News

SpaceX and NASA accidentally set the stage for a new race to the Moon

Almost entirely driven by chance, SpaceX and NASA may soon find themselves in an unintentional race to return humans to the Moon for the first time in half a century.

Both entities – SpaceX with its next-generation BFR and NASA with its Shuttle-derived SLS – are tentatively targeting 2023 for their similar circumlunar voyages, in which NASA astronauts and private individuals could theoretically travel around the Moon within just months of each other, showcasing two utterly dissimilar approaches to space exploration.

Over the course of no fewer than seven years of development, NASA’s SLS rocket and Orion spacecraft have run into an unrelenting barrage of issues, effectively delaying the system’s launch debut at a rate equivalent to or even faster than the passage of time itself. In other words, every month recently spent working on the vehicle seems to have reliably corresponded with at least an additional month of delays for the launch system.

Why these incessant delays continue to occur is an entire story in itself and demands the acknowledgment of some uncomfortable and inconvenient realities about the state of NASA’s human spaceflight program in the 21st century, but that is a story is for another time.

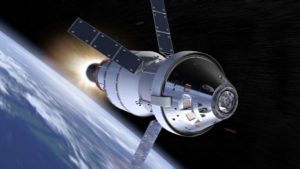

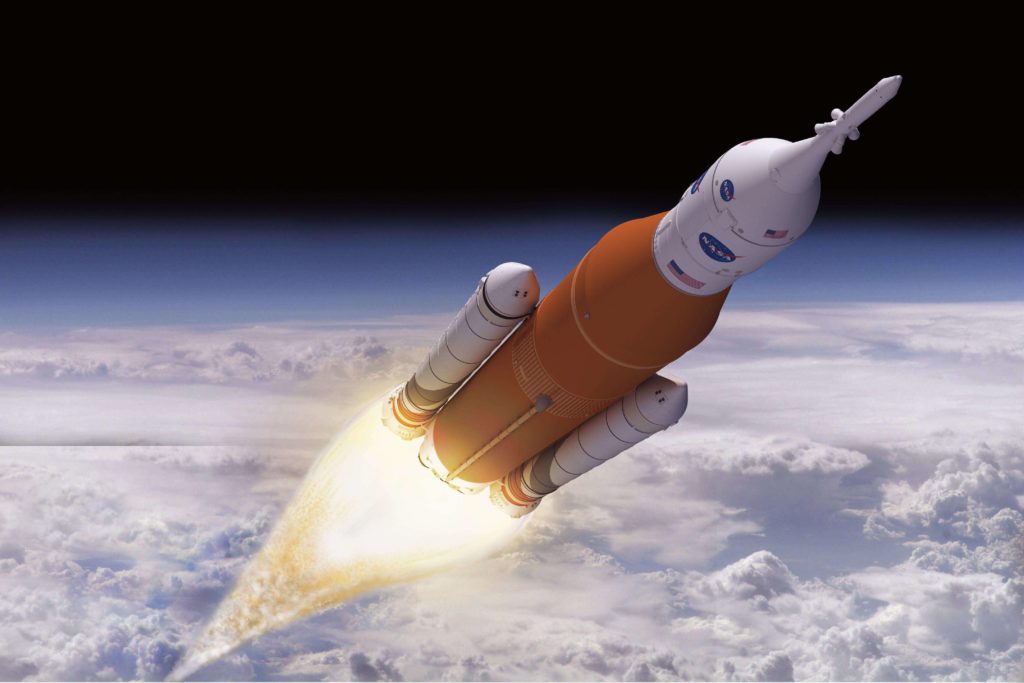

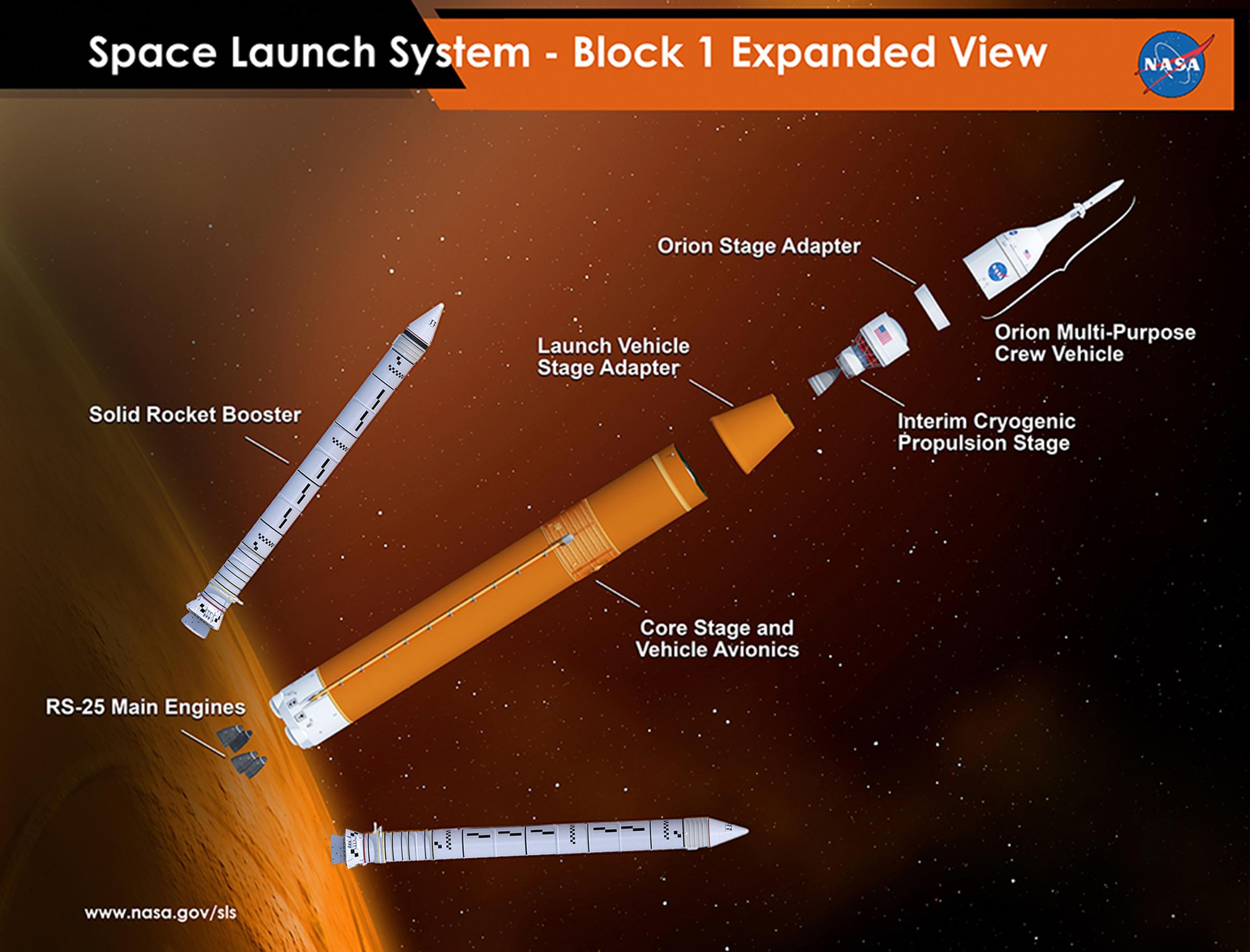

- SLS. (NASA)

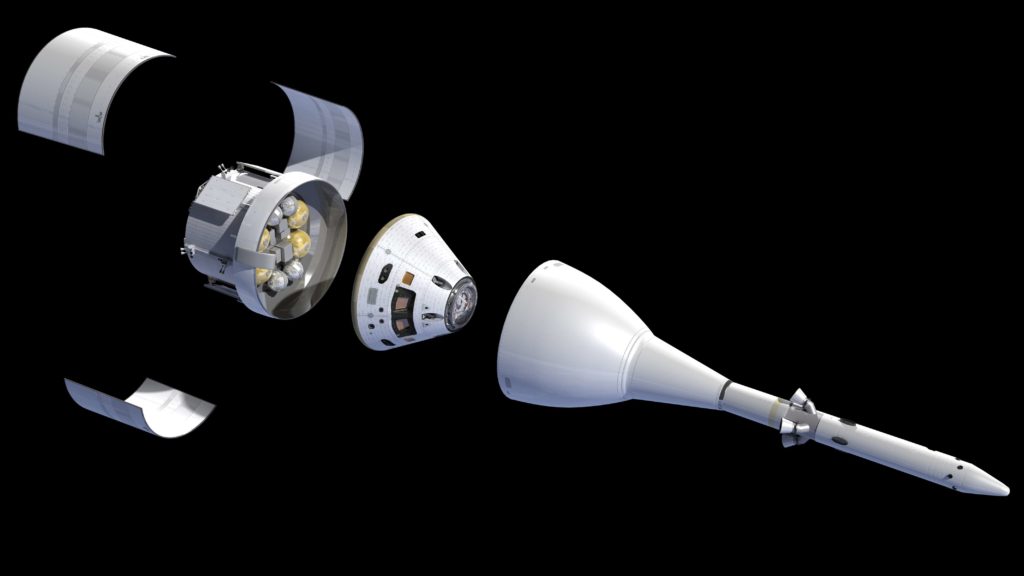

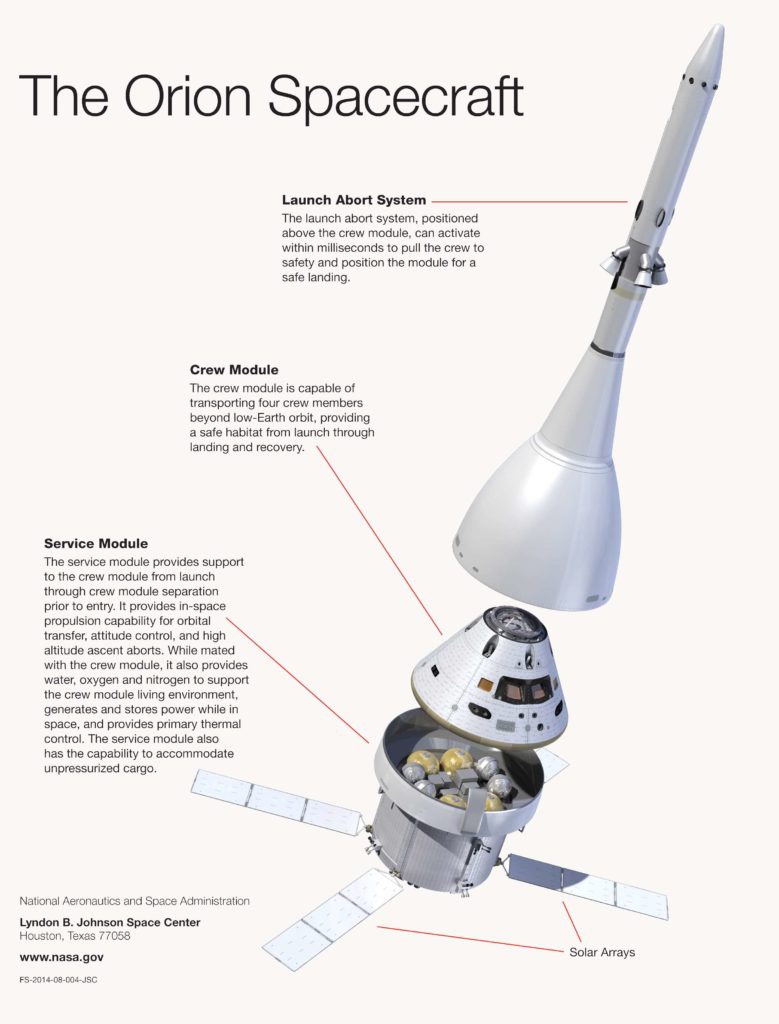

- NASA’s Orion spacecraft, European Service Module, and ICPS upper stage. (NASA)

A different kind of paper rocket

Returning to SLS, a brief overview is in order to properly contextualize what exactly the rocket and spacecraft are and what exactly their development has cost up to now. SLS is comprised of four major hardware segments.

- The Core Stage: A massive liquid hydrogen/liquid oxygen rocket booster, this section is essentially a lengthened version of the retired Space Shuttle’s familiar orange propellant tank, while the stage’s four engines are quite literally taken from stores of mothballed Space Shuttle hardware and will be ingloriously expended after each launch (SLS is 100% expendable).

- Solid Rocket Boosters (SRBs): Minimally modified copies of the SRBs used during the Space Shuttle program, SLS’ SRBs have slightly more solid propellant and have had all hints of reusability removed, whereas Space Shuttle boosters deployed parachutes and were reused after landing in the Atlantic Ocean.

- The Upper Stage (Interim Cryogenic Propulsion System, ICPS): ICPS is a slightly modified version of ULA’s off-the-shelf Delta IV upper stage.

- The Orion spacecraft and European Service Module: Borrowing heavily from the Apollo Command and Service Modules that took humanity to the Moon in the 1960s and 70s, Orion has been in funded development in one form or another for more than 12 years, with just one partial flight-test to call its own. Orion’s development has cost the U.S. approximately $16 billion since 2006, with another $4-6 billion expected between now and 2023, a sum that doesn’t account for the costs of production and operations once development is complete.

- The Orion spacecraft and ESM. (NASA)

For the SLS core stage and SRBs, a generous bottom-rung estimate indicates that $14 billion has been spent on the rocket itself between 2011 and 2018, not including many billions more spent refurbishing and modifying the rocket’s aging Saturn and Shuttle-derived launch infrastructure at Kennedy Space Center. Of the many distressing patterns that appear in the above descriptions of SLS hardware, most notable is a near-obsessive dependence upon “heritage” hardware that has already been designed and tested – in some cases even manufactured.

Despite cobbling together or reusing as many mature components, facilities, and workforces as possible and relying on slightly-modified commercial hardware at every turn, SLS and Orion will somehow end up costing the United States more than $30 billion dollars before it has completed a single full launch; potentially rising beyond $40 billion by the time the system is ready to launch NASA astronauts.

Moonward bound

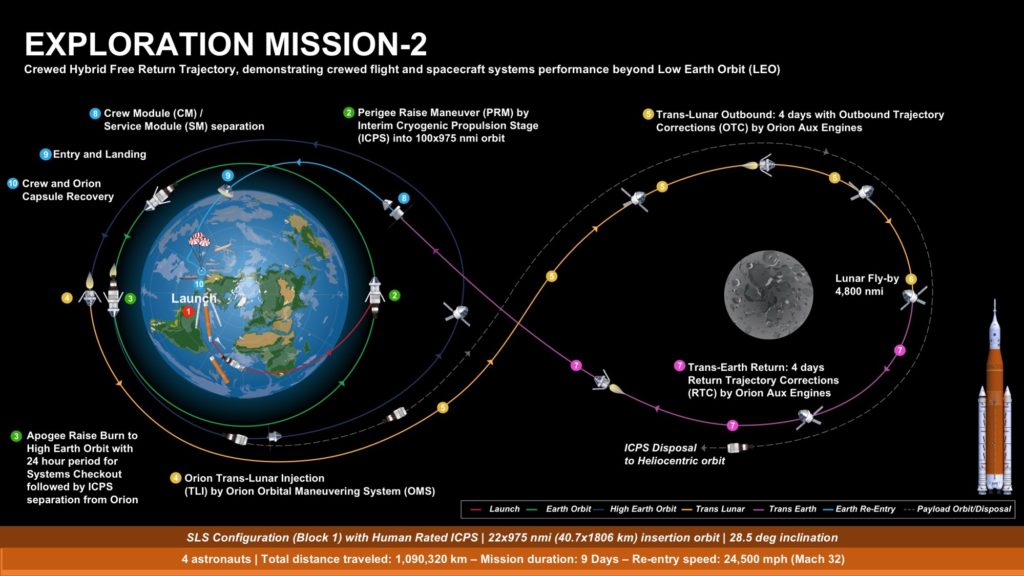

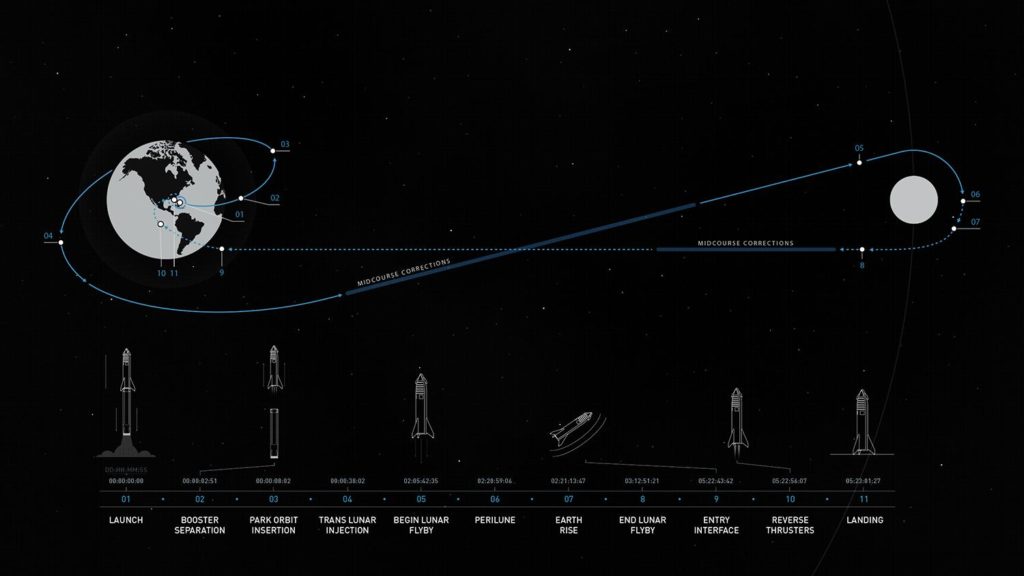

SLS’ first crewed mission, known as Exploratory Mission-2 (EM-2), brings us to the title – NASA’s mission planning has settled on sending a crew of four astronauts on what is known as a Free Lunar Return trajectory in the Orion spacecraft, essentially a single flyby of the Moon. Official NASA statements appear to be sending mixed messages on the schedule for EM-2’s launch, with September 2018 presentations indicating 2022 while a late-August blog post suggests that the crewed circumlunar mission is targeting launch in 2023.

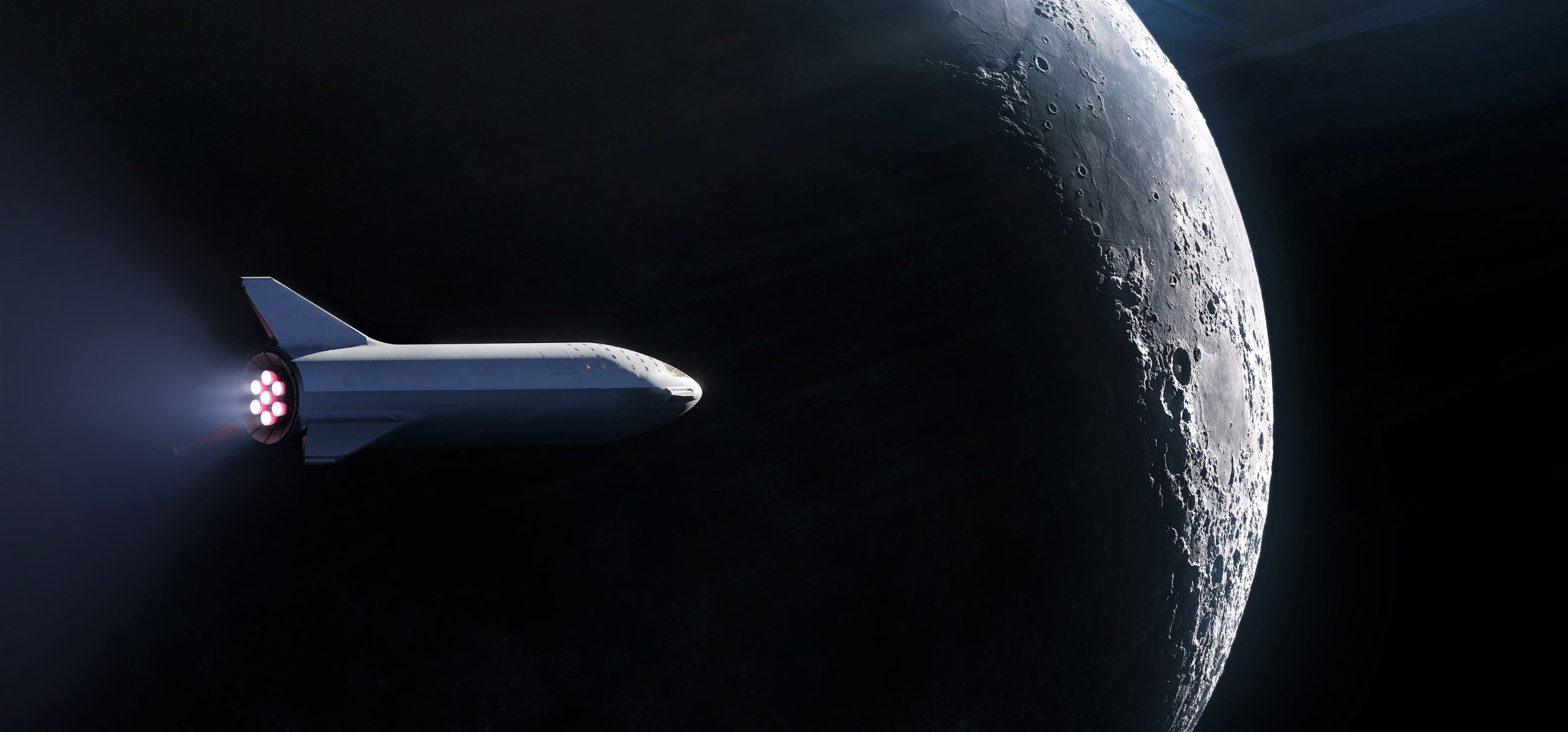

As it happens, SpaceX announced its own plans for a (private) crewed circumlunar voyage less than two weeks ago. Funded in large part by Japanese billionaire Yasuka Maezawa, SpaceX’s hopes to send 10+ people to the Moon on its next-generation BFR launch vehicle, comprised of a fully-reusable booster and spaceship. Deemed Dear Moon by Maezawa, SpaceX is targeting an extremely ambitious launch deadline sometime in 2023, although CEO Elon Musk frankly noted that hitting that 2023 window would require all aspects of BFR booster and spaceship development to proceed flawlessly over the next several years.

Compared to the 10+ years and $30+ billion of development SLS and Orion will have taken before their first full launch, SpaceX is targeting the first orbital BFR test flights as early as 2020 or 2021, self-admittedly optimistic deadlines that will likely slip. Still, betting against SpaceX completing its first BFR launch sometime in the early to mid-2020s for something approximating Musk’s $2-10 billion development cost seems a risky move in the context of SpaceX’s undeniable track record of proving the old-guard wrong.

- NASA’s EM-2 circumlunar voyage. (NASA)

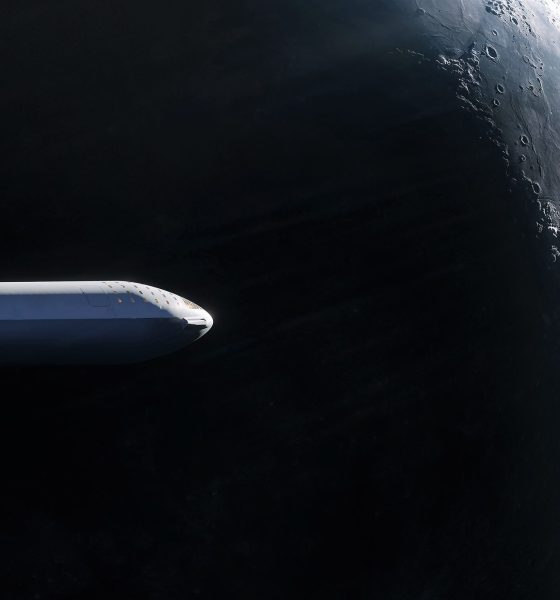

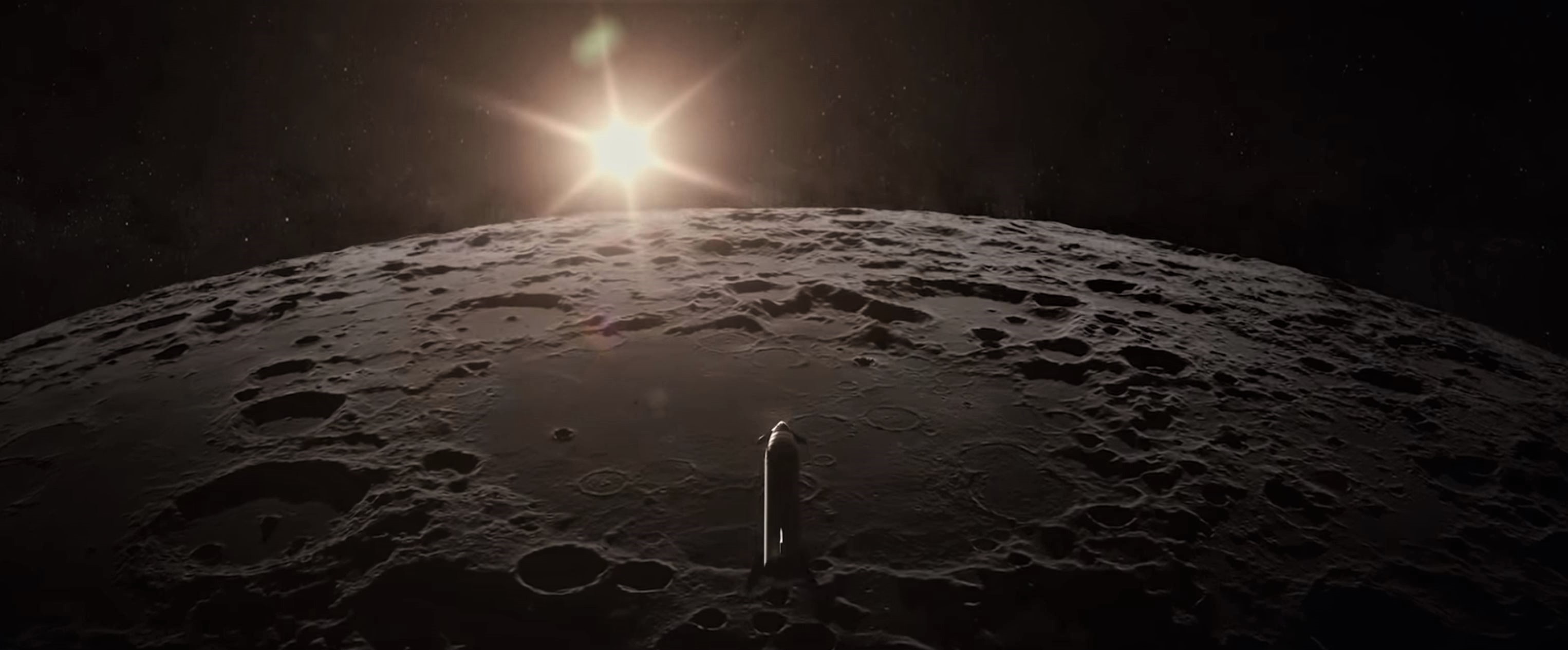

- SpaceX’s own circumlunar trajectory, nearly identical. (SpaceX)

- SLS Block 1. (NASA)

- BFR’s spaceship and booster (now Starship and Super Heavy) separate in a mid-2018 render of the vehicle. (SpaceX)

It must be noted that the apparent alignment of both SpaceX and NASA’s first crewed circumlunar missions with new rockets and spacecraft is a fluke of chance, and the fact that it may or may not take the shape of a second race to the Moon – pitting two dramatically different ideologies and organizational approaches against each other – is purely coincidental.

However, despite the undeniable fact that NASA and SpaceX are deeply and cooperatively involved through Crew and Cargo Dragon and despite Musk’s genuine affirmations of support and admiration for the space agency, it can be almost guaranteed that the world will look on in the 2020s with the same underlying emotions and motivations that were globally present during the Apollo Program. Rather than a battle of economic and nationalistic ideologies, the New Space Race of the 2020s will pit two (publicly) amicable private and public entities against each other at the same time as they work hand-in-hand to deliver crew and cargo to the International Space Station.

- An overview of BFR’s booster and spaceship, now known as Super Heavy and Starship. (SpaceX)

- SpaceX has already completed the first of many carbon-composite sections of its prototype spaceship. (SpaceX)

- SLS’ movable launch pad is very slowly being prepared for a 2020/2021 debut. (Tom Cross)

- SLS undoubtedly has several steps up on BFR in terms of volume of hardware in work, although target launch dates are quite similar for both rockets. (NASA)

Critically, this new “race” will be fairly illusory. Thanks to the fact that the new goal of human spaceflight appears to be the sustainable exploration of the solar system, there will inherently be no Apollo-style finish line for any one company or country or agency to cross. Rather than the Apollo Program’s shortsighted economic motivations and its consequentially abrupt demise, the end-result of this new age of competition will be the establishment of humanity as a (deep) spacefaring species, be it a temporary burst of effort or a permanent human condition.

Buckle up.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.

News

Tesla confirms Robotaxi expansion plans with new cities and aggressive timeline

Tesla plans to launch in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas. It lists the Bay Area as “Safety Driver,” and Austin as “Ramping Unsupervised.”

Tesla confirmed its intentions to expand the Robotaxi program in the United States with an aggressive timeline that aims to send the ride-hailing service to several large cities very soon.

The Robotaxi program is currently active in Austin, Texas, and the California Bay Area, but Tesla has received some approvals for testing in other areas of the U.S., although it has not launched in those areas quite yet.

However, the time is coming.

During Tesla’s Q4 Earnings Call last night, the company confirmed that it plans to expand the Robotaxi program aggressively, hoping to launch in seven new cities in the first half of the year.

Tesla plans to launch in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas. It lists the Bay Area as “Safety Driver,” and Austin as “Ramping Unsupervised.”

These details were released in the Earnings Shareholder Deck, which is published shortly before the Earnings Call:

🚨 BREAKING: Tesla plans to launch its Robotaxi service in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas in the first half of this year pic.twitter.com/aTnruz818v

— TESLARATI (@Teslarati) January 28, 2026

Late last year, Tesla revealed it had planned to launch Robotaxi in Las Vegas, Phoenix, Dallas, and Houston, but Tampa and Orlando were just added to the plans, signaling an even more aggressive expansion than originally planned.

Tesla feels extremely confident in its Robotaxi program, and that has been reiterated many times.

Although skeptics still remain hesitant to believe the prowess Tesla has seemingly proven in its development of an autonomous driving suite, the company has been operating a successful program in Austin and the Bay Area for months.

In fact, it announced it achieved nearly 700,000 paid Robotaxi miles since launching Robotaxi last June.

🚨 Tesla has achieved nearly 700,000 paid Robotaxi miles since launching in June of last year pic.twitter.com/E8ldSW36La

— TESLARATI (@Teslarati) January 28, 2026

With the expansion, Tesla will be able to penetrate more of the ride-sharing market, disrupting the human-operated platforms like Uber and Lyft, which are usually more expensive and are dependent on availability.

Tesla launched driverless rides in Austin last week, but they’ve been few and far between, as the company is certainly easing into the program with a very cautiously optimistic attitude, aiming to prioritize safety.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.