News

Tesla is going full throttle in what could be its most vital end-of-quarter push yet

The end of the second quarter is at hand, and all signs are pointing to Tesla (NASDAQ:TSLA) conducting an intense delivery blitz once more. With the possibility of a potential inclusion to the S&P 500 at hand, Tesla appears to be in the midst of what could very well be its most important end-of-quarter initiative yet.

The second quarter has been nothing short of brutal to the automotive industry as a whole, thanks in no small part to the outbreak of the coronavirus. With the pandemic resulting in lockdowns across the globe, companies such as Tesla were forced to close their production facilities to ensure their workers’ safety. Tesla, for its part, was able to resume operations in May, and by that time, the company only had a little less than two months before the end of the quarter.

Fortunately for Tesla, Gigafactory Shanghai has been ramping its Model 3 production in China, and deliveries of the all-electric sedan have been in an upswing recently. Propelled by new government incentives, the Made-in-China Model 3 may very well provide a healthy boost to Tesla’s delivery figures in the second quarter. Posts from China have also noted that Tesla is rolling out additional incentives to encourage customers to take delivery of their vehicle orders this month, such as free Supercharging for 1500 km.

Over in the United States, Tesla is all about the Model Y. Deliveries of the all-electric crossover have resumed since operations resumed in May, and if Elon Musk’s recent tweets are any indication, it appears that it’s all hands on deck for a delivery blitz once more. Just recently, for example, Musk posted an apology to customers due to the company’s shifting delivery dates. The CEO also expressed some special thanks to Tesla’s trucking and rail partners for “figuratively and literally” going the extra mile.

As noted in a report from The Wall Street Journal, Tesla has a fighting chance at being included in the S&P 500 if it turns even a small profit this quarter. To qualify for the S&P 500, a company has to post a cumulative profit over its previous four quarters, with its most recent quarter also showing a profit. Tesla, for its part, has reported a net profit in the past three quarters, with the company posting $143 million in Q3 2019, $105 million in Q4 2019, and $16 million in Q1 2020.

With this in mind, the company would only have to post a small profit to qualify for the S&P 500. Otherwise, the company would have to wait for its third quarter results this year to qualify for eligibility in the popular stock index. Either way, it appears that the electric car maker, one of the most shorted companies in the market, is within striking distance of yet another big milestone. And that, considering the presence of a pandemic, is quite respectable on its own right.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

Elon Musk

Tesla scrambles after Musk sidekick exit, CEO takes over sales

Tesla CEO Elon Musk is reportedly overseeing sales in North America and Europe, Bloomberg reports.

Tesla scrambled its executives around following the exit of CEO Elon Musk’s sidekick last week, Omead Afshar. Afshar was relieved of his duties as Head of Sales for both North America and Europe.

Bloomberg is reporting that Musk is now overseeing both regions for sales, according to sources familiar with the matter. Afshar left the company last week, likely due to slow sales in both markets, ending a seven-year term with the electric automaker.

Tesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

Afshar was promoted to the role late last year as Musk was becoming more involved in the road to the White House with President Donald Trump.

Afshar, whose LinkedIn account stated he was working within the “Office of the CEO,” was known as Musk’s right-hand man for years.

Additionally, Tom Zhu, currently the Senior Vice President of Automotive at Tesla, will oversee sales in Asia, according to the report.

It is a scramble by Tesla to get the company’s proven executives over the pain points the automaker has found halfway through the year. Sales are looking to be close to the 1.8 million vehicles the company delivered in both of the past two years.

Tesla is pivoting to pay more attention to the struggling automotive sales that it has felt over the past six months. Although it is still performing well and is the best-selling EV maker by a long way, it is struggling to find growth despite redesigning its vehicles and launching new tech and improvements within them.

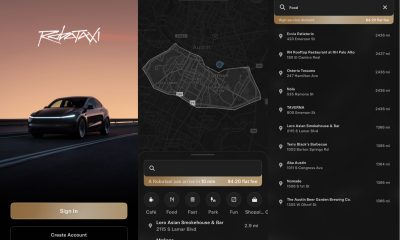

The company is also looking to focus more on its deployment of autonomous tech, especially as it recently launched its Robotaxi platform in Austin just over a week ago.

However, while this is the long-term catalyst for Tesla, sales still need some work, and it appears the company’s strategy is to put its biggest guns on its biggest problems.

News

Tesla upgrades Model 3 and Model Y in China, hikes price for long-range sedan

Tesla’s long-range Model 3 now comes with a higher CLTC-rated range of 753 km (468 miles).

Tesla has rolled out a series of quiet upgrades to its Model 3 and Model Y in China, enhancing range and performance for long-range variants. The updates come with a price hike for the Model 3 Long Range All-Wheel Drive, which now costs RMB 285,500 (about $39,300), up RMB 10,000 ($1,400) from the previous price.

Model 3 gets acceleration boost, extended range

Tesla’s long-range Model 3 now comes with a higher CLTC-rated range of 753 km (468 miles), up from 713 km (443 miles), and a faster 0–100 km/h acceleration time of 3.8 seconds, down from 4.4 seconds. These changes suggest that Tesla has bundled the previously optional Acceleration Boost for the Model 3, once priced at RMB 14,100 ($1,968), as a standard feature.

Delivery wait times for the long-range Model 3 have also been shortened, from 3–5 weeks to just 1–3 weeks, as per CNEV Post. No changes were made to the entry-level RWD or Performance versions, which retain their RMB 235,500 and RMB 339,500 price points, respectively. Wait times for those trims also remain at 1–3 weeks and 8–10 weeks.

Model Y range increases, pricing holds steady

The Model Y Long Range has also seen its CLTC-rated range increase from 719 km (447 miles) to 750 km (466 miles), though its price remains unchanged at RMB 313,500 ($43,759). The model maintains a 0–100 km/h time of 4.3 seconds.

Tesla also updated delivery times for the Model Y lineup. The Long Range variant now shows a wait time of 1–3 weeks, an improvement from the previous 3–5 weeks. The entry-level RWD version maintained its starting price of RMB 263,500, though its delivery window is now shorter at 2–4 weeks.

Tesla continues to offer several purchase incentives in China, including an RMB 8,000 discount for select paint options, an RMB 8,000 insurance subsidy, and five years of interest-free financing for eligible variants.

-

Elon Musk1 day ago

Elon Musk1 day agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News6 days ago

News6 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more