News

SpaceX’s internet satellite strategy faces possible setback (Correction: It’s actually in great shape)

Correction: Upon further analysis of FCC filings and proposed updates to ITU regulations, SpaceX’s Internet constellation is on much steadier ground than it initially appeared to be, and the FCC decision made on September 26 2017 to update its NGSO FSS regulations is likely to help SpaceX far more than it might harm the company.

The ITU has since 2015 taken a stance that aligns more with the FCC’s cooperative spectrum sharing policy and did not intend for Part 5 of its Radio Regulations to be interpreted as a “first come, first serve” attitude. Specifically, the ITU’s 2017 Rules of Procedure pointedly state in Article 9.6 (Word document download) that those rules were not intended “to state an order of priorities for rights to a particular orbital position” and that “the [interference] coordination process is a two way process”. An ex parte filed with the FCC (PDF download) by SpaceX on September 15 stated SpaceX’s support for these international and domestic policy adoptions, as well as the FCC International Bureau’s responsive consideration of SpaceX’s own suggestions.

The company’s first two test satellites could still launch later this year

The U.S. Federal Communications Commission (FCC) responded September 7th to requests for modification to existing satellite communications regulations and FCC practices from a number of prospective constellation operators, including OneWeb, Telesat, and SpaceX.

The FCC ultimately decided to avoid one major rule change that could force SpaceX to completely reconsider its strategic approach to its proposed Low Earth Orbit broadband constellation.

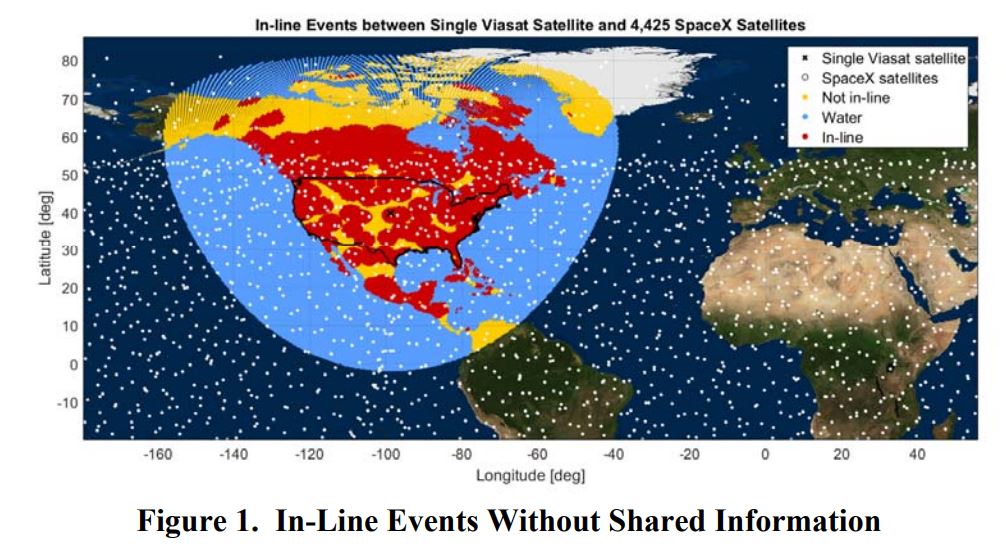

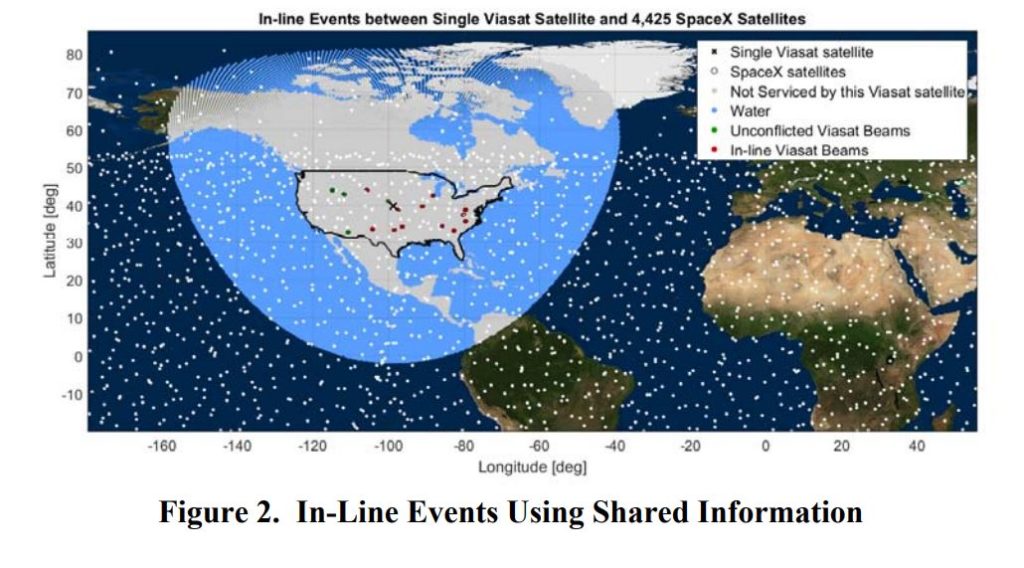

To grossly oversimplify, SpaceX had requested that the FCC apply their non-interference rules for lower orbit communications satellites to internet constellations operating both inside and outside the physical United States. These rules require that communication satellites operating in non-geostationary orbits (NGSO) share the available wireless spectrum equally among themselves when two or more satellites pass within a certain distance of each other relative to ground stations. In simpler terms, consider your smartphone’s cellular connectivity. The FCC’s rule for satellites in lower orbits can be thought of like multiple smartphones using the same cell tower to access the internet: the cell tower simply acknowledges the multiple devices it needs to serve and allows each device a certain amount of bandwidth.

However, the FCC is admittedly a domestic Commission focused on administering communications rules and regulations in the United States, and an agency already exists for coordinating global communications needs, called the International Telecommunication Union (ITU). The ITU’s Radio Regulations are considerably more simplistic. Rather than the FCC’s more nuanced and reasonable methods of spectrum sharing, the ITU allows the first satellite operator actively using a certain orbit or spectrum to become the primary coordinator for all interference issues. Put more simply, it gives those who launch communications satellites first a “first come, first serve” advantage that lets those entities then set the rules for interference with their constellation.

- In these figures, SpaceX attempts to demonstrate the significance of cooperation between different satellite constellation operators. (SpaceX/FCC)

- Compared to the first figure, interference events while sharing data on satellite locations is almost nonexistent. (SpaceX/FCC)

Both OneWeb and Telesat, companies also interested in launching global broadband constellations, are licensed in countries other than the United States, meaning that the FCC has given the ITU precedent in deciding how to deal with SpaceX’s potential constellation interference. SpaceX’s proposed constellation of at least several thousand satellites ends up being at a distinct disadvantage simply because it would take far longer for SpaceX to even partially complete its constellation when compared with competitors like OneWeb, who expect to finish launching the first phase of their constellation several hundred satellites by the end of 2020. Under the ITU’s regulations, SpaceX could be forced by competitors to effectively step on eggshells around their constellations by avoiding interference to the furthest extent possible, rather than simply sharing spectrum in the brief periods where different satellites temporarily interfere with each other.

While the FCC’s choice to cede international interference coordination to the ITU is a huge blow to SpaceX’s proposed internet constellation efforts, the same September 7th report also eased a handful of other requirements that would have proven difficult for SpaceX’s massive constellation. For geostationary constellations, the FCC previously required that all satellites be launched within a period of six years, with failure to do so resulting in a revoked license for the company in question. In a small concession to SES, O3b, and SpaceX, the FCC now plans to require that 50% of lower orbit satellite constellations be launched within six years of receiving an FCC license. This would still be a massive challenge for SpaceX’s plan of 4,425 initial satellites and a follow-up constellation of more than 7,000 additional satellites (PDF download).

- Falcon 9 lands on drone ship JRTI after launching Formosat-5, August 2017. (SpaceX)

- 2017 saw SpaceX recovery 10 Falcon 9 first stages, 5 by sea. (SpaceX)

- Falcon 9 B1040 returns to LZ-1 after the launch of the USAF’s X-37B spaceplane. (SpaceX)

The FCC’s September 7th report will not become final unless it is passed by vote in a September 26th Open Commission Meeting. It is possible that SpaceX council will make a statement protesting the FCC’s decision, but it is nevertheless likely that the FCC’s report will be accepted and become official. While the LEO internet constellation has remained a low priority for SpaceX since it was revealed in 2015, the company has steadily continued work on the project and SpaceX has every reason to continue pursuing it given the potential profit margins it could produce. In spite of the now expanded difficulties lying ahead, SpaceX appears to be preparing for the first launch of two test satellites related to its internet constellation efforts. The move is seen as a likely attempt to tag along as passengers during SpaceX’s launch of PAZ, a Spanish earth imaging satellite, during the final three months of 2017.

Elon Musk is scheduled to reveal more details on SpaceX’s Mars exploration and colonization efforts on September 29th. He has stated that this presentation will focus more on the “how” of colonizing Mars, revealing how exactly SpaceX thinks it can fund the development of its Interplanetary Transport System. Musk also confirmed several weeks ago that SpaceX had reduced the size of the ITS rocket to a still-massive diameter of 9 meters, and sources inside the company have also indicated that the company is thinking about modifying its LC-39A Florida launch pad to support both Falcon and ITS vehicles. SpaceX recruiters revealed earlier this week that SpaceX also intends to have their Boca Chica, Texas launch pad, which is currently under construction, be capable of eventually launching ITS-sized vehicles once it comes online in 2019 or later.

Elon Musk

Elon Musk’s Boring Company opens Vegas Loop’s newest station

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Elon Musk’s tunneling startup, The Boring Company, has welcomed its newest Vegas Loop station at the Fontainebleau Las Vegas.

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Fontainebleau Loop station

The new Vegas Loop station is located on level V-1 of the Fontainebleau’s south valet area, as noted in a report from the Las Vegas Review-Journal. According to the resort, guests will be able to travel free of charge to the stations serving the Las Vegas Convention Center, as well as to Loop stations in Encore and Westgate.

The Fontainebleau station connects to the Riviera Station, which is located in the northwest parking lot of the convention center’s West Hall. From there, passengers will be able to access the greater Vegas Loop.

Vegas Loop expansion

In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. Those trips include a limited above-ground segment, following approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

Under the approval, airport rides are limited to no more than four miles of surface street travel, and each trip must include a tunnel segment. The Vegas Loop currently includes more than 10 miles of tunnels. From this number, about four miles of tunnels are operational.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. That extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station located just north of Tropicana Avenue.

News

Tesla leases new 108k-sq ft R&D facility near Fremont Factory

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

Tesla has expanded its footprint near its Fremont Factory by leasing a 108,000-square-foot R&D facility in the East Bay.

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

A new Fremont lease

Tesla will occupy the entire building at 45401 Research Ave. in Fremont, as per real estate services firm Colliers. The transaction stands as the second-largest R&D lease of the fourth quarter, trailing only a roughly 115,000-square-foot transaction by Figure AI in San Jose.

As noted in a Silicon Valley Business Journal report, Tesla’s new Fremont lease was completed with landlord Lincoln Property Co., which owns the facility. Colliers stated that Tesla’s Fremont expansion reflects continued demand from established technology companies that are seeking space for engineering, testing, and specialized manufacturing.

Tesla has not disclosed which of its business units will be occupying the building, though Colliers has described the property as suitable for office and R&D functions. Tesla has not issued a comment about its new Fremont lease as of writing.

AI investments

Silicon Valley remains a key region for automakers as vehicles increasingly rely on software, artificial intelligence, and advanced electronics. Erin Keating, senior director of economics and industry insights at Cox Automotive, has stated that Tesla is among the most aggressive auto companies when it comes to software-driven vehicle development.

Other automakers have also expanded their presence in the area. Rivian operates an autonomy and core technology hub in Palo Alto, while GM maintains an AI center of excellence in Mountain View. Toyota is also relocating its software and autonomy unit to a newly upgraded property in Santa Clara.

Despite these expansions, Colliers has noted that Silicon Valley posted nearly 444,000 square feet of net occupancy losses in Q4 2025, pushing overall vacancy to 11.2%.

News

Tesla winter weather test: How long does it take to melt 8 inches of snow?

In Pennsylvania, we got between 10 and 12 inches of snow over the weekend as a nasty Winter storm ripped through a large portion of the country, bringing snow to some areas and nasty ice storms to others.

I have had a Model Y Performance for the week courtesy of Tesla, which got the car to me last Monday. Today was my last full day with it before I take it back to my local showroom, and with all the accumulation on it, I decided to run a cool little experiment: How long would it take for Tesla’s Defrost feature to melt 8 inches of snow?

Tesla’s Defrost feature is one of the best and most underrated that the car has in its arsenal. While every car out there has a defrost setting, Tesla’s can be activated through the Smartphone App and is one of the better-performing systems in my opinion.

It has come in handy a lot through the Fall and Winter, helping clear up my windshield more efficiently while also clearing up more of the front glass than other cars I’ve owned.

The test was simple: don’t touch any of the ice or snow with my ice scraper, and let the car do all the work, no matter how long it took. Of course, it would be quicker to just clear the ice off manually, but I really wanted to see how long it would take.

Tesla Model Y heat pump takes on Model S resistive heating in defrosting showdown

Observations

I started this test at around 10:30 a.m. It was still pretty cloudy and cold out, and I knew the latter portion of the test would get some help from the Sun as it was expected to come out around noon, maybe a little bit after.

I cranked it up and set my iPhone up on a tripod, and activated the Time Lapse feature in the Camera settings.

The rest of the test was sitting and waiting.

It didn’t take long to see some difference. In fact, by the 20-minute mark, there was some notable melting of snow and ice along the sides of the windshield near the A Pillar.

However, this test was not one that was “efficient” in any manner; it took about three hours and 40 minutes to get the snow to a point where I would feel comfortable driving out in public. In no way would I do this normally; I simply wanted to see how it would do with a massive accumulation of snow.

It did well, but in the future, I’ll stick to clearing it off manually and using the Defrost setting for clearing up some ice before the gym in the morning.

Check out the video of the test below:

❄️ How long will it take for the Tesla Model Y Performance to defrost and melt ONE FOOT of snow after a blizzard?

Let’s find out: pic.twitter.com/Zmfeveap1x

— TESLARATI (@Teslarati) January 26, 2026