News

SpaceX is in no rush for a Starlink IPO and that should terrify competitors

SpaceX President Gwynne Shotwell says that the Starlink satellite internet business is in no rush to become a separate company and pursue an IPO, and that relaxed demeanor should terrify competitor constellations and ISPs like OneWeb and Comcast.

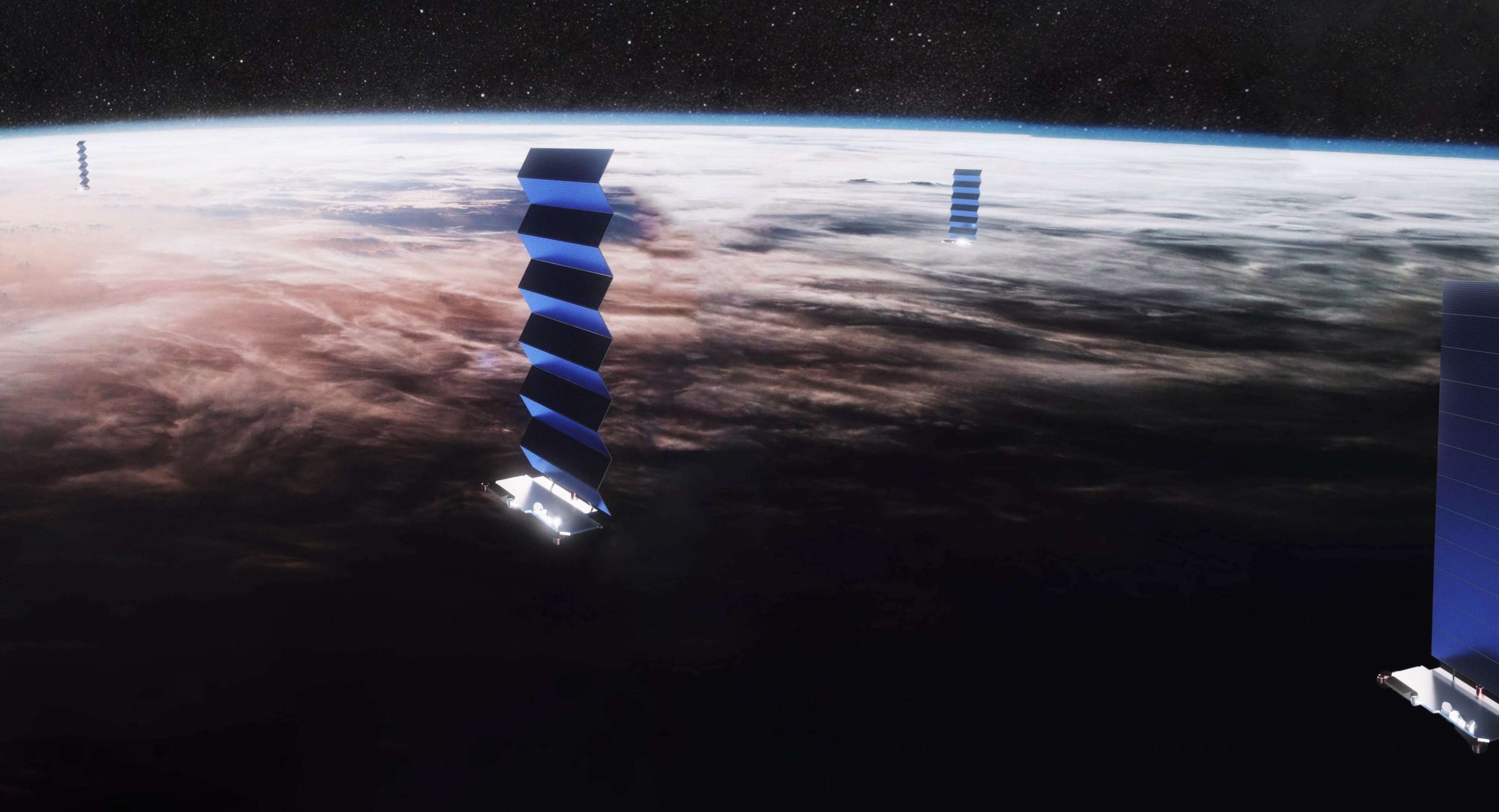

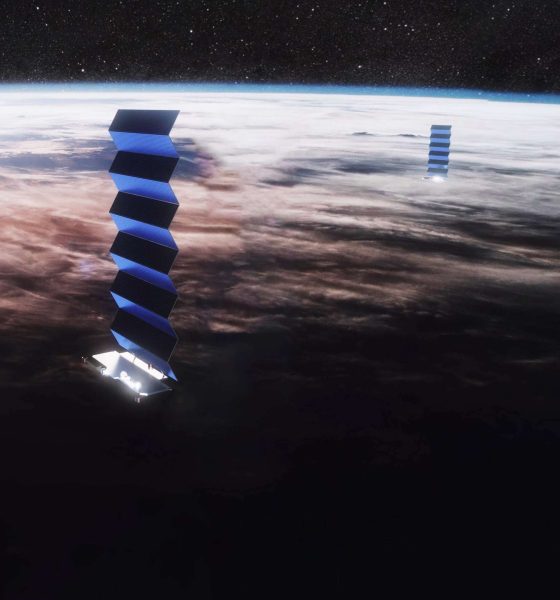

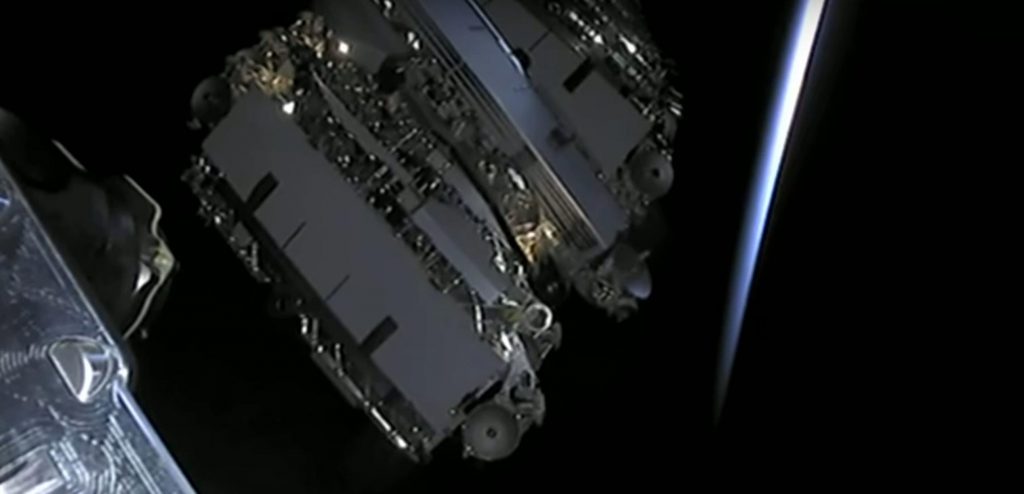

Announced in January 2015, SpaceX has been developing a massive constellation of satellites capable of delivering high-quality broadband internet anywhere on Earth for half a decade. Known as Starlink, SpaceX launched its first dedicated satellite prototypes – known as Tintin A and B – in February 2018, serving as a very successful alpha test for the myriad technologies the company would need to master to realize the constellation’s goals. 15 months later, SpaceX launched its first batch of 60 radically-redesigned Starlink satellites – packed flat to fit in an unmodified Falcon 9 payload fairing.

Less than nine months after that first ‘v0.9’ mission, SpaceX has completed another three dedicated launches and made Starlink – now some 235 operational satellites strong – the world’s largest private satellite constellation by a huge margin. Now just two days away from its fifth Starlink launch, SpaceX’s second-in-command has revealed that the company will likely split Starlink off into its own separate company, enabling an IPO without sacrificing SpaceX’s broader freedom. However, Shotwell also made it clear that SpaceX is in no rush to do so, and that fact should strike fear into the hearts of Starlink’s many potential competitors.

Bloomberg first broke the news with a snippet revealing that SpaceX COO and President Gwynne Shotwell had told a private investor event that Starlink could eventually IPO as an independent company. While undeniably important, a SpaceX source – after confirming the news – also told Reuters reporter Joey Roulette that it would be “several years” before the company might kick off the process of a Starlink IPO.

While a seemingly small piece of information at face value, the fact that SpaceX is years away from a potential Starlink IPO implies that the company is incredibly confident in where it stands today. Given that SpaceX only started ramping up its Starlink production rates and launch cadence a handful of months ago, that apparent confidence – assuming SpaceX’s respected President and COO isn’t lying to the faces of prospective investors – is no small feat.

Thanks to that production and launch cadence ramp, SpaceX is likely in the midst of one of the most capital-straining periods its Starlink program will ever experience. As a private company, SpaceX’s balance sheets are a black box to the public, but it’s safe to say that the it’s going through – or has already gone through – a phase of “production hell” similar to what Tesla experienced when it began building Roadsters, Model S/Xs, and Model 3s.

Building satellites like cars

In less than 12 months, SpaceX has effectively gone from manufacturing zero satellites to mass-producing something like 2-4 Starlink spacecraft every single day, almost without a doubt smashing any records previously held in the industry. It’s possible that companies like Planet (now the owner of the second-largest private constellation) or Spire have built more spacecraft in a given period, but SpaceX’s satellites are at least an order of magnitude larger, on average.

Around 260 kg (570 lb) apiece, SpaceX has built and launched a total of 240 spacecraft – together weighing more than 60 metric tons (135,000 lb) – in less than nine months. Furthermore, the company not only intends to crush that average but wants (if not needs) to do so for several years without interruption.

Back in May 2019, CEO Elon Musk confidently stated that he believes SpaceX already has all the capital it needs “to build an operational [Starlink] constellation”, likely referring to at least ~1500 operational communications satellites – launches included. This is why competitors should be moderately terrified that SpaceX isn’t even privately pushing for an IPO sooner than later. Perhaps the single biggest reason modern companies pursue IPOs is to raise substantial capital – usually far more than can be practically (or quickly) raised while private when executed successfully.

A step further, “several years” should mean titanic changes for SpaceX’s Starlink constellation if everything goes as planned. In 2020, SpaceX has publicly stated that it will attempt as many as 20-24 dedicated Starlink launches, an achievement that would translate to a constellation more than 1600 satellites strong by the end of the year. SpaceX says that 24 launches (20 if the first four missions are subtracted) is enough to offer global coverage and plans to begin serving customers in the northern US and Canada as early as this summer.

As of now, SpaceX has performed three 60-satellite Starlink launches total in the last three months – two in January 2020 alone – and Starlink V1 L4 (the fourth v1.0 launch and fifth launch overall) is scheduled to lift off just two days from now on February 15th. If Musk and Shotwell are correct and SpaceX can launch at least one or two thousand satellites without raising any additional capital, the constellation – potentially reaching those numbers by early to mid-2021 – may already have hundreds of thousands of customers by the time more funding is needed. 2000 Starlink v1.0 satellites, for reference, would theoretically offer enough collective bandwidth for more than 500,000 users to simultaneously stream Netflix content in 1080p.

As of early 2019, SpaceX had raised a total of $2B in venture capital, investments, and debt. Thus, even in the unlikely event that 100% of that funding goes to Starlink, the company would ultimately have to spend $500-700M annually from 2018 to the end of 2021 to run that large pool of capital dry by the time 1000-2000 satellites are in orbit.

500,000 customers paying $50-100 per month by the end of 2021 would conservatively allow Starlink to generate $300-600M in annual revenue, excluding the likely possibility of even more lucrative government or commercial contracts. In other words, if SpaceX can accumulate an average of 20,000 paying subscribers per month between now and the end of 2021, Starlink could very well become self-sustaining at its current rate of growth – or close to it – by the time SpaceX is hurting for more funding. In a worst-case scenario, it thus appears all but certain that “several years” from now, SpaceX’s Starlink program will have at least a few thousand high-performance satellites in orbit, an extensive network of ground stations, and a large swath of alpha or beta customers by the time IPO proceedings begin.

Given that all that potential infrastructure would easily be worth at least $1-2B purely from a capital investment standpoint, Starlink’s ultimate IPO valuation – under Shotwell’s patient “maybe one day” approach – could be stratospheric.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla’s most wanted Model Y heads to new region with no sign of U.S. entry

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

Tesla’s most wanted Model Y configuration is heading to a new region, and although U.S. fans and owners have requested the vehicle since its release last year, it appears the company has no plans to bring it to the market.

According to fresh regulatory filings, the six-seat Model Y L is coming to South Korea with signs indicating an imminent launch. The extended-wheelbase configuration, already a hit in China, just cleared energy-efficiency certification from the Korea Energy Agency, paving the way for deliveries as early as the first half of 2026.

The vehicle is already built at Tesla’s Giga Shanghai facility in China, making it an ideal candidate for the Asian market, as well as the European one, as the factory has been known as a bit of an export hub in the past.

$TSLA

BREAKING: The official launch of Tesla Model Y L in S.Korea seems to be quite imminent.Additional credentials related to Model YL were released today.

✅ Battery Manufacturer: LG Energy Solutions

✅ Number of passengers: 6 people

✅ Total battery capacity: 97.25 kWh… pic.twitter.com/hmy64XYi80— Tsla Chan (@Tslachan) March 6, 2026

It seems like Tesla was prepping for this release anyway, as the timing was no accident. A camouflaged Model Y L prototype was spotted testing on Korean highways the same day the certification dropped. Tesla has already secured similar approvals for Australia and New Zealand, with both markets expecting the larger Model Y in 2026.

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

South Korean filings list it as an all-wheel-drive imported electric passenger vehicle with a 97.25 kWh total battery capacity supplied by LG Energy Solution. Local tests show an impressive 543 km (337 miles) combined range at room temperature and 454 km (282 miles) in colder conditions, easing one of the biggest concerns for Korean EV buyers.

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

But for U.S. fans, things are not looking good for a launch in the market.

CEO Elon Musk has been blunt. The six-seater “wouldn’t arrive in the U.S. until late 2026, if ever,” he said, pointing to the company’s heavy bet on unsupervised Full Self-Driving and robotaxi platforms like the Cybercab. With the Model X slated for discontinuation, many families hoped the stretched Model Y would slide into the lineup as an affordable three-row bridge. So far, that hope remains unfulfilled.

For now, South Korean drivers will be among the first buyers outside China to enjoy the spacious, efficient Model Y L. Tesla continues its global rollout strategy, tailoring vehicles to regional tastes while North American customers keep refreshing their apps and crossing their fingers.

The Model Y L proves the appetite for practical, family-sized electric SUVs is stronger than ever. Hopefully, Tesla will listen to its fans and bring the vehicle to the U.S. where it would likely sell well.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.