News

Tesla ($TSLA) short sellers lost $1.55 billion over the past 30 days

Tesla’s ($TSLA) short sellers are down by $1.55 billion according to a report by S3 Partners. Yesterday, Tesla reported very strong Q2 results and the news isn’t good for those hoping for Tesla’s failure as a company.

In 2021, S3 Partners pointed out that Tesla held the largest short interest in the market. Jim Chanos and David Einhorn have been betting against the company’s stock for quite some time. In January 2021, their losses had already accumulated to $1 billion.

Down $1.55 Billion In The Last 30 Days

The analysis noted that Tesla’s short interest is $18.54 billion and that 24.98 million shares have been shorted. Tesla’s short sellers covered 2.09 million shares over the last 30 days.

These shares were worth $1.55 billion.

The analysis noted:

“TSLA short sellers were actively trimming their exposure ahead of the earnings release, covering 2.09 million shares, worth $1.55 billion, over the last thirty days. This is a -7.7% decrease in TSLA shares shorted as its stock price rose +14.2%. Over the last week, we saw 1.20 million shares bought to cover, worth $891 million, a -4.6% decrease in total shares shorted as TSLA’s stock price rose +4.4%.”

July 2022 was the most unprofitable for Tesla’s short sellers

For those of us enduring the intense summer 2022 heat wave this year, we are not alone. Tesla’s short sellers are feeling the burn in their portfolios as well.

S3 Partners noted that Tesla is the worst performing short in July in terms of dollars. Tesla isn’t alone here.

Several other popular stocks such as Facebook, Apple, Amazon, Netflix, and Google as well as crypto and meme stocks are on the list.

According to the analysis:

“With TSLA’s stock price rallying and short sellers incurring $1 billion of mark-to-market losses today, we should expect its short covering trend to continue as short sellers get squeezed out of their positions due to these large and sudden losses. These buy-to-covers and the potential for hedge funds to bulk up their positions in a high beta name with a positive price trend may help reverse TSLA’s year price weakness.”

Disclaimer: Johnna is a partial Tesla shareholder with under 1 share currently. She plans on buying more and supports Tesla and its mission.

If you have a tip, feel free to send them to johnna@teslarati.com

Elon Musk

Tesla reveals it is using AI to make factories more sustainable: here’s how

Tesla is using AI in its Gigafactory Nevada factory to improve HVAC efficiency.

Tesla has revealed in its Extended Impact Report for 2024 that it is using Artificial Intelligence (AI) to enable its factories to be more sustainable. One example it used was its achievement of managing “the majority of the HVAC infrastructure at Gigafactory Nevada is now AI-controlled” last year.

In a commitment to becoming more efficient and making its production as eco-friendly as possible, Tesla has been working for years to find solutions to reduce energy consumption in its factories.

For example, in 2023, Tesla implemented optimization controls in the plastics and paint shops located at Gigafactory Texas, which increased the efficiency of natural gas consumption. Tesla plans to phase out natural gas use across its factories eventually, but for now, it prioritizes work to reduce emissions from that energy source specifically.

It also uses Hygrometric Control Logic for Air Handling Units at Giafactory Berlin, resulting in 17,000 MWh in energy savings each year. At Gigafactory Nevada, Tesla saves 9.5 GWh of energy through the use of N-Methylpyrrolidone refineries when extracting critical raw material.

Perhaps the most interesting way Tesla is conserving energy is through the use of AI at Gigafactory Nevada, as it describes its use of AI to reduce energy demand:

“In 2023, AI Control for HVAC was expanded from Nevada and Texas to now include our Berlin-Brandenburg and Fremont factories. AI Control policy enables HVAC systems within each factory to work together to process sensor data, model factory dynamics, and apply control actions that safely minimize the energy required to support production. In 2024, this system achieved two milestones: the majority of HVAC infrastructure at Gigafactory Nevada is now AI-controlled, reducing fan and thermal energy demand; and the AI algorithm was extended to manage entire chiller plants, creating a closed-loop control system that optimizes both chilled water consumption and the energy required for its generation, all while maintaining factory conditions.”

Tesla utilizes AI Control “primarily on systems that heat or cool critical factory production spaces and equipment.” AI Control communicates with the preexisting standard control logic of each system, and any issues can be resolved by quickly reverting back to standard control. There were none in 2024.

Tesla says that it is utilizing AI to drive impact at its factories, and it has proven to be a valuable tool in reducing energy consumption at one of its facilities.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

Elon Musk

Tesla scrambles after Musk sidekick exit, CEO takes over sales

Tesla CEO Elon Musk is reportedly overseeing sales in North America and Europe, Bloomberg reports.

Tesla scrambled its executives around following the exit of CEO Elon Musk’s sidekick last week, Omead Afshar. Afshar was relieved of his duties as Head of Sales for both North America and Europe.

Bloomberg is reporting that Musk is now overseeing both regions for sales, according to sources familiar with the matter. Afshar left the company last week, likely due to slow sales in both markets, ending a seven-year term with the electric automaker.

Tesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

Afshar was promoted to the role late last year as Musk was becoming more involved in the road to the White House with President Donald Trump.

Afshar, whose LinkedIn account stated he was working within the “Office of the CEO,” was known as Musk’s right-hand man for years.

Additionally, Tom Zhu, currently the Senior Vice President of Automotive at Tesla, will oversee sales in Asia, according to the report.

It is a scramble by Tesla to get the company’s proven executives over the pain points the automaker has found halfway through the year. Sales are looking to be close to the 1.8 million vehicles the company delivered in both of the past two years.

Tesla is pivoting to pay more attention to the struggling automotive sales that it has felt over the past six months. Although it is still performing well and is the best-selling EV maker by a long way, it is struggling to find growth despite redesigning its vehicles and launching new tech and improvements within them.

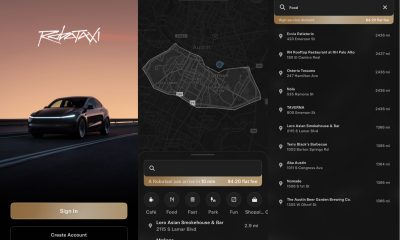

The company is also looking to focus more on its deployment of autonomous tech, especially as it recently launched its Robotaxi platform in Austin just over a week ago.

However, while this is the long-term catalyst for Tesla, sales still need some work, and it appears the company’s strategy is to put its biggest guns on its biggest problems.

-

Elon Musk1 day ago

Elon Musk1 day agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News6 days ago

News6 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more