Investor's Corner

Tesla’s (TSLA) stock split and how it has burned short sellers

Tesla’s (NASDAQ: TSLA) price adjustment from its stock split took effect yesterday, and short-sellers are feeling the heat from the company’s surge in price once again.

Tesla shares rallied 12% on the first day of post-split trading after the trading volume was well above its daily average, with 115.6 million pieces of stock trading hands. The company’s valuation has continued to explode amidst the rush to buy TSLA shares after the split occurred, and it’s not resulting in a lot of profitability for investors who are shorting the electric automaker.

CNBC described how short-sellers are continuing to feel pressure apart from the obvious fact, which is that Tesla’s shares have grown exponentially in value in 2020.

When stocks are split, especially if the stock in question is heavily shorted, it can cause problems. Whether the stock is put into a basket of derivatives or special financing is used on the short, things can get dicey because the price per share changes, the CNBC crew explained.

The issues do not usually affect retail investors who are shorting small amounts of the stock. The problems come more from large funds or companies that are shorting the company in massive figures.

Whether the stock is being shorted based on derivatives or Delta One products, which are derivatives that have no optionality, things can tend to go haywire, the team explained.

More relevant than not, the company’s surge in price yesterday also caused some issues for short-sellers, as it has done for the first eight months of the year.

According to financial analytics firm S3 Partners, Tesla shorts are down $25.4 billion in mark-to-market losses so far this year. With the adjusted price, Tesla stock has gone from $86.05 per share on January 2 to over $482 this year. The surge in price can be attributed to Tesla’s development of batteries and vehicle technology. The company’s energy supply and storage sector is also booming and has managed to grow this year, according to the company’s most recent Quarterly Earnings Update.

Additionally, shorting Tesla’s stock is not an expensive move anymore. “It’s a very inexpensive stock to short, believe it or not because nobody wants to get in front of a moving freight train!”

Tesla’s stock split was announced on August 11, and the primary intention of the move was to increase the likelihood that young people and employees of the company could get in on investing. Many trading platforms reported issues with functionality yesterday, which could be attributed to both Tesla and Apple stock performing splits on August 31.

Watch CNBC’s Squawk Box talk about TSLA stock and how its affected short-sellers below.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Elon Musk

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

Elon Musk

Tesla surges following better-than-expected delivery report

Tesla saw some positive momentum during trading hours as it reported its deliveries for Q2.

Tesla (NASDAQ: TSLA) surged over four percent on Wednesday morning after the company reported better-than-expected deliveries. It was nearly right on consensus estimations, as Wall Street predicted the company would deliver 385,000 cars in Q2.

Tesla reported that it delivered 384,122 vehicles in Q2. Many, including those inside the Tesla community, were anticipating deliveries in the 340,000 to 360,000 range, while Wall Street seemed to get it just right.

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

Despite Tesla meeting consensus estimations, there were real concerns about what the company would report for Q2.

There were reportedly brief pauses in production at Gigafactory Texas during the quarter and the ramp of the new Model Y configuration across the globe were expected to provide headwinds for the EV maker during the quarter.

At noon on the East Coast, Tesla shares were up about 4.5 percent.

It is expected that Tesla will likely equal the number of deliveries it completed in both of the past two years.

It has hovered at the 1.8 million mark since 2023, and it seems it is right on pace to match that once again. Early last year, Tesla said that annual growth would be “notably lower” than expected due to its development of a new vehicle platform, which will enable more affordable models to be offered to the public.

These cars are expected to be unveiled at some point this year, as Tesla said they were “on track” to be produced in the first half of the year. Tesla has yet to unveil these vehicle designs to the public.

Dan Ives of Wedbush said in a note to investors this morning that the company’s rebound in China in June reflects good things to come, especially given the Model Y and its ramp across the world.

He also said that Musk’s commitment to the company and return from politics played a major role in the company’s performance in Q2:

“If Musk continues to lead and remain in the driver’s seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.”

Ives maintained his $500 price target and the ‘Outperform’ rating he held on the stock:

“Tesla’s future is in many ways the brightest it’s ever been in our view given autonomous, FSD, robotics, and many other technology innovations now on the horizon with 90% of the valuation being driven by autonomous and robotics over the coming years but Musk needs to focus on driving Tesla and not putting his political views first. We maintain our OUTPERFORM and $500 PT.”

Moving forward, investors will look to see some gradual growth over the next few quarters. At worst, Tesla should look to match 2023 and 2024 full-year delivery figures, which could be beaten if the automaker can offer those affordable models by the end of the year.

Investor's Corner

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date.

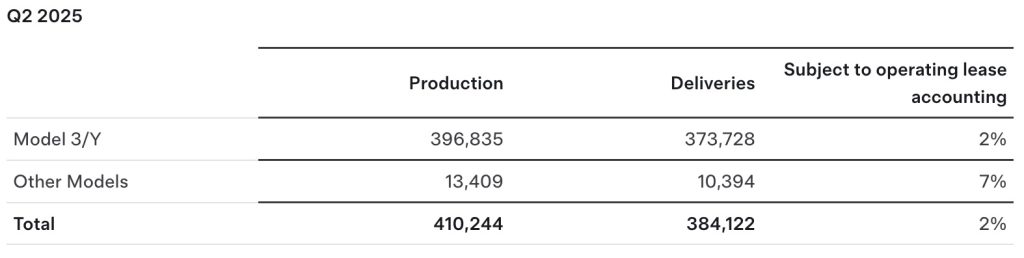

Tesla (NASDAQ: TSLA) has released its Q2 2025 vehicle delivery and production report. As per the report, the company delivered over 384,000 vehicles in the second quarter of 2025, while deploying 9.6 GWh in energy storage. Vehicle production also reached 410,244 units for the quarter.

Model 3/Y dominates output, ahead of earnings call

Of the 410,244 vehicles produced during the quarter, 396,835 were Model 3 and Model Y units, while 13,409 were attributed to Tesla’s other models, which includes the Cybertruck and Model S/X variants. Deliveries followed a similar pattern, with 373,728 Model 3/Ys delivered and 10,394 from other models, totaling 384,122.

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date, signaling continued strength in the Megapack and Powerwall segments.

Year-on-year deliveries edge down, but energy shows resilience

Tesla will share its full Q2 2025 earnings results after the market closes on Wednesday, July 23, 2025, with a live earnings call scheduled for 4:30 p.m. CT / 5:30 p.m. ET. The company will publish its quarterly update at ir.tesla.com, followed by a Q&A webcast featuring company leadership. Executives such as CEO Elon Musk are expected to be in attendance.

Tesla investors are expected to inquire about several of the company’s ongoing projects in the upcoming Q2 2025 earnings call. Expected topics include the new Model Y ramp across the United States, China, and Germany, as well as the ramp of FSD in territories outside the US and China. Questions about the company’s Robotaxi business, as well as the long-referenced but yet to be announced affordable models are also expected.

-

Elon Musk5 days ago

Elon Musk5 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report