Investor's Corner

LIVE BLOG: Tesla (TSLA) Q4 and Full Year 2020 earnings call summary

Tesla’s (NASDAQ:TSLA) fourth-quarter and full year earnings call comes on the heels of an impressive quarter that saw the electric car maker post $10.7 billion in revenue and $903 million non-GAAP net income. With these results, Tesla has now maintained its profitability for six consecutive quarters.

As revealed in the company’s Q4 FY 2020 Update Letter, Tesla currently sits on $19.4 billion in cash, thanks to a capital raise of $5 billion that further strengthened the company’s war chest. This should allow Tesla to pursue its projects in the United States and abroad, particularly in Texas and Berlin, where two Gigafactories are currently being built. Tesla has also taken the wraps off the Model S and Model X refresh, ending a long period of speculation among electric vehicle enthusiasts.

The following are live updates from Tesla’s Q4 FY 2020 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

16:34 PT – And that’s it for the Q4 FY 2020 earnings call, everyone! Tons of new info have been shared over the call, and considering what was discussed, it seems like 2021 would be a pretty exciting year once more. With that said, thanks for joining us this time once more for our live blog. We’ll see you in the Q1 2021 earnings call!

16:31 PT – Gene Munster from Loup Ventures asks about the Semi and if the vehicle is the first to achieve full autonomy considering that its routes are extremely predictable. Musk responds that this will indeed be the case. No retraining would be needed to adapt FSD for the Semi, the CEO explained, though some adjustments would need to be made.

16:28 PT – Emmanuel Rosner from Deutsche Bank asks about the cost efficiencies of the 4680 battery cell, as well as the company’s affordable car. Musk notes that three or four years would be a good timeframe to reach such goals. Baird, on the other hand, asks about X (Elon Musk’s possible umbrella company). Musk notes that he expects to be with Tesla for the next years. “I expect to be CEO of Tesla for several years in the future,” Musk said, though he noted that nobody should be CEO forever. “It would be nice to have more than free time in my hands,” Musk remarked, but “the mission is not over yet and there’s still a long way to go before we can make a dent in the world’s acceleration to sustainable energy.” The same is true for solar and stationary storage. There’s still so much work to be done.

16:23 PT – RBC Capital Markets asks about the electric van market. “Tesla is definitely going to make an electric van at one point,” Musk said, though he reiterates that the constraint lies in battery supply. He mentions the Semi, which uses a lot of cells. Musk notes that the Semi would make sense to produce once Tesla addresses its battery constraint. Simply put, when the 4680 is produced in volume, the Semi will come. Musk also talks about Tesla’s next-generation computer. He notes that Tesla’s next-gen chip would be 3x more powerful than the company’s current custom hardware, which is still not being utilized to its full potential today. “We’ve not been rushing the V2 computer. It’s coming along,” Musk said.

16:18 PT – Alex Potter from Piper Sandler asks about Tesla’s intention to increase its battery supply from its suppliers, and if suppliers need to produce 4680 cells. Musk notes that it does not. “It is not required,” Musk said, adding that even the new Model S still uses the 18650 form factor. He noted that Tesla will be retiring its old battery form factors in due time, but it’s better to have some flexibility. “Over time, it would make sense to have a consistency with battery form factor,” he adds. As for Tesla’s growth rate, Elon notes that Tesla poised to massive growth. “We do think we can maintain a growth rate of 50% for many years to come,” he said.

16:15 PT – Dan Levy from Credit Suisse asks about regulatory credits. Kirkhorn highlights that regulatory credit sales are difficult to forecast. He notes that most of Q4’ regulatory credit sales were not forecasted at all. They are simply not predictable. That being said, Tesla is not dependent on it nor does it rely on regulatory credits.

16:12 PT – Analyst questions begin. First up is from Oppenheimer asking about FSD regulations. Tesla notes that it will be all about reliability. There’s a slowdown in Europe, while China’s shown an interest in Level 4 or even Level 5 autonomy. As for the US, it will be all about how reliable autonomous software will be. As for the supply chain, Jerome Guillen notes that there are still challenges related to COVID, though work is underway to address this.

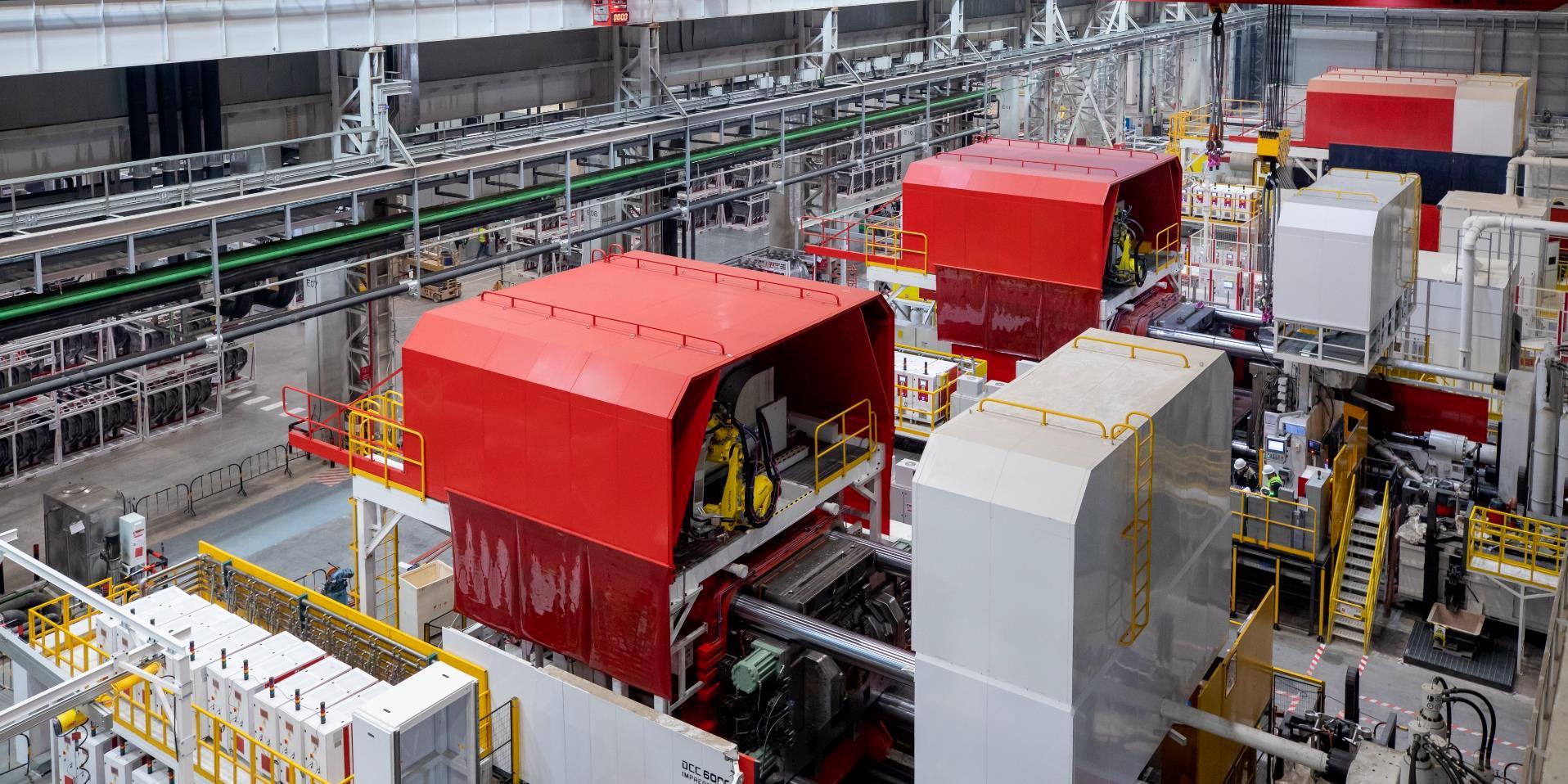

16:10 PT – As for Cybertruck development and 2021 deliveries, Musk stated that Tesla is finished with the vehicle’s engineering. Tesla has the necessary designs to make the Cybertruck work. Tesla will be using 8,000-ton press for the Cybertruck, which is more formidable than the Giga Press used for the Model Y, which is a 6,000-ton press.

16:08 PT – Elon also discusses Tesla’s China operations and its success, though he notes that FSD take rate in the country is conservative. He notes that Tesla has to work hard in ensuring that FSD and Autopilot work well in roads outside North America. As for Tesla’s long-term earnings being tied to profit per unit of battery capacity, Musk responded that this is indeed the case. EV makers can’t grow faster than their battery capacity. “Fundamentally, growth is dependent on cell production,” Musk said, noting that Tesla’s efforts to produce its own cells is to produce more batteries, not to compete with its suppliers. “Our goal with making our own cells is not to intimidate our suppliers. It is to supplement our suppliers,” Musk said.

16:04 PT – Addressing an inquiry from an institutional investor about Tesla’s possible plans to license its software like Autobidder to third party or OEMs. “We’re very open to licensing our software to other OEMs,” Musk said, adding that Tesla is in talks to license Autopilot to other companies. “We’re more than happy to license that to other car companies, and the same goes for Autobidder,” the CEO noted. He also mentions that the Supercharger Network will be fine for sharing too.

16:00 PT – Tesla service issues are addressed. Automotive Director Jerome Guillen notes that Tesla is looking to improve service amidst the company’s efforts to reduce service needs as possible. The executive noted that mobile service will play a huge part in this, with 40% of service needs in the US are now done through mobile. In terms of service appointments, Guillen notes that Tesla has 140 service centers in North America, with customers getting an appointment within 10 days. The pace of opening centers in North America is ramping, with Tesla planning on opening dozens in the first half of this year. He also explains that in terms of app vs phone support, apps are more robust. He notes that Tesla is investing everything it can on the app. “Our emphasis is on the app… It’s the way of the future,” he said.

15:57 PT – As for Tesla’s run rate for 4680 cell production, Elon Musk noted that the company is installing capacity to produce 200 GWh per year around 2022. Drew Baglino adds that with the S-curve of production, one could be off a bit, but Tesla is progressing through this S-curve as fast as possible.

15:52 PT – The second Say question from a retail investor is asked. FSD transfers. Elon notes that Tesla is not looking into this at this time. He mentions FSD’s price increases, and the fact that the market is undervaluing FSD considering its potential. He did note that Tesla will be offering subscriptions within the next month or two, which should help with pricing. As for the dry coating of the battery electrode for 4680 cells, VP of Technology Drew Baglino notes that the challenges are being addressed today. Tesla’s Roadrunner site in Fremont is getting better with its dry electrode process and its 4680 cell manufacturing. The setup for a 10 GWh annual production rate is there already. It’s only a matter of time.

15:49 PT – The first questions from Say are asked. First up, “What is currently holding Tesla back from being the market share leader in solar?” Musk notes that Tesla does indeed plan on being the market share leader. He explains that attention is now being put on solar, which should improve its ramp. “It won’t be long before Tesla becomes the leader in solar.” Kirkhorn also highlights that having industry-leading pricing is pivotal in dominating the solar industry. This is something that Tesla is doing right now.

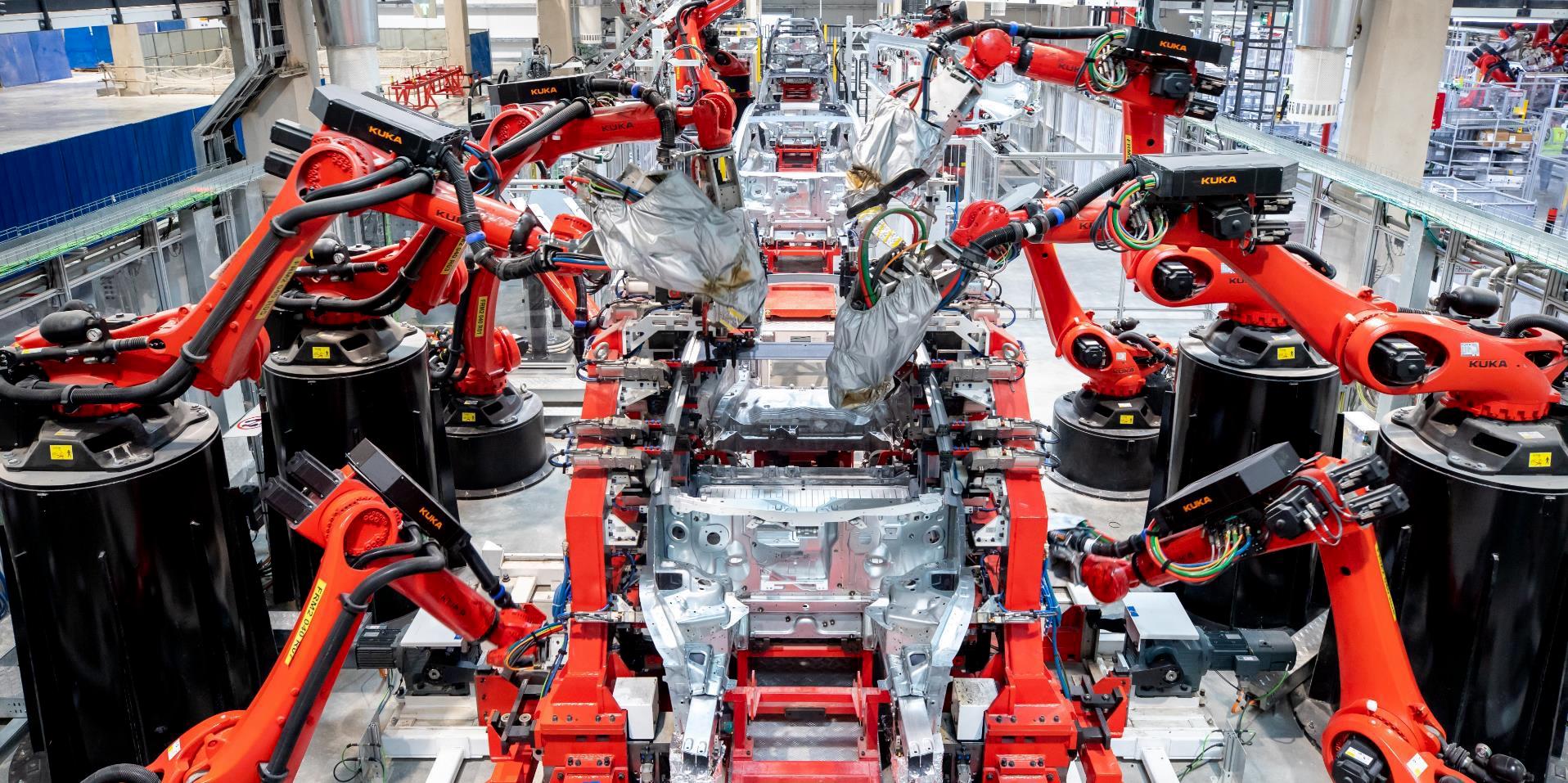

15:45 PT – CFO Zachary Kirkhorn takes the floor. He highlights Tesla’s strong free cash flow, which secures the company’s funds for its programs. He also mentions that Tesla relies less on debts now, especially as the company establishes its momentum with its sixth consecutive profitable quarter. He also explains automotive margins in Q4, noting that it was affected by the changes in the Model S and Model X line for the refresh, as well as the deployment of machines like the Giga Press in Fremont.

15:43 PT – Musk talks about how to justify Tesla’s high valuation. He explains that FSD will play a huge part in this. In conclusion, Musk noted that 2020 was just the beginning in terms of profitability. “It will be exciting,” he said. Provided that 2021 is relatively normal (unlike 2020), Musk is optimistic that Tesla can reach new heights. “We think 2021 will be more exciting…it’s going to be a great year for Tesla. Many new great products coming out,” he said.

15:40 PT – Musk also talks about the FSD beta rollout. “We have made massive improvements to FSD Beta,” he said. He adds that there are almost 1K people testing the software at this point. “It’s very common to have no interventions in drives to places that I’ve never been to,” Musk said, sharing some of his experiences with the FSD beta.

15:38 PT – Tesla Model S and Model X production is ongoing now. Model S Plaid will start deliveries next month. Model S Plaid will come a bit later. “It’s really a tremendous improvement over the prior version.” The Model S will be the first production car ever that will be able to go from 0-60 mph in under 2 seconds. “This is a luxury sedan that can go 0-60 in less than 2 seconds, and it will have the capability to seat seven people with its third row seats,” Musk remarked. More details to come later this week.

15:35 PT – Elon’s opening remarks. He recaps 2020, calling it a defining year for Tesla, especially when as the company accomplishes its target of delivering and producing half a million cars. That’s despite the challenging year. Free cash flow is healthy despite spending quite a lot of money. Simply put, Tesla has enough funds for its ambitious projects. Elon notes that Model 3 and Model Y are ramping in Shanghai and Fremont, and the heat pump is also rolled out to all vehicles. He also talks about Giga Berlin, Texas, and the Roadrunner site in Fremont.

15:32 PT – And it begins! Martin Viecha Senior Director of Investor Relations takes the floor. He introduces Elon Musk and Zachary Kirkhorn and a number of Tesla executives.

15:25 PT – Last few minutes guys. Here we go.

15:21 PT – Ok, guys, homestretch here. Who has bets on the earnings call starting on Elon Time? Then again, the earnings results are positive, so Tesla may be quite excited.

15:20 PT – I also just realized that the Model S and Model X refresh’s 17″ display is probably identical to the one used in the Cybertruck. Now I’m wondering if the Semi will use two of these screens. Kinda makes sense, doesn’t it?

15:15 PT – Also noteworthy is that the Model S and Model X refresh is now taking the fight to the world’s best luxury sedans with in terms of comfort as well. As could be seen in Tesla’s online configurator, both flagship vehicles are now equipped with a 22-speaker system with new microphone setup, which paves the way for active noise canceling tech. We reported on this recently, as could be seen here.

15:00 PT – Another thing that’s particularly notable is Tesla’s subtle, continued efforts to kill the FUD against electric cars. The Model S and Model X refresh are both equipped with a heat pump, which should enable the flagship vehicles to perform five times as many high-speed quarter-mile runs as before. Repeatability? Check.

14:45 PT – Several things stick out from the Q4 FY 2020 Update Letter. I’m particularly impressed with the company’s performance in its Energy business. Tesla Energy has long been underrated, and it’s always pushed to the background by the company’s auto business. But every quarter, Tesla Energy is becoming more and more prominent. In 2020, energy battery deployment surpassed 3 GWh for the first time. That’s some serious momentum.

14:30 PT – Well, well, well, looks like I’m early this time around. Please do check back in a bit as we will be covering the entire Q&A session. There’s usually a ton of interesting tidbits of information that get shared in Tesla’s earnings calls. Some analysts’ questions are also usually unforgettable.

14:15 PT – Good day, everyone, and welcome to another live blog of Tesla’s earnings call! While Tesla missed Wall Street’s EPS estimates, the company did post a huge profit and its war chest is very formidable now. But all the exciting financials aside, there’s very little doubt that the EV community is currently most excited about the Model S and Model X refresh. The wait for these vehicles has been significant, but boy oh boy, are they worth it.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.