Investor's Corner

Tesla shares (TSLA) up in premarket as new Model 3 production goals get leaked

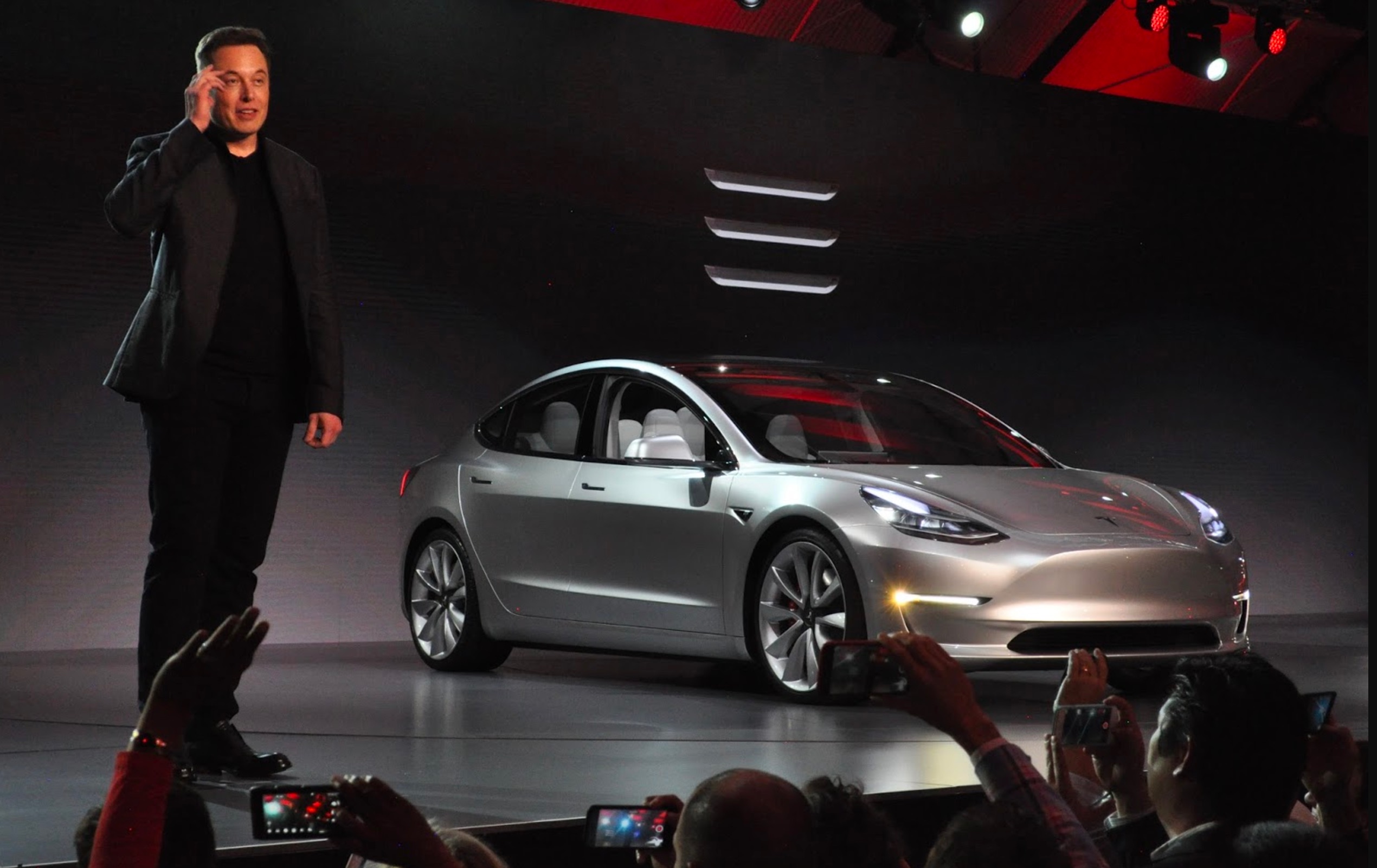

Tesla shares (NASDAQ:TSLA) are up in pre-market trading Wednesday, with the company’s stock up +2.83% at $295.84 per share as of writing, amid reports of a leaked email from CEO Elon Musk outlining new Model 3 production goals.

Tesla ended in the negative on Tuesday, with the company’s stocks trading -1.21% at $287.69 per share amid the company’s feud with Reveal magazine about the publication’s allegations of workplace safety shortcomings and reports of China loosening its ownership restrictions on facilities owned by foreign companies.

Sent around 12:30 p.m. PST on Tuesday, Musk’s lengthy message to his employees included a discussion on the Model 3’s manufacturing ramp, Tesla’s expenses, and its goal of being profitable by the third and fourth quarter of 2018.

Musk’s email, a copy of which was obtained by auto news website Jalopnik, also confirmed recent reports stating that the Model 3 production line will be temporarily suspended for a few days for a “comprehensive set of upgrades” that would allow Tesla to produce 3,000-4,000 of the electric cars every week. Musk also noted in his email that another planned downtime in May is expected, which would allow the company to produce 5,000-6,000 Model 3 weekly.

Considering its new Model 3 production goals, Musk further noted that it would be hiring an additional 400 employees per week for the next several weeks between the Fremont factory and the Nevada Gigafactory.

Musk also discussed Tesla’s push towards profitability in the leaked email. Referencing Tesla’s critics who have made it a point to state that the company is yet to attain profitability, Musk stated that the Tesla is now ready to pursue more revenue as it reaches economies of scale. With this in mind, any capital or miscellaneous expenditure exceeding $1 million “should be considered on hold until explicitly approved” by Musk himself.

Elon Musk’s leaked email to Tesla employees about the new Model 3 production goals can be read in its entirety below.

Progress, Precision and Profit

Progress

First, congratulations are in order! We have now completed our third full week of producing over 2000 Model 3 vehicles. The first week was 2020, the second was 2070 and we just completed 2250 last week, along with 2000 Model S/X vehicles.

This is more than double Tesla’s weekly production rate last year and an amazing feat in the face of many challenges! It is extremely rare for an automotive company to grow the production rate by over 100% from one year to the next. Moreover, there has simultaneously been a significant improvement in quality and build accuracy, which is reflected in positive owner feedback.

Starting today at Giga and tomorrow at Fremont, we will be stopping for three to five days to do a comprehensive set of upgrades. This should set us up for Model 3 production of 3000 to 4000 per week next month.

Another set of upgrades starting in late May should be enough to unlock production capacity of 6000 Model 3 vehicles per week by the end of June. Please note that all areas of Tesla and our suppliers will be required to demonstrate a Model 3 capacity of ~6000/week by building 850 sets of car parts in 24 hours no later than June 30th.

Any Tesla department or supplier that is unable to do this will need to have a very good explanation why not, along with a plan for fixing the problem and present that to me directly. If anyone needs help achieving this, please let me know as soon as possible. We are going to find a way or make a way to get there.

The reason that the burst-build target rate is 6000 and not 5000 per week in June is that we cannot have a number with no margin for error across thousands of internally and externally produced parts and processes, amplified by a complex global logistics chain. Actual production will move as fast as the least lucky and least well-executed part of the entire Tesla production/supply chain system.

By having a Model 3 subsystem burst-build requirement of 6k by the end of June, we will lay the groundwork for achieving a steady 6k/week across the whole Model 3 system a few months later.

As part of the drive towards 6k, all Model 3 production at Fremont will move to 24/7operations. This means that we will be adding another shift to general assembly, body and paint. Please refer anyone you know who you think meets the Tesla bar for talent, drive and trust. Between Fremont and Giga, Tesla will be adding about 400 people per week for several weeks.

Precision

Most of the design tolerances of the Model 3 are already better than any other car in the world. Soon, they will all be better. This is not enough. We will keep going until the Model 3 build precision is a factor of ten better than any other car in the world. I am not kidding.

Our car needs to be designed and built with such accuracy and precision that, if an owner measures dimensions, panel gaps and flushness, and their measurements don’t match the Model 3 specs, it just means that their measuring tape is wrong.

Some parts suppliers will be unwilling or unable to achieve this level of precision. I understand that this will be considered an unreasonable request by some. That’s ok, there are lots of other car companies with much lower standards. They just can’t work with Tesla.

Profit

A fair criticism leveled at Tesla by outside critics is that you’re not a real company unless you generate a profit, meaning simply that revenue exceeds costs. It didn’t make sense to do that until reaching economies of scale, but now we are there.

Going forward, we will be far more rigorous about expenditures. I have asked the Tesla finance team to comb through every expense worldwide, no matter how small, and cut everything that doesn’t have a strong value justification.

All capital or other expenditures above a million dollars, or where a set of related expenses may accumulate to a million dollars over the next 12 months, should be considered on hold until explicitly approved by me. If you are the manager responsible, please make sure you have a detailed, first principles understanding of the supplier quote, including every line item of parts & labor, before we meet.

I have been disappointed to discover how many contractor companies are interwoven throughout Tesla. Often, it is like a Russian nesting doll of contractor, subcontractor, sub-subcontractor, etc. before you finally find someone doing actual work. This means a lot of middle-managers adding cost but not doing anything obviously useful. Also, many contracts are essentially open time & materials, not fixed price and duration, which creates an incentive to turn molehills into mountains, as they never want to end the money train.

There is a very wide range of contractor performance, from excellent to worse than a drunken sloth. All contracting companies should consider the coming week to be a final opportunity to demonstrate excellence. Any that fail to meet the Tesla standard of excellence will have their contracts ended on Monday.

Btw, here are a few productivity recommendations:

– Excessive meetings are the blight of big companies and almost always get worse over time. Please get of all large meetings, unless you’re certain they are providing value to the whole audience, in which case keep them very short.

– Also get rid of frequent meetings, unless you are dealing with an extremely urgent matter. Meeting frequency should drop rapidly once the urgent matter is resolved.

– Walk out of a meeting or drop off a call as soon as it is obvious you aren’t adding value. It is not rude to leave, it is rude to make someone stay and waste their time.

– Don’t use acronyms or nonsense words for objects, software or processes at Tesla. In general, anything that requires an explanation inhibits communication. We don’t want people to have to memorize a glossary just to function at Tesla.

– Communication should travel via the shortest path necessary to get the job done, not through the “chain of command”. Any manager who attempts to enforce chain of command communication will soon find themselves working elsewhere.

– A major source of issues is poor communication between depts. The way to solve this is allow free flow of information between all levels. If, in order to get something done between depts, an individual contributor has to talk to their manager, who talks to a director, who talks to a VP, who talks to another VP, who talks to a director, who talks to a manager, who talks to someone doing the actual work, then super dumb things will happen. It must be ok for people to talk directly and just make the right thing happen.

– In general, always pick common sense as your guide. If following a “company rule” is obviously ridiculous in a particular situation, such that it would make for a great Dilbert cartoon, then the rule should change.

If there is something you think should be done to make Tesla execute better or allow you to look forward to coming to work more (same thing in the long term), please send a note to [redacted].

Thanks for being such a kickass team and accomplishing miracles every day. It matters. We are burning the midnight oil to burn the midnight oil.

Elon

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.