News

Signs that Tesla may soon discontinue the Model X P90D

It would appear that Tesla is anxious to sell down its stock of new Model X P90D cars according to the latest listing of inventory cars for sale by the Silicon Valley automaker. At the time of writing, nearly 85% of the vehicles listed on the company’s New Inventory page are for the Performance version of its 90 kWh Model X SUV which may suggest that production for the P90D may soon come to an end. With such a modest performance gap between the P100D and P90D, it makes sense to only offer one range topping configuration. But there may be more to the story.

Updated November 3, 2016: Tesla says goodbye to P90D Model S, X: P100D is the new king of the hill

Elon Musk has made it clear that people who opt for the P100D option in either the Model S or Model X are helping to fund development of the Model 3 — especially if the Ludicrous Mode upgrade is included. Tesla has a lot of balls in the air at the moment, especially with the proposed merger between it and SolarCity set to happen in less than a month. It needs to bring money in the door to calm nervous investors who fear the company his bitten off more than it can chew in terms of cash flow.

It is racing to expand its Supercharger network in preparation for having more Teslas on the road once the Model 3 goes into production. It needs to open more stores and service locations. And it needs to fund the SolarCity acquisition. The P100D variant likely has the highest profit margin for the company. With the pressure to bring cash in the door paramount at the moment, this is the perfect time to drop the less profitable P90D and maximize income.

Looking beyond the immediate moment, however, Tesla has always preferred to have two basic battery packs for its Model S and Model X. Right now it has four variants — 60 kWh, 75 kWh, 90 kWh and 100 kWh. The current 60 kWh battery is a software limited version of the 75 kWh battery pack. Eliminating the 90 kWh battery entirely would leave it free to offer a software limited version of the 100 kWh to customers who want something more than the 75 kWh unit but don’t want to spend the money for the 100 kWh choice.

A pair of Model S and Model X P90D Ludicrous seen at the Gardnerville, NV Supercharger

The software limited 60 kWh battery costs $6,000 less than the original 60. That means Tesla could offer a software limited 90 kWh option for less money than the 90D costs today, which would give customers the range of options they want while allowing the company to save money by only building and stocking 2 basic batteries for its long range vehicles – a 75 kWh and 100 kWh battery pack. It wouldn’t come as a surprise if Tesla soon drops the P90D for both the Model S and Model X.

Tesla is charting new territory by offering features that can be unlocked later upon payment of a upgrade charge. All Teslas now come with the second generation hardware needed for its Enhanced Autopilot system. Buyers have a choice of activating that option at the time the car is built or upgrading later. The same is true of Full Self-Driving Capability. Because of Tesla’s ability to alter the configuration of its cars wirelessly at any time, a buyer today can elect to add features later if so desired. That capability should help keep the resale value of used Teslas high.

If you have your heart set on a Model X P90D or Model S P90D, both of which no longer have the Ludicrous mode upgrade available, better act fast before they’re all gone. You can save yourself a significant amount of money by not waiting until the higher priced P100D is the only option available.

News

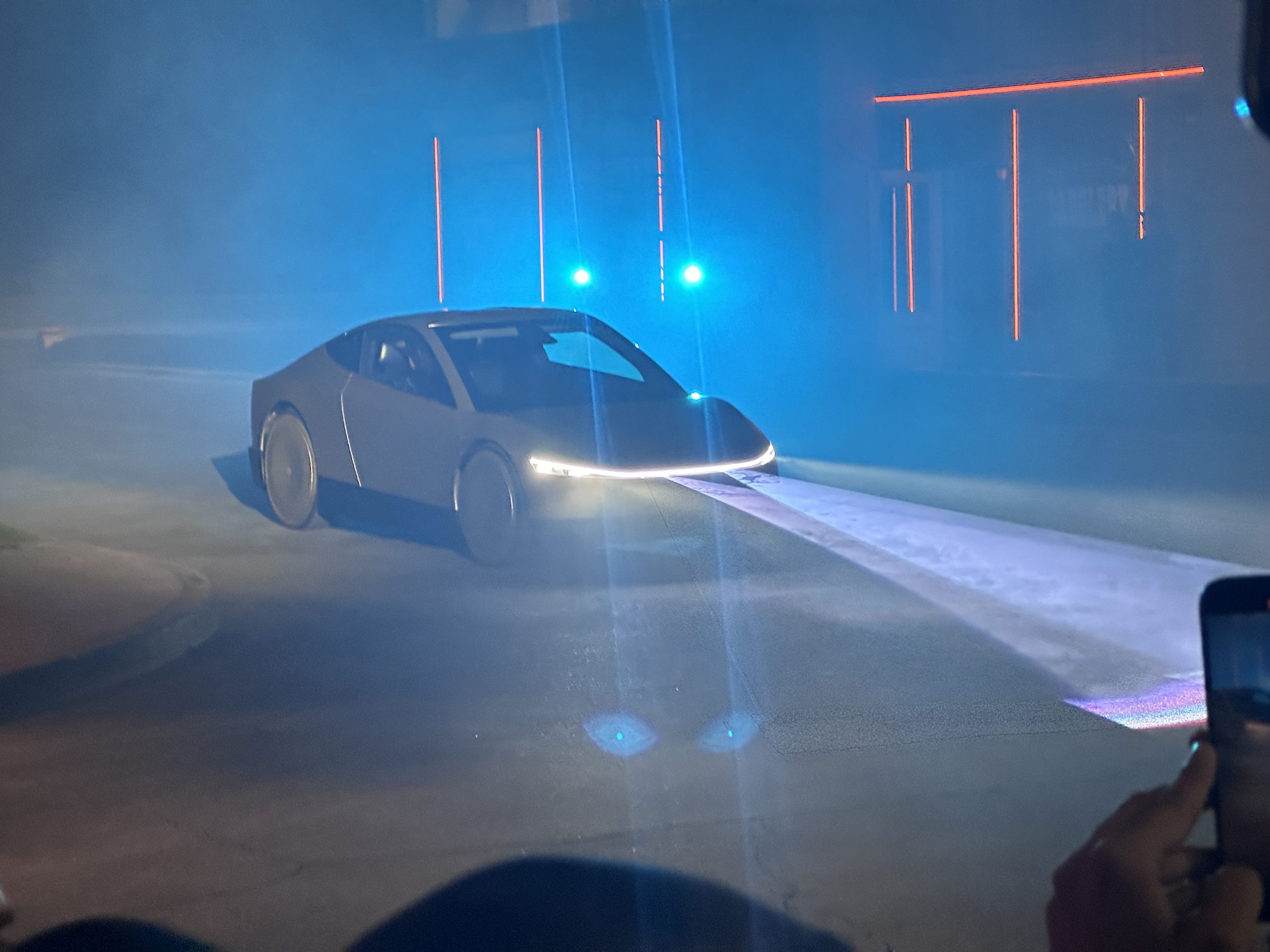

Tesla Cybercab spotted testing on public roads for the first time

The car was spotted just minutes from Tesla’s Engineering Headquarters in Los Altos, California. There are a few interesting tidbits we can gather from the photo and the information shared with it.

The Tesla Cybercab has been spotted testing on public roads for the first time, marking a substantial step forward in the vehicle’s development.

The car was spotted just minutes from Tesla’s Engineering Headquarters in Los Altos, California. There are a few interesting tidbits we can gather from the photo and the information shared with it:

BREAKING: Tesla’s Cybercab spotted testing on public roads for the first time!

This was in Los Altos, California, about 10 minutes from Tesla’s Engineering HQ. As would be expected at this stage, a person was in the driver seat.

The future is autonomous 🤖 pic.twitter.com/cvd6UrnKZo

— Sawyer Merritt (@SawyerMerritt) October 29, 2025

The vehicle had a driver and side view mirrors equipped on it, which seems to be pretty expected, especially at this stage.

Tesla might have been using its Full Self-Driving software with the vehicle as it enters this new stage of testing on public roads. This seems most likely, especially as the car, which has long been developed to be void of a steering wheel and pedals, will totally rely on autonomous tech to transport one or two passengers to their destination.

Additionally, side view mirrors are required by law at delivery, and Tesla was likely looking to keep things as safe and elementary as possible, especially with this early stage of testing.

As this is the first time the vehicle has been spotted on public roads and the first time it was likely testing on them, Tesla was being cautious.

There have been a lot of developments with Cybercab over the past few weeks, as the car has been spotted testing on the Fremont Factory’s test track, units have been seen outside of Gigafactory Texas’s crash testing facility, and there has been some additional speculation about what the vehicle’s standard equipment will be.

There have also been quite a few job postings by Tesla for manufacturing and production roles related to Cybercab over the past few weeks.

Yesterday, Tesla’s Board Chair, Robyn Denholm, revealed that the company could end up building Cybercab with a steering wheel and pedals, contrary to what Tesla and CEO Elon Musk have wanted to do.

The vehicle has yet to reach that stage of regulatory testing, but Tesla wants to start volume production in Q2. If it wants to release the vehicle without any manual controls, that means that Full Self-Driving will need to be completed within the next eight months.

News

Tesla hints it could see ‘a few more vehicles’ released soon

Denholm said on CNBC yesterday that “we do have a few other vehicles coming out.”

Tesla Board Chair Robyn Denholm hinted the company could see “a few more vehicles” coming out and being released soon, although there is no indication of what could be on the way based on her comments.

However, Tesla has hinted toward several potential releases in the coming years, as other executives, including Chief Designer Franz von Holzhausen, have talked briefly about what could be on the way.

Denholm said on CNBC yesterday that “we do have a few other vehicles coming out.”

BREAKING: $TSLA BOARD CHAIR ROBYN SAYS — “WE HAVE NEW VEHICLES COMING OUT” 👀

It’s happening ! pic.twitter.com/f8UuZWGLuP

— TheSonOfWalkley (@TheSonOfWalkley) October 27, 2025

It was a vague and almost cryptic sentence, as, in all honesty, it was not completely clear whether she was talking about recent releases that are just making their way to market, like the Model 3 and Model Y “Standard,” or new vehicles altogether.

Nevertheless, it’s worth dissecting.

Tesla “Standard” Models

On October 7, Tesla launched the Standard Model 3 and Model Y, stripped-down versions of their now “Premium” siblings. The Standard trims lack premium features like leather seats, a rear touchscreen, and a glass roof, among other features.

These cars are just starting to be delivered for the first time, so it is possible that Denholm was referring to these cars.

Potential Model 2 Hint?

There has always been a looming vehicle model that many Tesla fans and owners have been intrigued by: the Model 2.

This car was hinted at being the $25,000 model that Tesla was rumored to be developing, and many thought that was the vehicle that would be released earlier this month, not the Standard Model 3 and Model Y.

Instead, the Model 2 could be something that would enable Tesla to reach an entirely new consumer base, including those who are not able to swing the payment for the company’s more premium offerings.

It seems Tesla will have to launch some sort of extremely affordable model in the future, and with the Cybercab being slotted at that rough price point, it would not be out of the question for it to be in the realm of possibility for future releases.

It’s worth noting, however, that it is probably unlikely this will happen. Tesla is so deadset focused on autonomy, it seems Cybercab would take extreme precedence over the unconfirmed “Model 2.”

Cybertruck-inspired SUV

Tesla fans have been begging the company to develop a full-size SUV that would compete with the Ford Expedition or Chevrolet Tahoe, but the company has not given any indication that this would be something it would build.

Nevertheless, there was a very subtle hint in a recent promotional clip that showed a Cyber SUV mock-up placed strategically next to a clay model of a Model 3:

The Model X is simply not what people want when it comes to an SUV, as it does not have the seating capacity and cargo space that many need with a full-sized SUV.

This issue, in particular, has been one that has been extremely relevant to the company’s future lineup as consumers have shown they would be interested in a Tesla vehicle that fit this description.

Additionally, von Holzhausen said in September that a Cyber SUV or a smaller electric pickup with a more traditional design is “definitely things we’ve considered…We’re working on so many innovative and fun things.”

Tesla gives big hint that it will build Cyber SUV, smaller Cybertruck

Investor's Corner

Tesla enters new stability phase, firm upgrades and adjusts outlook

Dmitriy Pozdnyakov of Freedom Capital upgraded his outlook on Tesla shares from “Sell” to “Hold” on Wednesday, and increased the price target from $338 to $406.

Tesla is entering a new phase of stability in terms of vehicle deliveries, one firm wrote in a new note during the final week of October, backing its position with an upgrade and price target increase on the stock.

Dmitriy Pozdnyakov of Freedom Capital upgraded his outlook on Tesla shares from “Sell” to “Hold” on Wednesday, and increased the price target from $338 to $406.

While most firms are interested in highlighting Tesla’s future growth, which will be catalyzed mostly by the advent of self-driving vehicles, autonomy, and the company’s all-in mentality on AI and robotics, Pozdnyakov is solely focusing on vehicle deliveries.

The analyst wrote in a note to investors that he believes Tesla’s updated vehicle lineup, which includes its new affordable “Standard” trims of the Model 3 and Model Y, is going to stabilize the company’s delivery volumes and return the company to annual growth.

Tesla launches two new affordable models with ‘Standard’ Model 3, Y offerings

Tesla launched the new affordable Model 3 and Model Y “Standard” trims on October 7, which introduced two stripped-down, less premium versions of the all-electric sedan and crossover.

They are both priced at under $40,000, with the Model 3 at $37,990 and the Model Y at $39,990, and while these prices may not necessarily be what consumers were expecting, they are well under what Kelley Blue Book said was the average new car transaction price for September, which swelled above $50,000.

Despite the rollout of these two new models, it is interesting to hear that a Wall Street firm would think that Tesla is going to return to more stable delivery figures and potentially enter a new growth phase.

Many Wall Street firms have been more focused on AI, Robotics, and Tesla’s self-driving project, which are the more prevalent things that will drive investor growth over the next few years.

Wedbush’s Dan Ives, for example, tends to focus on the company’s prowess in AI and self-driving. However, he did touch on vehicle deliveries in the coming years in a recent note.

Ives said in a note on October 2:

“While EV demand is expected to fall with the EV tax credit expiration, this was a great bounce-back quarter for TSLA to lay the groundwork for deliveries moving forward, but there is still work to do to gain further ground from a delivery perspective.”

Tesla has some things to figure out before it can truly consider guaranteed stability from a delivery standpoint. Initially, the next two quarters will be a crucial way to determine demand without the $7,500 EV tax credit. It will also begin to figure out if its new affordable models are attractive enough at their current price point to win over consumers.

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoSpaceX posts Starship booster feat that’s so nutty, it doesn’t even look real

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla Full Self-Driving gets an offer to be insured for ‘almost free’

-

News2 weeks ago

News2 weeks agoElon Musk confirms Tesla FSD V14.2 will see widespread rollout

-

News2 weeks ago

News2 weeks agoTesla is adding an interesting feature to its centerscreen in a coming update

-

News2 weeks ago

News2 weeks agoTesla launches new interior option for Model Y

-

News2 weeks ago

News2 weeks agoTesla widens rollout of new Full Self-Driving suite to more owners

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla CEO Elon Musk’s $1 trillion pay package hits first adversity from proxy firm

-

News1 week ago

News1 week agoTesla might be doing away with a long-included feature with its vehicles