News

Tesla’s streamlining efforts are a secret weapon against rival automakers

Tesla’s rise over the years from an upstart electric sports car maker to the world’s most valuable automaker by market cap is remarkable. Tesla’s lead in the electric vehicle sector continues to grow technology-wise, and the company is also catching up to the world’s veteran carmakers when it comes to its business.

Tesla, for example, has accelerated the timeline for turning cash into product and back to cash, allowing the company to commit more of its resources for investments in its upcoming projects. Tesla’s net profit increased over sevenfold in the year ending in the January to March quarter to $3.3 billion. That’s not far behind Toyota, which posted $3.93 billion.

As noted in a Nikkei Asia report, Tesla’s cash conversion cycle fell to minus 15 days in fiscal 2021. This was the first time that Tesla entered the negative territory since starting the mass production of the Model S back in 2012. Automakers typically require a large amount of working capital on hand to operate. Nikkei noted that a negative cash cycle eliminates this need, as it allows the company to invest its money instead.

Tesla’s cash conversion cycle of minus 15 days is quite a rare feat. Even auto juggernaut Toyota has a cash conversion cycle of 31 days, while Volkswagen has a cycle of 74 days excluding financial operations. Ryosuke Izumida, an analyst at financial services provider Monicle, noted that Tesla is extremely efficient at collecting revenue.

“It almost runs like a built-to-order business, with cash already on hand before starting production,” Izumida said.

What is quite remarkable is that Tesla tends to not sit on its laurels, with the company improving its cash cycle even further by cutting its inventory turnover to 45 days. This became possible through an aggressive streamlining of parts and its vehicles’ assembly process. As a result, Tesla posted a gross profit margin of 26.5% for its automobiles in fiscal 2021. In comparison, Toyota logged 16.7%, while Volkswagen posted 18.7%.

Tesla’s streamlining efforts are not only reflected in the company’s financials. The design of the company’s vehicles themselves is optimized for streamlining as well. The Model 3 and Model Y, which comprise over 90% of Tesla’s total vehicle production, features a minimalist interior centered on a massive touchscreen that replaces traditional meters and buttons.

Nikkei noted that Tesla’s electric cars, thanks to their streamlined design, require far fewer electronic control units (ECUs), which are responsible for steering and stopping vehicles. Typical vehicles utilize about 50 to 70 ECUs, and luxury cars could have about 100. Since Tesla uses fewer components, the need for wiring decreases, saving weight and production costs.

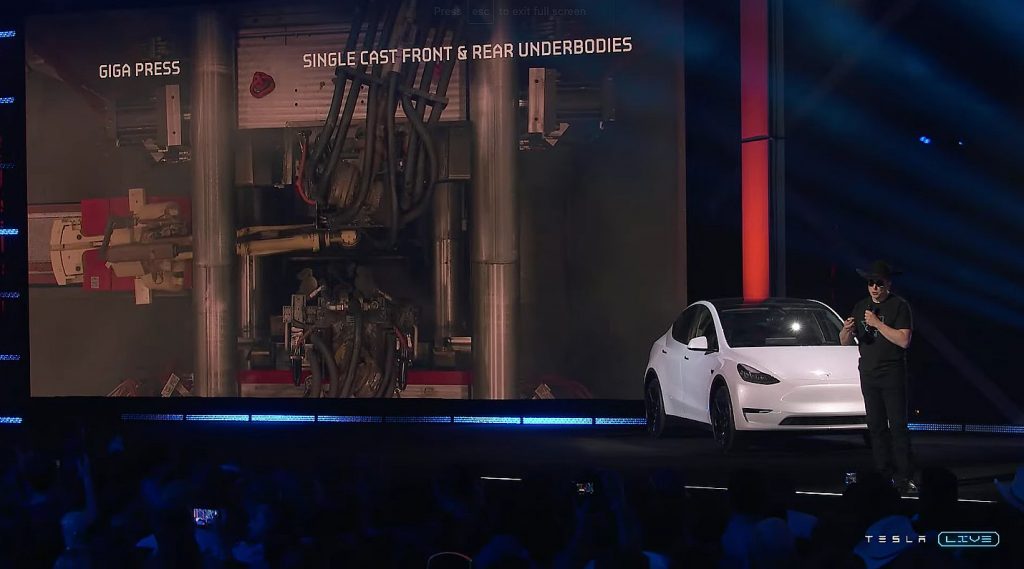

The company’s use of megacasts from the company’s custom Giga Press machines also allows Tesla to build complex components in one casting. Conventional electric cars are estimated to require about 20,000 parts, while gasoline-powered cars require about 30,000. Tesla, however, is believed to have reduced this number further to just about 10,000 parts per vehicle.

Electric vehicles are becoming more mainstream, but it will not be easy to overtake Tesla. More than its sleek cars and rockstar CEO, Tesla’s secret weapon against upcoming rivals is its aggressive streamlining — from its business strategies to the smallest components of its premium electric cars.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

News

Tesla Robotaxi has already surpassed Waymo in this key metric

Tesla Robotaxi has already overtaken Waymo in Austin in one key metric, but there’s still more work to do.

Tesla Robotaxi has already surpassed Waymo in one extremely important key metric: size of service area.

Tesla just expanded its service area in Austin on Monday morning, pushing the boundaries of its Robotaxi fleet in an interesting fashion with new capabilities to the north. Yes, we know what it looks like:

🚨 Tesla’s new Robotaxi geofence is…

Finish the sentence 🥸 pic.twitter.com/3bjhMqsRm5

— TESLARATI (@Teslarati) July 14, 2025

The expansion doubled Tesla Robotaxi’s potential travel locations, which now include the University of Texas at Austin, a school with over 53,000 students.

The doubling of the service area by Tesla has already made its travel area larger than Waymo’s, which launched driverless rides in October 2024. It became available to the public in March 2025.

According to Grok, the AI agent on X, Tesla Robotaxi’s current service area spans 42 square miles, which is five square miles larger than Waymo’s service area of 37 square miles.

Tesla Robotaxi (red) vs. Waymo geofence in Austin.

Much can be said about the shape… but the Robotaxi area is now ~3.9 mi² (10 km²) larger than Waymo’s!! pic.twitter.com/dVfh2ODxJC

— Robin (@xdNiBoR) July 14, 2025

The service area is one of the most important metrics in determining how much progress a self-driving ride-hailing service is making. Safety is the priority of any company operating a ride-hailing network, especially ones that are making it a point to use autonomy to deploy it.

However, these companies are essentially racing for a larger piece of the city or cities they are in. Waymo has expanded to several different regions around the United States, including Arizona and Los Angeles.

Tesla is attempting to do the same in the coming months as it has already filed paperwork in both California and Arizona to deploy its Robotaxi fleet in states across the U.S.

As the platform continues to show more prowess and accuracy in its operation, Tesla will begin to expand to new areas, eventually aiming for a global rollout of its self-driving service.

News

Tesla Megapacks arrive for massive battery replacing coal plant

Tesla Megapacks have started arriving on-site to the Stanwell Battery Project, just as Queensland prepares to wind down the Stanwell coal plant.

The first of over 300 Tesla Megapacks have arrived to the site of a massive battery energy storage system (BESS) being built in Australia, dubbed the Stanwell Battery Project after a coal plant it’s set to replace.

In a press release last week, the Stanwell Battery Project announced that the first Tesla Megapack 2XL units had arrived to the site, which is located outside of Rockhampton in Queensland, Australia. The project will eventually feature 324 Megapack units, set to arrive in the coming months, in order to support the 300MW/1,200MWh battery project.

“The Stanwell Battery is part of the diversification of our portfolio, to include cleaner and more flexible energy solutions,” said Angie Zahra, Stanwell Central Generation General Manager. “It is just one part of the 800 MW of battery energy storage capacity we have in our pipeline.

“Capable of discharging 300 MW of energy for up to four hours (1,200 MWh), our mega battery will be one of the largest in Queensland.”

Credit: Stanwell

Did you know Tesla’s Lathrop facility churns out a Megapack every 68 minutes? That’s enough energy to power 3,600 homes for an hour per unit! ⚡️ pic.twitter.com/bG6fpHkB9O

— TESLARATI (@Teslarati) June 11, 2025

READ MORE ON TESLA MEGAPACKS: Tesla Lathrop Megafactory celebrates massive Megapack battery milestone

The state is working with government-owned company Yurika to facilitate construction, and the process is expected to create roughly 80 jobs. The project is expected to come fully online in May 2027, with initial commissioning of the Megapacks aiming for November 2025.

The Stanwell Battery is set to replace the nearby Stanwell coal generation plant, which the government is planning to wind down starting in 2026 as part of efforts to reach an 80 percent renewable energy generation ratio by 2035. Meanwhile, the government is also set to begin winding down the Tarong and Callide coal plants, while several other Megapack projects are being built or coming online. o ya

Tesla currently has two Megapack production facilities, located in Lathrop, California, in the U.S. and another that came online earlier this year in Shanghai, China. The Shanghai Megafactory shipped its first units to Australia in March, while both factories are expected to be capable of producing 10,000 Megapack units per year upon reaching volume production.

News

The Tesla Diner is basically finished—here’s what it looks like

The company first broke ground on the Diner, Drive-in, and Supercharger location in September 2023. Now, it has served one of its first internal customers.

Tesla has finally completed the construction of its highly anticipated Diner, Drive-in, and Supercharger in Los Angeles, and recent photos of the interior’s “retro-futuristic” style are making their way around the internet.

X user Brad Goldberg shared photos from the Tesla Diner site last Tuesday, depicting some of the Supercharger stalls, indoor and outdoor seating areas, multiple neon lights, and even an Optimus robot. Goldberg also noted that there had been a “flurry of activity on site” while he was snapping the photos last week, suggesting that the restaurant location could be getting close to opening.

The Tesla Diner also served one of its first internal customers in the past few days, as Elon Musk posted on X on early Monday morning that he had just finished up eating a meal at the site:

I just had dinner at the retro-futuristic Tesla diner and Supercharger.

Team did great work making it one of the coolest spots in LA!

The photos also show that the site is pretty much done, with some of them even showing vehicles charging at the charging stalls.

You can see some of the latest photos of the Tesla Diner below.

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: TeslaKing420 | X

Credit: TeslaKing420 | X

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

READ MORE ON TESLA’S LA DINER: Tesla readies Drive-In Diner Supercharger for launch with app inclusion

When will the Tesla Diner open to external customers?

While it’s still not open to external customers yet, the news again suggests that the company could be close to an official opening date. Tesla first broke ground on the Diner in September 2023, after receiving a wave of building permit approvals throughout that year. Teslarati also covered much of the construction progress throughout last year, including when crews installed the first and second drive-in screens.

Located at 7001 West Santa Monica Boulevard, the idea was first discussed in 2018 by Musk and a few others on Twitter, featuring 1950s rock and roll, waiters on roller skates, and drive-in movie theater screens playing clips from some of history’s best movies. Notably, the photos of the front doors also show that the site will be open 24 hours a day, 7 days a week, whenever it does end up opening.

Tesla’s progress on Supercharger with diner, drive-in seen in aerial footage

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News2 days ago

News2 days agoTesla debuts hands-free Grok AI with update 2025.26: What you need to know

-

Elon Musk4 days ago

Elon Musk4 days agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

Elon Musk7 days ago

Elon Musk7 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

News1 week ago

News1 week agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Memphis data center receives air permit despite community criticism

-

News4 days ago

News4 days agoTesla begins Robotaxi certification push in Arizona: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla scrambles after Musk sidekick exit, CEO takes over sales