News

NASA head hints that reusable rocket cos. like SpaceX will enable Moon return

In a series of thoroughly unexpected and impassioned introductory remarks at one of several 2018 Advisory Council meetings, NASA administrator Jim Bridenstine bucked at least two decades of norms by all but explicitly stating that reusable rockets built by innovative private companies like SpaceX and Blue Origin will enable the true future of space exploration.

Incredibly, over the course his fascinating hour-long prelude, Bridenstine effectively mentioned NASA’s own SLS rocket and Orion spacecraft – under development for the last decade at a cost of at least several tens of billions of dollars – a total of one time each. Instead, heavily emphasizing the absolute necessity that NASA’s next major human exploration project be sustainable, the administrator spoke at length about the foundational roles that international and domestic space agencies and private companies will need to take on in order to make NASA’s on-paper return to the Moon both real, successful, and useful.

Aside from his arguably brave (but spot-on) decision to all but ignore Boeing and Northrop Grumman’s SLS rocket and Lockheed Martin’s Orion spacecraft over the course of an hour spent speaking about the future of NASA’s human exploration of the Moon and on spaceflight more generally, Bridenstine had nothing but praise for recent successes in the American aerospace industry.

Most notably, he spoke about his belief – at least partially stemming from an executive order requiring it – that the only way NASA can seriously succeed and continue to lead the world in the task of human space exploration is to put an extreme focus on sustainability. Judging from his comments on the matter, the new NASA/Federal buzzword of choice is just a different way to describe hardware reusability, although it certainly leaves wiggle room for more than simply avoiding expendable rocket hardware.

“It’s on me to figure out how to [return to the Moon] sustainably. … And this time, when we go, we’re gonna go to stay. So how do we do go sustainably? Well, [we take] advantage of capabilities that didn’t exist in this country even five or ten years ago. We have commercial companies that can do things that weren’t possible even just a few years ago … to help develop this sustainable [Moon exploration] architecture.” – NASA Administrator Jim Bridenstine, 08/29/2018

While it might not look like much (aside from a “no duh” statement) to anyone unfamiliar with the trials and tribulations of NASA bureaucracy and politicking, this quote – directed at an audience of senior NASA scientists and managers and independent experts – is absolutely extraordinary in the context of NASA’s history and the formulaic eggshells NASA administrators have traditionally been forced to walk on when discussing American rocketry.

Not only is SLS/Orion utterly and conspicuously absent in a response to the “how” of starting a new wave of lunar exploration, but Bridenstine also almost explicitly names Blue Origin and SpaceX as torchbearers of the sort of exceptional technological innovation that might revolutionize humanity’s relationship with space. By referring specifically to “commercial companies that can do things that weren’t possible even just a few years ago”, the only obvious answers in the context of serious human exploration on and around the Moon are Blue Origin and SpaceX, both of which managed their first commercial rocket landings in late 2015.

Bridenstine went even further still, noting that NASA will need not just reusable rockets for this sustainable lunar exploration, but also reusable orbital tugboats (space tugs) to sustainably ferry both humans and cargo to and from Earth and the Moon and reusable lunar landers capable of many trips back and forth from space stations orbiting the moon. At one point, he even used SpaceX CEO Elon Musk’s (in)famous and well-worn analogy of commercial airlines to emphasize the insanity of not using reusable rockets:

“We have reusable rockets [now]… Imagine if you flew here across the country to [NASA Ames] in a 737 and when the mission was over, you threw the airplane away. How many of you would have flown here?” – NASA Administrator Jim Bridenstine, 08/29/2018

At today's NASA Advisory Council (NAC) meeting, Administrator Jim Bridenstine says the next hop to the moon is going to be sustainable – and will require reusable spaceflight hardware. Uses the same airplane analogy @ElonMusk does when it comes to explaining advantages.

— Emre Kelly (@EmreKelly) August 29, 2018

Reusable rockets lead the charge

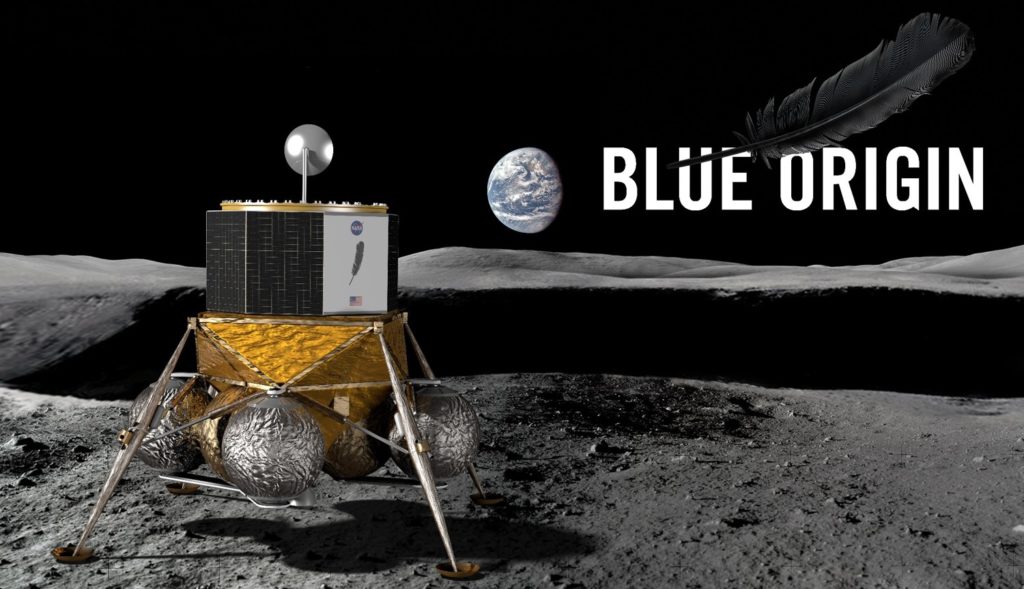

It may be generous to include Blue Origin side by side with SpaceX, given the fact that its New Shepard rocket is extremely small and very suborbital, but the company does have eyes specifically set lunar landers and outposts (a project called Blue Moon) and is developing a large and reusable orbital-class rocket (New Glenn) set to debut in the early 2020s.

- Falcon Heavy’s side boosters seconds away from near-simultaneous landings at Landing Zones 1 and 2. (SpaceX)

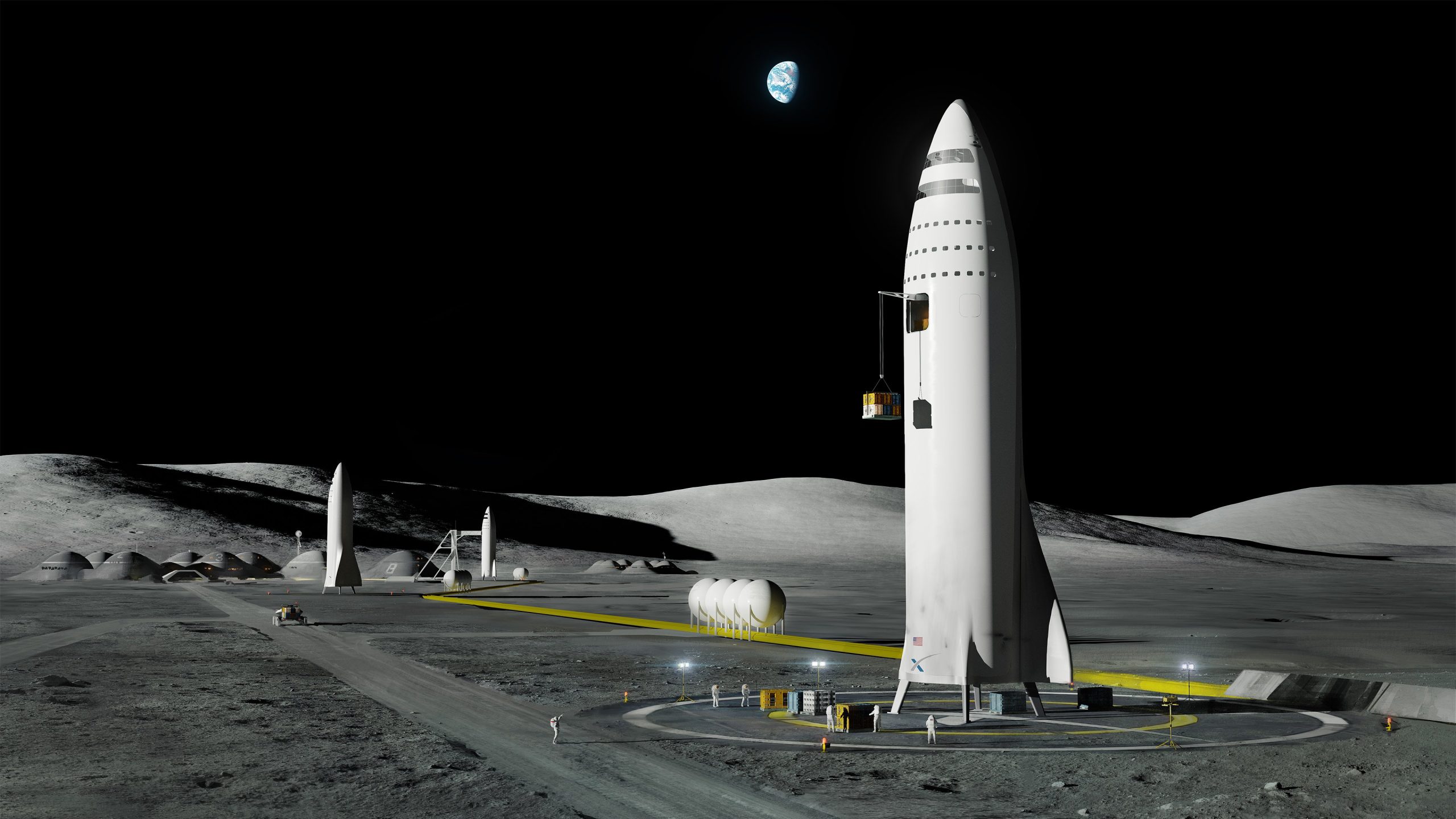

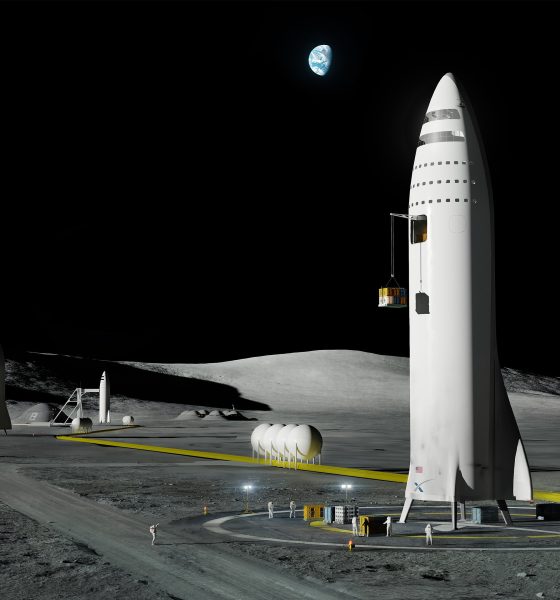

- We’re not here just yet, but SpaceX is pushing hard to build BFR and get humanity to Mars as quickly as practicable. (SpaceX)

- Blue Origin’s aspirational future, the highly reusable BE-4 powered New Glenn rocket. (Blue Origin)

- Blue Origin’s Blue Moon concept, set to begin experimental lunar landings as early as 2022 or 2023. (Blue Origin)

SpaceX, while focused on Mars colonization, has also expressed a willingness to participate in any sort of lunar exploration that NASA or other international space agencies might have interest in. Currently in the middle of developing its own massive and fully reusable rocket, known as the Big F_____ Rocket (BFR), SpaceX nevertheless already has a flight-tested, highly successfully, and unbeatably cost-effective family of reusable Falcon rockets capable of affordably launching significant mass to the Moon. In fact, both NASA and ESA (European Space Agency) are already seriously considering SpaceX’s Falcon Heavy as the launch vehicle of choice for several critical pieces of a Moon-orbiting space station, expected to launch no earlier than the early to mid-2020s.

Whether or not Bridenstine’s incredible and eloquent statements translate into tangible changes to NASA’s long-term strategy, it’s quite simply refreshing to hear a senior NASA executive – let alone the administrator – speak freely and rationally about the reality of what is needed to enable a truly new era of human spaceflight and exploration.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Investor's Corner

LIVE BLOG: Tesla (TSLA) Q4 and FY 2025 earnings call

Tesla’s (NASDAQ:TSLA) earnings call follows the release of the company’s Q4 and full-year 2025 update letter.

Tesla’s (NASDAQ:TSLA) earnings call follows the release of the company’s Q4 and full-year 2025 update letter, which was published on Tesla’s Investor Relations website after markets closed on January 28, 2025.

The results cap a quarter in which Tesla produced more than 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products. For the full year, Tesla produced 1.65 million vehicles and delivered 1.63 million, while total energy storage deployments reached 46.7 GWh.

Tesla’s Q4 and FY 2025 Results

According to Tesla’s Q4 and FY 2025 Update Letter, the company posted GAAP earnings per share of $0.24 and non-GAAP EPS of $0.50 in the fourth quarter. Total revenue for Q4 came in at $24.901 billion, while GAAP net income was reported at $840 million.

For full-year 2025, Tesla reported GAAP EPS of $1.08 and non-GAAP EPS of $1.66 per share. Total revenue reached $94.83 billion, including $69.53 billion from automotive operations and $12.78 billion from the company’s energy generation and storage business. GAAP net income for the year totaled $3.79 billion.

Earnings call updates

The following are live updates from Tesla’s Q4 and FY 2025 earnings call. I will be updating this article in real time, so please keep refreshing the page to view the latest updates on this story.

16:25 CT – Good day to everyone, and welcome to another Tesla earnings call live blog. There’s a lot to unpack from Tesla’s Q4 and FY 2025 update letter, so I’m pretty sure this earnings call will be quite interesting.

16:30 CT – The Q4 and FY 2025 earnings call officially starts. IR exec Travis Axelrod opens the call. Elon and other executives are present.

16:30 CT – Elon makes his opening statement and explains why Tesla changed its mission to “Amazing Abundance.” “With the continued growth of AI and robotics, I think we’re headed towards a future of universal high income,” Musk said, adding that along the way, Tesla will still be improving its products while keeping the environment safe and healthy.

16:34 CT – Elon noted that the first steps for this future are happening this year, thanks to Tesla’s autonomy and robotics programs, which will be launching and ramping this year. He also highlighted that Tesla will be making major investments this year, though the company will be very strategic when it comes to its funding. “I think it makes a ton of strategic sense,” Musk said.

16:36 CT – Elon also announces the end of the Model S and Model X programs “with an honorable discharge.” If you’re interested in buying a Model S or X, it’s best to do it now, Musk said. The Model S and Model X factory in Fremont will be replaced by an Optimus line. “It’s slightly sad, but it is time to bring the S and X program to an end. It’s part of our overall shift to an autonomous future,” Musk said.

16:38 CT – Elon discusses how Unsupervised FSD is now starting for the Robotaxi service. He noted that these Unsupervised Robotaxis don’t have any chase cars as of yesterday. He reiterated Tesla’s plans for owners to be able to add their own vehicles to the Robotaxi fleet. Autonomy target for the end of the year is about a quarter or half of the United States, Musk said.

16:41 CT – Elon noted that the Tesla Energy team is absolutely killing it. He also stated that Tesla expects its Energy business to continue growing, and that the “solar opportunity is underrated.”

16:43 CT –Elon also added that Tesla Optimus 3 will be unveiled in about three months, probably. The Model S and Model X line in Fremont will be a million-unit Optimus production line. Looks like Optimus is really coming out of the gate with large, meaningful volumes. “The normal S curve for manufacturing ramps is longer for Optimus,” Musk stated. “Long term, I think Optimus will have a significant impact on the US GDP.”

16:44 CT – Elon closes his opening statements with a sincere thanks to the Tesla team. He also noted that he feels fortunate to be able to work alongside such a talented workforce.

Elon ends his opening remarks with an optimistic prediction about the future.“The future is more exciting than you can imagine,” he concluded.

16:47 CT – Tesla CFO Vaibhav Taneja makes his opening remarks. He discusses several aspects of Tesla’s Q4 milestones. He noted that Tesla Energy achieved yet another gross profit record during the fourth quarter. There’s insane demand for the Megapack and Powerwall. Backlogs for these products are healthy over this year.

News

Tesla announces massive investment into xAI

“On January 16, 2026, Tesla entered into an agreement to invest approximately $2 billion to acquire shares of Series E Preferred Stock of xAI as part of their recent publicly-disclosed financing round,” it said.

Tesla has announced a major development in its ventures outside of electric vehicles, as it confirmed today that it invested $2 billion into xAI on January 16.

The move is significant, as it marks the acquisition of shares of Series E Preferred Stock, executed on market terms alongside other investors. The company officially announced it in its Q4 2025 Shareholder Deck, which was released at market close on Wednesday.

The investment follows shareholder approval in 2025 for potential equity stakes in xAI and echoes SpaceX’s earlier $2 billion contribution to xAI’s $10 billion fundraising round.

Tesla said that, earlier this month, it entered an agreement to invest $2 billion to acquire shares of Series E Preferred Stock of xAI:

“Tesla’s investment was made on market terms consistent with those previously agreed to by other investors in the financing round. As set forth… pic.twitter.com/HgtrcHdB2U

— TESLARATI (@Teslarati) January 28, 2026

CEO Elon Musk, who is behind both companies, is now weaving what appears to be an even tighter ecosystem among his ventures, blending Tesla’s hardware prowess with xAI’s cutting-edge AI models, like Grok.

Tesla confirmed the investment in a statement in its Shareholder Deck:

“On January 16, 2026, Tesla entered into an agreement to invest approximately $2 billion to acquire shares of Series E Preferred Stock of xAI as part of their recent publicly-disclosed financing round. Tesla’s investment was made on market terms consistent with those previously agreed to by other investors in the financing round. As set forth in Master Plan Part IV, Tesla is building products and services that bring AI into the physical world. Meanwhile, xAI is developing leading digital AI products and services, such as its large language model (Grok).”

It continued:

“In that context, and as part of Tesla’s broader strategy under Master Plan Part IV, Tesla and xAI also entered into a framework agreement in connection with the investment. Among other things, the framework agreement builds upon the existing relationship between Tesla and xAI by providing a framework for evaluating potential AI collaborations between the companies. Together, the investment and the related framework agreement are intended to enhance Tesla’s ability to develop and deploy AI products and services into the physical world at scale. This investment is subject to customary regulatory conditions with the expectation to close in Q1’2026.”

The history of the partnership traces back to xAI’s founding in July 2023, as Musk launched the company as a counterweight to dominant AI players like OpenAI and Google.

xAI aimed to “understand the true nature of the universe” through unbiased, truth-seeking AI. Tesla, meanwhile, has long invested in AI for its Full Self-Driving (FSD) software and Optimus robots, training models on vast datasets from its vehicle fleet.

The investment holds profound significance for both companies.

For Tesla, it accelerates its Master Plan Part IV, which envisions AI-driven autonomy in vehicles and humanoid robots. xAI’s Grok could enhance Tesla’s real-world AI applications, from optimizing battery management to predictive maintenance, potentially giving Tesla an edge over its biggest rivals, like Waymo.

Investors, on the other hand, stand to gain from this symbiosis. Tesla Shareholders may see boosted stock value through AI innovations, with analysts projecting enhanced margins and significant future growth in robotics. xAI’s valuation could soar, attracting more capital.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings results

Tesla’s Q4 and FY 2025 earnings come on the heels of a quarter where the company produced over 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products.

Tesla (NASDAQ:TSLA) has released its Q4 and FY 2025 earnings results in an update letter. The document was posted on the electric vehicle maker’s official Investor Relations website after markets closed today, January 28, 2025.

Tesla’s Q4 and FY 2025 earnings come on the heels of a quarter where the company produced over 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products.

For the Full Year 2025, Tesla produced 1,654,667 and delivered 1,636,129 vehicles. The company also deployed a total of 46.7 GWh worth of energy storage products.

Tesla’s Q4 and FY 2025 results

As could be seen in Tesla’s Q4 and FY 2025 Update Letter, the company posted GAAP EPS of $0.24 and non-GAAP EPS of $0.50 per share in the fourth quarter. Tesla also posted total revenues of $24.901 billion. GAAP net income is also listed at $840 million in Q4.

Analyst consensus for Q4 has Tesla earnings per share falling 38% to $0.45 with revenue declining 4% to $24.74 billion, as per estimates from FactSet. In comparison, the consensus compiled by Tesla last week forecasted $0.44 per share on sales totaling $24.49 billion.

For FY 2025, Tesla posted GAAP EPS of $1.08 and non-GAAP EPS of $1.66 per share. Tesla also posted total revenues of $94.827 billion, which include $69.526 billion from automotive and $12.771 billion from the battery storage business. GAAP net income is also listed at $3.794 billion in FY 2025.

xAI Investment

Tesla entered an agreement to invest approximately $2 billion to acquire Series E preferred shares in Elon Musk’s artificial intelligence startup, xAI, as part of the company’s recently disclosed financing round. Tesla said the investment was made on market terms consistent with those agreed to by other participants in the round.

The investment aligns with Tesla’s strategy under Master Plan Part IV, which centers on bringing artificial intelligence into the physical world through products and services. While Tesla focuses on real-world AI applications, xAI is developing digital AI platforms, including its Grok large language model.

Below is Tesla’s Q4 and FY 2025 update letter.

TSLA-Q4-2025-Update by Simon Alvarez