News

Mayor tied to Tesla Supercharger site questioned over ‘conflict of interest’

He was young. Ambitious. Gifted. One of the greatest players to ever set foot on a professional baseball diamond, “Shoeless” Joe Jackson’s career ended in tatters for his alleged role in the infamous Chicago “Black Sox scandal” of 1919.

Call it a “conflict of interest.” It involved money. Lots of it.

Something else that involves money – lots of it – is afoot in Aberdeen, Washington: A Tesla Supercharger station and a “Gateway Center.” Aberdeen Mayor Erik Larson is a staunch proponent of both.

Updated: Mayor Larson fines himself $500 for violating the state’s conflict of interest ethics code

Mayor Larson is making the rounds looking for funding to help cover the costs of Gateway Center construction which is expected to cost upwards of $8M to complete, and incorporate Tesla’s Supercharger station into the design.

Questions within the community are swirling around what appears to be a conflict of interest regarding the mayor’s involvement in the Tesla deal. Documents have surfaced showing that the mayor has, or had, a financial interest in the electric car company that’s building the Supercharger station, apparently while he was negotiating with the company to bring the project to a city-owned lot. Why the station is being built on publicly owned land rather than on a private site is also in question.

Background

Mayor Larson negotiated the original agreement with Tesla for the charging station, which could have cost the city up to $2,000 a month in utility bills. The lease agreement came before the Aberdeen City Council for approval last summer. Originally, the City of Aberdeen was on the hook for paying electricity costs.

Tesla Supercharger station in Aberdeen, Washington during construction [Credit: Trebor Thickweb via app check-in]

As noted in the Aberdeen City Council meeting agenda dated July 13, 2016, the lease language at that time included (see page three):

“The Mayor has negotiated with Tesla Motors, Inc. for the construction of a Tesla supercharger station in Aberdeen on the city of the former Chevron station. The supercharger will be incorporated into the design of the Gateway Center. … the city will also be responsible for… paying the utility bills for Tesla vehicles that use the charging station, up to monthly cap of $2,000 per month.” (Emphasis added.)

Reading further, Item 8 of that actual lease agreement specifies that:

“Tesla agrees to arrange for all Tesla-related utility services provided or used in or at the Premises… Tesla shall pay directly to the utility company the cost of installation of any all such Tesla-related utility services and shall arrange to have the utility service separately metered. (Counterparty) shall be responsible for paying all utility bills related to such meter after installation, including payment for electricity consumed at the Premises during the Term, up to two thousand dollars ($2,000) per month.” (Emphasis added.)

Other Cities, Other Charging Stations

Tesla lease agreements with city governments aren’t new. Similar charging stations exist in five other Washington cities: Centralia, Burlington, Ellensburg, Kennewick, and Ritzville. There are eleven Supercharger stations in Oregon. All are located on either hotel/resort type private property or some other type of retail/outlet center. But the Aberdeen location is on a city-owned lot.

In California, two Supercharging stations on publicly owned property exist in Ukiah and Crescent City. But the terms negotiated by those cities for the stations are jarringly different from those negotiated for the Aberdeen site:

In Ukiah:

– “Tesla pays for the entire project, including staff time and utility costs.” (Ukiah Daily Journal, August 8, 2015.)

In Crescent City:

- The city is being paid by the tenant for use of its property. A proposal by Recargo, Inc. to build and operate a universal electric vehicle charging station in Crescent City included a $4,800 annual payment from Recargo to the district for use of the property. (Del Norte Triplicate, October 11, 2016.)

- “Essential components” of the city’s lease agreement with Tesla includes: “(1) the term, which is five years with two five-year options to renew, (2) Tesla will build and maintain the facility, and (3) the lease amount is one dollar per month.” (City of Crescent City Council Agenda Report, April 6, 2015.)

- Tenant “agrees to arrange for and pay for all Tenant-related utility services provided or used in or at the Premises during the term of the Lease.” (#10 – Utilities – City of Crescent City Ground Lease for Tesla Supercharging Station, April 6, 2015.)

- “Tenant shall pay directly to the utility company the cost of installation of any and all such Tenant-related utility services and shall arrange to have the utility service separately metered.” (#10, Utilities – City of Crescent City Ground Lease for Tesla Supercharging Station, April 6, 2015.)

In Aberdeen:

- The city (re: taxpayers) could get stuck with “up to 30,000 for the costs of installing the new infrastructure for the city” per the re-negotiated August agreement.

- The provision requiring the city to pay for electricity used by Tesla vehicles was removed.

- The proposed new lease requires Tesla to pay for all costs of charging Tesla vehicles.

- The lease also requires Tesla to install infrastructure “that would allow the city to add charging stations for other electric vehicles at some point in the future.”

- The city “will reimburse Tesla up to $30,000 for the costs of installing the new infrastructure for the city.” (Emphasis added.)

According to minutes from the August 24, 2016 Aberdeen City Council Meeting, a motion to adopt the re-negotiated lease agreement carried.

An interesting wrinkle, as announced by Tesla on November 7, 2016, is that Tesla has decided to stop offering unlimited free use of its network fast-charging stations worldwide beginning this year.

So, other than hopes of helping “attract potential tenants to the center as the first project participant” and providing “nearby restaurants and retailers with additional business” per Mayor Larson, just how, exactly, does the supercharging station tangibly benefit Aberdeen taxpayers or offset “up to $30,000” in reimbursements to Tesla “for the costs of installing the new infrastructure for the city”?

The Daily World reports that “A $30,000 grant will help Aberdeen reimburse Tesla for installing the station.” In light of the agreements hammered out with other cities for charging stations on public land, however, why is Aberdeen on the hook for reimbursing Tesla for any installation costs?

Another wrinkle:

According to an October 28, 2016 story in The Daily World, five Aberdeen sites were in the running as possible locations for the new Supercharger station, including the parking area for the Center. Larson explains:

“They (Tesla) could have easily worked with Gateway Mall or sought out private ownership, but they were interested in the Gateway Center parking lot.”

Why was a publicly owned site selected instead of a privately owned one? Is city government using public funds to compete with private business?

Additional questions swirl around Mayor Larson’s financial interest in Tesla Motors.

Some questions:

- Did Mayor Larson disclose his financial interest/common stock in Tesla Motor Company anywhere other than on his 2015 and 2016 PDC F-1 forms?

- As a candidate, Mayor Larson reported his stock value as $4.5K – $23.9K. After he was elected, he reported the value as $24K – 47.9K. What’s up with that?

- The mayor apparently handled all negotiations with Tesla, even though he had/has a financial interest in the motor company (See PDC F-1 forms, above). Did the city know about his financial interest in this company? If so, did it okay the mayor as negotiator of the Tesla lease agreement anyway? Why?

Perhaps a contract negotiator sans an apparent financial interest in the project under negotiation might be a good idea?

While we’re raising questions, what of Shoeless Joe? After the Black Sox scandal, Jackson never set foot on a professional baseball diamond again. He was banned for life along with seven other Chicago players for their alleged involvement in intentionally throwing the 1919 World Series to the Cincinnati Reds. Jackson’s alleged involvement in the conspiracy is still the subject of hot debate. Some maintain that the only things Joe was guilty of were being young, ambitious, gifted, and a bit naive.

Ring any bells?

Kristine Lowder

This guest post was written by Kristine Lowder of Conservelocity. Do you have a post you’d like to share? Email it to us at info@teslarati.com

News

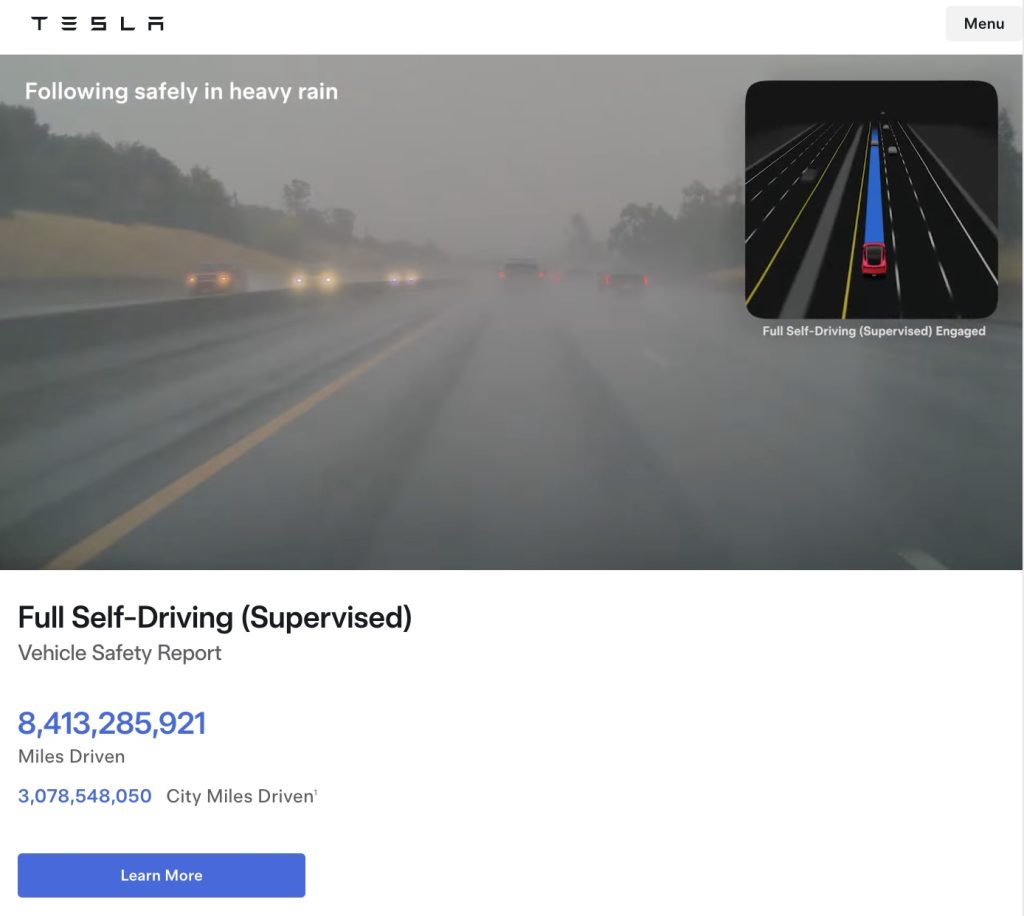

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla’s Full Self-Driving (Supervised) system has now surpassed 8.4 billion cumulative miles.

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla has long emphasized that large-scale real-world data is central to improving its neural network-based approach to autonomy. Each mile driven with FSD (Supervised) engaged contributes additional edge cases and scenario training for the system.

The milestone also brings Tesla closer to a benchmark previously outlined by CEO Elon Musk. Musk has stated that roughly 10 billion miles of training data may be needed to achieve safe unsupervised self-driving at scale, citing the “long tail” of rare but complex driving situations that must be learned through experience.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable.

As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

With the fleet now past 8.4 billion cumulative miles, Tesla’s supervised system is approaching that threshold, even as regulatory approval for fully unsupervised deployment remains subject to further validation and oversight.

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

News

Tesla Sweden appeals after grid company refuses to restore existing Supercharger due to union strike

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons.

Tesla Sweden is seeking regulatory intervention after a Swedish power grid company refused to reconnect an already operational Supercharger station in Åre due to ongoing union sympathy actions.

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons. A temporary construction power cabinet supplying the station had fallen over, described by Tesla as occurring “under unclear circumstances.” The power was then cut at the request of Tesla’s installation contractor to allow safe repair work.

While the safety issue was resolved, the station has not been brought back online. Stefan Sedin, CEO of Jämtkraft elnät, told Dagens Arbete (DA) that power will not be restored to the existing Supercharger station as long as the electric vehicle maker’s union issues are ongoing.

“One of our installers noticed that the construction power had been backed up and was on the ground. We asked Tesla to fix the system, and their installation company in turn asked us to cut the power so that they could do the work safely.

“When everything was restored, the question arose: ‘Wait a minute, can we reconnect the station to the electricity grid? Or what does the notice actually say?’ We consulted with our employer organization, who were clear that as long as sympathy measures are in place, we cannot reconnect this facility,” Sedin said.

The union’s sympathy actions, which began in March 2024, apply to work involving “planning, preparation, new connections, grid expansion, service, maintenance and repairs” of Tesla’s charging infrastructure in Sweden.

Tesla Sweden has argued that reconnecting an existing facility is not equivalent to establishing a new grid connection. In a filing to the Swedish Energy Market Inspectorate, the company stated that reconnecting the installation “is therefore not covered by the sympathy measures and cannot therefore constitute a reason for not reconnecting the facility to the electricity grid.”

Sedin, for his part, noted that Tesla’s issue with the Supercharger is quite unique. And while Jämtkraft elnät itself has no issue with Tesla, its actions are based on the unions’ sympathy measures against the electric vehicle maker.

“This is absolutely the first time that I have been involved in matters relating to union conflicts or sympathy measures. That is why we have relied entirely on the assessment of our employer organization. This is not something that we have made any decisions about ourselves at all.

“It is not that Jämtkraft elnät has a conflict with Tesla, but our actions are based on these sympathy measures. Should it turn out that we have made an incorrect assessment, we will correct ourselves. It is no more difficult than that for us,” the executive said.