News

Tesla's battery acquisitions are paying off in spades, and giving rivals a lot of pain

There was a time, not too long ago, when Tesla skeptics questioned the company’s focus in designing and producing its own batteries with a dedicated partner like Panasonic and a facility like Gigafactory 1 in Nevada. Batteries, after all, are available off-the-shelf from companies like LG Chem, and it seemed pretty futile for Tesla to insist that it needs its own battery supply for its future business.

Fast forward to 2020, and Tesla’s extreme focus on battery development is paying off in spades. Over the years, Tesla has acquired multiple companies that have, in some way, enabled the company to accelerate or improve its products’ batteries. Included among these are Grohmann Automation, whose machines are the bread and butter in Gigafactory 1, Maxwell Technologies, and more recently, HIBAR systems.

At this point, Tesla’s batteries have pretty much become the gold standard for EVs, and the company appears to be well on its way towards releasing vehicles that have a range of 400 miles or more. The Plaid Model S and X will likely be the first of these, as well as the next-gen Roadster, which will have 620 miles of range. Even the reasonably-priced Cybertruck tops out at over 500 miles of range per charge. Massive battery developments are needed to achieve these, and Tesla seems to have done it, or at least is well on its way.

This does not appear to be true for other OEMs attempting to enter the electric vehicle market. As veteran companies unveiled their EVs, and as none have really managed to hold a candle to Tesla’s flagship Model S in terms of range, it is becoming evident that the electric car maker’s investments in batteries may have actually been the right strategy all along. Daimler, for one, seems to be feeling this inconvenient truth, with works council chief Michael Brecht explaining during a recent interview with Manager Magazin that Tesla’s battery-related acquisitions are actually having an effect on Germany’s EV efforts.

Daimler launched its first EV, the Mercedes-Benz EQC, in 2018, and it has not really lived up to the hype. Despite being dubbed at some point as a potential “Tesla Killer” due to its pedigree and excellent German build quality, the all-electric SUV has faced battery shortages and low sales. Registrations in Germany for the vehicle only show about 55 units sold to date despite all the ad campaigns dedicated to the SUV. Battery supply shortages have also forced Daimler to cut the annual production target of the EQC by 50% from 60,000 to just 30,000.

Quite interestingly, Brecht partly blames Tesla for some of the challenges facing the EQC today. Explaining his points to the publication, he argued that one of the reasons Daimler is struggling with battery demand is because Tesla bought Grohmann Engineering, which has valuable technology that could be used for battery-related developments and activities. Brecht also mentioned that Grohmann was actually hired by Mercedes-Benz to build up its own battery manufacturing capacity.

Brecht’s statements are notable since it is quite rare to see a veteran car manufacturer actually point the finger at Tesla to explain the dire condition of its own EV program. One can only hope that perhaps, the EQC would be a lesson that Daimler could learn from. After all, Daimler, among German automakers, would likely have no issues tapping into Tesla’s established technologies, batteries and powertrains alike, as the two companies have already worked together in the past. Elon Musk has stated that eventually, Tesla may be open to selling its batteries and powertrains with other OEMs. If this were to happen, it would be wise for Daimler to wait right in front of the line to avoid another EQC-sized flop.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

Elon Musk

Tesla scrambles after Musk sidekick exit, CEO takes over sales

Tesla CEO Elon Musk is reportedly overseeing sales in North America and Europe, Bloomberg reports.

Tesla scrambled its executives around following the exit of CEO Elon Musk’s sidekick last week, Omead Afshar. Afshar was relieved of his duties as Head of Sales for both North America and Europe.

Bloomberg is reporting that Musk is now overseeing both regions for sales, according to sources familiar with the matter. Afshar left the company last week, likely due to slow sales in both markets, ending a seven-year term with the electric automaker.

Tesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

Afshar was promoted to the role late last year as Musk was becoming more involved in the road to the White House with President Donald Trump.

Afshar, whose LinkedIn account stated he was working within the “Office of the CEO,” was known as Musk’s right-hand man for years.

Additionally, Tom Zhu, currently the Senior Vice President of Automotive at Tesla, will oversee sales in Asia, according to the report.

It is a scramble by Tesla to get the company’s proven executives over the pain points the automaker has found halfway through the year. Sales are looking to be close to the 1.8 million vehicles the company delivered in both of the past two years.

Tesla is pivoting to pay more attention to the struggling automotive sales that it has felt over the past six months. Although it is still performing well and is the best-selling EV maker by a long way, it is struggling to find growth despite redesigning its vehicles and launching new tech and improvements within them.

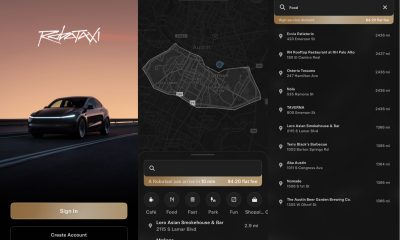

The company is also looking to focus more on its deployment of autonomous tech, especially as it recently launched its Robotaxi platform in Austin just over a week ago.

However, while this is the long-term catalyst for Tesla, sales still need some work, and it appears the company’s strategy is to put its biggest guns on its biggest problems.

News

Tesla upgrades Model 3 and Model Y in China, hikes price for long-range sedan

Tesla’s long-range Model 3 now comes with a higher CLTC-rated range of 753 km (468 miles).

Tesla has rolled out a series of quiet upgrades to its Model 3 and Model Y in China, enhancing range and performance for long-range variants. The updates come with a price hike for the Model 3 Long Range All-Wheel Drive, which now costs RMB 285,500 (about $39,300), up RMB 10,000 ($1,400) from the previous price.

Model 3 gets acceleration boost, extended range

Tesla’s long-range Model 3 now comes with a higher CLTC-rated range of 753 km (468 miles), up from 713 km (443 miles), and a faster 0–100 km/h acceleration time of 3.8 seconds, down from 4.4 seconds. These changes suggest that Tesla has bundled the previously optional Acceleration Boost for the Model 3, once priced at RMB 14,100 ($1,968), as a standard feature.

Delivery wait times for the long-range Model 3 have also been shortened, from 3–5 weeks to just 1–3 weeks, as per CNEV Post. No changes were made to the entry-level RWD or Performance versions, which retain their RMB 235,500 and RMB 339,500 price points, respectively. Wait times for those trims also remain at 1–3 weeks and 8–10 weeks.

Model Y range increases, pricing holds steady

The Model Y Long Range has also seen its CLTC-rated range increase from 719 km (447 miles) to 750 km (466 miles), though its price remains unchanged at RMB 313,500 ($43,759). The model maintains a 0–100 km/h time of 4.3 seconds.

Tesla also updated delivery times for the Model Y lineup. The Long Range variant now shows a wait time of 1–3 weeks, an improvement from the previous 3–5 weeks. The entry-level RWD version maintained its starting price of RMB 263,500, though its delivery window is now shorter at 2–4 weeks.

Tesla continues to offer several purchase incentives in China, including an RMB 8,000 discount for select paint options, an RMB 8,000 insurance subsidy, and five years of interest-free financing for eligible variants.

-

Elon Musk1 day ago

Elon Musk1 day agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News6 days ago

News6 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more