News

Billionaire resigns CEO role to pay, train for SpaceX’s first crewed Starship Moon launch

Eccentric Japanese billionaire Yusaku Maezawa — known for collecting modern art and founding online fashion retailer Zozo — has stepped down as CEO to free up time and money for his privately-chartered launch around the moon.

Set to launch no earlier than 2023 on what is expected to be SpaceX’s first crewed, circumlunar Starship launch, Maezawa stated in September 2018 that he had arranged to pay SpaceX a huge amount of money (likely several hundred million dollars) for that right. Along with resigning as CEO of Zozo, Maezawa will sell ~85% of his 36% stake to Yahoo Japan, giving the conglomerate a 50.1% ownership stake of Zozo and Maezawa a $2.3 billion cash windfall.

As noted by Business Insider, when asked by a follower if he had any money after an announcement that he would sell off a portion of his extensive art collection in a Sotheby’s auction, Maezawa admitted that he frequently has “no money” because he spends it “right away”, inadvisable but admittedly in-line with his eccentric reputation.

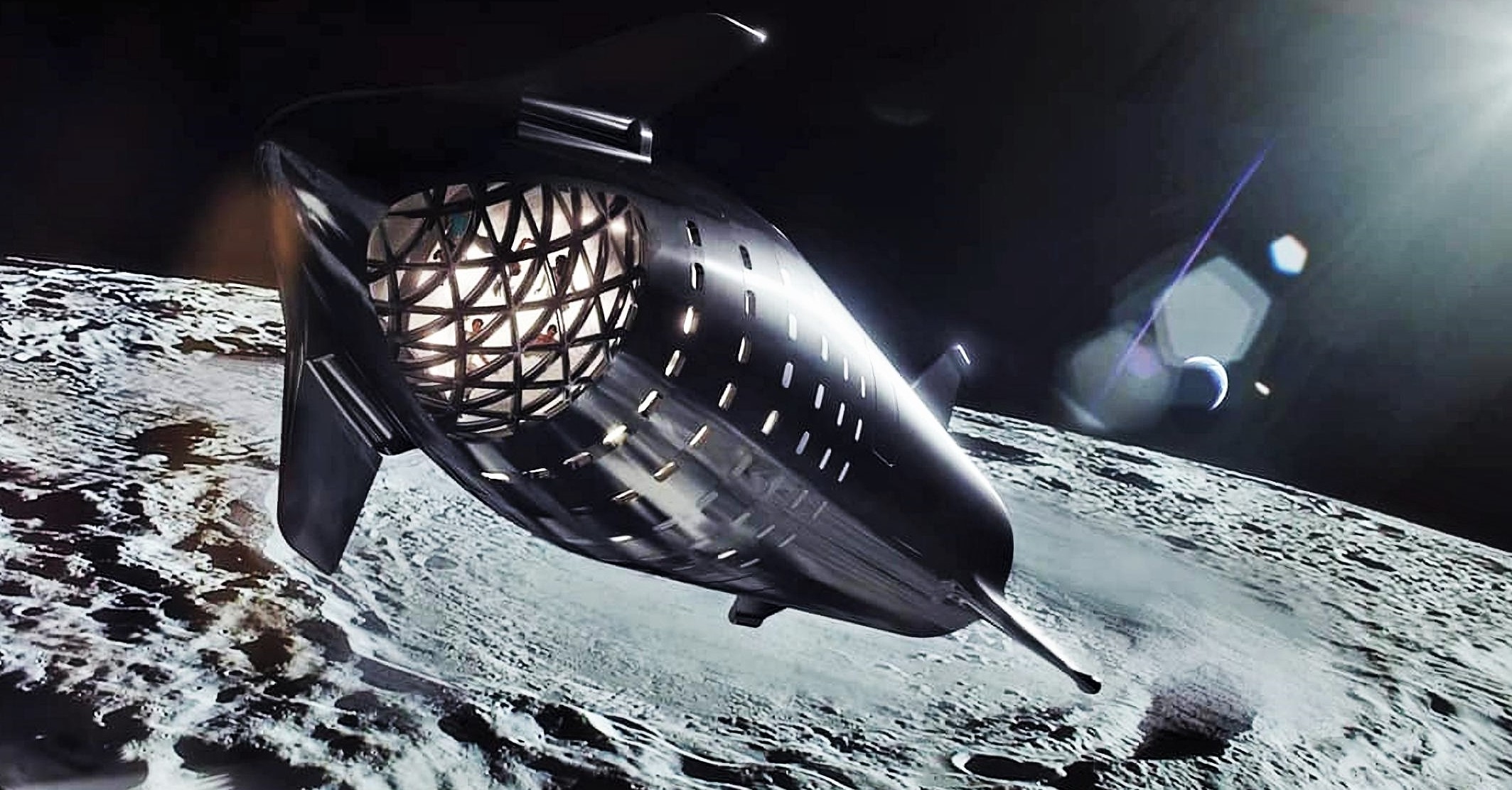

The resignation and sale comes just weeks after SpaceX successfully completed Starhopper’s second and final launch, reaching an altitude of ~150m (500 ft) with the power of a single Raptor engine. During a September 2018 SpaceX press event, Maezawa announced that he had come to an agreement with the company to buy the entirety of Starship’s first crewed mission around the Moon. The billionaire’s motivation: gifting the 8-10 available ‘seats’ to some of the best artists in the world in a project known as dearMoon.

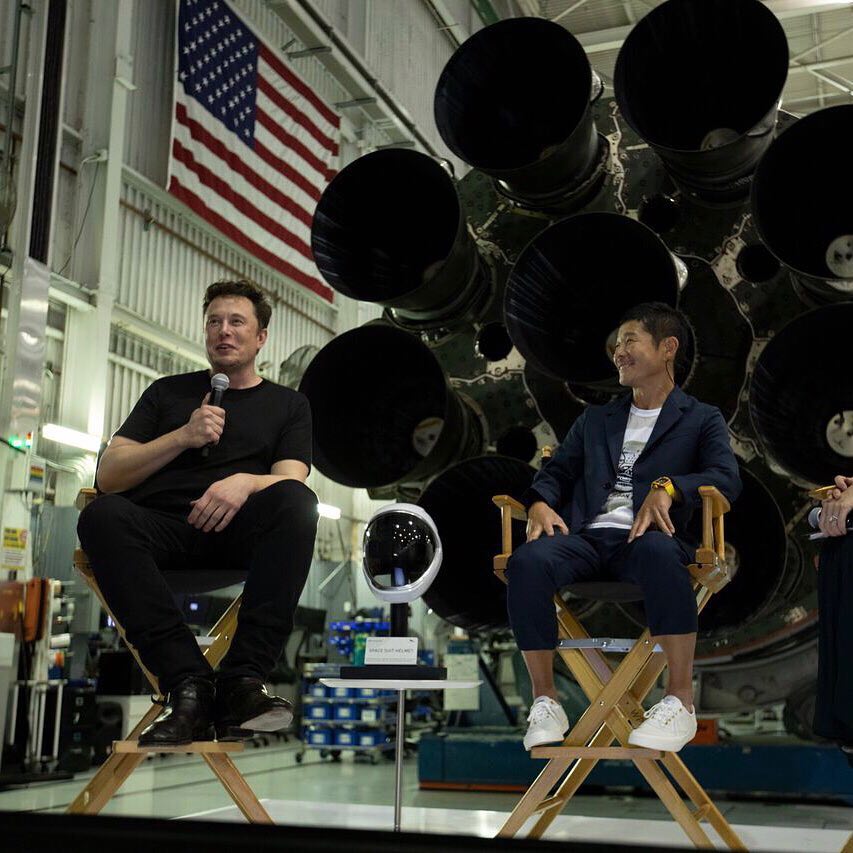

At the same event, SpaceX CEO Elon Musk estimated that the company’s Starship program would cost anwhere from $2B- $10B and confirmed that the bulk of Maezawa’s contributions would go directly towards the rocket’s development costs. Business Insider also quotes Musk as stating that “[Maezawa is] paying a lot of money that would help with the ship and its booster – ultimately paying for the average citizen to travel to other planets.” Alongside Yusaku’s frank Twitter acknowledgment that he may not be the most financially responsible individual and repeated indications that he is extremely proud of Zozo, it’s safe to surmise that the decision to resign was not easily made.

More likely than not, now that SpaceX has completed its Starhopper flight program and is on the verge of its first Starship prototype flight tests, Maezawa simply needs money – and a huge amount of it – to continue fulfilling his contractual commitment to SpaceX. Even if a significant portion of the $2.2-2.3B cash payout he is set to receive goes to settling old debts, the Japanese billionaire should now have more than enough assets to fully fund his SpaceX contract.

At the time, SpaceX had partially completed pieces of the megarocket – then referred to as BFR – in a makeshift development facility at the Port of Los Angeles, pictured above with Maezawa. Since then, SpaceX has renamed the rocket to Starship, drastically redesigned it, and relocated all production operations to Hawthorne, CA, Boca Chica, Texas, and Cocoa, Florida.

Currently, SpaceX is developing twin Starship prototypes at launch and landing test facilities in Boca Chica, Texas (“Mk1”) and in Cocoa, FL (“Mk2”). Musk recently visited the facilities and announced that he is planning to present a technical Starship development update as early as September 28th.

According to an interview posted on WWDJapan.com as part of a September 12th Zozo press conference, Maezawa explained that he believes he made some missteps while serving as Zozo CEO, negatively affecting the company’s bottom line. He believes that more team-oriented business practices and a change of leadership could help to improve the company, which is currently holding its head well above water but still likely to far fall behind its FY2019 performance goals. It’s also hoped that selling an ownership stake in the company will give Yahoo Japan the flexibility to grow Zozo and improve its global reach.

The role of Zozo CEO now goes to Kotaro Sawada who accompanied Maezawa on stage at the announcement event along with Yahoo Japan’s president, Kentaro Kawamata. According to Forbes.com Maezawa stated that “Sawada is the exact opposite of my instinct-based management and adept at management based on logic, like crunching data and testing things out first.”

While Yahoo Japan will look to expand Zozo and the associated online shopping mall Zozotown to compete with other online retailers such as Amazon and Rakuten, Maezawa says that he will turn his attention to achieving his personal goal of a trip around the moon. He mentioned that he plans to fly to space prior to his circumlunar flight in 2023 and will spend much of his time training and learning foreign languages for spaceflight.

He also plans to pursue building another company from the ground up. Whether his next company will be an endeavor focused around space tourism remains to be seen.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla China January wholesale sales rise 9% year-on-year

Tesla reported January wholesale sales of 69,129 China-made vehicles, as per data released by the China Passenger Car Association.

Tesla China reported January wholesale sales of 69,129 Giga Shanghai-made vehicles, as per data released by the China Passenger Car Association (CPCA). The figure includes both domestic sales and exports from Gigafactory Shanghai.

The total represented a 9.32% increase from January last year but a 28.86% decline from December’s 97,171 units.

China EV market trends

The CPCA estimated that China’s passenger new energy vehicle wholesale volume reached about 900,000 units in January, up 1% year-on-year but down 42% from December. Demand has been pressured by the start-of-year slow season, a 5% additional purchase tax cost, and uncertainty around the transition of vehicle trade-in subsidies, as noted in a report from CNEV Post.

Market leader BYD sold 210,051 NEVs in January, down 30.11% year-on-year and 50.04% month-on-month, as per data released on February 1. Tesla China’s year-over-year growth then is quite interesting, as the company’s vehicles seem to be selling very well despite headwinds in the market.

Tesla China’s strategies

To counter weaker seasonal demand, Tesla China launched a low-interest financing program on January 6, offering up to seven-year terms on select produced vehicles. The move marked the first time an automaker offered financing of that length in the Chinese market.

Several rivals, including Xiaomi, Li Auto, XPeng, and NIO, later introduced similar incentives. Tesla China then further increased promotions on January 26 by reinstating insurance subsidies for the Model 3 sedan. The CPCA is expected to release Tesla’s China retail sales and export breakdown later this month.

News

Tesla’s Apple CarPlay ambitions are not dead, they’re still in the works

For what it’s worth, as a Tesla owner, I don’t particularly see the need for CarPlay, as I have found the in-car system that the company has developed to be superior. However, many people are in love with CarPlay simply because, when it’s in a car that is capable, it is really great.

Tesla’s Apple CarPlay ambitions appeared to be dead in the water after a large amount of speculation late last year that the company would add the user interface seemed to cool down after several weeks of reports.

However, it appears that CarPlay might make its way to Tesla vehicles after all, as a recent report seems to indicate that it is still being worked on by software teams for the company.

The real question is whether it is truly needed or if it is just a want by so many owners that Tesla is listening and deciding to proceed with its development.

Back in November, Bloomberg reported that Tesla was in the process of testing Apple CarPlay within its vehicles, which was a major development considering the company had resisted adopting UIs outside of its own for many years.

Nearly one-third of car buyers considered the lack of CarPlay as a deal-breaker when buying their cars, a study from McKinsey & Co. outlined. This could be a driving decision in Tesla’s inability to abandon the development of CarPlay in its vehicles, especially as it lost a major advantage that appealed to consumers last year: the $7,500 EV tax credit.

Tesla owners propose interesting theory about Apple CarPlay and EV tax credit

Although we saw little to no movement on it since the November speculation, Tesla is now reportedly in the process of still developing the user interface. Mark Gurman, a Bloomberg writer with a weekly newsletter, stated that CarPlay is “still in the works” at Tesla and that more concrete information will be available “soon” regarding its development.

While Tesla already has a very capable and widely accepted user interface, CarPlay would still be an advantage, considering many people have used it in their vehicles for years. Just like smartphones, many people get comfortable with an operating system or style and are resistant to using a new one. This could be a big reason for Tesla attempting to get it in their own cars.

Tesla gets updated “Apple CarPlay” hack that can work on new models

For what it’s worth, as a Tesla owner, I don’t particularly see the need for CarPlay, as I have found the in-car system that the company has developed to be superior. However, many people are in love with CarPlay simply because, when it’s in a car that is capable, it is really great.

It holds one distinct advantage over Tesla’s UI in my opinion, and that’s the ability to read and respond to text messages, which is something that is available within a Tesla, but is not as user-friendly.

With that being said, I would still give CarPlay a shot in my Tesla. I didn’t particularly enjoy it in my Bronco Sport, but that was because Ford’s software was a bit laggy with it. If it were as smooth as Tesla’s UI, which I think it would be, it could be a really great addition to the vehicle.

News

Tesla brings closure to Model Y moniker with launch of new trim level

With the launch of a new trim level for the Model Y last night, something almost went unnoticed — the loss of a moniker that Tesla just recently added to a couple of its variants of the all-electric crossover.

Tesla launched the Model Y All-Wheel-Drive last night, competitively priced at $41,990, but void of the luxurious features that are available within the Premium trims.

Upon examination of the car, one thing was missing, and it was noticeable: Tesla dropped the use of the “Standard” moniker to identify its entry-level offerings of the Model Y.

The Standard Model Y vehicles were introduced late last year, primarily to lower the entry price after the U.S. EV tax credit changes were made. Tesla stripped some features like the panoramic glass roof, premium audio, ambient lighting, acoustic-lined glass, and some of the storage.

Last night, it simply switched the configurations away from “Standard” and simply as the Model Y Rear-Wheel-Drive and Model Y All-Wheel-Drive.

There are three plausible reasons for this move, and while it is minor, there must be an answer for why Tesla chose to abandon the name, yet keep the “Premium” in its upper-level offerings.

“Standard” carried a negative connotation in marketing

Words like “Standard” can subtly imply “basic,” “bare-bones,” or “cheap” to consumers, especially when directly contrasted with “Premium” on the configurator or website. Dropping it avoids making the entry-level Model Y feel inferior or low-end, even though it’s designed for affordability.

Tesla likely wanted the base trim to sound neutral and spec-focused (e.g., just “RWD” highlights drivetrain rather than feature level), while “Premium” continues to signal desirable upgrades, encouraging upsells to higher-margin variants.

Simplifying the overall naming structure for less confusion

The initial “Standard vs. Premium” split (plus Performance) created a somewhat clunky hierarchy, especially as Tesla added more variants like Standard Long Range in some markets or the new AWD base.

Removing “Standard” streamlines things to a more straightforward progression (RWD → AWD → Premium RWD/AWD → Performance), making the lineup easier to understand at a glance. This aligns with Tesla’s history of iterative naming tweaks to reduce buyer hesitation.

Elevating brand perception and protecting perceived value

Keeping “Premium” reinforces that the bulk of the Model Y lineup (especially the popular Long Range models) remains a premium product with desirable features like better noise insulation, upgraded interiors, and tech.

Eliminating “Standard” prevents any dilution of the Tesla brand’s upscale image—particularly important in a competitive EV market—while the entry-level variants can quietly exist as accessible “RWD/AWD” options without drawing attention to them being decontented versions.

You can check out the differences between the “Standard” and “Premium” Model Y vehicles below:

@teslarati There are some BIG differences between the Tesla Model Y Standard and Tesla Model Y Premium #tesla #teslamodely ♬ Sia – Xeptemper