News

Legacy and startup EV sales likely to drop if leasing tax credit is overturned

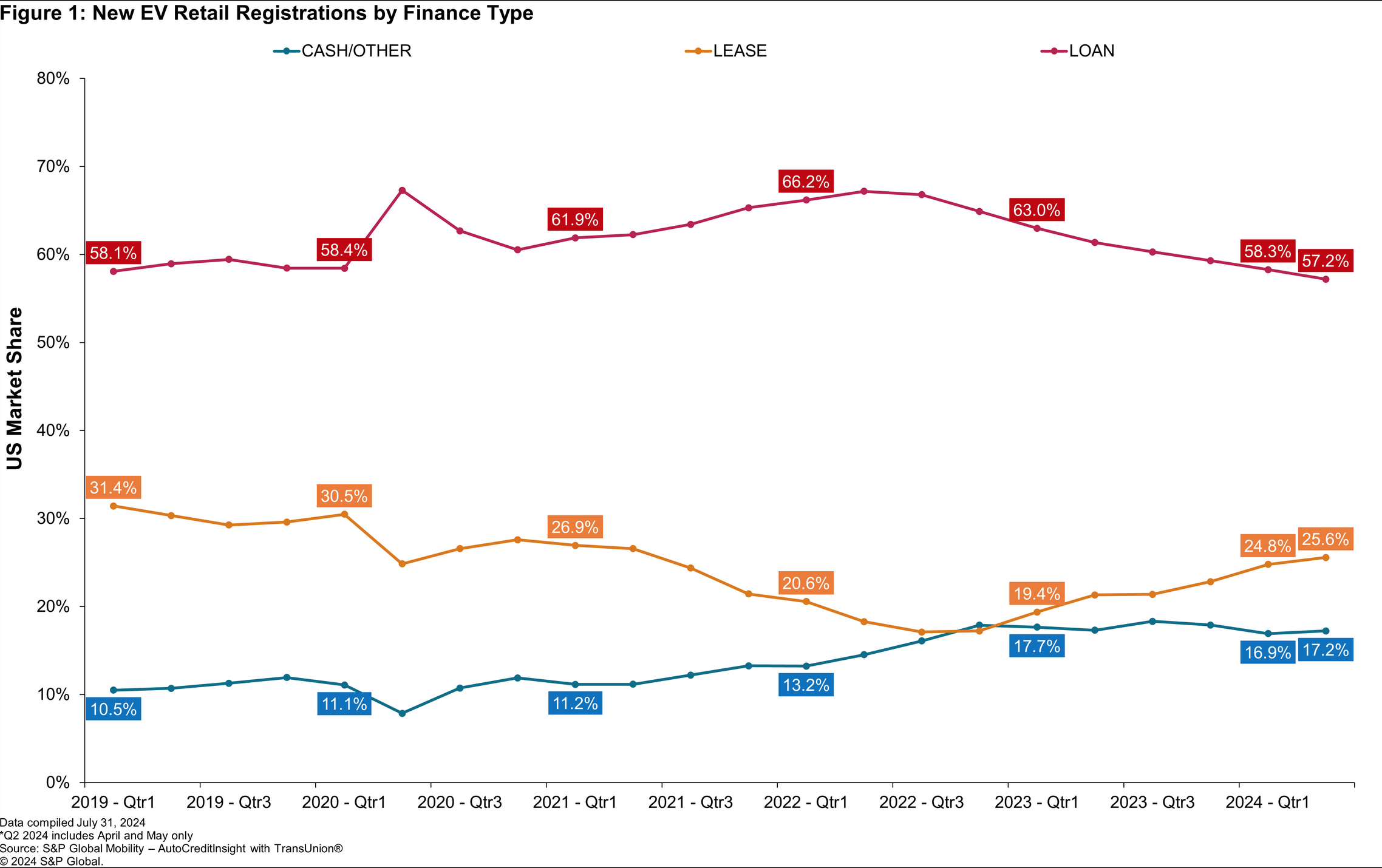

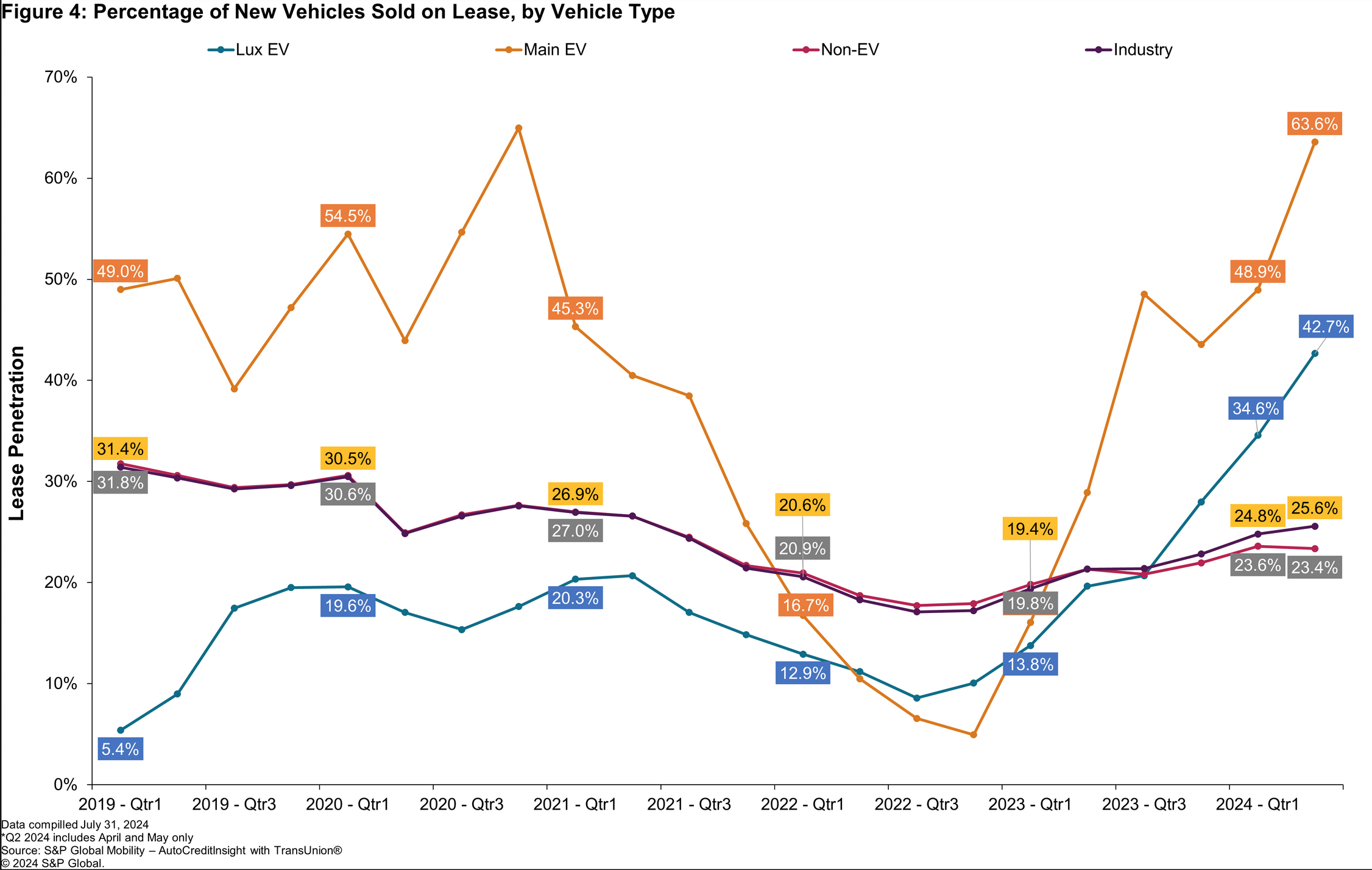

Lucid Motors, VinFast, Rivian, and several other electric vehicle (EV) makers are likely to see their sales drop if President-elect Donald Trump follows through on promises to overturn the $7,500 federal tax credit on EV purchases, especially since many companies are getting access to the credit through a special leasing loophole.

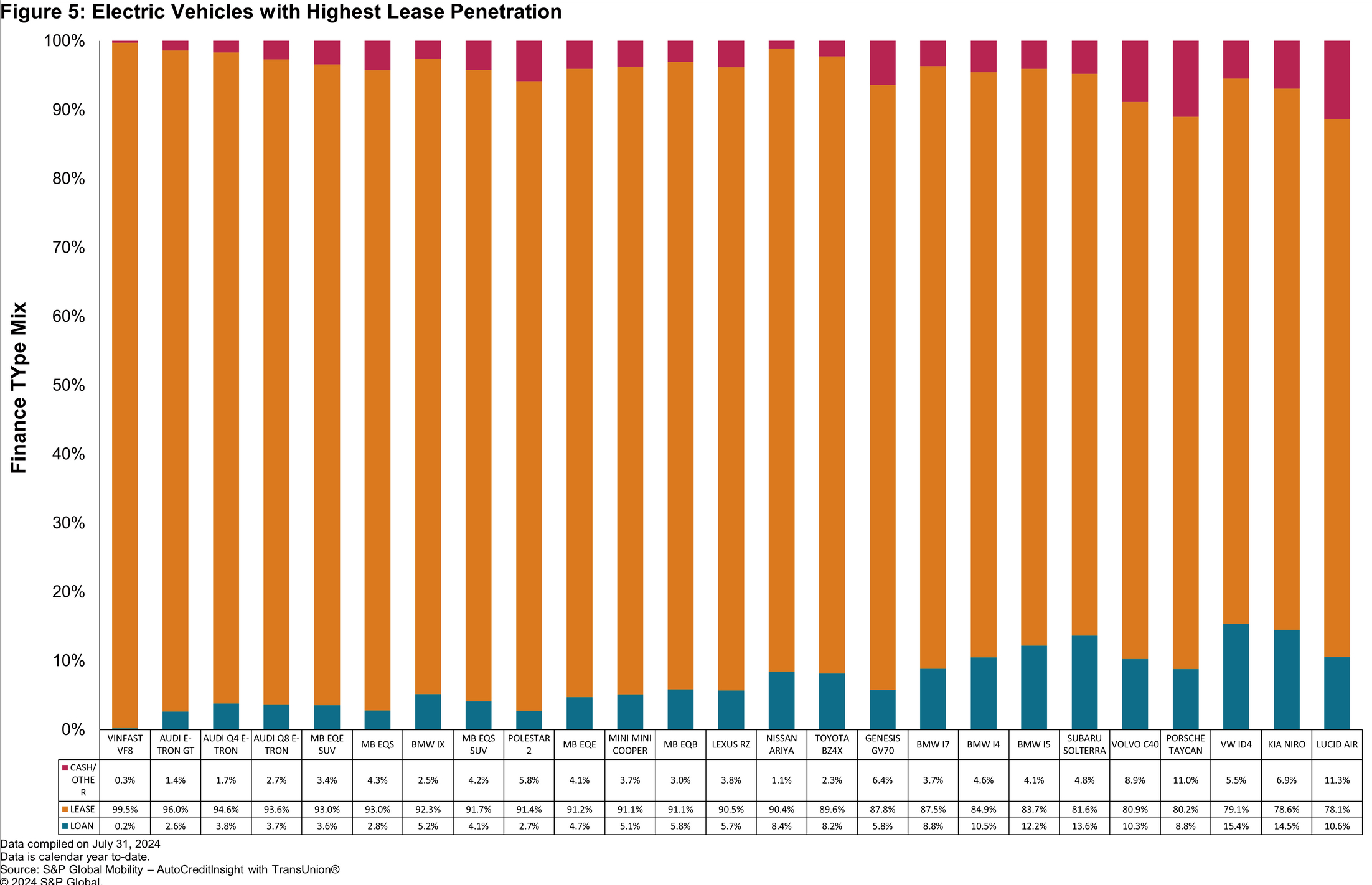

According to reports from S&P Global Mobility in August, the Lucid Air had a leasing rate of 78.1 percent as of the end of July, while the VinFast VF8 was leased 99.5 percent of the time. Other models such as the Polestar 2, Nissan Ariya, and the Volkswagen ID.4 had leasing rates of 91.4 percent, 90.4 percent, and 79.1 percent, respectively.

Across the industry in both the luxury and mainstream segments—and across legacy and EV startups alike—EV leasing levels have increased substantially over the past few years, especially as the option has allowed legacy automakers and EV startups alike to access a loophole, making their vehicles eligible for the $7,500 tax credit. These leases effectively let the automaker receive the tax credit, rather than the consumer, before it’s passed onto buyers through specialized, low-monthly-payment leasing agreements. Most direct-to-consumer automakers also factor the credit into purchase prices through their website.

Credit: S&P Global Mobility Credit: S&P Global Mobility Credit: S&P Global Mobility

S&P Global Mobility also pointed to the importance of brands being “aggressive players” in the leasing business to garner competitive EV sales, while it also notes that government regulations at both the state and federal levels will have a large impact on the market. As of last month, the point-of-sale EV credits had surpassed $2 billion, representing purchases from more than 300,000 buyers.

While Trump’s potential repeal of the tax credit and other EV incentives may come as a detriment to the majority of EV makers, however, Elon Musk has regularly highlighted how such a move could actually stand to benefit Tesla.

“As for Tesla, take a minute to read our public filings and you will see that EV incentives represent a minor part of our revenue. On the other hand, oil & gas companies get massive tax breaks that exceed those given to the EV industry by several orders of magnitude,” Musk wrote in a post on X in September, responding to critiques of Trump’s potential removal of the federal incentive.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

News

Tesla launches in India with Model Y, showing pricing will be biggest challenge

Tesla finally got its Model Y launched in India, but it will surely come at a price for consumers.

Tesla has officially launched in India following years of delays, as it brought its Model Y to the market for the first time on Tuesday.

However, the launch showed that pricing is going to be its biggest challenge. The all-electric Model Y is priced significantly higher than in other major markets in which Tesla operates.

On Tuesday, Tesla’s Model Y went up for sale for 59,89,000 rupees for the Rear-Wheel Drive configuration, while the Long Range Rear-Wheel Drive was priced at 67,89,000.

This equates to $69,686 for the RWD and $78,994 for the Long Range RWD, a substantial markup compared to what these cars sell for in the United States.

🚨 Here’s the difference in price for the Tesla Model Y in the U.S. compared to India.

🚨 59,89,000 is $69,686

🚨 67,89,000 is $78,994 pic.twitter.com/7EUzyWLcED— TESLARATI (@Teslarati) July 15, 2025

Deliveries are currently scheduled for the third quarter, and it will be interesting to see how many units they can sell in the market at this price point.

The price includes tariffs and additional fees that are applied by the Indian government, which has aimed to work with foreign automakers to come to terms on lower duties that increase vehicle cost.

Tesla Model Y seen testing under wraps in India ahead of launch

There is a chance that these duties will be removed, which would create a more stable and affordable pricing model for Tesla in the future. President Trump and Indian Prime Minister Narendra Modi continue to iron out those details.

Maharashtra Chief Minister Devendra Fadnavis said to reporters outside the company’s new outlet in the region (via Reuters):

“In the future, we wish to see R&D and manufacturing done in India, and I am sure at an appropriate stage, Tesla will think about it.”

It appears to be eerily similar to the same “game of chicken” Tesla played with Indian government officials for the past few years. Tesla has always wanted to enter India, but was unable to do so due to these import duties.

India wanted Tesla to commit to building a Gigafactory in the country, but Tesla wanted to test demand first.

It seems this could be that demand test, and the duties are going to have a significant impact on what demand will actually be.

Elon Musk

Tesla ups Robotaxi fare price to another comical figure with service area expansion

Tesla upped its fare price for a Robotaxi ride from $4.20 to, you guessed it, $6.90.

Tesla has upped its fare price for the Robotaxi platform in Austin for the first time since its launch on June 22. The increase came on the same day that Tesla expanded its Service Area for the Robotaxi ride-hailing service, offering rides to a broader portion of the city.

The price is up from $4.20, a figure that many Tesla fans will find amusing, considering CEO Elon Musk has used that number, as well as ’69,’ as a light-hearted attempt at comedy over the past several years.

Musk confirmed yesterday that Tesla would up the price per ride from that $4.20 point to $6.90. Are we really surprised that is what the company decided on, as the expansion of the Service Area also took effect on Monday?

But the price is now a princely $6.90, as foretold in the prophecy 😂

— Elon Musk (@elonmusk) July 14, 2025

The Service Area expansion was also somewhat of a joke too, especially considering the shape of the new region where the driverless service can travel.

I wrote yesterday about how it might be funny, but in reality, it is more of a message to competitors that Tesla can expand in Austin wherever it wants at any time.

Tesla’s Robotaxi expansion wasn’t a joke, it was a warning to competitors

It was only a matter of time before the Robotaxi platform would subject riders to a higher, flat fee for a ride. This is primarily due to two reasons: the size of the access program is increasing, and, more importantly, the service area is expanding in size.

Tesla has already surpassed Waymo in Austin in terms of its service area, which is roughly five square miles larger. Waymo launched driverless rides to the public back in March, while Tesla’s just became available to a small group in June. Tesla has already expanded it, allowing new members to hail a ride from a driverless Model Y nearly every day.

The Robotaxi app is also becoming more robust as Tesla is adding new features with updates. It has already been updated on two occasions, with the most recent improvements being rolled out yesterday.

Tesla updates Robotaxi app with several big changes, including wider service area

News

Tesla Model Y and Model 3 dominate U.S. EV sales despite headwinds

Tesla’s two mainstream vehicles accounted for more than 40% of all EVs sold in the United States in Q2 2025.

Tesla’s Model Y and Model 3 remained the top-selling electric vehicles in the U.S. during Q2 2025, even as the broader EV market dipped 6.3% year-over-year.

The Model Y logged 86,120 units sold, followed by the Model 3 at 48,803. This means that Tesla’s two mainstream vehicles accounted for 43% of all EVs sold in the United States during the second quarter, as per data from Cox Automotive.

Tesla leads amid tax credit uncertainty and a tough first half

Tesla’s performance in Q2 is notable given a series of hurdles earlier in the year. The company temporarily paused Model Y deliveries in Q1 as it transitioned to the production of the new Model Y, and its retail presence was hit by protests and vandalism tied to political backlash against CEO Elon Musk. The fallout carried into Q2, yet Tesla’s two mass-market vehicles still outsold the next eight EVs combined.

Q2 marked just the third-ever YoY decline in quarterly EV sales, totaling 310,839 units. Electric vehicle sales, however, were still up 4.9% from Q1 and reached a record 607,089 units in the first half of 2025. Analysts also expect a surge in Q3 as buyers rush to qualify for federal EV tax credits before they expire on October 1, Cox Automotive noted in a post.

Legacy rivals gain ground, but Tesla holds its commanding lead

General Motors more than doubled its EV volume in the first half of 2025, selling over 78,000 units and boosting its EV market share to 12.9%. Chevrolet became the second-best-selling EV brand, pushing GM past Ford and Hyundai. Tesla, however, still retained a commanding 44.7% electric vehicle market share despite a 12% drop in in Q2 revenue, following a decline of almost 9% in Q1.

Incentives reached record highs in Q2, averaging 14.8% of transaction prices, roughly $8,500 per vehicle. As government support winds down, the used EV market is also gaining momentum, with over 100,000 used EVs sold in Q2.

Q2 2025 Kelley Blue Book EV Sales Report by Simon Alvarez on Scribd

-

News3 days ago

News3 days agoTesla debuts hands-free Grok AI with update 2025.26: What you need to know

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

Elon Musk5 days ago

Elon Musk5 days agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

News2 weeks ago

News2 weeks agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Memphis data center receives air permit despite community criticism

-

News5 days ago

News5 days agoTesla begins Robotaxi certification push in Arizona: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla reveals it is using AI to make factories more sustainable: here’s how

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla scrambles after Musk sidekick exit, CEO takes over sales