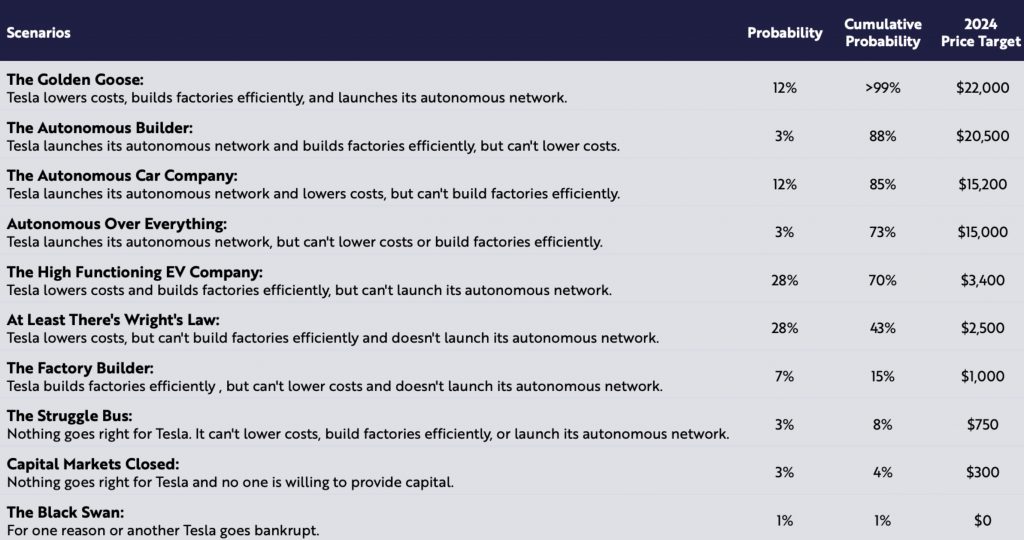

Tesla (NASDAQ:TSLA) may be slowly making its way toward Ark Invest’s Golden Goose scenario, which involves a $22,000 price target pre-split. At the beginning of 2020, ARK Invest released its updated TSLA valuation based on new research it had collected at the time. ARK analysts described ten different scenarios Tesla could take leading up to 2024 and gave each one a price target.

Tesla seems to be on track to hit the scenario ARK Invest labeled “The High Functioning EV Company” which has a price target of $3,400. Keep in mind that ARK released these estimates before Tesla announced the stock split. In this scenario, Tesla manages to lower costs and build factories efficiently, but doesn’t launch its autonomous network.

Tesla has managed to reduce costs further this year and could continue to do so in the coming years. In the third-quarter earnings call, CFO Zachary Kirkhorn stated that Tesla would continue to reduce manufacturing and operational costs in the future.

“We are also seeing benefits from the ongoing upward trend of locally built and delivered cars, which has increased from under 50% at the beginning of last year to over 70% most recently, which is a core component of our cost reduction strategy,” he added.

Gigafactory Shanghai showed that Tesla could build factories efficiently. Tesla China has been an integral part of the company’s profitable quarters this year. The construction of Giga Berlin and Giga Texas are not moving at quite the same speed as Giga Shanghai. However, Tesla has stated that the construction of Gigafactory Berlin and Texas are on schedule and could still start production by 2021.

Tesla seems to have checked off the two factors under ARK Invest’s “The High Functioning EV Company” scenario that warranted a $3,400 price target. After this scenario, Tesla would have to tackle autonomy.

ARK analysts split the ten scenario into two categories: No Autonomous and Autonomous. The difference between Tesla achieving autonomy and failing at it significantly affect its price target. ARK’s price target jumps from $3,400—the highest in the No Autonomous category—to $15,000 which is the lowest price target in the Autonomous category.

It seems that Tesla’s Golden Goose scenario hinges on the success of Full Self-Driving. The EV automaker released FSD beta last month and it showed massive improvements. Tesla still has a long way to go before it can successfully launch an autonomous network, but FSD beta seems to be a step in the right direction.

Disclosure: I am long TSLA.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

Elon Musk

Tesla scrambles after Musk sidekick exit, CEO takes over sales

Tesla CEO Elon Musk is reportedly overseeing sales in North America and Europe, Bloomberg reports.

Tesla scrambled its executives around following the exit of CEO Elon Musk’s sidekick last week, Omead Afshar. Afshar was relieved of his duties as Head of Sales for both North America and Europe.

Bloomberg is reporting that Musk is now overseeing both regions for sales, according to sources familiar with the matter. Afshar left the company last week, likely due to slow sales in both markets, ending a seven-year term with the electric automaker.

Tesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

Afshar was promoted to the role late last year as Musk was becoming more involved in the road to the White House with President Donald Trump.

Afshar, whose LinkedIn account stated he was working within the “Office of the CEO,” was known as Musk’s right-hand man for years.

Additionally, Tom Zhu, currently the Senior Vice President of Automotive at Tesla, will oversee sales in Asia, according to the report.

It is a scramble by Tesla to get the company’s proven executives over the pain points the automaker has found halfway through the year. Sales are looking to be close to the 1.8 million vehicles the company delivered in both of the past two years.

Tesla is pivoting to pay more attention to the struggling automotive sales that it has felt over the past six months. Although it is still performing well and is the best-selling EV maker by a long way, it is struggling to find growth despite redesigning its vehicles and launching new tech and improvements within them.

The company is also looking to focus more on its deployment of autonomous tech, especially as it recently launched its Robotaxi platform in Austin just over a week ago.

However, while this is the long-term catalyst for Tesla, sales still need some work, and it appears the company’s strategy is to put its biggest guns on its biggest problems.

News

Tesla upgrades Model 3 and Model Y in China, hikes price for long-range sedan

Tesla’s long-range Model 3 now comes with a higher CLTC-rated range of 753 km (468 miles).

Tesla has rolled out a series of quiet upgrades to its Model 3 and Model Y in China, enhancing range and performance for long-range variants. The updates come with a price hike for the Model 3 Long Range All-Wheel Drive, which now costs RMB 285,500 (about $39,300), up RMB 10,000 ($1,400) from the previous price.

Model 3 gets acceleration boost, extended range

Tesla’s long-range Model 3 now comes with a higher CLTC-rated range of 753 km (468 miles), up from 713 km (443 miles), and a faster 0–100 km/h acceleration time of 3.8 seconds, down from 4.4 seconds. These changes suggest that Tesla has bundled the previously optional Acceleration Boost for the Model 3, once priced at RMB 14,100 ($1,968), as a standard feature.

Delivery wait times for the long-range Model 3 have also been shortened, from 3–5 weeks to just 1–3 weeks, as per CNEV Post. No changes were made to the entry-level RWD or Performance versions, which retain their RMB 235,500 and RMB 339,500 price points, respectively. Wait times for those trims also remain at 1–3 weeks and 8–10 weeks.

Model Y range increases, pricing holds steady

The Model Y Long Range has also seen its CLTC-rated range increase from 719 km (447 miles) to 750 km (466 miles), though its price remains unchanged at RMB 313,500 ($43,759). The model maintains a 0–100 km/h time of 4.3 seconds.

Tesla also updated delivery times for the Model Y lineup. The Long Range variant now shows a wait time of 1–3 weeks, an improvement from the previous 3–5 weeks. The entry-level RWD version maintained its starting price of RMB 263,500, though its delivery window is now shorter at 2–4 weeks.

Tesla continues to offer several purchase incentives in China, including an RMB 8,000 discount for select paint options, an RMB 8,000 insurance subsidy, and five years of interest-free financing for eligible variants.

-

Elon Musk1 day ago

Elon Musk1 day agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News6 days ago

News6 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more