Investor's Corner

Tesla is now more valuable than Volkswagen and BMW combined

Tesla stock closed at a record-high of $780 per share on Monday, pushing the California-based electric carmaker’s valuation to $140.591 billion and above the market cap of Volkswagen and BMW combined. Tesla’s latest record-setting valuation further solidifies the Elon Musk-led company’s position among legacy automakers, eclipsing Volkswagen’s market cap of $90.672 billion and BMW’s $45.894 billion.

Earlier this month, Tesla overtook Volkswagen as the second most valuable carmaker in the world. The latest valuation widens the gap between the two manufacturers to roughly $50 billion on Monday.

Wall Street’s prediction on the further upside of TSLA gave the price some boost. Argus Research upped its price target for the electric carmaker to $808 from $556 citing revenue growth from Model S and Model X and the strong demand for the Model 3.

“Despite past production delays, parts shortages, labor cost overruns and other difficulties, we expect Tesla to benefit from its dominant position in the electric vehicle industry and to improve performance in 2020 and beyond,” said Argus Research analyst Bill Selesky.

ARK Investment Management also updated its valuation model and believes the stock could hit $7,000 per share or even a best-case scenario of $15,000 by 2024.

For Gene Munster, managing partner of Loup Ventures and a known Tesla Bull, he attributes the bright future of Tesla to its head start against automotive giants with deeper pockets.

“The thesis for Tesla’s business miracle is rooted in the handful of years that the company operated with effectively no competition. Tesla has nearly a decade head start in EVs as other automakers under-invested in the space,” Munster said.

Tesla has a commanding presence in the mid-luxury sedan market that’s wreaked havoc on BMW and Mercedes Benz who have both been slow in delivering a viable electric vehicle for the everyday consumer. With Tesla’s investment into fun yet useful over-the-air features that have been otherwise foreign to traditional automakers, the company will continue to see unparalleled growth in the industry.

Tesla chief Elon Musk will host an AI hackathon party at his house to accelerate the development of Tesla’s full self-driving capability and Autopilot feature, and most likely fish for new talents to join the company.

Tesla will start the delivery of the Model Y this March, way ahead of schedule. The much-awaited crossover also has an updated EPA range of 315 miles from the original rating of 280 miles.

The Silicon Valley-based carmaker is also getting closer to laying the first bricks of its first factory in Europe, Giga Berlin. It also recently applied for subsidies for its battery cell production in Grunheide, which will help keep costs optimal. In China, Tesla’s factory is offline at the moment due to the ongoing novel coronavirus pandemic but Tesla China is continuing its push and answers questions from potential customers via social media.

If Tesla keeps on track and execute flawlessly, we can only expect to see analysts and the automotive world get more bullish and the long-term expectations of skyrocketing stock prices will highly likely come true.

As for the short sellers, losses amounted to $2.5 billion on Monday or about $8 billion since the start of 2020, according to data power company S3 Partners.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

Elon Musk

Tesla investors will be shocked by Jim Cramer’s latest assessment

Jim Cramer is now speaking positively about Tesla, especially in terms of its Robotaxi performance and its perception as a company.

Tesla investors will be shocked by analyst Jim Cramer’s latest assessment of the company.

When it comes to Tesla analysts, many of them are consistent. The bulls usually stay the bulls, and the bears usually stay the bears. The notable analysts on each side are Dan Ives and Adam Jonas for the bulls, and Gordon Johnson for the bears.

Jim Cramer is one analyst who does not necessarily fit this mold. Cramer, who hosts CNBC’s Mad Money, has switched his opinion on Tesla stock (NASDAQ: TSLA) many times.

He has been bullish, like he was when he said the stock was a “sleeping giant” two years ago, and he has been bearish, like he was when he said there was “nothing magnificent” about the company just a few months ago.

Now, he is back to being a bull.

Cramer’s comments were related to two key points: how NVIDIA CEO Jensen Huang describes Tesla after working closely with the Company through their transactions, and how it is not a car company, as well as the recent launch of the Robotaxi fleet.

Jensen Huang’s Tesla Narrative

Cramer says that the narrative on quarterly and annual deliveries is overblown, and those who continue to worry about Tesla’s performance on that metric are misled.

“It’s not a car company,” he said.

He went on to say that people like Huang speak highly of Tesla, and that should be enough to deter any true skepticism:

“I believe what Musk says cause Musk is working with Jensen and Jensen’s telling me what’s happening on the other side is pretty amazing.”

Tesla self-driving development gets huge compliment from NVIDIA CEO

Robotaxi Launch

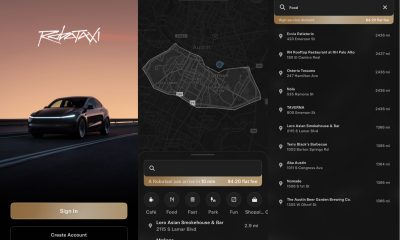

Many media outlets are being extremely negative regarding the early rollout of Tesla’s Robotaxi platform in Austin, Texas.

There have been a handful of small issues, but nothing significant. Cramer says that humans make mistakes in vehicles too, yet, when Tesla’s test phase of the Robotaxi does it, it’s front page news and needs to be magnified.

He said:

“Look, I mean, drivers make mistakes all the time. Why should we hold Tesla to a standard where there can be no mistakes?”

It’s refreshing to hear Cramer speak logically about the Robotaxi fleet, as Tesla has taken every measure to ensure there are no mishaps. There are safety monitors in the passenger seat, and the area of travel is limited, confined to a small number of people.

Tesla is still improving and hopes to remove teleoperators and safety monitors slowly, as CEO Elon Musk said more freedom could be granted within one or two months.

Investor's Corner

Tesla gets $475 price target from Benchmark amid initial Robotaxi rollout

Tesla’s limited rollout of its Robotaxi service in Austin is already catching the eye of Wall Street.

Venture capital firm Benchmark recently reiterated its “Buy” rating and raised its price target on Tesla stock (NASDAQ: TSLA) from $350 to $475 per share, citing the company’s initial Robotaxi service deployment as a sign of future growth potential.

Benchmark analyst Mickey Legg praised the Robotaxi service pilot’s “controlled and safety-first approach,” adding that it could help Tesla earn the trust of regulators and the general public.

Confidence in camera-based autonomy

Legg reiterated Benchmark’s belief in Tesla’s vision-only approach to autonomous driving. “We are a believer in Tesla’s camera-focused approach that is not only cost effective but also scalable,” he noted.

The analyst contrasted Tesla’s simple setup with the more expensive hardware stacks used by competitors like Waymo, which use various sophisticated sensors that hike up costs, as noted in an Investing.com report. Compared to Tesla’s Model Y Robotaxis, Waymo’s self-driving cars are significantly more expensive.

He also pointed to upcoming Texas regulations set to take effect in September, suggesting they could help create a regulatory framework favorable to autonomous services in other cities.

“New regulations for autonomous vehicles are set to go into place on Sept. 1 in TX that we believe will further help win trust and pave the way for expansion to additional cities,” the analyst wrote.

Tesla as a robotics powerhouse

Beyond robotaxis, Legg sees Tesla evolving beyond its roots as an electric vehicle maker. He noted that Tesla’s humanoid robot, Optimus, could be a long-term growth driver alongside new vehicle programs and other future initiatives.

“In our view, the company is undergoing an evolution from a trailblazing vehicle OEM to a high-tech automation and robotics company with unmatched domestic manufacturing scale,” he wrote.

Benchmark noted that Tesla stock had rebounded over 50% from its April lows, driven in part by easing tariff concerns and growing momentum around autonomy. With its initial Robotaxi rollout now underway, the firm has returned to its previous $475 per share target and reaffirmed TSLA as a Benchmark Top Pick for 2025.

-

Elon Musk1 day ago

Elon Musk1 day agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News6 days ago

News6 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more