Investor's Corner

Tesla releases Q2 results: Sets quarterly production record

This is a quick cut of the main items from the shareholder letter outlining Tesla Q2 financial results:

Summary

- Completed Model 3 design phase

- Increased automotive gross margin on both Model S and Model X

- Exited Q2 consistently producing nearly 2,000 vehicles/week

- Production and demand on track to support 50,000 deliveries in 2H 2016

- Merger agreement to acquire SolarCity signed, subject to shareholder vote

Production

“In Q2, we delivered 14,402 new vehicles consisting of 9,764 Model S and 4,638 Model X, which was slightly higher than what we stated in our July announcement. Model S remains the market share leader in North America and Europe among all comparably priced four-door sedans, and Model X is quickly gaining ground against similarly priced SUVs in all regions.”

“We exited Q2 consistently producing nearly 2,000 vehicles per week and our total Q2 production of 18,345 vehicles constituted a new quarterly production record, up 18% from Q1 and up 43% from Q2 last year.”

These numbers are in line with the 14,370 new vehicles deliveries and the “just under 2,000 vehicles per week” reported in the July 3rd release. So nothing new here.

One good number is that “production hours per vehicle also declined throughout the quarter for both cars”, indicating the ability to continue to produce more cars per hour.

Gigafactory

“Gigafactory construction remains on target to support volume production of Model 3 in late 2017, and we recently accelerated construction to reach a rate of 35 GWh/year of cell production in 2018. This will allow us to meet the needs of our accelerated Model 3 production plan.”

Notice that the 35GWh/year of cell production is currently the total worldwide output.

Earnings

“Our Q2 GAAP net loss was $293 million or a $2.09 loss per share on 140 million basic shares, while our non-GAAP net loss was $150 million, or a $1.06 loss per basic share. Both figures include a $0.05 per basic share loss related mostly to losses from foreign currency transactions.”

According to MarketWatch, “Analysts polled by FactSet [expected] Tesla to report an adjusted loss of 59 cents a share in the second quarter. […] Estimize, which crowdsources estimates from analysts, fund managers, and academics, expected Tesla to report a loss of 54 cents a share, based on 379 estimates.”.

Loss is higher than anticipated. This number scared a few traders that bid the stock lower to 217 in after hours trading, but the stock quickly retraced back to 228, higher than the daily close. For a company like Tesla, where the price is based on future expectations, the earning numbers are really not what counts.

Revenue

Total Q2 GAAP revenue was $1.3 billion, while non-GAAP revenue was $1.6 billion for the quarter, up 31% from a year ago. Total Q2 gross margin was 21.6% on a GAAP basis and 20.8% on a non-GAAP basis.

Also according to MarketWatch, “FactSet analysts [were] expecting sales to reach $1.63 billion in the quarter, compared with $1.20 billion in the second quarter of 2015. […] Estimize [was] expecting sales of $1.55 billion.”

Revenue is pretty much matching expectations, and this will be seen positively by Wall Street.

Gross Margins

“Q2 Automotive gross margin was 23.1% on a GAAP basis. On a non-GAAP basis, gross margin excluding ZEV credits increased over 200 basis points from Q1 to 21.9%. We recognized an insignificant amount of ZEV credit revenue in Q2. The strong sequential gross margin increase was primarily due to improved manufacturing for Model X and favorable pricing for Model S. Our warranty accrual rates on new vehicles were generally consistent with Q1.”

Another good number that Wall Street likes a lot: increasing gross margins!

“We delivered fewer cars in Q2 than originally planned as a result of our steep production ramp, which resulted in almost half of Q2 production occurring in the final four weeks of the quarter. Given inflection points in the production ramp and firm shipping cutoffs, shifting production by even a short period of time had a disproportionate impact on the number of cars that were delivered by quarter end.”

This is also nothing new as it was originally disclosed in the July 3rd release.

Services

“Q2 Services and other revenue was $88 million, up 15% from a year ago but down sequentially. The decline was primarily due to having fewer pre-owned cars to sell because of the need to use them to expand our service loaner fleet. Q2 Service and other gross margin was 2.5%, down from 4.7% in Q1, but generally in line with our expectations.”

Stores

“We are also accelerating store openings and plan to add a new retail location every four days on average during the remainder of Q3 and through Q4. We are adding stores in new population-dense markets like Taipei, Seoul, and Mexico City, while also adding stores in our most mature markets like California.”

That is about 45 new stores by the end of the year.

Outlook

“Production and demand are on track to support deliveries of approximately 50,000 new Model S and Model X vehicles during the second half of 2016.”

Given the Q1 and Q2 reported deliveries, the 2016 deliveries are now slated to be around 79,000, pretty close to the bottom of the previously reported 80,000 to 90,000 range.

“Vehicle production efficiency is improving rapidly and we are now increasing our weekly production rate even further. Barring any further supply constraints, we plan to exit Q3 with a steady production rate of 2,200 vehicles per week, and plan to increase production to 2,400 vehicles per week in Q4.”

“Despite the disciplined pace of capital spending in the first half of this year, we still expect to invest about $2.25 billion in capital expenditures in 2016, in support of our accelerated production plan for Model 3.”

What is not there

Surprisingly there is nothing in the letter about the pending $2.6 billion SolarCity acquisition.

Full Q2 Results

From the Tesla Q2 Shareholder Letter.

Initial Market Reaction

$TSLA stock immediately dropped to $217 right after the close of regular market trading, but after about an hour of extended hours trading it was back to the previous daily close of $225.30, indicating that we should not expect much fireworks when the stock market reopens on Thursday.

Wall Street seems relieved that the weekly production numbers are in line with expectations, and that the corresponding “production ramp” is still in play.

Investor's Corner

Cantor Fitzgerald reaffirms bullish view on Tesla after record Q3 deliveries

The firm reiterated its Overweight rating and $355 price target.

Cantor Fitzgerald is maintaining its bullish outlook on Tesla (NASDAQ:TSLA) following the company’s record-breaking third quarter of 2025.

The firm reiterated its Overweight rating and $355 price target, citing strong delivery results driven by a rush of consumer purchases ahead of the end of the federal tax credit on September 30.

On Tesla’s vehicle deliveries in Q3 2025

During the third quarter of 2025, Tesla delivered a total of 497,099 vehicles, significantly beating analyst expectations of 443,079 vehicles. As per Cantor Fitzgerald, this was likely affected by customers rushing at the end of Q3 to purchase an EV due to the end of the federal tax credit, as noted in an Investing.com report.

“On 10/2, TSLA pre-announced that it delivered 497,099 vehicles in 3Q25 (its highest quarterly delivery in company history), significantly above Company consensus of 443,079, and above 384,122 in 2Q25. This was due primarily to a ‘push forward effect’ from consumers who rushed to purchase or lease EVs ahead of the $7,500 EV tax credit expiring on 9/30,” the firm wrote in its note.

A bright spot in Tesla Energy

Cantor Fitzgerald also highlighted that while Tesla’s full-year production and deliveries would likely fall short of 2024’s 1.8 million total, Tesla’s energy storage business remains a bright spot in the company’s results.

“Tesla also announced that it had deployed 12.5 GWh of energy storage products in 3Q25, its highest in company history vs. our estimate/Visible Alpha consensus of 11.5/10.9 GWh (and vs. ~6.9 GWh in 3Q24). Tesla’s Energy Storage has now deployed more products YTD than all of last year, which is encouraging. We expect Energy Storage revenue to surpass $12B this year, and to account for ~15% of total revenue,” the firm stated.

Tesla’s strong Q3 results have helped lift its market capitalization to $1.47 trillion as of writing. The company also teased a new product reveal on X set for October 7, which the firm stated could serve as another near-term catalyst.

Investor's Corner

Tesla just got a weird price target boost from a notable bear

Tesla stock (NASDAQ: TSLA) just got a weird price target boost from a notable bear just a day after it announced its strongest quarter in terms of vehicle deliveries and energy deployments.

JPMorgan raised its price target on Tesla shares from $115 to $150. It maintained its ‘Underweight’ rating on the stock.

Despite Tesla reporting 497,099 deliveries, about 12 percent above the 443,000 anticipated from the consensus, JPMorgan is still skeptical that the company can keep up its momentum, stating most of its Q3 strength came from leaning on the removal of the $7,500 EV tax credit, which expired on September 30.

Tesla hits record vehicle deliveries and energy deployments in Q3 2025

The firm said Tesla benefited from a “temporary stronger-than-expected industry-wide pull-forward” as the tax credit expired. It is no secret that consumers flocked to the company this past quarter to take advantage of the credit.

The bump will need to be solidified as the start of a continuing trend of strong vehicle deliveries, the firm said in a note to investors. Analysts said that one quarter of strength was “too soon to declare Tesla as having sustainably returned to growth in its core business.”

JPMorgan does not anticipate Tesla having strong showings with vehicle deliveries after Q4.

There are two distinct things that stick out with this note: the first is the lack of recognition of other parts of Tesla’s business, and the confusion that surrounds future quarters.

JPMorgan did not identify Tesla’s strength in autonomy, energy storage, or robotics, with autonomy and robotics being the main focuses of the company’s future. Tesla’s Full Self-Driving and Robotaxi efforts are incredibly relevant and drive more impact moving forward than vehicle deliveries.

Additionally, the confusion surrounding future delivery numbers in quarters past Q3 is evident.

Will Tesla thrive without the EV tax credit? Five reasons why they might

Tesla will receive some assistance from deliveries of vehicles that will reach customers in Q4, but will still qualify for the credit under the IRS’s revised rules. It will also likely introduce an affordable model this quarter, which should have a drastic impact on deliveries depending on pricing.

Tesla shares are trading at $422.40 at 2:35 p.m. on the East Coast.

Investor's Corner

Tesla Q3 deliveries expected to exceed 440k as Benchmark holds $475 target

Tesla stock ended the third quarter at $444.72 per share, giving the EV maker a market cap of $1.479 trillion at the end of Q3 2025.

Benchmark has reiterated its “Buy” rating and $475 price target on Tesla stock (NASDAQ: TSLA) as the company prepares to report its third-quarter vehicle deliveries in the coming days.

Tesla stock ended the third quarter at $444.72 per share, giving the EV maker a market cap of $1.479 trillion at the end of Q3 2025.

Benchmark’s estimates

Benchmark analyst Mickey Legg noted that he expects Tesla’s deliveries to hit around 442,000 vehicles this Q3, which is under the 448,000-unit consensus but still well above the 384,000 vehicles that the company reported in Q2 2025. According to the analyst, some optimistic estimates for Tesla’s Q3 deliveries are as high as mid-460,000s.

“Tesla is expected to report 3Q25 global production and deliveries on Thursday. We model 442,000 deliveries versus ~448,000 for FactSet consensus with some high-side calls in the mid-460,000s. A solid sequential uptick off 2Q25’s ~384,000, a measured setup into year-end given a choppy incentive/pricing backdrop,” the analyst wrote.

Benchmark is not the only firm that holds an optimistic outlook on Tesla’s Q3 results. Deutsche Bank raised its own delivery forecast to 461,500, while Piper Sandler lifted its price target to $500 following a visit to China to assess market conditions. Cantor Fitzgerald also reiterated an “Overweight” rating and $355 price target for TSLA stock.

Stock momentum meets competitive headwinds

Tesla’s anticipated Q3 results are boosted in part by the impending expiration of the federal EV tax credit in the United States, which analysts believe has encouraged buyers to finalize vehicle purchases sooner, as noted in an Investing.com report.

Tesla shares have surged nearly 30% in September, raising expectations for a strong delivery report. Benchmark warned, however, that some volatility may emerge in the coming quarter.

“With the stock up sharply into the print (roughly ~28-32% in September), its positioning raises the bar for an upside surprise to translate into further near-term strength; we also see risk of volatility if regional mix or ASPs underwhelm. We continue to anticipate policy-driven choppiness after 3Q as certain EV incentives/credits tighten or roll off in select markets, potentially creating 4Q demand air pockets and order-book lumpiness,” the analyst wrote.

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla FSD V14 set for early wide release next week: Elon Musk

-

News1 week ago

News1 week agoElon Musk gives update on Tesla Optimus progress

-

News2 weeks ago

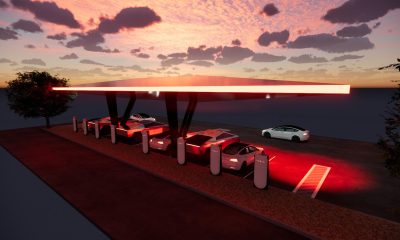

News2 weeks agoTesla has a new first with its Supercharger network

-

News2 weeks ago

News2 weeks agoTesla job postings seem to show next surprise market entry

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla gets new Street-high price target with high hopes for autonomy domination

-

Lifestyle1 week ago

Lifestyle1 week ago500-mile test proves why Tesla Model Y still humiliates rivals in Europe

-

News1 week ago

News1 week agoTesla Giga Berlin’s water consumption has achieved the unthinkable

-

Lifestyle1 week ago

Lifestyle1 week agoTesla Model S Plaid battles China’s 1500 hp monster Nurburgring monster, with surprising results