News

SpaceX closes out 2021 with $1.85 billion in new funding

On the eve of the last day of 2021, SEC filings show that SpaceX has secured another $337 million, bringing the total funding the company has raised this year to approximately $1.85 billion.

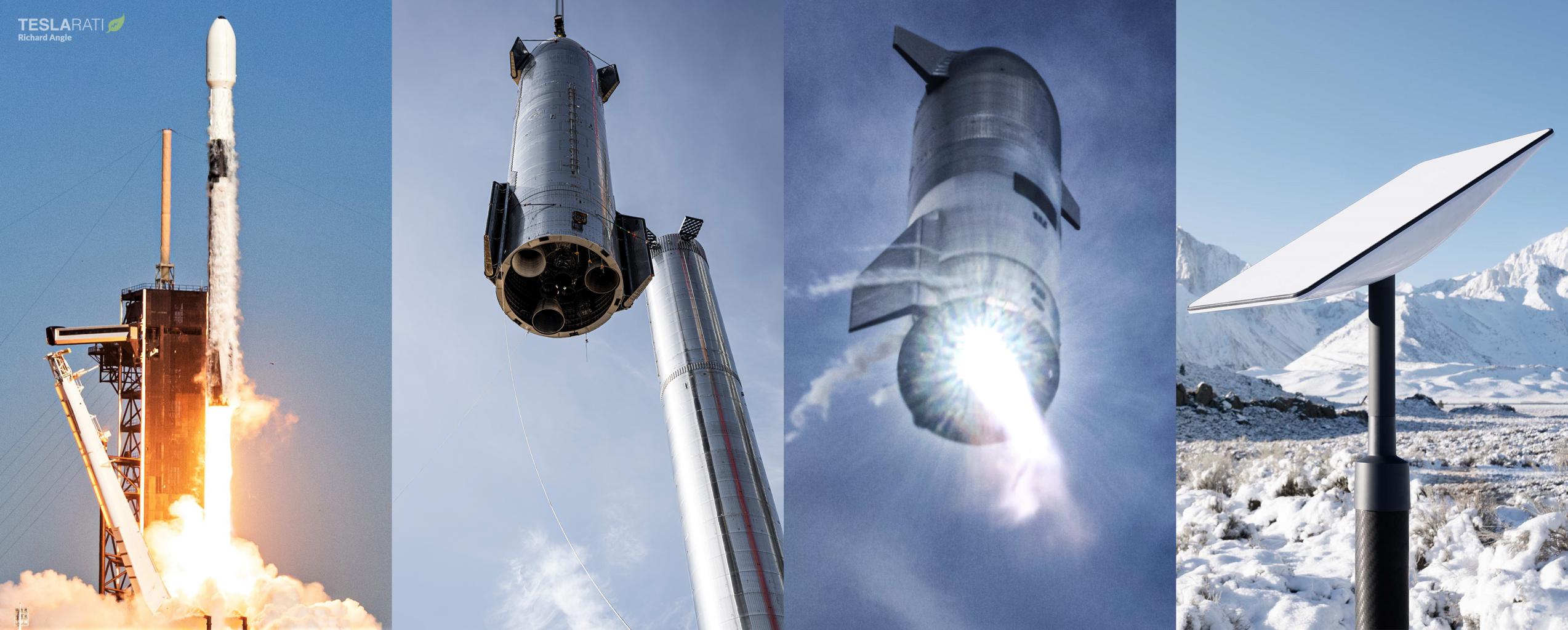

While there’s evidence that SpaceX’s Falcon and Dragon launch business is easily profitable on its own, the company has been simultaneously developing a next-generation rocket (Starship) and an unprecedentedly ambitious internet satellite constellation (Starlink) for at least the last 5-6 years. Additionally, SpaceX developed Falcon booster reusability and Falcon Heavy entirely on its own at a total cost of at least $1-2 billion. In short, rocket development is incredibly expensive, and adding a far more ambitious rocket and an immense satellite constellation into the mix has created an insatiable demand for fresh capital.

Investors have been more than eager to satisfy that demand, practically chomping at the bit to buy SpaceX equity or debt over the last six years. Since 2015, SpaceX has raised an average of more than $1B per year for the last seven years.

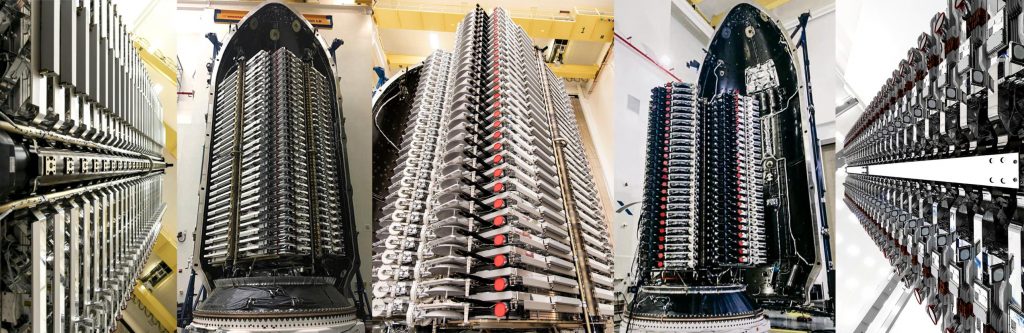

That funding has accomplished a great deal. As of the end of 2021, SpaceX has built and launched 1869 operational Starlink satellites in 25 months, more than 1750 of which are still in orbit and working. SpaceX has also built hundreds of thousands of ‘user terminals’ – dishes and WiFi routers that currently connect more than 150,000 subscribers to the internet even while the service remains in beta.

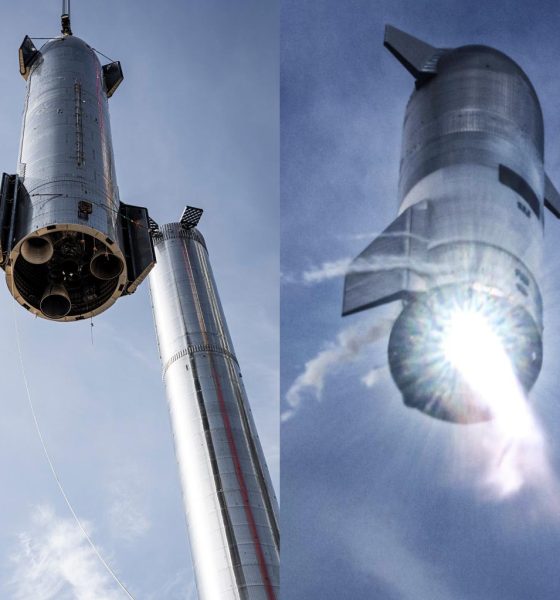

Starship, while somewhat behind its CEO’s optimistic schedules, continues to march towards its first spaceflight and orbital-velocity launch attempt – possibly in the first half of 2022. With help from its Hawthorne, CA headquarters, SpaceX’s Starbase factory continues to churn out Starship, Super Heavy booster, and test tank prototypes and appears to be ramping back up after six or so months of relative quiet. Having produced approximately 150 Raptor 1 and Raptor 1.5 engines in the last two years, Hawthorne is now focused on ramping up production of Raptor 2 – an upgraded engine variant capable of producing up to 25% more thrust while, in theory, being far cheaper to produce.

In about 12 months, SpaceX has also built – from nothing – an orbital launch site on the verge of being ready to support the first test flights of the largest, heaviest, and most powerful rocket ever built. To accommodate the massive vehicle, SpaceX has also nearly completed the largest cryogenic tank farm ever built for a launch site and partially filled at least four or five of its seven cryogenic storage tanks. Alongside that tank farm, the company has more or less completed a skyscraper-sized launch tower and outfitted it with three giant, moving arms – two of which are designed to stack Starship on Super Heavy and, maybe one day, catch ships and boosters out of mid-air.

According to a company-wide email CEO Elon Musk recently wrote but subsequently downplayed on Twitter, SpaceX’s financial health could be heavily dependent on the successful start and expansion of Raptor 2 production to enable Starship to begin launching new and much-improved Starlink V2.0 satellites. Those satellites are several times larger than V1.0 or V1.5 spacecraft, apparently making it hard or impossible for Falcon 9 to cost-effectively launch them.

On top of building and activating new factories capable of producing millions of Starlink user terminals per year, completing the first phase of orbital Starship development, ramping up Raptor 2 production, starting to build a fleet of operational Starships and Super Heavy boosters, continuing Falcon 9 Starlink V1.5 launches, and simultaneously building or completing no less than three orbital Starship launch sites in Florida and Texas, SpaceX thus also apparently needs to complete Starlink V2.0 satellite development and effectively build one or several entirely new production lines to start producing the substantially different spacecraft.

A large portion of SpaceX’s 2021 funding – especially the ~$337M raised in the last two weeks – will likely help support a portion of all those development efforts next year.

News

Tesla Cybercab display highlights interior wizardry in the small two-seater

Photos and videos of the production Cybercab were shared in posts on social media platform X.

The Tesla Cybercab is currently on display at the U.S. Department of Transportation in Washington, D.C., and observations of the production vehicle are highlighting some of its notable design details.

Photos and videos of the production Cybercab were shared in posts on social media platform X.

Observers of the Cybercab display unit noted that the two-seat Robotaxi provides unusually generous legroom for a vehicle of its size. Based on the vehicle’s video, the compact two-seater appears to offer more legroom than Tesla’s larger vehicles such as the Model Y, Model X, and Cybertruck.

The Cybercab’s layout allows Tesla to dedicate nearly the entire cabin to passengers. The vehicle is designed without a steering wheel or pedals, which helps maximize interior space.

Footage from the display also highlights the Cybercab’s large center screen, which is positioned prominently in front of the passenger bench. The display appears intended to provide entertainment and ride information while the vehicle operates autonomously.

Images of the vehicle also show an additional camera integrated into the Cybercab’s C-pillar. The extra camera appears to expand the vehicle’s field of view, which would be useful as Tesla works toward fully unsupervised Full Self-Driving.

Tesla engineers have previously explained that the Cybercab was designed to be highly efficient both in manufacturing and in operation. Cybercab Lead Engineer Eric E. stated in 2024 that the Robotaxi would be built with roughly half the number of parts used in a Model 3 sedan.

“Two seats unlocks a lot of opportunity aerodynamically. It also means we cut the part count of Cybercab down by a substantial margin. We’re gonna be delivering a car that has roughly half the parts of Model 3 today,” the Tesla engineer said.

The Tesla engineer also noted that the Cybercab’s cargo area can accommodate multiple golf bags, two carry-on suitcases, and two full-size checked bags. The trunk can also fit certain bicycles and a foldable wheelchair depending on size, which is quite impressive for a small car like the Cybercab.

Elon Musk

Elon Musk’s xAI wins permit for power plant supporting AI data centers

The development was reported by CNBC, citing confirmation from the Mississippi Department of Environmental Quality (MDEQ).

Mississippi regulators have approved a permit allowing Elon Musk’s artificial intelligence company xAI to construct a natural gas power plant in Southaven. The facility is expected to support the company’s expanding AI infrastructure tied to its Colossus data center operations near Memphis.

The development was reported by CNBC, citing confirmation from the Mississippi Department of Environmental Quality (MDEQ).

According to the report, regulators “voted to approve the permit” of xAI subsidiary MZX Tech LLC to construct a power plant featuring 41 natural gas-burning turbines “after careful consideration of all public comments and community concerns.”

The Mississippi Department of Environmental Quality stated that the permit followed a regulatory review process that included public comments and community input. Jaricus Whitlock, air division chief for the MDEQ, stated that the project met all applicable environmental standards.

“The proposed PSD permit in front of the board today not only meets all state and federal permitting regulations, but goes above and beyond what is required by law. MDEQ and the EPA agree that not a single person around our facilities will be exposed to unhealthy levels of air pollution,” Whitlock stated.

The planned facility will help provide electricity for xAI’s AI computing infrastructure in the Memphis region.

The Southaven project forms part of xAI’s efforts to scale computing capacity for its artificial intelligence systems.

The company currently operates two major data centers in Memphis, known as Colossus 1 and Colossus 2, which provide computing power for xAI’s Grok AI models. xAI is also planning to build another large data center in Southaven called Macrohardrr, which would be located in a warehouse previously used by GXO Logistics.

Large-scale AI training requires substantial computing power and electricity, prompting technology companies to develop dedicated energy infrastructure for their data centers.

SpaceX President Gwynne Shotwell previously stated that xAI plans to develop 1.2 gigawatts of power capacity for its Memphis-area AI supercomputer site as part of the federal government’s Ratepayer Protection Pledge. The commitment was announced during an event with United States President Donald Trump.

“As part of today’s commitment, we will take extensive additional steps to continue to reduce the costs of electricity for our neighbors. xAI will therefore commit to develop 1.2 GW of power as our supercomputer’s primary power source. That will be for every additional data center as well. We will expand what is already the largest global Megapack power installation in the world,” Shotwell said.

“The installation will provide enough backup power to power the city of Memphis, and more than sufficient energy to power the town of Southaven, Mississippi where the data center resides. We will build new substations and invest in electrical infrastructure to provide stability to the area’s grid.”

Elon Musk

Tesla China teases Optimus robot’s human-looking next-gen hands

The image was shared by Tesla AI’s account on Weibo and later reposted by Tesla community members on X.

A new teaser shared by Tesla’s China team appears to show a pair of unusually human-like hands for Optimus.

The image was shared by Tesla AI’s account on Weibo and later reposted by Tesla community members on X.

As could be seen in the teaser image, the new version of Optimus’ hands features proportions and finger structures that look strikingly similar to those of a human hand. Their appearance suggests that they might have dexterity approaching that of a human hand.

If the image reflects a new generation of Optimus’ hands, it could indicate Tesla is continuing to refine one of the most critical components of its humanoid robot.

Hands are widely viewed as one of the most difficult engineering challenges in robotics. For Optimus to perform complex real-world work, from manufacturing tasks to household activities, its hands would need to be the best in the industry.

Elon Musk has repeatedly described Optimus as Tesla’s most important long-term product. In posts on social media platform X, Musk has stated that Optimus could eventually become the first real-world Von Neumann machine.

In theory, a Von Neumann machine is a self-replicating system capable of building copies of itself using available materials. The concept was originally proposed by mathematician John von Neumann in the mid-20th century.

“Optimus will be the first Von Neumann machine, capable of building civilization by itself on any viable planet,” Musk wrote in a post on X.

If Optimus is expected to carry out complex work autonomously in the future, high levels of dexterity will likely be essential. This makes the development of advanced robotic hands a key step towards Musk’s long-term expectations for the product.