News

NASA asks SpaceX to decide the fate of ‘Dragon XL’ lunar cargo spacecraft

In a new Request For Information (RFI) quietly released by NASA on April Fools’ Day, the space agency appears to have indirectly asked SpaceX to determine the fate of its ‘Dragon XL’ lunar cargo spacecraft.

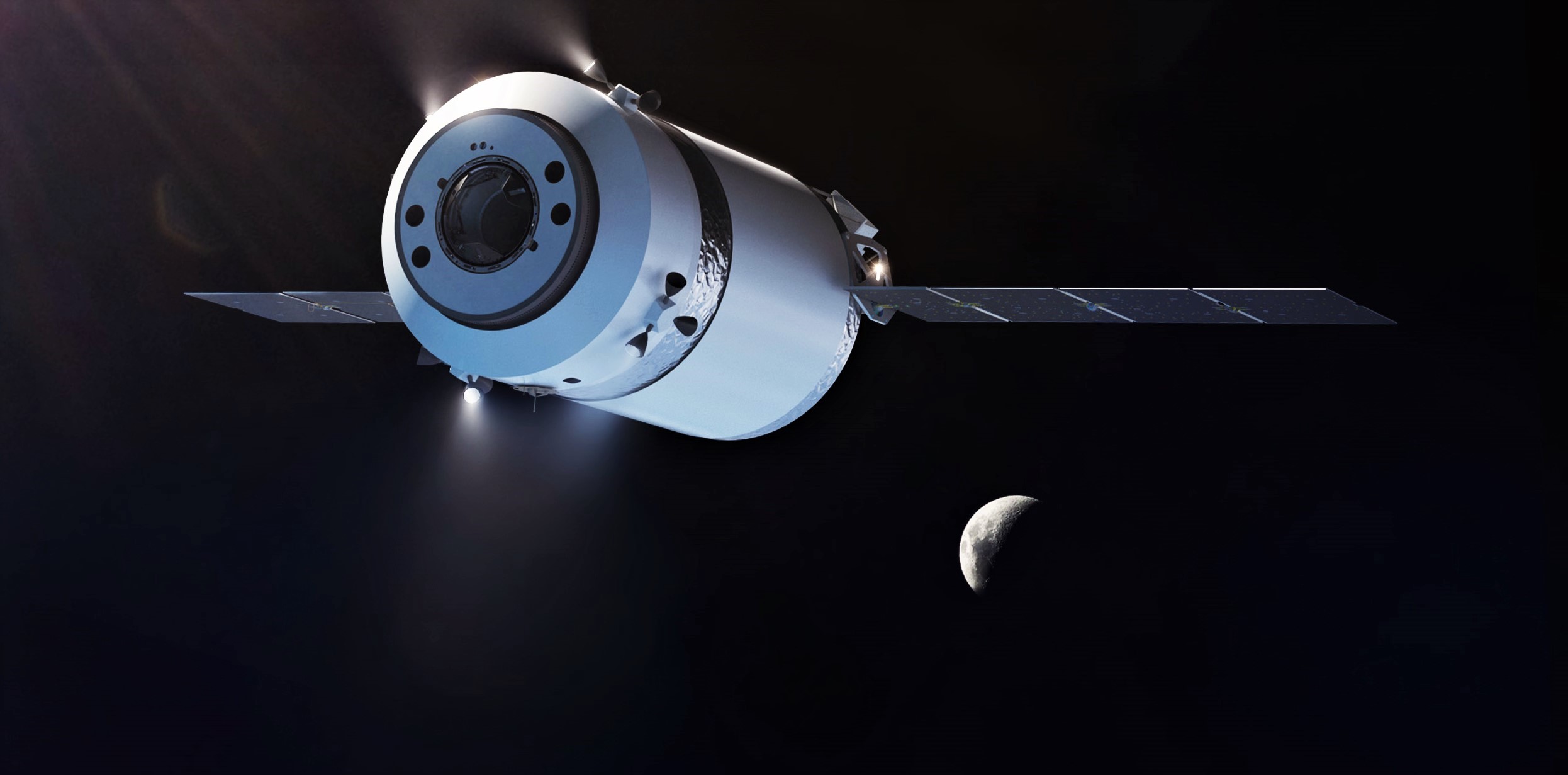

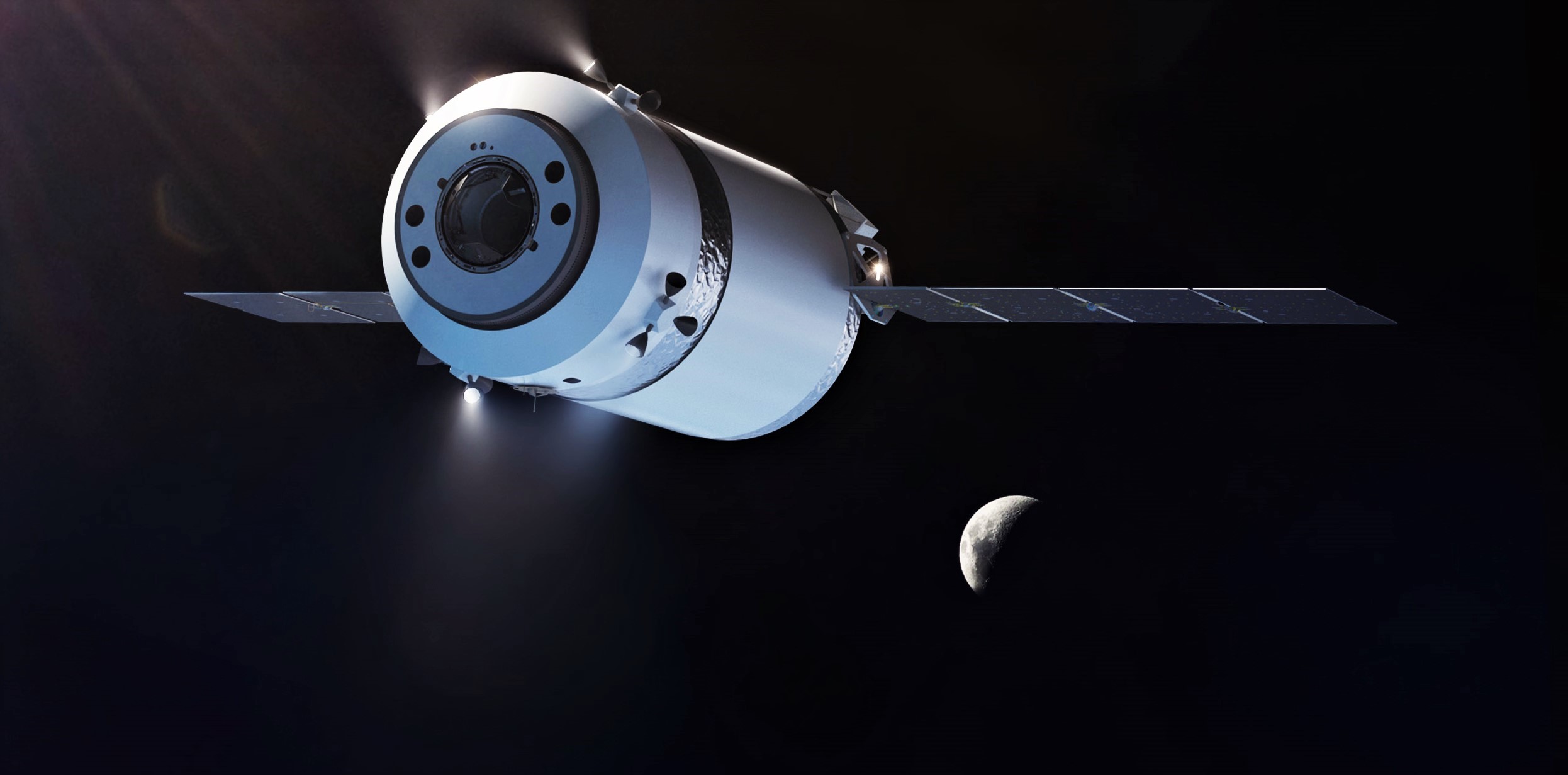

In March 2020, NASA announced that it had selected SpaceX to deliver the bulk of pressurized and unpressurized cargo it would need to crewed and operate a proposed “Gateway” lunar space station for the first several years of its existence. To accomplish that task, SpaceX would develop a heavily-modified single-use version of its Dragon 2 spacecraft with more propellant storage, more space for cargo, and a range of other design changes.

Known as Dragon XL, that spacecraft would weigh around 15 to 16 tons (~33,000-35,000 lb) at liftoff and likely require a fully or partially expendable Falcon Heavy launch for each mission to the Moon. At the time, it was a fairly balanced and reasonable choice on NASA’s part, leveraging existing investments and experience with SpaceX and Dragon and erecting no major technical hurdles. However, more than two years later, NASA still hasn’t started work on the contract.

That’s why the new April 1st RFI is so intriguing. NASA begins by referencing fine print in the original 2018 Gateway Logistics Services (GLS) Request For Proposals (RFP) that allows the agency to continue receiving and considering new proposals from new and existing providers throughout the program’s planned 17-year lifespan. The agency says its primary motivations are for “information and planning purposes, to request feedback, to promote competition,” and to “[determine] whether to conduct an on-ramp in 2022.” NASA doesn’t specify what exactly that means, but in the context of the rest of the text, it appears that the agency wants to use this RFI to help determine whether or not to finally “on-ramp” its existing Dragon XL contract with SpaceX.

However, the document gets far more interesting and suggestive. Later, NASA spells out what exactly it wants respondents to discuss. In a list of eight main questions, the agency repeatedly hints at a desire to substantially expand the scope of GLS. In question #8, NASA asks if, to help “create a vibrant supply chain in deep space,” respondents would be able to deliver additional cargo to “cislunar orbits [and] the lunar surface” or offer a “dedicated delivery tug capability” or “rapid response delivery service.”

NASA also asks for information on ways prospective GLS providers could “[minimize] the cost impact of…requirement changes,” “reduce operating costs,” and “minimize upfront costs.” In questions #2 and #3, NASA requests details about “new and/or innovative capabilities” that could “significantly increase…cargo delivery capacity” within “the next five years” and states that “offerors exceeding the minimum [cargo] capabilities may be viewed more favorably.”

NASA seems very interested in the potential benefits of alternative deep space cargo transport services that are both cheaper and more capable than Dragon XL. Between the lines, however, the RFI also reads as if it was written directly to SpaceX. The first question is perhaps the most telling: “Is your company interested in on-ramping to the GLS contract to provide Logistics Services as described in the original solicitation?”

SpaceX is the only company with an existing GLS contract that it could “on-ramp to” – a roundabout way to say “start work on”. In the following questions, NASA then repeatedly expresses interest in cargo transport capabilities well beyond the original contract’s requirements and asks about innovative new capabilities that could enable such improvements. NASA even “recognizes” and hints at a willingness to consider unorthodox solutions that, for example, might require “more than one launch” per cargo delivery or help “minimize upfront costs to the Government.” Put simply, while it does open the door for just about any US company to inform NASA about new GLS options, it’s hard not to conclude that this new RFI is at least partially designed to give SpaceX an opportunity to propose Dragon XL alternatives or upgrades.

The most obvious option: Starship. Through the Human Landing System (HLS) program, NASA has already committed to investing at least $3 billion to develop a crewed Starship Moon lander and the fully-reusable launch vehicle and refueling infrastructure required to launch and operate it. With barely any modification, the Starship architecture SpaceX and NASA are already developing could be used to deliver dozens of tons of pressurized cargo to cislunar space, lunar orbit, the Gateway, the lunar surface, or just about anywhere else NASA wants. Leveraging that significant investment would also tick almost every box in NASA’s new RFI by drastically reducing upfront and total development costs, helping to stimulate a “vibrant” deep space supply chain, and beating Dragon XL’s cargo capabilities by a factor of 5, 10, or even 20+.

Of course, there are technical challenges and reasons to believe that Starship can’t easily replace Dragon XL. Even Dragon XL risked running into Gateway’s visiting vehicle mass limit of just 14 tons. Starship would likely weigh at least 100-200 tons – more than the entire Gateway. Dragon XL would use non-cryogenic propellant and is baselined to spend at least 6-12 months at a time at the Gateway. NASA has also studied the possibility of using Dragon XL as a crew cabin or bathroom to temporarily relieve Gateway’s extremely cramped habitable volume. Starship’s main engines use cryogenic propellant that wants nothing more than to warm up and boil into gas, making it far harder to keep at the station for months at a time. Those problems are likely solvable, but it’s still worth noting that Starship is not a perfect fit right out of the box.

The RFI could also end with a whimper if SpaceX simply tells NASA that it’s happy to proceed with Dragon XL as proposed. Only time will tell. NASA is planning to hold an industry day on April 20th to better explain the RFI’s goals and wants responses by May 31st, 2022, after which the agency will decide whether or not to follow up with a solicitation or on-ramp Dragon XL.

News

These Tesla, X, and xAI engineers were just poached by OpenAI

The news is the latest in an ongoing feud between Elon Musk and the Sam Altman-run firm OpenAI.

OpenAI, the xAI competitor for which Elon Musk previously served as a boardmember and helped to co-found, has reportedly poached high-level engineers from Tesla, along with others from xAI, X, and still others.

On Tuesday, Wired reported that OpenAI hired four high-level engineers from Tesla, xAI, and X, as seen in an internal Slack message sent by co-founder Greg Brockman. The engineers include Tesla Vice President of Software Engineering David Lau, X and xAI’s head of infrastructure engineering Uday Ruddarraju, and fellow xAI infrastructure engineer Mike Dalton. The hiring spree also included Angela Fan, an AI researcher from Meta.

“We’re excited to welcome these new members to our scaling team,” said Hannah Wong, an OpenAI spokesperson. “Our approach is to continue building and bringing together world-class infrastructure, research, and product teams to accelerate our mission and deliver the benefits of AI to hundreds of millions of people.”

Lau has been in his position as Tesla’s VP of Software Engineering since 2017, after previously working for the company’s firmware, platforms, and system integration divisions.

“It has become incredibly clear to me that accelerating progress towards safe, well-aligned artificial general intelligence is the most rewarding mission I could imagine for the next chapter of my career,” Lau said in a statement to Wired.

🚨Optimistic projections point to xAI possibly attaining profitability by 2027, according to Bloomberg's sources.

If accurate, this would be quite a feat for xAI. OpenAI, its biggest rival, is still looking at 2029 as the year it could become cash flow positive.💰 https://t.co/pE5Z9daez8

— TESLARATI (@Teslarati) June 18, 2025

READ MORE ON OPENAI: Elon Musk’s OpenAI lawsuit clears hurdle as trial looms

At xAI, Ruddarraju and Dalton both played a large role in developing the Colossus supercomputer, which is comprised of over 200,000 GPUs. One of the major ongoing projects at OpenAI is the company’s Stargate program,

“Infrastructure is where research meets reality, and OpenAI has already demonstrated this successfully,” Ruddarraju told Wired in another statement. “Stargate, in particular, is an infrastructure moonshot that perfectly matches the ambitious, systems-level challenges I love taking on.”

Elon Musk is currently in the process of suing OpenAI for shifting toward a for-profit model, as well as for accepting an investment of billions of dollars from Microsoft. OpenAI retaliated with a counterlawsuit, in which it alleges that Musk is interfering with the company’s business and engaging in unfair competition practices.

Elon Musk confirms Grok 4 launch on July 9 with livestream event

News

SpaceX share sale expected to back $400 billion valuation

The new SpaceX valuation would represent yet another record-high as far as privately-held companies in the U.S. go.

A new report this week suggests that Elon Musk-led rocket company SpaceX is considering an insider share sale that would value the company at $400 billion.

SpaceX is set to launch a primary fundraising round and sell a small number of new shares to investors, according to the report from Bloomberg, which cited people familiar with the matter who asked to remain anonymous due to the information not yet being public. Additionally, the company would sell shares from employees and early investors in a follow-up round, while the primary round would determine the price for the secondary round.

The valuation would represent the largest in history from a privately-owned company in the U.S., surpassing SpaceX’s previous record of $350 billion after a share buyback in December. Rivaling company valuations include ByteDance, the parent company of TikTok, as well as OpenAI.

Bloomberg went on to say that a SpaceX representative didn’t respond to a request for comment at the time of publishing. The publication also notes that the details of such a deal could still change, especially depending on interest from the insider sellers and share buyers.

Axiom’s Ax-4 astronauts arriving to the ISS! https://t.co/WQtTODaYfj

— TESLARATI (@Teslarati) June 26, 2025

READ MORE ON SPACEX: SpaceX to decommission Dragon spacecraft in response to Pres. Trump war of words with Elon Musk

SpaceX’s valuation comes from a few different key factors, especially including the continued expansion of the company’s Starlink satellite internet company. According to the report, Starlink accounts for over half of the company’s yearly revenue. Meanwhile, the company produced its 10 millionth Starlink kit last month.

The company also continues to develop its Starship reusable rocket program, despite the company experiencing an explosion of the rocket on the test stand in Texas last month.

The company has also launched payloads for a number of companies and government contracts. In recent weeks, SpaceX launched Axiom’s Ax-4 mission, sending four astronauts to the International Space Station (ISS) for a 14-day stay to work on around 60 scientific experiments. The mission was launched using the SpaceX Falcon 9 rocket and a new Crew Dragon capsule, while the research is expected to span a range of fields including biology, material and physical sciences, and demonstrations of specialized technology.

News

Tesla Giga Texas continues to pile up with Cybercab castings

Tesla sure is gathering a lot of Cybercab components around the Giga Texas complex.

Tesla may be extremely tight-lipped about the new affordable models that it was expected to start producing in the first half of the year, but the company sure is gathering a lot of Cybercab castings around the Giga Texas complex. This is, at least, as per recent images taken of the facility.

Cybercab castings galore

As per longtime drone operator Joe Tegtmeyer, who has been chronicling the developments around the Giga Texas complex for several years now, the electric vehicle maker seems to be gathering hundreds of Cybercab castings around the factory.

Based on observations from industry watchers, the drone operator appears to have captured images of about 180 front and 180 rear Cybercab castings in his recent photos.

Considering the number of castings that were spotted around Giga Texas, it would appear that Tesla may indeed be preparing for the vehicle’s start of trial production sometime later this year. Interestingly enough, large numbers of Cybercab castings have been spotted around the Giga Texas complex in the past few months.

Cybercab production

The Cybercab is expected to be Tesla’s first vehicle that will adopt the company’s “unboxed” process. As per Tesla’s previous update letters, volume production of the Cybercab should start in 2026. So far, prototypes of the Cybercab have been spotted testing around Giga Texas, and expectations are high that the vehicle’s initial trial production should start this year.

With the start of Tesla’s dedicated Robotaxi service around Austin, it might only be a matter of time before the Cybercab starts being tested on public roads as well. When this happens, it would be very difficult to deny the fact that Tesla really does have a safe, working autonomous driving system, and it has the perfect vehicle for it, too.

-

Elon Musk1 week ago

Elon Musk1 week agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News2 weeks ago

News2 weeks agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk1 day ago

Elon Musk1 day agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

News2 weeks ago

News2 weeks agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News5 days ago

News5 days agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoA Tesla just delivered itself to a customer autonomously, Elon Musk confirms

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI welcomes Memphis pollution results, environmental groups push back

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk confirms Tesla Optimus V3 already uses Grok voice AI