Investor's Corner

Tesla Semi-truck: What will be the ROI and is it worth it?

Elon Musk’s announcement that a Tesla Semi will be arriving as early as September is the first step to what will eventually be a reinvention of an entire industry. We’ve discussed before what, exactly, that means, but given that the man in charge of the Tesla truck program is Jerome Guillen who has a history with Daimler (specifically Freightliner) and large Class 8 semi-trucks, it’s not hard to see where Tesla plans to go with this. That leaves only the question of how far, literally, they plan to take it. In tractor-trailer operations, there are two basic types of freight moving: short-haul and long-haul.

We’re going to look at each of these types of freight hauling and how the return on investment (ROI) for a battery-electric rig (such as that we expect Tesla to unveil) would be. If there is any. We’ll also consider what type of equipment this might entail, in a broad sense, and how that compares to current paradigms in tractor-trailer freight hauling.

Before we dive into that, a few words on what the trucking industry is like are needed. About 69.5 percent of the freight moved in the United States is moved on a commercial truck. The U.S. Department of Transportation (USDOT) also says that a staggering 92 percent of prepared foods are moved by trucks and 82.7 percent of agricultural products are moved by truck, as are 65 percent of pharmaceuticals. However you measure it, that’s a lot of goods being moved on highways and surface roads nationally.

Currently, the trucking industry is seeing a lot of change, internally, as technology improves the way that freight hauling operates. The Internet and faster communications, for example, has begun to erode the traditional consignee-broker-hauler paradigm in which someone with goods to haul contacted a freight broker who then contracted a freight hauler to move the goods, skimming a percentage off the top for the connection. The middleman is often cut out in today’s trucking, with many trucking companies having load brokers on staff.

Electronics and global positioning have also changed how trucks operate, with computers more efficiently organizing load and truck movements to minimize empty movement. The USDOT says that about 29 percent of all truck movement is pulling an empty trailer to or from a freight drop-off point, costing about $30 billion annually. That number, while high, has been dropping for some time and drops exponentially as networks of computers get more efficient at organizing trucking and trucking companies consolidate into larger and larger fleets.

Finally, we should note that the longer the average trip (load to delivery) is for a tractor-trailer, the faster the truck’s ROI for the owner. Shorter hauls have higher per-mile maintenance costs than do longer hauls. Even discounting the cost of fuel, that becomes true as equipment maintenance costs beyond engine and fuel are still higher with shorter distances. There are several reasons for this, including how often brakes are used, how much time is spent not working (idling or sitting), and higher incidences of accidents. To name a few. Many short-haul operations are undertaken on less than ideal roads and in areas where any kind of breakdown, including a flat tire, can mean hours wasted waiting for repair.

Knowing those things, we can look at potential ROI for both short-haul and long-haul Tesla electric semi-trucks.

Short Haul

Conventionally, short-haul operations are defined as being tractor-trailer shipments moving 250 miles or less and long-haul is defined as being those same types of shipments moving more than 250 miles. Each of these has sub-categories, of course, but in the main, those are the two major markets for large Class 8 semi-trucks pulling freight. It should be noted that the overlap between short-haul and long-haul is large, as many short-haul shipments are being carried to a distribution location where it’s reassembled for longer distance hauling.

Of the two operations, short-haul has the most diversity in terms of machines used and types of freight carried. It’s in this category that we find items as aggregate as grain freshly harvested from fields to stones to specialized equipment being carried. Sometimes by the same truck and driver over the course of a year’s work. It’s also in this category that we find specialized rigs meant for entering pit mines, climbing steep grades on primitive dirt roads, moving overweight and outsized items, and so forth. For the most part, trucks in this category are “day cabs” meaning they have no sleeper unit attached for the driver to use as a rest quarters when not at the wheel.

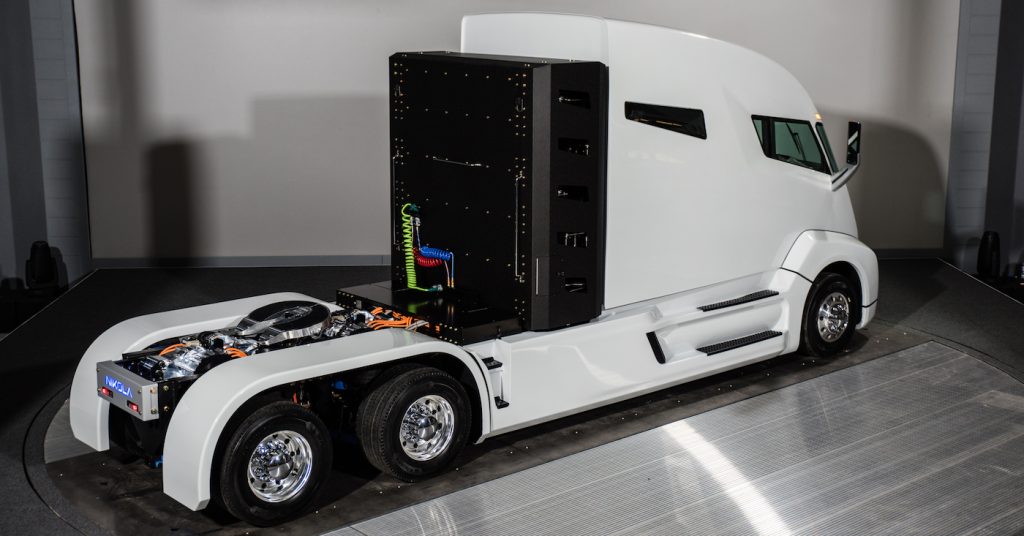

So far, the electrified Class 8 vehicles we’ve seen actually enter the market have nearly all fallen into the short-haul category. These have included battery-electric, hydrogen fuel cell, and hybrid units working as “yard dogs” moving trailers around a dock area, as portage trucks moving containers and freight out of port to staging areas or local distribution centers, and local area urban and suburban delivery vehicles. Currently, there is a large push in California to make all port vehicles (including container-moving trucks) as zero-emissions as possible.

The good news for battery-electric truck makers and those who aspire to become them is that, according to the USDOT, about half of all of the shipments (by value) is moved less than 250 miles. That accounts for about 80 percent of the weight being moved around the country. The bad news is that in this segment, less is paid per ton for that freight to be moved and, according to the American Transportation Research Institute, this segment only accounts for about 25 percent of the trucks on the road. Equipment age also tends to be higher in this category, with trucks being used for more years (and generally fewer miles) than compared to long-haul trucks.

In terms of cost, outside of maintenance, the most expensive items for a tractor-trailer, whether short- or long-haul, are fuel (38 percent), driver wages and benefits (34 percent), and truck-trailer lease payments and insurance (14 percent). These costs are about the same no matter what the truck is used for in most conventional operations, short-haul or long. Maintenance is about six percent higher in short-haul operations when compared to long-haul and insurance is usually a bit higher(1.5 percent), but not by so much that it can’t be averaged between them without skewing the numbers.

We can safely assume that a battery-electric semi-truck will have a higher price tag than its diesel-powered counterpart, which itself averages about $150,000 new. How much larger the electric truck would be is mostly conjecture, but we can probably be considered conservative to say it’s up-front costs will be at least 50 percent higher ($225,000) due to the expense of the batteries. Morgan Stanley’s report on electric and autonomous trucking assumed $75,000 for 500 kWh of battery storage, translating to roughly 150 or so miles of range in a fully loaded (80,000 pound) semi-truck. Given the current lithium crunch and the likelihood that economies of scale will take a lot of time to come to fruition, it’s easy to predict that more than half the Tesla Semi’s cost would be in batteries should it aim for a 250-mile range.

Over time, of course, that larger up-front price tag would be returned with fuel savings. In short-haul operations, about four years (250,000 miles) would be required to pay off $100,000 in battery premium with fuel savings. There are, however, other costs that would rise with the higher price of the rig. A higher-priced rig will have higher lease payments and higher insurance costs for replacement. This would stretch the ROI of the short-haul truck, by roughly another year, making it a five year investment return. If the truck stays in operation for the typical usage cycle in this segment, however, that would mean the truck pays for itself in about two thirds (70 percent) of its intended lifespan. Some percentage of the maintenance would also be lower in cost due to the nature of the electric truck, but much of it (tires, drivetrain, brakes, etc.) remains stagnant, further whittling at that ROI timeframe.

By and large, most forward-thinking fleet managers would jump at that. With one point of caution: by nature of their business and the long timeframes involved, most fleet managers are averse to change on a large scale. A few EV trucks here and there to prove out the technology and make the suits and ties happy are one thing. Jumping whole hog into the change is quite another. It would take some time (likely years) for fleet managers of short-haul fleets to decide that battery-electric trucks (or any type of unconventional powertrain) is a healthy decision. That, more than anything, will be the major delay towards adoption of something like a Tesla Semi.

Long-Haul Operations

Assuming that a Tesla Semi could be capable of hauling freight for 500-1,000 miles on a charge (the average long-haul trip is 600 miles per day), it would jump into a segment of trucking that accounts for more ton-miles than any other type of freight movement and that is growing faster than any other segment of commercial transportation in terms of both value and weight being moved. Further, the average turnover for a tractor in the long-haul business is 6.6 years (ATRI numbers) and the average mileage is over 110,000 miles per year per truck. ROI is typically faster as well, given the lower costs versus the miles driven.

Coming up with an ROI for a long-haul electric semi-truck is much trickier here and may be nearly impossible without knowing more about the EV truck to be used. At this stage, a battery-electric Tesla Semi would be nearly impossible for long-haul given the size and thus weight of the batteries required. So something involving very fast charging, battery swapping, or similar would be required. That adds costs to the equation that we cannot easily quantify without knowing what those logistics are.

What we can easily project is that the cost-benefit for a Tesla Semi in a long-haul scenario would not likely be nearly as compelling as it is for a short-haul fleet manager. A typical over-the-road truck sees about a million miles during its lifespan with a cost of about $400,000 in fuel and $100,000 in maintenance (ATRI) during that time. Most fleets own the truck for about seventy percent that time (700,000 miles), on average. So the cost of a truck, in terms of purchase price, fuel, and maintenance over its expected fleet lifespan is about half a million dollars ($280,000 fuel + $70,000 maintenance + $150,000 purchase = $500,000). This might begin to look very close to break even on a higher-priced EV truck by comparison, which would very likely save on fuel but would have higher up-front costs in balance. Further, those fuel savings might not be as good given the likelihood that logistics like battery swapping or more frequent stops for plugging in would be required.

Conclusion

A Tesla Semi would likely have a good return on investment for any fleet manager who is willing to look over the long-term and consider the cost-benefit. For the short-haul manager, however, the potential ROI is far more provocative than it would be for the long-haul manager. We can see a clear business case for a Tesla Semi for a large proportion of the short-haul industry, though we do caution that it will likely take some time for those in the industry to cast anything but a dubious eye towards an unconventional powertrain.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.