Investor's Corner

Tesla’s growth story continues in manufacturing and not autonomy: Morgan Stanley

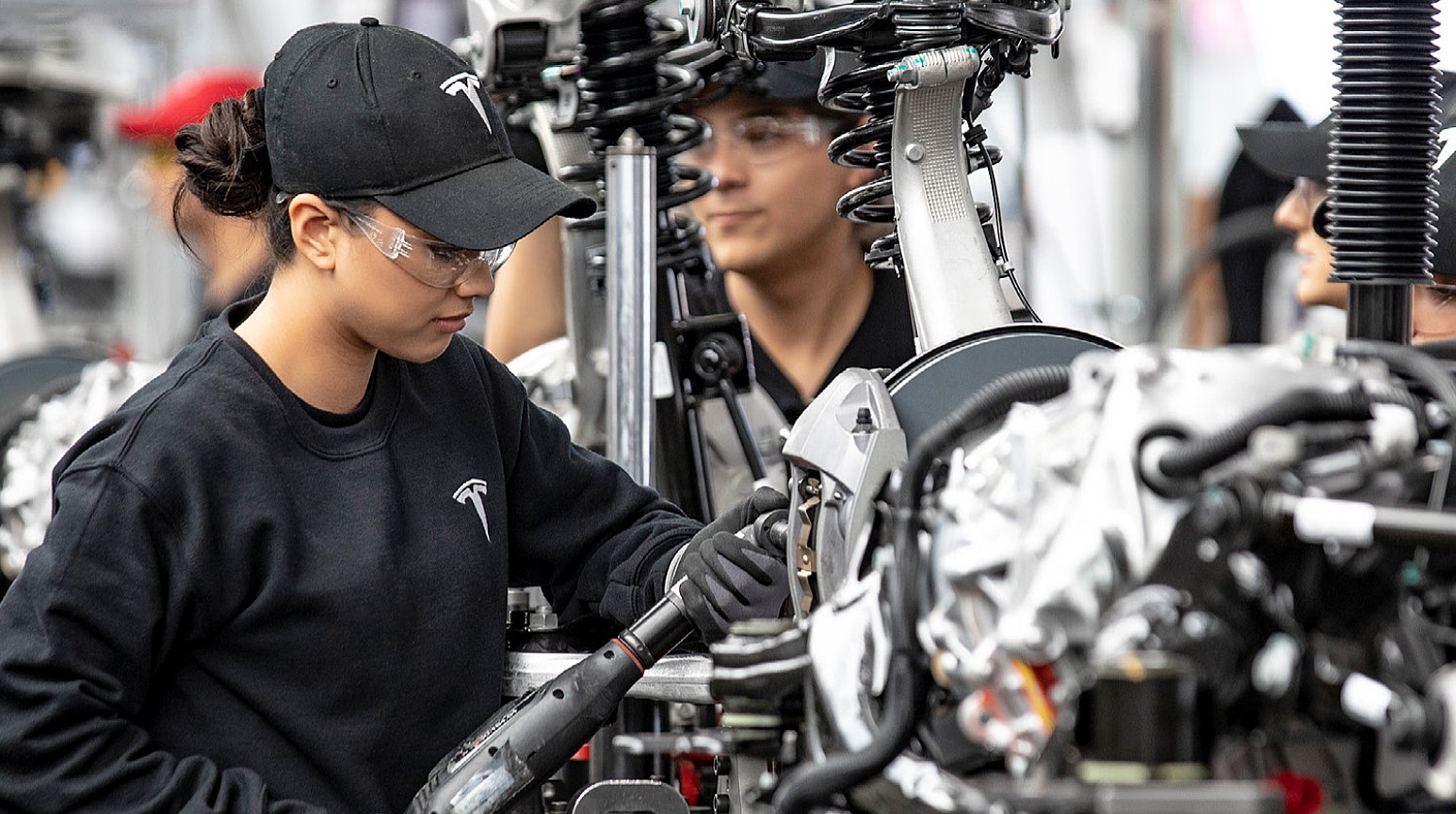

Tesla’s (NASDAQ: TSLA) growth story has leaned on the potential of autonomous, self-driving vehicles revolutionizing the way everyday transportation is performed. While Tesla has developed its Autopilot and Full Self-Driving suites with relative success in the past several years, Morgan Stanley analysts are not convinced that autonomous driving programs will continue to fuel the automaker’s growth story and continuing expansion. Instead, Tesla’s bread and butter, which is vehicle manufacturing, along with other strengths like material sourcing, supply chain, and infrastructure development, is where the financial firm is putting its money.

It is no secret Tesla has fallen short with its FSD and Robotaxi plans, as CEO Elon Musk has predicted since 2018 that the automaker would complete its venture into fully-autonomous vehicles. However, each year has gone by with a new set of challenges, whether they would be based on manufacturing or the supply of necessary parts, further delaying the rollout of a “feature complete” FSD suite or a rollout of the planned Robotaxi fleet. This has led to some skepticism about whether the electric car company will really continue its monumental pace of growth through that medium, and not another, which Tesla has already proven to be well-versed in: manufacturing.

Tesla manufacturing prowess, stock split plans indicate ‘massive position of strength:’ Wedbush

A new note to investors from Adam Jonas and other analysts at Morgan Stanley seems to indicate the latter, that Tesla’s true road to continuing expansion and increased valuations is a focus on what it does best. For the past several years, Tesla has focused intently on increasing manufacturing efficiency and accuracy, and it has ultimately led to a streak of nine consecutive quarters of growth in vehicle deliveries. While that streak may be in jeopardy due to the shutdowns of its most-productive factory, which is in Shanghai, there is still evidence to suggest that Tesla’s best way to continue growing is through its production prowess.

“With respect to Tesla, we think attributes like AI, autonomous, and EV are fully, if not over-appreciated here,” the analysts wrote in their note. “In fact, we believe Tesla’s more ‘gritty’ capabilities in terms of manufacturing, material sourcing, supply chain, and infrastructure will drive the next leg of growth to the story.”

Tesla will trade with increased volatility in the coming weeks and months, Morgan Stanley predicted in the new note. The company’s focus on its autonomy may be dragging down expectations for the stock, as Tesla continues to push its belief that FSD and Level 4 to Level 5 autonomy will be arriving by the end of the year. The analysts see this as a major issue in Tesla’s outlook moving forward:

“Firstly, we think the core auto margin is too high at this point, as it does not fully reflect input cost inflation. Secondly, we believe expectations of full autonomy or FSD ‘flipping’ into a major near-term margin boost are overestimated. In fact, we believe L4/L5 autonomy at scale is well over a decade away. It will come folks, but it’s too darn difficult.”

- Credit: Gary Black | Twitter

- Credit: Gary Black | Twitter

- Credit: Gary Black | Twitter

In reality, Tesla has made major strides in its FSD program through the Beta fleet, and Autopilot is coming off of one of its safest years in history when compared to nationwide accident data from the NHTSA. But whether Tesla will solve full autonomy by the end of the year as Musk expects truly remains to be seen.

Musk remains confident with Tesla’s development of FSD and said earlier this year that he would be “shocked” if the company cannot effectively develop major improvements and complete the suite by the end of 2022. Meanwhile, Tesla’s Robotaxi fleet will likely come with a dedicated vehicle design in the coming years, based on predictions from company executives during its most recent earnings call. While Tesla’s outlook on Robotaxis was previously about owners making money from the operation of the ride-sharing service, the automaker has shifted to another perspective, which aligns more with its focus on sustainability. Read more about that here.

Jonas still holds a $1,300 price target on Tesla stock with an ‘Overweight’ rating.

Disclosure: Joey Klender is a TSLA Shareholder.

I’d love to hear from you! If you have any comments, concerns, or questions, please email me at joey@teslarati.com. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.

Investor's Corner

LIVE BLOG: Tesla (TSLA) Q4 and FY 2025 earnings call

Tesla’s (NASDAQ:TSLA) earnings call follows the release of the company’s Q4 and full-year 2025 update letter.

Tesla’s (NASDAQ:TSLA) earnings call follows the release of the company’s Q4 and full-year 2025 update letter, which was published on Tesla’s Investor Relations website after markets closed on January 28, 2025.

The results cap a quarter in which Tesla produced more than 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products. For the full year, Tesla produced 1.65 million vehicles and delivered 1.63 million, while total energy storage deployments reached 46.7 GWh.

Tesla’s Q4 and FY 2025 Results

According to Tesla’s Q4 and FY 2025 Update Letter, the company posted GAAP earnings per share of $0.24 and non-GAAP EPS of $0.50 in the fourth quarter. Total revenue for Q4 came in at $24.901 billion, while GAAP net income was reported at $840 million.

For full-year 2025, Tesla reported GAAP EPS of $1.08 and non-GAAP EPS of $1.66 per share. Total revenue reached $94.83 billion, including $69.53 billion from automotive operations and $12.78 billion from the company’s energy generation and storage business. GAAP net income for the year totaled $3.79 billion.

Earnings call updates

The following are live updates from Tesla’s Q4 and FY 2025 earnings call. I will be updating this article in real time, so please keep refreshing the page to view the latest updates on this story.

16:25 CT – Good day to everyone, and welcome to another Tesla earnings call live blog. There’s a lot to unpack from Tesla’s Q4 and FY 2025 update letter, so I’m pretty sure this earnings call will be quite interesting.

16:30 CT – The Q4 and FY 2025 earnings call officially starts. IR exec Travis Axelrod opens the call. Elon and other executives are present.

16:30 CT – Elon makes his opening statement and explains why Tesla changed its mission to “Amazing Abundance.” “With the continued growth of AI and robotics, I think we’re headed towards a future of universal high income,” Musk said, adding that along the way, Tesla will still be improving its products while keeping the environment safe and healthy.

16:34 CT – Elon noted that the first steps for this future are happening this year, thanks to Tesla’s autonomy and robotics programs, which will be launching and ramping this year. He also highlighted that Tesla will be making major investments this year, though the company will be very strategic when it comes to its funding. “I think it makes a ton of strategic sense,” Musk said.

16:36 CT – Elon also announces the end of the Model S and Model X programs “with an honorable discharge.” If you’re interested in buying a Model S or X, it’s best to do it now, Musk said. The Model S and Model X factory in Fremont will be replaced by an Optimus line. “It’s slightly sad, but it is time to bring the S and X program to an end. It’s part of our overall shift to an autonomous future,” Musk said.

16:38 CT – Elon discusses how Unsupervised FSD is now starting for the Robotaxi service. He noted that these Unsupervised Robotaxis don’t have any chase cars as of yesterday. He reiterated Tesla’s plans for owners to be able to add their own vehicles to the Robotaxi fleet. Autonomy target for the end of the year is about a quarter or half of the United States, Musk said.

16:41 CT – Elon noted that the Tesla Energy team is absolutely killing it. He also stated that Tesla expects its Energy business to continue growing, and that the “solar opportunity is underrated.”

16:43 CT –Elon also added that Tesla Optimus 3 will be unveiled in about three months, probably. The Model S and Model X line in Fremont will be a million-unit Optimus production line. Looks like Optimus is really coming out of the gate with large, meaningful volumes. “The normal S curve for manufacturing ramps is longer for Optimus,” Musk stated. “Long term, I think Optimus will have a significant impact on the US GDP.”

16:44 CT – Elon closes his opening statements with a sincere thanks to the Tesla team. He also noted that he feels fortunate to be able to work alongside such a talented workforce.

Elon ends his opening remarks with an optimistic prediction about the future.“The future is more exciting than you can imagine,” he concluded.

16:47 CT – Tesla CFO Vaibhav Taneja makes his opening remarks. He discusses several aspects of Tesla’s Q4 milestones. He noted that Tesla Energy achieved yet another gross profit record during the fourth quarter. There’s insane demand for the Megapack and Powerwall. Backlogs for these products are healthy this 2026. He also noted that Tesla ended 2025 with a bigger vehicle order backlog compared to recent years.

16:53 CT – Investor questions from Say begin. The first question is about Tesla’s expectations for the Robotaxi Network. Lars Moravy noted that it has the advantage of manufacturing and scale, and Tesla believes that the Robotaxi Network will significantly grow year over year. Elon highlighted that the Cybercab will be produced with no steering wheel or pedals. No fallback. Elon also noted that Tesla expects to produce more Cybercabs than all its other vehicles combined in the future.

16:51 CT – The next question is if Tesla still expects to launch new models, such as affordable cars. Lars Moravy noted that Tesla did release affordable variants last year, and Tesla is still pushing hard to lower its costs. That being said, Tesla is really pushing the Cybercab as its total addressable market is larger than consumer-owned cars. Lars also mentioned that Tesla will produce different vehicles for its Robotaxi services.

16:56 CT – Elon noted that eventually, Tesla will produce mostly autonomous cars. The exception would be the next-generation Roadster, which will be a true driver’s car.

17:03 CT – A question about Elon’s past comments about a potential next pickup truck was asked. Lars noted that the Cybertruck is still performing well in the electric pickup truck segment, though Tesla is known for flexibility. Elon added that Tesla will be transitioning the Cybertruck line to a fully autonomous vehicle line. He also stated that the Cybertruck is a useful vehicle. “An autonomous Cybertruck will be useful for that.”

17:10 CT – A question was asked about when FSD will be 100% Unsupervised. Elon noted that 100% Unsupervised FSD is already being used today, though only in the Austin Robotaxi program. Tesla is still being extremely careful with its rollout.

When asked about Tesla’s chip program, Elon noted that he feels pretty good about Tesla’s chip strategy. But in terms of selling Tesla’s chips outside Tesla, the company has to make sure it has enough chips for Optimus robots, data centers, and other programs first.

17:18 CT – Analyst questions begin. First up is Wolf Research. He asks about Tesla’s increasing Capex, specifically where the majority of it is going. The Tesla CFO noted that programs in six factories are going live this year, so that consumes Capex. The Optimus program also consumes a lot of resources. The growth of Tesla’s current capacity is also consuming a lot of resources. As for how these programs will be funded, the CFO pointed to Tesla’s massive war chest, as well as initiatives such as the Robotaxi Network.

17:21 CT – Morgan Stanley asks about Tesla’s xAI investment. The analyst asked about more information about how Tesla and xAI will work together. The CFO noted that this investment is part of Master Plan Part IV. Elon also mentioned some advantages for xAI’s technology for Tesla’s products, like Grok being used to manage a Robotaxi fleet or a group of Optimus robots.

17:24 CT – Barclays asks Elon about the constraints on memory. Does Tesla have any near term constraints for Tesla vehicles’ memory? Elon responded that the Tesla AI computer is already very compute and memory-efficient. The intelligence per gigabyte is important. Musk noted that Tesla is ahead of the industry by an order of magnitude or more.

17:29 CT – Cannacord asks about startups from China entering the humanoid market. What competitive advantage does Optimus have compared to these rivals? Elon stated that he believes China will be a key competitor in the humanoid robot market. China will be the toughest competitor for Tesla. That being said, Elon noted that Tesla believes Optimus will be ahead in real-world intelligence, electromechanical dexterity, and hand design.