Investor's Corner

TSLA’s resilience in the stock market is partly due to the ‘Tesla Killers” failure

To say that the last few months have been a roller coaster ride for Tesla is an understatement. Just a few months ago, Tesla stock (NASDAQ:TSLA) was closing in on trading below $250 per share, and it was being bashed by a continuous stream of criticism from Wall Street. One analyst even called Tesla “no longer investable” due to Elon Musk’s behavior on Twitter. Short-sellers bet on a dramatic drop, with one stating that it was apparent “Tesla is having difficulties paying their bills.”

And yet, no dramatic drop happened. The company surprised Wall Street by posting $6.8 billion in revenue in the third quarter instead, and the stock has been up since then. Today, TSLA is trading near the $370 level, close to the highs it achieved on the day Elon Musk posted his now-infamous “funding secured” tweet. After a year of volatility, Tesla stock is up nearly 18% as of Wednesday’s close. That’s quite notable, considering that the S&P 500 is down 1.4% this year so far.

Apart from the company’s improving fundamentals, a good part of the Tesla narrative today is the company’s lead in the electric car market. One of the most notable bear thesis against the company is the notion that once legacy automakers decide to dip their feet into the production of EVs, Tesla would be overwhelmed and outgunned. Several automakers did release their first premium all-electric cars this year. But instead of overwhelming Tesla with their expertise (hence the term “Tesla Killer”), legacy auto’s first EVs have fallen short of the standards set by the Silicon Valley-based electric car maker.

In a recent note, Oppenheimer analyst Colin Rusch admonished traditional carmakers and their electric creations, stating that they present what could be described as a “slow and disappointing” competition for Tesla. JMP Securities analyst Joseph Osha was a bit more direct than Rusch, remarking that “It is incredible to me, at the end of 2018, that the major automakers still haven’t figured out how to respond competitively to Tesla.”

Tesla’s vehicles compete on the luxury segment, where brands such as Mercedes-Benz, BMW, and Audi are reigning. This year, three notable premium electric cars emerged by legacy carmakers — the Mercedes-Benz EQC, the Audi e-tron, and the Jaguar I-PACE — and while each is an admirable vehicle on their own, the EVs themselves include flaws that make them inferior to Tesla. Both the EQC and the e-tron incited questions about their real range when the vehicles were unveiled, and the Jaguar I-PACE, despite being well-received by critics, is far less efficient than an older Tesla Model X.

Tesla’s lead in the electric car segment was even acknowledged by UBS, which has a history of taking a bearish stance on the electric car maker. Following a teardown of the vehicle and a comparison between the Model 3 and competitors like the BMW i3 and the Chevy Bolt, UBS concluded that instead of being the underdog in the EV market, “Tesla has won the race and leads the championship,” thanks to its superior battery, powertrain, and overall tech.

As Tesla approaches the end of what could be yet another impressive quarter, the company continues to garner votes of confidence from Wall Street. Just recently, Baird analyst Ben Kallo reiterated his “Outperform” rating on TSLA stock while raising his price target from $411 to $465. Kallo cited the strengthening narrative surrounding the company, which changed from negative to positive in recent months.

“We believe the narrative will continue to change from ‘TSLA will never make money’ to ‘TSLA can be sustainably profitable,’” Kallo wrote in a note Thursday. “The narrative on TSLA, particularly in the middle of 2018, was as negative as we have experienced in our coverage, but we believe sentiment will continue to improve as the company proves it can be self-supportive, which should drive sustained share appreciation,” Kallo wrote.

With competitors only highlighting Tesla’s lead in the EV market, the potential of Tesla in the global stage remains vast. The Model 3 alone, which continues to sell well despite the US’ preference for pickup trucks and SUVs, is expected to be popular in Europe, whose sedan market is notably larger than that of America. With these factors in play, as well as the absence of notable competition from fellow luxury carmakers in the near future, the next year could prove to be one impressive ride for Tesla.

As of writing, Tesla is trading +1.20% at $371.01 per share.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Elon Musk

Tesla investors will be shocked by Jim Cramer’s latest assessment

Jim Cramer is now speaking positively about Tesla, especially in terms of its Robotaxi performance and its perception as a company.

Tesla investors will be shocked by analyst Jim Cramer’s latest assessment of the company.

When it comes to Tesla analysts, many of them are consistent. The bulls usually stay the bulls, and the bears usually stay the bears. The notable analysts on each side are Dan Ives and Adam Jonas for the bulls, and Gordon Johnson for the bears.

Jim Cramer is one analyst who does not necessarily fit this mold. Cramer, who hosts CNBC’s Mad Money, has switched his opinion on Tesla stock (NASDAQ: TSLA) many times.

He has been bullish, like he was when he said the stock was a “sleeping giant” two years ago, and he has been bearish, like he was when he said there was “nothing magnificent” about the company just a few months ago.

Now, he is back to being a bull.

Cramer’s comments were related to two key points: how NVIDIA CEO Jensen Huang describes Tesla after working closely with the Company through their transactions, and how it is not a car company, as well as the recent launch of the Robotaxi fleet.

Jensen Huang’s Tesla Narrative

Cramer says that the narrative on quarterly and annual deliveries is overblown, and those who continue to worry about Tesla’s performance on that metric are misled.

“It’s not a car company,” he said.

He went on to say that people like Huang speak highly of Tesla, and that should be enough to deter any true skepticism:

“I believe what Musk says cause Musk is working with Jensen and Jensen’s telling me what’s happening on the other side is pretty amazing.”

Tesla self-driving development gets huge compliment from NVIDIA CEO

Robotaxi Launch

Many media outlets are being extremely negative regarding the early rollout of Tesla’s Robotaxi platform in Austin, Texas.

There have been a handful of small issues, but nothing significant. Cramer says that humans make mistakes in vehicles too, yet, when Tesla’s test phase of the Robotaxi does it, it’s front page news and needs to be magnified.

He said:

“Look, I mean, drivers make mistakes all the time. Why should we hold Tesla to a standard where there can be no mistakes?”

It’s refreshing to hear Cramer speak logically about the Robotaxi fleet, as Tesla has taken every measure to ensure there are no mishaps. There are safety monitors in the passenger seat, and the area of travel is limited, confined to a small number of people.

Tesla is still improving and hopes to remove teleoperators and safety monitors slowly, as CEO Elon Musk said more freedom could be granted within one or two months.

Investor's Corner

Tesla gets $475 price target from Benchmark amid initial Robotaxi rollout

Tesla’s limited rollout of its Robotaxi service in Austin is already catching the eye of Wall Street.

Venture capital firm Benchmark recently reiterated its “Buy” rating and raised its price target on Tesla stock (NASDAQ: TSLA) from $350 to $475 per share, citing the company’s initial Robotaxi service deployment as a sign of future growth potential.

Benchmark analyst Mickey Legg praised the Robotaxi service pilot’s “controlled and safety-first approach,” adding that it could help Tesla earn the trust of regulators and the general public.

Confidence in camera-based autonomy

Legg reiterated Benchmark’s belief in Tesla’s vision-only approach to autonomous driving. “We are a believer in Tesla’s camera-focused approach that is not only cost effective but also scalable,” he noted.

The analyst contrasted Tesla’s simple setup with the more expensive hardware stacks used by competitors like Waymo, which use various sophisticated sensors that hike up costs, as noted in an Investing.com report. Compared to Tesla’s Model Y Robotaxis, Waymo’s self-driving cars are significantly more expensive.

He also pointed to upcoming Texas regulations set to take effect in September, suggesting they could help create a regulatory framework favorable to autonomous services in other cities.

“New regulations for autonomous vehicles are set to go into place on Sept. 1 in TX that we believe will further help win trust and pave the way for expansion to additional cities,” the analyst wrote.

Tesla as a robotics powerhouse

Beyond robotaxis, Legg sees Tesla evolving beyond its roots as an electric vehicle maker. He noted that Tesla’s humanoid robot, Optimus, could be a long-term growth driver alongside new vehicle programs and other future initiatives.

“In our view, the company is undergoing an evolution from a trailblazing vehicle OEM to a high-tech automation and robotics company with unmatched domestic manufacturing scale,” he wrote.

Benchmark noted that Tesla stock had rebounded over 50% from its April lows, driven in part by easing tariff concerns and growing momentum around autonomy. With its initial Robotaxi rollout now underway, the firm has returned to its previous $475 per share target and reaffirmed TSLA as a Benchmark Top Pick for 2025.

Elon Musk

Tesla blacklisted by Swedish pension fund AP7 as it sells entire stake

A Swedish pension fund is offloading its Tesla holdings for good.

Tesla shares have been blacklisted by the Swedish pension fund AP7, who said earlier today that it has “verified violations of labor rights in the United States” by the automaker.

The fund ended up selling its entire stake, which was worth around $1.36 billion when it liquidated its holdings in late May. Reuters first reported on AP7’s move.

Other pension and retirement funds have relinquished some of their Tesla holdings due to CEO Elon Musk’s involvement in politics, among other reasons, and although the company’s stock has been a great contributor to growth for many funds over the past decade, these managers are not willing to see past the CEO’s right to free speech.

However, AP7 says the move is related not to Musk’s involvement in government nor his political stances. Instead, the fund said it verified several labor rights violations in the U.S.:

“AP7 has decided to blacklist Tesla due to verified violations of labor rights in the United States. Despite several years of dialogue with Tesla, including shareholder proposals in collaboration with other investors, the company has not taken sufficient measures to address the issues.”

Tesla made up about 1 percent of the AP7 Equity Fund, according to a spokesperson. This equated to roughly 13 billion crowns, but the fund’s total assets were about 1,181 billion crowns at the end of May when the Tesla stake was sold off.

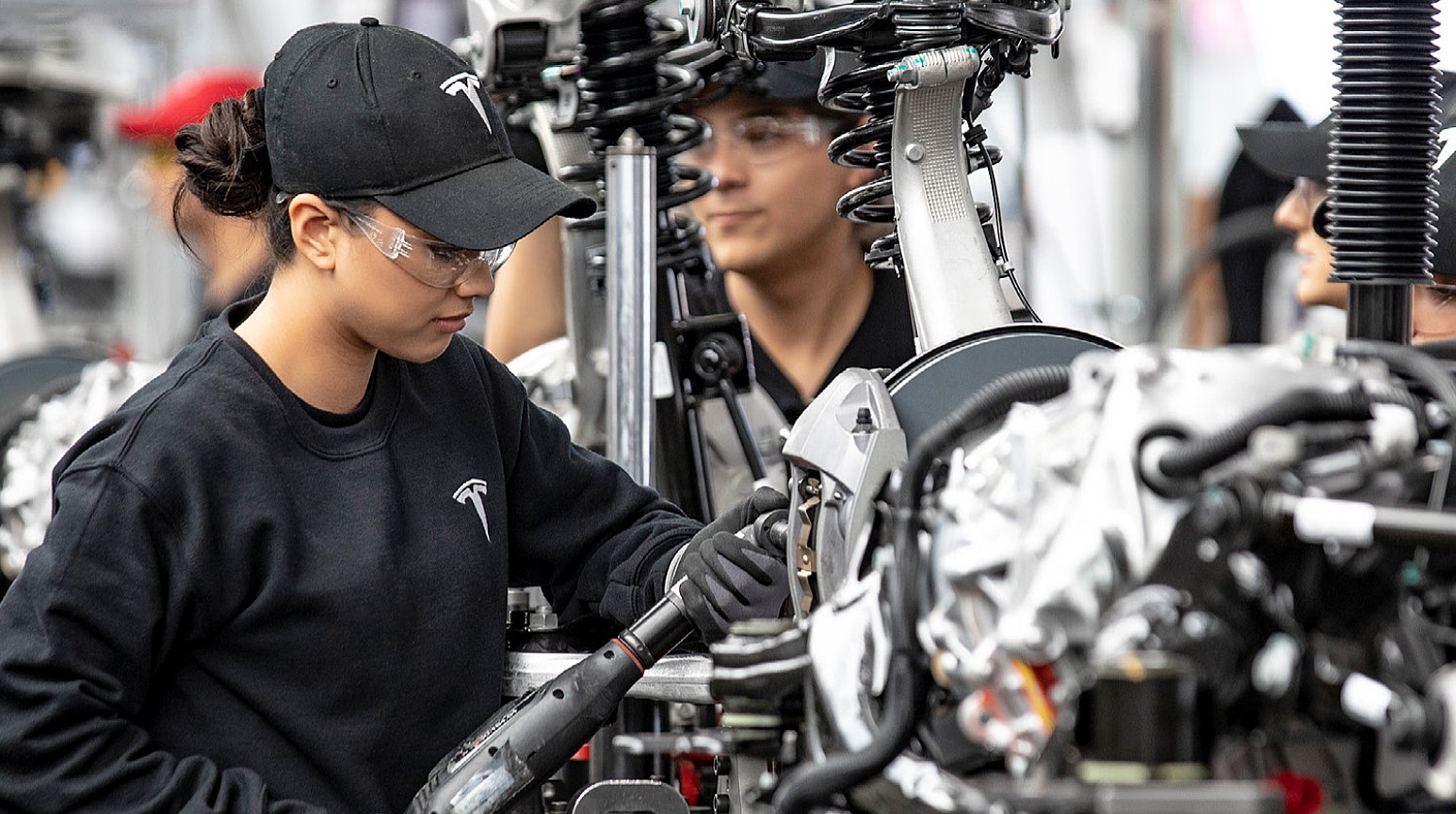

Tesla has had its share of labor lawsuits over the past few years, just as any large company deals with at some point or another. There have been claims of restrictions against labor union supporters, including one that Tesla was favored by judges, as they did not want pro-union clothing in the factory. Tesla argued that loose-fitting clothing presented a safety hazard, and the courts agreed.

(Photo: Tesla)

There have also been claims of racism at the Fremont Factory by a former elevator contractor named Owen Diaz. He was awarded a substantial sum of $137m. However, U.S. District Judge William Orrick ruled the $137 million award was excessive, reducing it to $15 million. Diaz rejected this sum.

Another jury awarded Diaz $3.2 million. Diaz’s legal team said this payout was inadequate. He and Tesla ultimately settled for an undisclosed amount.

AP7 did not list any of the current labor violations that it cited as its reason for

-

News5 days ago

News5 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla confirms massive hardware change for autonomy improvement

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTesla features used to flunk 16-year-old’s driver license test

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature