Investor's Corner

Tesla Model 3 headlights gain the IIHS’ elusive ‘Good’ rating after design update

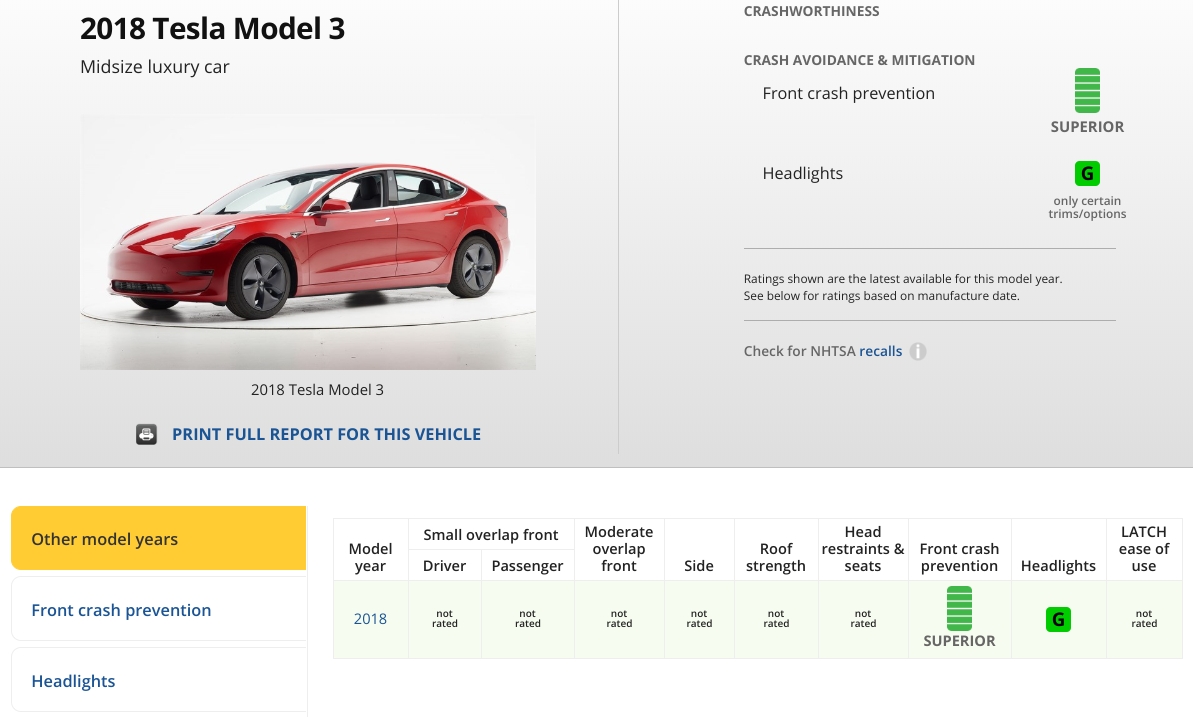

Earlier this year, the Insurance Institute for Highway Safety (IIHS), a nonprofit organization dedicated to reducing the number of accidents and injuries on the road, awarded the Tesla Model 3’s headlights with an “Acceptable” rating. While the IIHS’ tests gave a “Superior” rating for the vehicle’s front crash avoidance features then, the safety organization only listed the vehicle’s headlights as “Acceptable,” due to glaring issues from the Model 3’s low beams.

In a recent Twitter announcement, though, the IIHS noted that the Tesla Model 3 now earns a “Good” rating for its standard LED reflector headlights. The IIHS stated that the vehicle’s improved, updated score reflects the headlights of Model 3 that were produced after June 2018, a time when Tesla was starting to hit its stride with the production of the electric sedan.

The IIHS’ updated results could be seen in the Model 3’s page on the nonprofit’s website. So far, though, the IIHS has not released the Model 3’s official full safety ratings, which include metrics such as “Roof Strength” and “LATCH ease of use.”

That said, the Model 3’s “Good” rating for its headlights says a lot about Tesla’s focus on designing an incredibly safe electric car. The IIHS, after all, utilizes one of the strictest metrics for testing headlights. The headlights of the Tesla Model S, for one, were given a “Poor” rating by the IIHS. The Chevy Bolt EV’s headlights, which are incredibly bright, were also rated as “Poor.”

The IIHS evaluates headlights based on the lamps’ reach as the vehicle travels on straight and curved lines. Low beams are measured on five approaches — straightaways, left and right curves on an 800-foot radius, and sharp left and right curves on a 500-foot radius. The IIHS weighs low beams more heavily than high beams since they are used more often when driving. During the Model 3’s initial tests earlier this year, the vehicle’s low beams exhibited a 15.2% glare during straightways, preventing the Model 3 from earning the IIHS’ “Good” rating. As noted by the IIHS, this particular issue was addressed in Model 3 produced after Q2 2018.

The updated score of the Model 3’s headlights highlights Tesla’s unique tendency to update its vehicles as soon as improvements are available. This was pointed out by Elon Musk on Twitter, when he stated that when it comes to Tesla’s electric cars, there is “no such thing as a full refresh” since all vehicles are “partially upgraded every month as soon as a new subsystem is ready for production.” This practice was also mentioned by Tesla President of Automotive Jerome Guillen in an interview with CNBC, when he noted that the company’s technology is always in a process of evolution.

The 2018 Tesla Model 3 now earns a good rating for its standard LED reflector headlights for models built after June 2018. Previous models earn an acceptable rating. https://t.co/EUWXFLBnkm pic.twitter.com/TOctSTGaAl

— IIHS (@IIHS_autosafety) December 26, 2018

In a statement to CNET, IIHS senior vice president for communications Russ Rader explained the organization’s focus on headlights as a metric for vehicle safety. Rader also noted that headlights must be seen not just as a decorative component of a vehicle. Instead, they should be perceived as safety equipment.

“When one vehicle’s low beams only illuminate the right side of a straightaway for 148 feet, and another vehicle’s low beams allow a driver to see more than twice as far, there’s a problem. IIHS has incorporated headlight performance into our Top Safety Pick awards. We’re already seeing manufacturers make improvements, especially tightening up aim at the factory. Headlights shouldn’t just be about what looks cool. They’re important safety equipment. When they perform well, they can help drivers spot trouble sooner and avoid a crash.”

Apart from the IIHS, the Model 3 is also gaining accolades from other safety organizations. The National Highway Traffic Safety Administration (NHTSA), for one, has given the Model 3 a flawless 5-Star Safety Rating. The organization tested the Model 3 on frontal crash, side crash, and rollover safety; and in all categories and subcategories, the electric car displayed a level of industry-leading driver and passenger safety. As highlighted by Tesla in a following blog post, the scores of the Model 3 from the NHTSA’s tests place the electric car as the vehicle with the “lowest probability of injury” among all cars tested by the NHTSA to date.

Elon Musk

Tesla stock gets another analysis from Jim Cramer, and investors will like it

“Tesla is morphing right now. It’s in transition from being a car company to being a technology company.”

Tesla stock (NASDAQ: TSLA) got its latest analysis from Jim Cramer, and investors will like what he has to say.

Cramer has flip-flopped his thoughts on Tesla shares many times over the years. One time, he said CEO Elon Musk was a genius; the next, he said Ford stock was a better play. He’s always changing his tune.

However, Cramer’s most recent analysis is of a bullish tone, as he talks about the company’s evolution from an automaker to a tech powerhouse. He made the comments on CNBC’s Mad Money:

“Tesla is morphing right now. It’s in transition from being a car company to being a technology company. You wanna be in there because the tech is worth a lot more than what it’s selling for right now. Don’t care where you bought it, care where it’s going to.”

Jim Cramer last night on $TSLA: “Tesla is morphing right now. It’s in transition from being a car company to being a technology company. You wanna be in there because the tech is worth a lot more than what it’s selling for right now. Don’t care where you bought it, care where… pic.twitter.com/WzlPdQD7gq

— Sawyer Merritt (@SawyerMerritt) August 5, 2025

Tesla has always been looked at by the mainstream media as an automaker. While that is its main business currently, Tesla has always had other divisions: Energy, Solar, Charging, AI, and Robotics. Some came after others, but the important point is that Tesla has not been an automaker exclusively for a decade.

It launched Powerwall and Powerpack in April 2015, marking the start of Tesla Energy.

But Cramer has a point here: Tesla is truly becoming much more than a car company, and it is turning into an AI and overall tech company more than ever before. Eventually, it will be recognized as such, more so than it will be as an automotive company.

Cramer’s comments also follow a recent prediction by Musk, who stated on X that he believes a $150,000 investment in Tesla shares right now would eventually turn someone into a millionaire:

I think this is probably correct

— Elon Musk (@elonmusk) August 5, 2025

Musk has said he believes Tesla could be headed to a serious increase in valuation. Eventually, it could become the most valuable company in the world. He said this during the Q2 Earnings Call:

“I do think if Tesla continues to execute well with vehicle autonomy and humanoid robot autonomy, it will be the most valuable company in the world. A lot of execution between here and there. It doesn’t just happen. Provided we execute very well, I think Tesla has a shot at being the most valuable company in the world. Obviously, I am extremely optimistic about the future of the company.”

Elon Musk

Tesla executes ‘a must’ with Musk as race to AI supremacy goes on: Wedbush

Dan Ives of Wedbush says Tesla made the right move getting Elon Musk his pay package.

Tesla (NASDAQ: TSLA) executed what Wedbush’s Dan Ives called “a must” this morning as it finalized a new pay package for its CEO Elon Musk.

The move helped give Musk his first meaningful compensation at Tesla since 2017, when the company offered a pay package that was based on performance and proven growth. That package was approved by shareholders on two separate occasions, but was denied to Musk both times by the Delaware Chancery Court.

On Monday, Tesla announced on X that it had created a new package that would give 96 million shares of restricted stock to Musk to compensate him for the “immense value generated for Tesla and all our shareholders.”

🚨 BREAKING: Tesla has announced that its Board has unanimously approved a recommendation from the Special Committee of the Board to grant Elon an award of restricted stock equal to approximately one-third of the compensation he earned under the 2018 CEO Performance Award.

The… https://t.co/g7RKrTymDL pic.twitter.com/dnvkILlz6H

— TESLARATI (@Teslarati) August 4, 2025

The details of the pay package are designed to retain Musk, who has voiced some concerns about his control of Tesla, as “activist shareholders” have used lawsuits to disrupt the previously approved package.

You can read all the details of it here:

Tesla rewards CEO Elon Musk with massive, restricted stock package

Ives says Musk’s retention is ‘a must’

Ives said in a note to investors on Monday that with the raging AI talent war that Tesla made a smart move by doing what it could to retain Musk.

He wrote:

“With the AI talent war now fully underway across Big Tech, we believe this was a strategic move to keep TSLA’s top asset, Musk, would stay focused at the company with his priority being to bolster the company’s growth strategy over the coming years. With this interim award increasing Musk’s voting rights upon this grant, which Musk honed in on and mentioned was increasingly important to incentivize him to stay focused on the matters at hand, this was a strategic move by the Board to solidify Musk as CEO of Tesla over the coming years with this framework for Musk’s pay package and greater voting control removing a major overhang on the story.”

He went on to say:

“While the groundwork is now in place for the next few years, it will be critical for the Tesla Board of Directors to get this long-term compensation strategy in place prior to the company’s November 6th shareholder meeting which would address the elephant in the room and remove a significant overhang on the stock.”

Wedbush maintained its Outperform rating and its $500 price target on the stock.

Elon Musk

Tesla rewards CEO Elon Musk with massive, restricted stock package

Tesla announced a new pay package for Elon Musk that is restricted and will award him nearly $30 billion for contributions to the company.

Tesla has rewarded CEO Elon Musk with a massive, restricted stock package that equates to about $29 billion in shares in an effort to retain him as the head of the company.

It is also a package that aims to reward Musk for leading numerous Tesla projects that have brought billions in value for shareholders over the past seven years. After his 2018 pay package was rejected by a Delaware Chancery Court, Musk started to question his future at the company.

This move, performed by a Special Committee of the Tesla Board, should retain him for several years.

🚨 BREAKING: Tesla has announced that its Board has unanimously approved a recommendation from the Special Committee of the Board to grant Elon an award of restricted stock equal to approximately one-third of the compensation he earned under the 2018 CEO Performance Award.

The… https://t.co/g7RKrTymDL pic.twitter.com/dnvkILlz6H

— TESLARATI (@Teslarati) August 4, 2025

On Monday morning, Tesla shared on X that it had approved a recommendation from a Special Committee comprised of Board Chair Robyn Denholm and fellow board member Kathleen Wilson-Thompson. It aimed to compensate Musk for his “extraordinary work” and reward him after not receiving “meaningful compensation” for the last eight years.

The post stated that “Tesla is committed to honoring its promises in the 2018 CEO Performance Award and intends to compensate its CEO for his future services commensurate with his contributions to our company and shareholders, we have recommended this award as a first step, ‘good faith’ payment to Elon.”

The award includes the following:

- 96 million restricted shares of stock, subject to Elon paying a purchase price upon meeting a two-year vesting term, to be delivered after receipt of antitrust regulatory approval

- The purchase price will be equal to the split-adjusted exercise price of the stock options awarded to Elon under the 2018 CEO Performance Award ($23.34 per share)

- A requirement that Elon serve continuously in a senior leadership role at Tesla during the two-year vesting term

- A pledging allowance to cover tax payments or the purchase price

- A mandatory holding period of five years from the grant date, except to cover tax payments or the purchase price (with any sales for such purposes to be conducted through an orderly disposition in coordination with Tesla); and

- If the Delaware courts fully reinstate the 2018 CEO Performance Award, this interim award will be forfeited or returned or a portion of the 2018 CEO Performance Award will be forfeited. To put it simply, there cannot be any “double dip.” Elon will not be able to keep this new award in addition to the options he will be awarded under the 2018 CEO Performance Award, should the courts rule in our favor

The board added:

“The Special Committee believes now is the right time to take decisive action to recognize the extraordinary value that Elon created for Tesla shareholders. As such, the Board (with Elon and Kimbal Musk recusing themselves) has unanimously approved a recommendation from the Special Committee of the Board to grant Elon an award of restricted stock equal to approximately one-third of the compensation he earned under the 2018 CEO Performance Award.”

Musk and his brother, Kimbal, are both members of the Tesla board. However, both Musk brothers recused themselves from any voting on this pay package.

The move comes as Musk has hinted on several occasions that he is concerned about his control of the company. His current stake in Tesla stands at about 12.8 percent. He has said a few times he would be more comfortable with a 25 percent stake to protect himself against “activist shareholders.”

He commented on it during the Q2 Earnings Call in late July:

“That is a major concern for me, as I’ve mentioned in the past. I hope that is addressed at the upcoming shareholders’ meeting. But, yeah, it is a big deal. I want to find that I’ve got so little control that I can easily be ousted by activist shareholders after having built this army of humanoid robots. I think my control over Tesla, Inc. should be enough to ensure that it goes in a good direction, but not so much control that I can’t be thrown out if I go crazy.”

The pay package should alleviate any concerns that Tesla would lose Musk as its CEO. Retaining him is perhaps the biggest step in ensuring consistent progress is made on several fronts, including AI and Robotics.

-

News1 week ago

News1 week agoTesla hints a smaller pickup truck could be on the way

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoLIVE BLOG: Tesla (TSLA) Q2 2025 earnings call updates

-

News2 weeks ago

News2 weeks agoTesla is ready with a perfect counter to the end of US EV tax credits

-

News2 weeks ago

News2 weeks agoTesla Q2 2025 vehicle safety report proves FSD makes driving almost 10X safer

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla gives a massive update on its affordable model plans

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla (TSLA) Q2 2025 earnings results

-

News2 weeks ago

News2 weeks agoElon Musk reveals big plans for Tesla Optimus at the Supercharger Diner

-

News2 weeks ago

News2 weeks agoTesla expands FSD Transfer offer to Europe and the Middle East