News

SpaceX CEO Elon Musk explains why Blue Origin’s Starship lawsuit makes no sense

For the first time since SpaceX competitor Blue Origin took NASA to federal court after losing a Moon lander contract to Starship and a protest over that loss, unsealed documents have finally revealed the argument Jeff Bezos’ space startup is focusing on in court.

After the details broke in new court documents filed on Wednesday, SpaceX CEO Elon Musk weighed in on Twitter to offer his take on why the arguments Blue Origin has hinged its lawsuit on make very little sense.

While one seemingly significant portion of the main complaint claiming to reveal “additional substantial errors” in SpaceX’s Starship HLS proposal was almost fully redacted, most of the opening argument is legible. In short, Blue Origin appears to have abandoned the vast majority of arguments it threw about prior to suing NASA and the US government and is now almost exclusively hinging its case on the claim that SpaceX violated NASA’s procurement process by failing to account for a specific kind of prelaunch review before every HLS-related Starship launch.

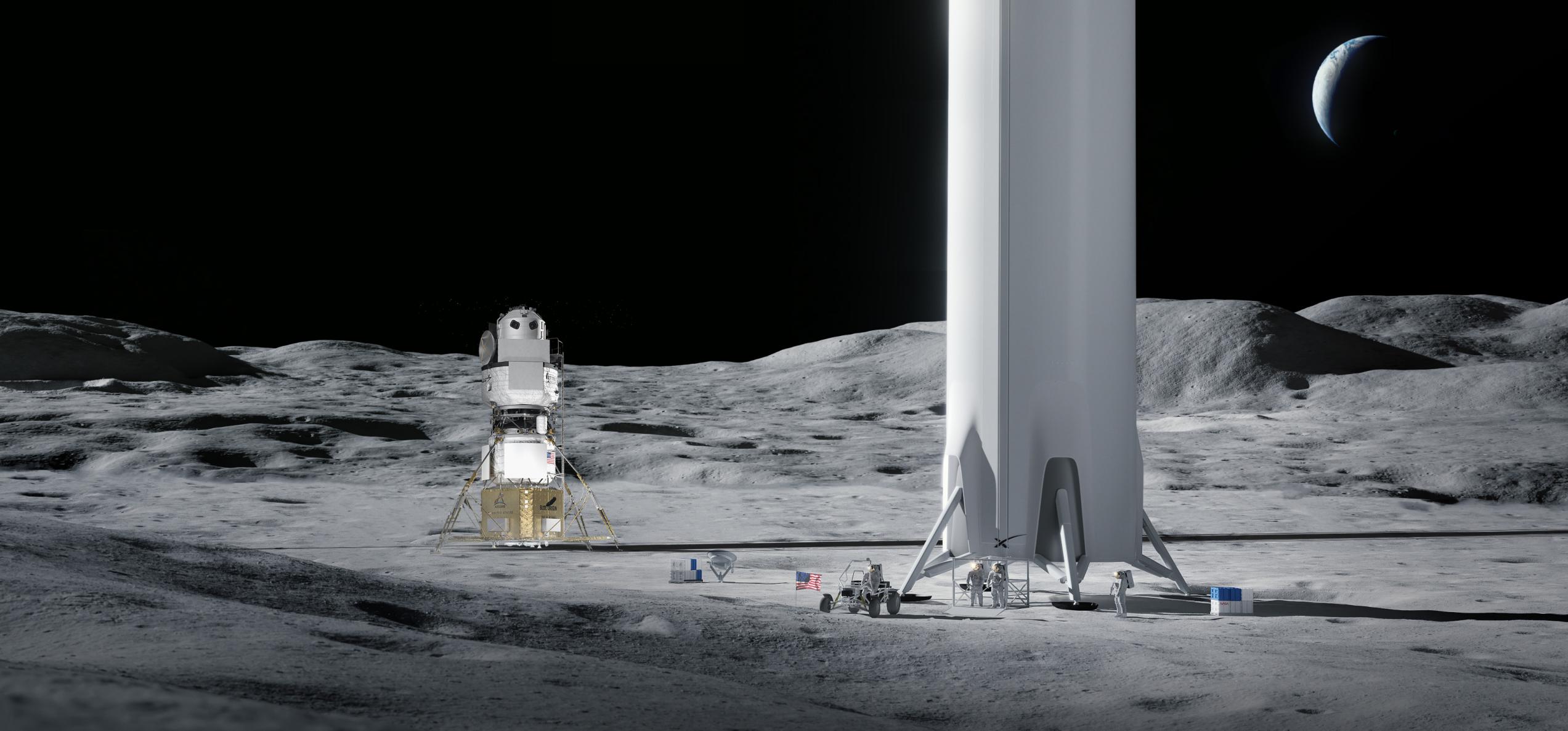

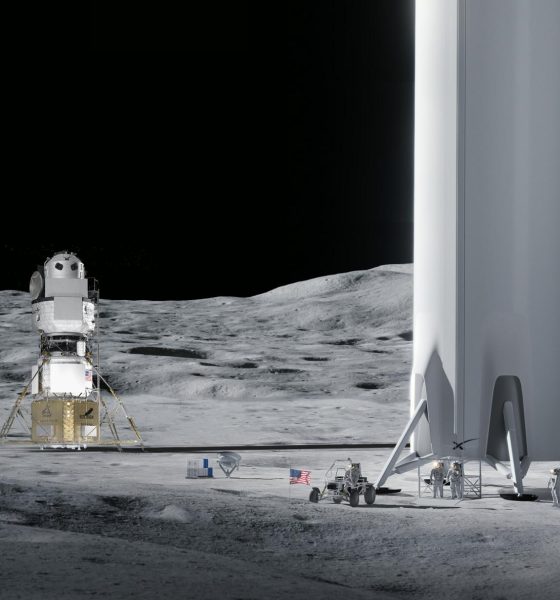

For NASA’s HLS competition, SpaceX proposed to create a custom variant of Starship capable of serving as a single-stage-to-orbit crewed Moon lander with the help of the rest of the Starship fleet – including Super Heavy boosters, cargo/tanker Starships, and a depot or storage ship. SpaceX would begin a Moon landing campaign by launching a (likely heavily modified) depot Starship into a stable Earth orbit. Anywhere from 8 to 14 Starship tanker missions – each carrying around 100-150 tons of propellant – would then gradually fill that depot ship over the course of no more than six or so months. Once filled, an HLS lander would launch to orbit, refill its tanks from the depot ship, and make its way to an eccentric lunar orbit to rendezvous with NASA’s Orion spacecraft and three Artemis astronauts.

As Blue Origin has exhaustively reminded anyone within earshot for the last five months, SpaceX’s Starship Moon lander proposal is extremely complex and NASA is taking an undeniable risk (of delays, not for astronauts) by choosing SpaceX. Nevertheless, NASA’s Kathy Lueders and a source evaluation panel made it abundantly clear in public selection statement that SpaceX’s proposal was by far the most competent, offering far a far superior management approach and technical risk no worse than Blue Origin’s far smaller, drastically less capable lander.

The bulk of Blue Origin’s argument appears to be that its National Team Lander proposal was drastically disadvantaged by the fact that SpaceX may or may not have incorrectly planned for just three ‘flight readiness reviews’ (FRRs) for each 16-launch HLS Starship mission. While heavily redacted, Blue Origin wants a judge to believe that contrary to the US Government Accountability Office’s (GAO) fair assessment that such a small issue is incredibly unlikely to have changed the competition’s outcome, it would have “been able to propose a substantially lower price” for its lander. To be clear, a flight readiness review is an admittedly important part of NASA’s safety culture, but it ultimately amounts to paperwork and doublechecks over the course of a day or two of meetings.

All else equal, the need to complete an FRR before a launch is incredibly unlikely to cause more than a few days of delays in a worst-case scenario and would have next to no cost impact. There is no reasonable way to argue that being allowed to complete some launches without an FRR would have singlehandedly allowed Blue Origin to “[engineer] and [propose] an entirely different architecture.” Nevertheless, that’s exactly what the company attempts to argue – that it would have radically and completely changed the design it spent more than half a billion dollars sketching out if it had only been able to skip a few reviews.

Curiously, Blue Origin nevertheless does make a few coherent and seemingly fact-based arguments in the document. Perhaps most notably, it claims that when NASA ultimately concluded that it didn’t have funds for even a single award (a known fact) and asked SpaceX – its first choice – to make slight contract modifications to make the financial side of things work, NASA consciously chose to waive the need for an FRR before every HLS Starship launch. Only via purported cost savings from those waived reviews, Blue Origin claims, was NASA able to afford SpaceX’s proposal – which, it’s worth noting, was more than twice as cheap as the next cheapest option (Blue Origin).

Ultimately, it thus appears that Blue Origin may have a case to make that NASA awarded SpaceX the HLS Option A contract despite a handful of errors that violated contracting rules and the HLS solicitation. Relative to just about any other possible issue, though, it’s hard not to perceive the problems Blue Origin may or may have correctly pointed out as anything more than marginal and extraordinarily unlikely to have changed the outcome in Blue’s favor had they been rectified before the award. Most importantly, even if Blue Origin’s argument is somehow received favorably and a judge orders NASA to overturn its SpaceX HLS award and reconsider all three proposals, it’s virtually inconceivable that even that best-case outcome would result in Blue Origin receiving a contract of any kind.

Cybertruck

Tesla confirms date when new Cybertruck trim will go up in price

Tesla has officially revealed that this price will only be available until February 28, as the company has placed a banner atop the Design Configurator on its website reflecting this.

Tesla has confirmed the date when its newest Cybertruck trim level will increase in price, after CEO Elon Musk noted that the All-Wheel-Drive configuration of the all-electric pickup would only be priced at its near-bargain level for ten days.

Last week, Tesla launched the All-Wheel-Drive configuration of the Cybertruck. Priced at $59,990, the Cybertruck featured many excellent features and has seemingly brought some demand to the pickup, which has been underwhelming in terms of sales figures over the past couple of years.

Tesla launches new Cybertruck trim with more features than ever for a low price

When Tesla launched it, many fans and current owners mulled the possibility of ordering it. However, Musk came out and said just hours after launching the pickup that Tesla would only keep it at the $59,990 price level for ten days.

What it would be priced at subsequently was totally dependent on how much demand Tesla felt for the new trim level, which is labeled as a “Dual Motor All-Wheel-Drive” configuration.

Tesla has officially revealed that this price will only be available until February 28, as the company has placed a banner atop the Design Configurator on its website reflecting this:

NEWS: Tesla has officially announced that the price of the new Cybertruck Dual-Motor AWD will be increasing after February 28th. pic.twitter.com/vZpA521ZwC

— Sawyer Merritt (@SawyerMerritt) February 24, 2026

Many fans and owners have criticized Tesla’s decision to unveil a trim this way, and then price it at something, only to change that price a few days later based on how well it sells.

Awful way to treat customers – particularly when they already sent out a marketing email announcing the $59,990 truck…with zero mention of it being a limited-time offer.

— Ryan McCaffrey (@DMC_Ryan) February 24, 2026

It seems the most ideal increase in price would be somewhere between $5,000 and $10,000, but it truly depends on how many orders Tesla sees for this new trim level. The next step up in configuration is the Premium All-Wheel-Drive, which is priced at $79,990.

The difference between the Dual Motor AWD Cybertruck and the Premium AWD configuration comes down to towing, interior quality, and general features. The base package is only capable of towing up to 7,500 pounds, while the Premium can handle 11,000 pounds. Additionally, the seats in the Premium build are Vegan Leather, while the base trim gets the textile seats.

It also has only 7 speakers compared to the 15 that the Premium trim has. Additionally, the base model does not have an adjustable ride height, although it does have a coil spring with an adaptive damping suspension package.

Cybertruck

Tesla set to activate long-awaited Cybertruck feature

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, as the company has officially added the feature to its list of features by trim on its website.

Tesla is set to activate a long-awaited Cybertruck feature, and no matter when you bought your all-electric pickup, it has the hardware capable of achieving what it is designed to do.

Tesla simply has to flip the switch, and it plans to do so in the near future.

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, according to Not a Tesla App, as the company has officially added the feature to its list of features by trim on its website.

Tesla rolls out Active Road Noise Reduction for new Model S and Model X

The ANC feature suddenly appeared on the spec sheet for the Premium All-Wheel-Drive and Cyberbeast trims, which are the two configurations that have been delivered since November 2023.

However, those trims have both had the ANC disabled, and although they are found in the Model S and Model X, and are active in those vehicles, Tesla is planning to activate them.

In Tesla’s Service Toolbox, it wrote:

“ANC software is not enabled on Cybertruck even though the hardware is installed.”

Tesla has utilized an ANC system in the Model S and Model X since 2021. The system uses microphones embedded in the front seat headrests to detect low-frequency road noise entering the cabin. It then generates anti-noise through phase-inverted sound waves to cancel out or reduce that noise, creating quieter zones, particularly around the vehicle’s front occupants.

The Model S and Model X utilize six microphones to achieve this noise cancellation, while the Cybertruck has just four.

Tesla Cybertruck Dual Motor AWD estimated delivery slips to early fall 2026

As previously mentioned, this will be activated through a software update, as the hardware is already available within Cybertruck and can simply be activated at Tesla’s leisure.

The delays in activating the system are likely due to Tesla Cybertruck’s unique design, which is unlike anything before. In the Model S and Model X, Tesla did not have to do too much, but the Cybertruck has heavier all-terrain tires and potentially issues from the aluminum castings that make up the vehicle’s chassis, which are probably presenting some challenges.

Unfortunately, this feature will not be available on the new Dual Motor All-Wheel-Drive configuration, which was released last week.

News

Tesla Model S and X customization options begin to thin as their closure nears

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

Tesla Model S and Model X customization options are beginning to thin for the first time as the closure of the two “sentimental” vehicles nears.

We are officially seeing the first options disappear as Tesla begins to work toward ending production of the two cars and the options that are available to those vehicles specifically.

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

🚨 Tesla Model S and Model X availability is thinning, as Tesla has officially shown that the Lunar Silver color option on both vehicles is officially sold out

To be fair, Frost Blue is still available so no need to freak out pic.twitter.com/YnwsDbsFOv

— TESLARATI (@Teslarati) February 25, 2026

Tesla is making way for the Optimus humanoid robot project at the Fremont Factory, where the Model S and Model X are produced. The two cars are low-volume models and do not contribute more than a few percent to Tesla’s yearly delivery figures.

With CEO Elon Musk confirming that the Model S and Model X would officially be phased out at the end of the quarter, some of the options are being thinned out.

This is an expected move considering Tesla’s plans for the two vehicles, as it will make for an easier process of transitioning that portion of the Fremont plant to cater to Optimus manufacturing. Additionally, this is likely one of the least popular colors, and Tesla is choosing to only keep around what it is seeing routine demand for.

During the Q4 Earnings Call in January, Musk confirmed the end of the Model S and Model X:

“It is time to bring the Model S and Model X programs to an end with an honorable discharge. It is time to bring the S/X programs to an end. It’s part of our overall shift to an autonomous future.”

Fremont will now build one million Optimus units per year as production is ramped.