy storage is now becoming more integrated into resource plans,” she said.

Amidst this transition, companies such as Tesla are taking the battle to heart. Last November, for example, Tesla opened the doors of Gigafactory 2 in Buffalo, NY to select members of the media. During the media visit, Tesla noted that it is aiming to ramp operations in the site with more hires, and that the 1.2-million sq ft facility is already running 24/7, with employees alternating 12-hour shifts. Tesla’s Gigafactory 2 is expected to play a huge role in the company’s energy business, considering that it is the site where the Solar Roof tiles, the company’s flagship solar product, are being manufactured.

Energy

Tesla Lathrop Megafactory celebrates massive Megapack battery milestone

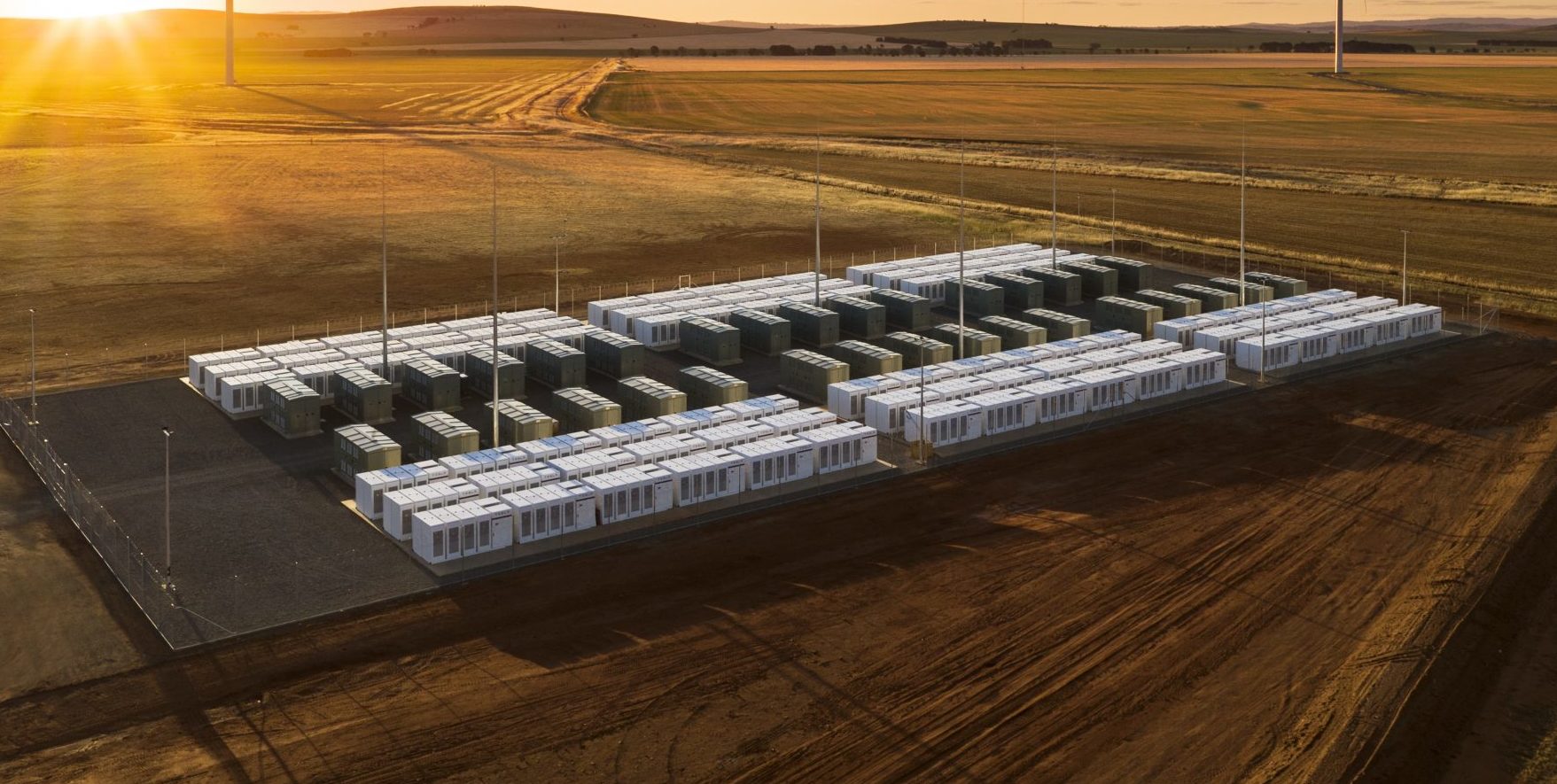

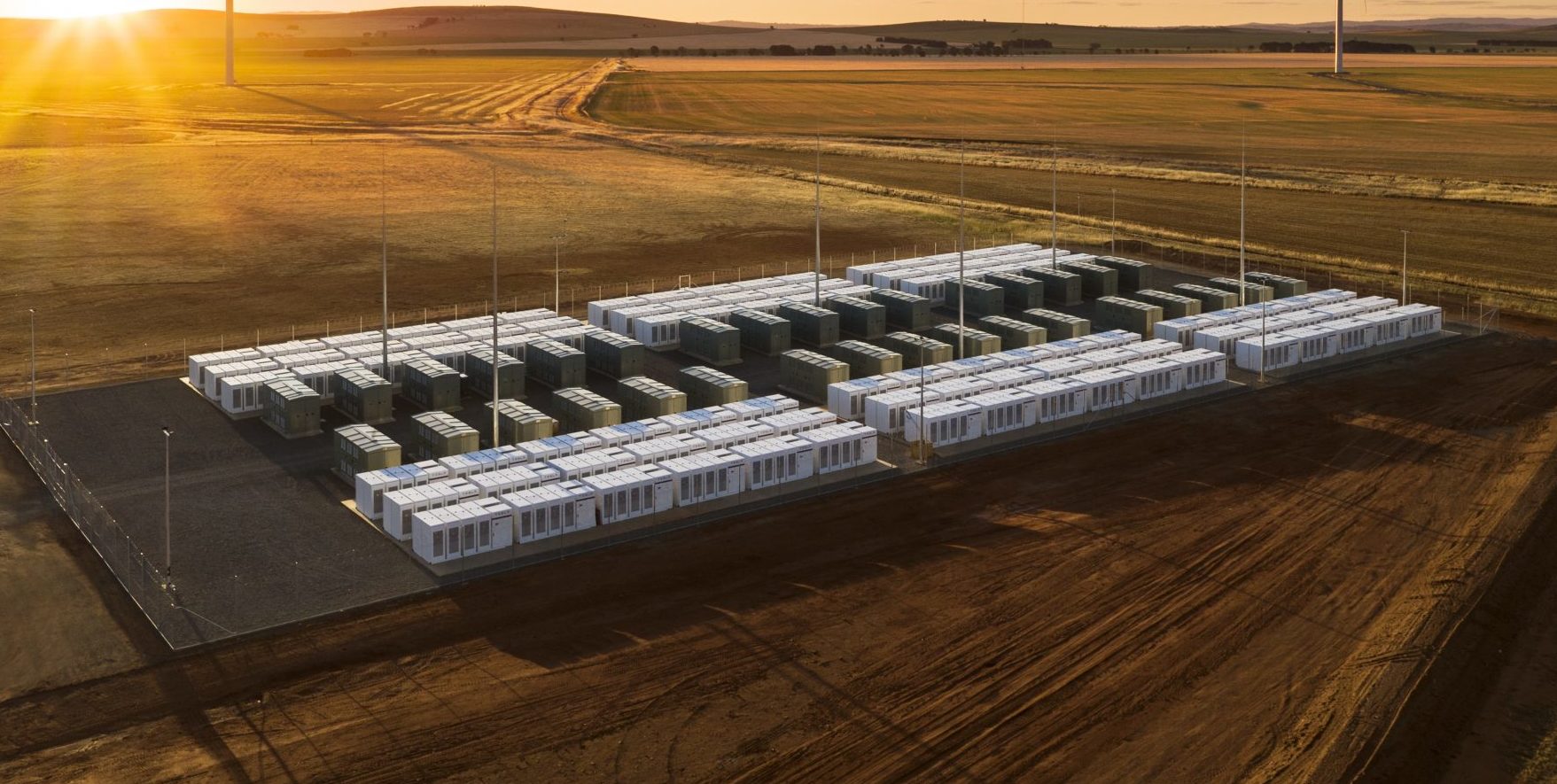

The Tesla Megapack is the backbone of Tesla Energy’s battery deployments.

The Tesla Lathrop Megafactory recently achieved a new milestone. As per the official Tesla Megapack account on X, the Lathrop Megafactory has produced its 15,000th Megapack 2 XL battery.

15,000 Megapack Batteries

Tesla celebrated the milestone with a photo of the Lathrop Megafactory team posing with a freshly produced Megapack battery. To commemorate the event, the team held balloons that spelled out “15,000” as they posed for the photo.

The Tesla Megapack is the backbone of Tesla Energy’s battery deployments. Designed for grid-scale applications, each Megapack offers 3.9 MWh of energy and 1.9 MW of power. The battery is extremely scalable, making it perfect for massive energy storage projects.

More Megafactories

The Lathrop Megafactory is Tesla’s first dedicated facility for its flagship battery storage system. It currently stands as the largest utility-scale battery factory in North America. The facility is capable of producing 10,000 Megapack batteries every year, equal to 40 GWh of clean energy storage.

Thanks to the success of the Megapack, Tesla has expanded its energy business by building and launching the Shanghai Megafactory, which is also expected to produce 40 GWh of energy storage per year. The ramp of the Shanghai Megafactory is quite impressive, with Tesla noting in its Q1 2025 Update Letter that the Shanghai Megafactory managed to produce over 100 Megapack batteries in the first quarter alone.

Tesla Energy’s Potential

During the first quarter earnings call, CEO Elon Musk stated that the Megapack is extremely valuable to the energy industry.

“The Megapack enables utility companies to output far more total energy than would otherwise be the case… This is a massive unlock on total energy output of any given grid over the course of a year. And utility companies are beginning to realize this and are buying in our Megapacks at scale,” Musk said.

Energy

Tesla Megapacks powers the xAI Colossus supercomputer

Tesla Megapacks step in to stabilize xAI’s Colossus supercomputer, replacing natural gas turbines. Musk’s ventures keep intertwining.

Tesla Megapack batteries will power the xAI Colossus supercomputer in Memphis to ensure power stability. The collaboration between Tesla and xAI highlights the synergy among Elon Musk’s ventures.

The artificial intelligence startup has integrated Tesla Megapacks to manage outages and demand surges, bolstering the facility’s reliability. The Greater Memphis Chamber announced that Colossus, recently connected to a new 150-megawatt electric substation, is completing its first construction phase. This transition addresses criticism from environmental justice groups over the initial use of natural gas turbines.

“The temporary natural gas turbines that were being used to power the Phase I GPUs prior to grid connection are now being demobilized and will be removed from the site over the next two months.

“About half of the operating turbines will remain operating to power Phase II GPUs of xAI until a second substation (#22) already in construction is completed and connected to the electric grid, which is planned for the Fall of 2025, at which time the remaining turbines will be relegated to a backup power role,” the Chamber stated.

xAI’s rapid development of Colossus reflects its ambition to advance AI capabilities, but the project has faced scrutiny for environmental impacts. The shift to Megapacks and grid power aims to mitigate these concerns while ensuring operational continuity.

The Megapack deployment underscores the collaboration among Musk’s companies, including Tesla, SpaceX, Neuralink, and The Boring Company. Tesla appears to be the common link between all of Musk’s companies. For example, The Boring Company built a tunnel in Giga, Texas. In addition, Musk has hinted at a potential collaboration between the Tesla Optimus Bot and Neuralink. And from January 2024 to February 2025, xAI invested $230 million in Megapacks, per a Tesla filing.

Tesla Energy reported a 156% year-over-year increase in Q1 2025, deploying 10.4 GWh of storage products, including Megapacks and Powerwalls. Tesla’s plans for a new Megapack factory in Waller County, Texas, which is expected to create 1,500 jobs in the area, further signal its commitment to scaling energy solutions.

As xAI leverages Tesla’s Megapacks to power Colossus, the integration showcases Musk’s interconnected business ecosystem. The supercomputer’s enhanced stability positions xAI to drive AI innovation, while Tesla’s energy solutions gain prominence, setting the stage for broader technological and economic impacts.

Energy

Tesla Energy celebrates one decade of sustainability

Tesla Energy has gone far since its early days, and it is now becoming a progressively bigger part of the company.

Tesla Energy recently celebrated its 10th anniversary with a dedicated video showcasing several of its milestones over the past decade.

Tesla Energy has gone far since its early days, and it is now becoming a progressively bigger part of the company.

Tesla Energy Early Days

When Elon Musk launched Tesla Energy in 2015, he noted that the business is a fundamental transformation of how the world works. To start, Tesla Energy offered the Powerwall, a 7 kWh/10 kWh home battery system, and the Powerpack, a grid-capable 100 kWh battery block that is designed for scalability. A few days after the products’ launch, Musk noted that Tesla had received 38,000 reservations for the Powerwall and 2,500 reservations for the Powerpack.

Tesla Energy’s beginnings would herald its quiet growth, with the company later announcing products like the Solar Roof tile, which is yet to be ramped, and the successor to the Powerwall, the 13.5 kWh Powerwall 2. In recent years, Tesla Energy also launched its Powerwall 3 home battery and the massive Megapack, a 3.9 MWh monster of a battery unit that has become the backbone for energy storage systems across the globe.

Key Milestones

As noted by Tesla Energy in its recent video, it has now established facilities that allow the company to manufacture 20,000 units of the Megapack every year, which should help grow the 23 GWh worth of Megapacks that have already been deployed globally.

The Powerwall remains a desirable home battery as well, with more than 850,000 units installed worldwide. These translate to 12 GWh of residential entry storage delivered to date. Just like the Megapack, Tesla is also ramping its production of the Powerwall, allowing the division to grow even more.

Tesla Energy’s Role

While Tesla Energy does not catch as much headlines as the company’s electric vehicle businesses, its contributions to the company’s bottom line have been growing. In the first quarter of 2025 alone, Tesla Energy deployed 10.4 GWh of energy storage products. Powerwall deployments also crossed 1 GWh in one quarter for the first time. As per Tesla in its Q1 2025 Update Letter, the gross margin for the Energy division has improved sequentially as well.

-

Elon Musk4 days ago

Elon Musk4 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report