The Tesla Model 3 has become cheaper to buy than ever before, thanks to a recent price cut and inflation over the past four years.

When the $35,000 Tesla Model 3 arrived (and quickly departed) in 2019, it was heralded as the electric vehicle for the everyman, a Volkswagen Bug for the modern era. But now, thanks to a recent Tesla price cut and elevated inflation in the United States over the past four years, the Tesla Model 3 is cheaper to buy than ever.

Thanks to a remarkable price cut for Tesla vehicles, car buyers can now get a base model Model 3 for $43,990, and with the EV tax credit in the United States, that price is further reduced to $37,390. And for those who live in certain states or municipalities, that price can even be reduced further with local grants and EV incentives, often approaching the same $35,000 mark that earned the Model 3 praise way back in 2019.

But this deal becomes even more appealing considering inflation has been so high over the past four years. This has meant that the $35,000 Model 3 of 2019, translated to “2023 dollars,” comes in at just over $40,000, meaning that the current Model 3 is the cheapest the vehicle has ever been.

This same record low pricing doesn’t just apply to the Model 3 either. Via the same math, the base model Tesla Model Y has never been cheaper to buy at $45,190 (with federal incentives).

Perhaps most shocking is how competitive this price shift has made the Tesla Model S and Model X, which are the brand’s luxury/high-performance offerings and have seldom been called “affordable.” The Model S now starts at just under $100,000, and for one of the quickest vehicles on the planet, it might just be the best deal in supercars. And when looking at the Model X, a starting price of $109,990 makes the large three-row SUV a borderline bargain compared to competitors from Jaguar, Land Rover, or Rivian.

As electric vehicles continue to gain in popularity and Tesla sales continue to grow globally, hopefully, the brand can continue to work to provide customers with affordable EV options in the coming years. And while high inflation has obviously negatively impacted countless people over the past year, this is a great example of a silver lining in the new year.

What do you think of the article? Do you have any comments, questions, or concerns? Shoot me an email at william@teslarati.com. You can also reach me on Twitter @WilliamWritin. If you have news tips, email us at tips@teslarati.com!

News

Tesla Semis to get 18 new Megachargers at this PepsiCo plant

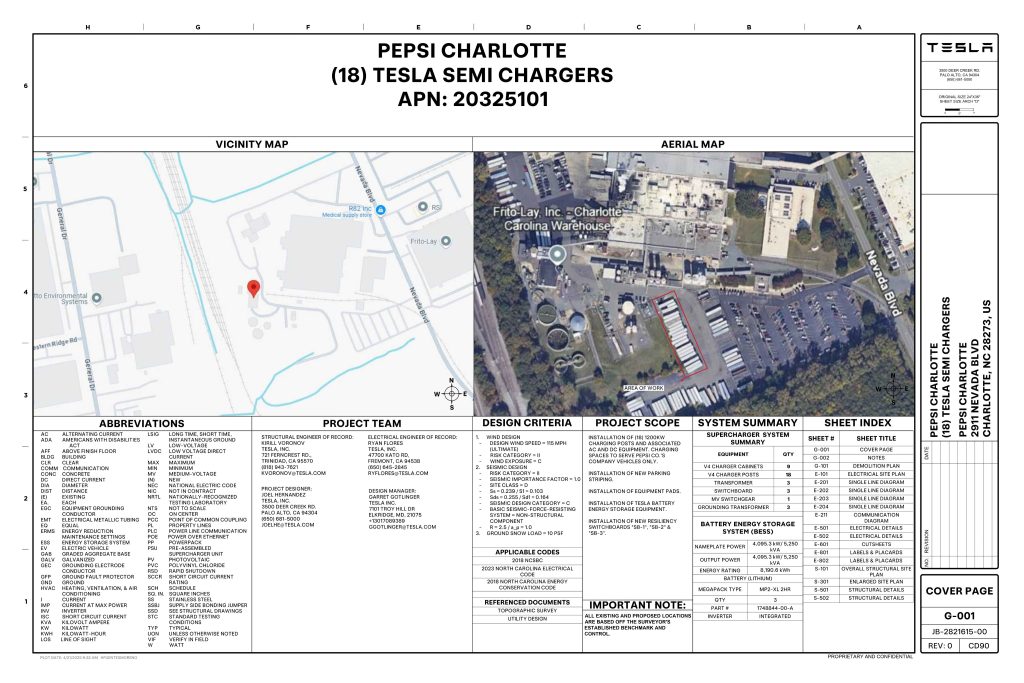

PepsiCo is set to add more Tesla Semi Megachargers, this time at a facility in North Carolina.

Tesla partner PepsiCo is set to build new Semi charging stations at one of its manufacturing sites, as revealed in new permitting plans shared this week.

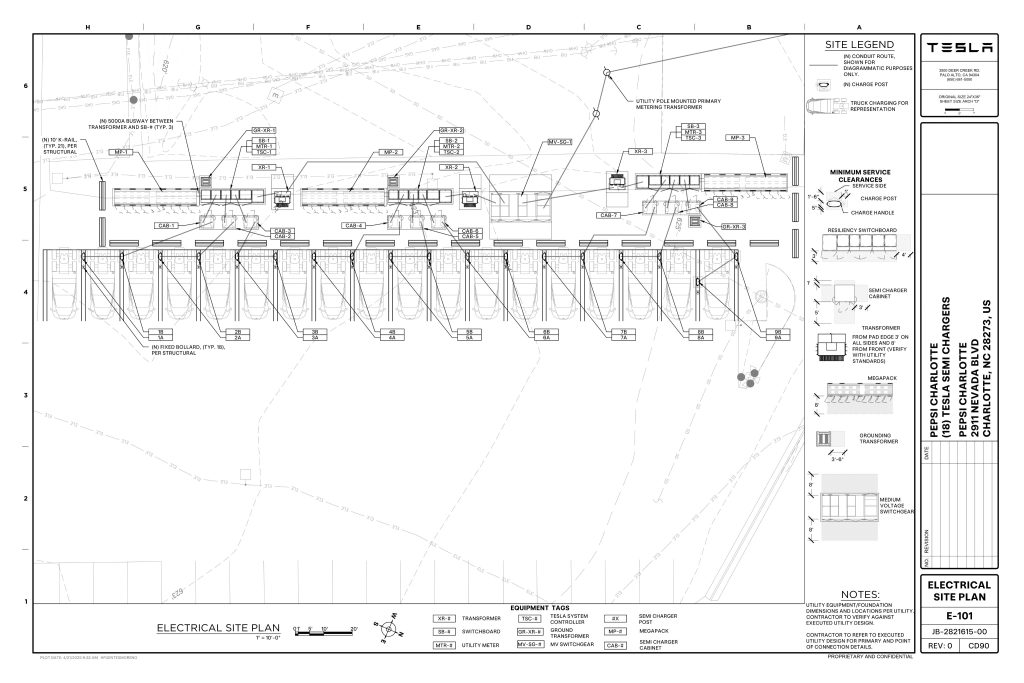

On Friday, Tesla charging station scout MarcoRP shared plans on X for 18 Semi Megacharging stalls at PepsiCo’s facility in Charlotte, North Carolina, coming as the latest update plans for the company’s increasingly electrified fleet. The stalls are set to be built side by side, along with three Tesla Megapack grid-scale battery systems.

The plans also note the faster charging speeds for the chargers, which can charge the Class 8 Semi at speeds of up to 1MW. Tesla says that the speed can charge the Semi back to roughly 70 percent in around 30 minutes.

You can see the site plans for the PepsiCo North Carolina Megacharger below.

Credit: PepsiCo (via MarcoRPi1 on X)

Credit: PepsiCo (via MarcoRPi1 on X)

READ MORE ON THE TESLA SEMI: Tesla to build Semi Megacharger station in Southern California

PepsiCo’s Tesla Semi fleet, other Megachargers, and initial tests and deliveries

PepsiCo was the first external customer to take delivery of Tesla’s Semis back in 2023, starting with just an initial order of 15. Since then, the company has continued to expand the fleet, recently taking delivery of an additional 50 units in California. The PepsiCo fleet was up to around 86 units as of last year, according to statements from Semi Senior Manager Dan Priestley.

Additionally, the company has similar Megachargers at its facilities in Modesto, Sacramento, and Fresno, California, and Tesla also submitted plans for approval to build 12 new Megacharging stalls in Los Angeles County.

Over the past couple of years, Tesla has also been delivering the electric Class 8 units to a number of other companies for pilot programs, and Priestley shared some results from PepsiCo’s initial Semi tests last year. Notably, the executive spoke with a handful of PepsiCo workers who said they really liked the Semi and wouldn’t plan on going back to diesel trucks.

The company is also nearing completion of a higher-volume Semi plant at its Gigafactory in Nevada, which is expected to eventually have an annual production capacity of 50,000 Semi units.

Tesla executive teases plan to further electrify supply chain

News

Tesla sales soar in Norway with new Model Y leading the charge

Tesla recorded a 54% year-over-year jump in new vehicle registrations in June.

Tesla is seeing strong momentum in Norway, with sales of the new Model Y helping the company maintain dominance in one of the world’s most electric vehicle-friendly markets.

Model Y upgrades and consumer preferences

According to the Norwegian Road Federation (OFV), Tesla recorded a 54% year-over-year jump in new vehicle registrations in June. The Model Y led the charge, posting a 115% increase compared to the same period last year. Tesla Norway’s growth was even more notable in May, with sales surging a whopping 213%, as noted in a CNBC report.

Christina Bu, secretary general of the Norwegian EV Association (NEVA), stated that Tesla’s strong market performance was partly due to the updated Model Y, which is really just a good car, period.

“I think it just has to do with the fact that they deliver a car which has quite a lot of value for money and is what Norwegians need. What Norwegians need, a large luggage space, all wheel drive, and a tow hitch, high ground clearance as well. In addition, quite good digital solutions which people have gotten used to, and also a charging network,” she said.

Tesla in Europe

Tesla’s success in Norway is supported by long-standing government incentives for EV adoption, including exemptions from VAT, road toll discounts, and access to bus lanes. Public and home charging infrastructure is also widely available, making the EV ownership experience in the country very convenient.

Tesla’s performance in Europe is still a mixed bag, with markets like Germany and France still seeing declines in recent months. In areas such as Norway, Spain, and Portugal, however, Tesla’s new car registrations are rising. Spain’s sales rose 61% and Portugal’s sales rose 7% last month. This suggests that regional demand may be stabilizing or rebounding in pockets of Europe.

News

Tesla to open first India experience center in Mumbai on July 15

The event is scheduled for July 15 at the Bandra Kurla Complex, a premier business district in Mumbai.

Tesla is officially entering India with the opening of its first showroom and experience center in Mumbai next week. The event is scheduled for July 15 at the Bandra Kurla Complex, a premier business district in Mumbai.

Tesla imports to India signal an early-stage market entry strategy

According to Indian customs data, Tesla has imported approximately $1 million worth of vehicles, charging equipment, and merchandise into the country between January and June. The shipments include six Model Y comprised of five standard variants valued at $32,500 each and one long-range model valued at $46,000. Several Superchargers and related accessories were also imported into the country, as noted in a Yahoo Finance report.

These vehicles are expected to serve as display models and test units as Tesla gauges interest and navigates India’s high import duties, which hover around 70% on fully built vehicles. Despite the significant tariffs in the country, Tesla has opted to begin its India expansion with imported cars.

An invitation to the Tesla India launch event has been making the rounds online. As could be seen in the document, Tesla noted that July 15 would be the launch of Tesla in India through the opening of a Tesla experience centre at Bandra Kurla Complex in Mumbai.

Tesla India’s hiring and expansion efforts are underway

Tesla has filled a number of key roles from the 30+ positions it advertised earlier this year. Recent hires include store managers, service executives, and sales staff, while ongoing recruitment is focused on supply chain engineers and vehicle operators to support the company’s Autopilot program.

Indian officials have been open about their intention to encourage Tesla to establish a manufacturing hub in the country. Tesla does seem open to the idea, at least, with reports last year hinting that Elon Musk was set to visit the country to discuss or even potentially announce a domestic project. The trip, however, was ultimately canceled.

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

Elon Musk1 day ago

Elon Musk1 day agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

Elon Musk4 days ago

Elon Musk4 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

News1 week ago

News1 week agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoA Tesla just delivered itself to a customer autonomously, Elon Musk confirms

-

Elon Musk1 week ago

Elon Musk1 week agoxAI’s Memphis data center receives air permit despite community criticism

-

News2 weeks ago

News2 weeks agoXiaomi CEO congratulates Tesla on first FSD delivery: “We have to continue learning!”

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla gets $475 price target from Benchmark amid initial Robotaxi rollout