Investor's Corner

Tesla upsells Model 3 Performance as Musk ponders ‘mental scar tissue’ from production ramp

Tesla is starting to upsell the Model 3 Performance to reservation holders, with CEO Elon Musk announcing more exciting aspects of the vehicle on Twitter. Musk’s recent announcements describe the vehicle’s suspension and brakes, as well as the company’s ongoing test drive program for the compact electric car.

According to Musk, the Model 3 Performance will feature a lower ride height helped by the performance suspension system and stronger brakes than non-Performance variants, which would enhance the vehicles’ track capabilities. The upgrade would further bolster claims that Model 3 Performance will outperform all vehicles in its class on the race track, including the BMW M3.

Performance version suspension is 1cm lower & has stronger brakes in upgrade package

— Elon Musk (@elonmusk) July 13, 2018

Equipping larger brakes on the Model 3 Performance is definitely the right decision from Tesla. The car’s stock brakes, after all, are unable to handle hard track driving, as evidenced in a Laguna Seca run by a mostly stock Model 3 earlier this year. With upgraded brakes, the Model 3, even the single motor, non-Performance Long Range RWD version, becomes a formidable vehicle on the racecourse, recently beating Porsche to win a Time Attack challenge in a Canadian racing event.

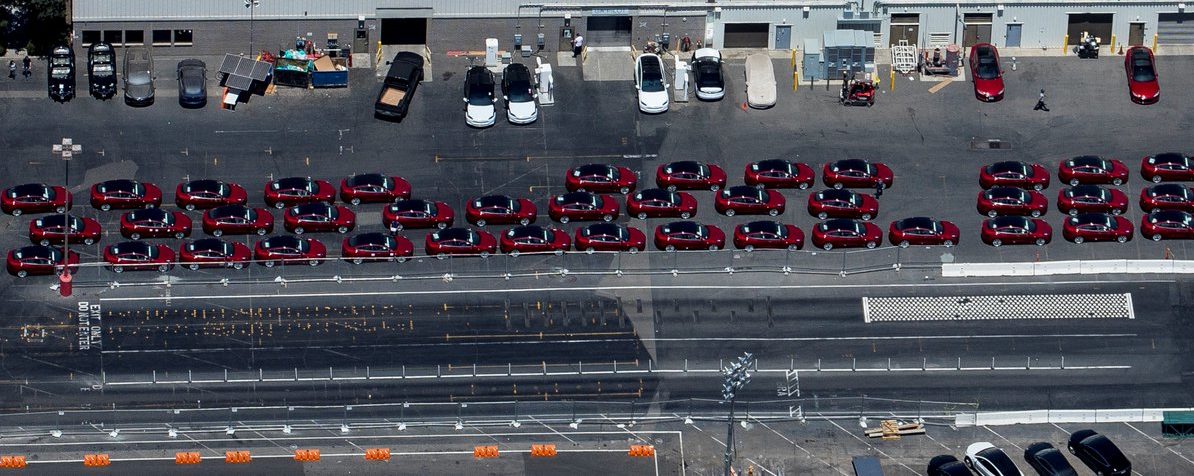

Overall, Musk’s recent Twitter statements for the Model 3 Performance comes amidst the company’s latest attempt to upsell the vehicle. Tesla, after all, has been putting some extra attention on the Model 3 Performance, with the electric car maker recently showcasing the car’s drifting capabilities in a skidpad testing video. Elon Musk also noted that the company had produced approximately 100 units of the Model 3 Performance to date, which would be used for test drive units in the company’s showrooms. In a recent Twitter announcement, Musk further encouraged reservation holders to test drive the Model 3 Performance regardless of whether they plan to buy the top trim variant or not.

These sure look like the ~100 performance #Model3 that $TSLA says were built for test drives. Question is when will they move off the lot into stores? Or have they already and these are leftovers? Images are from July 10th. https://t.co/PRuKZUvBtf #Tesla pic.twitter.com/SpU3ivTIA7

— RS Metrics (@RSMetrics) July 12, 2018

Tesla’s upselling of the Model 3 Performance comes amidst the company’s push to sustain mass production of its electric car. Since the company achieved its ever-elusive goal of producing 5,000 Model 3 per week during the end of Q2 2018, Tesla has been ramping the deliveries of the vehicle. Recent signs from Tesla also appear to be teasing that the company would be able to sustain a 5,000/week pace this Q3 2018. Among these are frequent mass VIN registrations, a new 5-minute Sign & Drive delivery program, and recent statements related by Senior Director of Investor Relations Aaron Chew, who reportedly stated in meeting with investors and analysts that the company is targeting a sustained 5,000-6,000/week production pace for the current quarter.

Whether you plan to buy a Dual Motor Performance Model 3 or not, take it for a test drive anyway. It’s like having pure fun jacked straight into your brain whenever you want.

— Elon Musk (@elonmusk) July 13, 2018

While Tesla appears to have broken through a massive roadblock with the Model 3, Elon Musk’s recent statements to Bloomberg reveal that the manufacturing feat came at a high price. As noted by Musk in a recent interview with the publication, the Model 3 ramp has been incredibly difficult for him and Tesla, to the point where he feels he developed permanent mental scars from the experience.

“It’s been super-hard. Like there is for sure some permanent mental scar tissue here. But I do feel good about the months to come. I think the results will speak for themselves,” Musk said.

Musk, however, noted that the risks Tesla took with the Model 3 ramp, such as betting the entire company on the vehicle’s success, will likely not be replicated in the future. According to Musk, he does not foresee any bet-the-company situations arising, regardless of Tesla’s upcoming projects and vehicles.

“To the best of my judgment, I do not think we have any future bet-the-company situations. We will still need to work hard and be vigilant and not be complacent because it is very difficult just to survive as a car company. But it will not be the same level of strain as getting to volume production of Model 3,” he said.

Elon Musk

Tesla blacklisted by Swedish pension fund AP7 as it sells entire stake

A Swedish pension fund is offloading its Tesla holdings for good.

Tesla shares have been blacklisted by the Swedish pension fund AP7, who said earlier today that it has “verified violations of labor rights in the United States” by the automaker.

The fund ended up selling its entire stake, which was worth around $1.36 billion when it liquidated its holdings in late May. Reuters first reported on AP7’s move.

Other pension and retirement funds have relinquished some of their Tesla holdings due to CEO Elon Musk’s involvement in politics, among other reasons, and although the company’s stock has been a great contributor to growth for many funds over the past decade, these managers are not willing to see past the CEO’s right to free speech.

However, AP7 says the move is related not to Musk’s involvement in government nor his political stances. Instead, the fund said it verified several labor rights violations in the U.S.:

“AP7 has decided to blacklist Tesla due to verified violations of labor rights in the United States. Despite several years of dialogue with Tesla, including shareholder proposals in collaboration with other investors, the company has not taken sufficient measures to address the issues.”

Tesla made up about 1 percent of the AP7 Equity Fund, according to a spokesperson. This equated to roughly 13 billion crowns, but the fund’s total assets were about 1,181 billion crowns at the end of May when the Tesla stake was sold off.

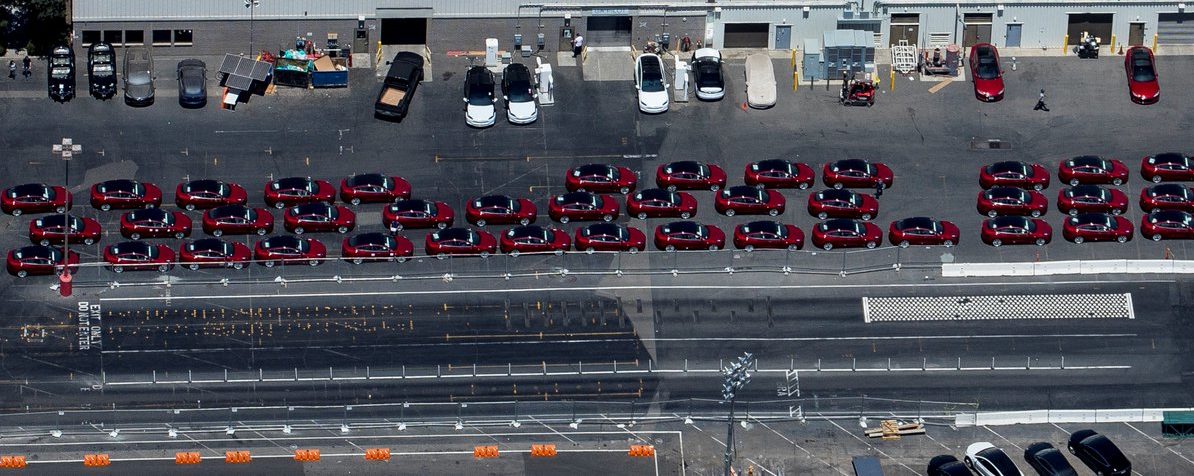

Tesla has had its share of labor lawsuits over the past few years, just as any large company deals with at some point or another. There have been claims of restrictions against labor union supporters, including one that Tesla was favored by judges, as they did not want pro-union clothing in the factory. Tesla argued that loose-fitting clothing presented a safety hazard, and the courts agreed.

(Photo: Tesla)

There have also been claims of racism at the Fremont Factory by a former elevator contractor named Owen Diaz. He was awarded a substantial sum of $137m. However, U.S. District Judge William Orrick ruled the $137 million award was excessive, reducing it to $15 million. Diaz rejected this sum.

Another jury awarded Diaz $3.2 million. Diaz’s legal team said this payout was inadequate. He and Tesla ultimately settled for an undisclosed amount.

AP7 did not list any of the current labor violations that it cited as its reason for

Investor's Corner

xAI targets $5 billion debt offering to fuel company goals

Elon Musk’s xAI is targeting a $5B debt raise, led by Morgan Stanley, to scale its artificial intelligence efforts.

xAI’s $5 billion debt offering, marketed by Morgan Stanley, underscores Elon Musk’s ambitious plans to expand the artificial intelligence venture. The xAI package comprises bonds and two loans, highlighting the company’s strategic push to fuel its artificial intelligence development.

Last week, Morgan Stanley began pitching a floating-rate term loan B at 97 cents on the dollar with a variable interest rate of 700 basis points over the SOFR benchmark, one source said. A second option offers a fixed-rate loan and bonds at 12%, with terms contingent on investor appetite. This “best efforts” transaction, where the debt size hinges on demand, reflects cautious lending in an uncertain economic climate.

According to Reuters sources, Morgan Stanley will not guarantee the issue volume or commit its own capital in the xAI deal, marking a shift from past commitments. The change in approach stems from lessons learned during Musk’s 2022 X acquisition when Morgan Stanley and six other banks held $13 billion in debt for over two years.

Morgan Stanley and the six other banks backing Musk’s X acquisition could only dispose of that debt earlier this year. They capitalized on X’s improved operating performance over the previous two quarters as traffic on the platform increased engagement around the U.S. presidential elections. This time, Morgan Stanley’s prudent strategy mitigates similar risks.

Beyond debt, xAI is in talks to raise $20 billion in equity, potentially valuing the company between $120 billion and $200 billion, sources said. In April, Musk hinted at a significant valuation adjustment for xAI, stating he was looking to put a “proper value” on xAI during an investor call.

As xAI pursues this $5 billion debt offering, its financial strategy positions it to lead the AI revolution, blending innovation with market opportunity.

Elon Musk

Tesla tops Cathie Wood’s stock picks, predicts $2,600 surge

Tesla’s future lies beyond cars—with robotaxis, humanoid bots & AI-driven factories. Cathie Wood predicts a 9x surge in 5 years.

Cathie Wood shared that Tesla is her top stock pick. During Steven Bartlett’s podcast “The Diary Of A CEO,” the Ark Invest founder highlighted Tesla’s innovative edge, citing its convergence of robotics, energy storage, and AI.

“Because think about it. It is a convergence among three of our major platforms. So, robots, energy storage, AI,” Wood said of Tesla. She emphasized the company’s potential beyond its current offerings, particularly with its Optimus robots.

“And it’s not stopping with robotaxis; there’s a story beyond that with humanoid robots, and our $2,600 number has nothing for humanoid robots. We just thought it’d be an investment, period,” she added.

In June 2024, Ark Invest issued a $2,600 price target for Tesla, which Wood reaffirmed in a March Bloomberg interview, projecting the stock to reach this level within five years. She told Bartlett that Tesla’s Optimus robots would drive productivity gains and create new revenue streams.

Elon Musk echoed Wood’s optimism in a CNBC interview last month.

“We expect to have thousands of Optimus robots working in Tesla factories by the end of this year, beginning this fall. And we expect to scale Optimus up faster than any product, I think, in history to get to millions of units per year as soon as possible,” Musk said.

Tesla’s stock has faced volatility lately, hitting a peak closing price of $479 in December after President Donald Trump’s election win. However, Musk’s involvement with the White House DOGE office triggered protests and boycotts, contributing to a stock decline of over 40% from mid-December highs by March.

The volatility in Tesla stock alarmed investors, who urged Musk to refocus on the company. In a May earnings call, Musk responded, stating he would be “scaling down his involvement with DOGE to focus on Tesla.” Through it all, Cathie Wood and Ark Invest maintained their faith in Tesla. Wood, in particular, predicted that the “brand damage” Tesla experienced earlier this year would not be long term.

Despite recent fluctuations, Wood’s confidence in Tesla underscores its potential to redefine industries through AI and robotics. As Musk shifts his focus back to Tesla, the company’s advancements in Optimus and other innovations could drive it toward Wood’s ambitious $2,600 target, positioning Tesla as a leader in the evolving tech landscape.

-

News2 weeks ago

News2 weeks agoTesla to lose 64 Superchargers on New Jersey Turnpike in controversial decision

-

News4 days ago

News4 days agoI took a Tesla Cybertruck weekend Demo Drive – Here’s what I learned

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk explains Tesla’s domestic battery strategy

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla stock: Morgan Stanley says eVTOL is calling Elon Musk for new chapter

-

Elon Musk5 days ago

Elon Musk5 days agoTesla tops Cathie Wood’s stock picks, predicts $2,600 surge

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk responds to Tesla Supercharger shutdown on NJ Turnpike

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla bull writes cautious note on Robotaxi launch: ‘Keep expectations well contained’

-

News2 weeks ago

News2 weeks agoSpaceX hit with mishap investigation by FAA for Starship Flight 9