News

Tesla makes offer to acquire SolarCity, Elon Musk doubles down

BREAKING: Tesla’s board of directors has made a bid to acquire SolarCity. The proposed acquisition of SolarCity by Tesla would amount to an approximate $2.8 billion stock-only deal or a premium of 21% to 30% over today’s SolarCity (NASDAQ:SCTY) closing price.

The two companies have shared history with one another through strategic partnerships that have allowed each company to leverage its core technology to provide clean energy and off-grid energy storage. Not only do both companies share a mission rooted in accelerating the transition to a sustainable energy future, they also share arguably the most critical component to driving this mission forward – Elon Musk.

Musk sits as chairman at SolarCity and also the largest individual shareholder of the company. He’s also majority shareholder and CEO at Tesla, now split into automotive division Tesla Motors, and Tesla Energy which designs and manufacturers the Powerall and Powerpack lithium-ion battery storage system used in SolarCity’s massive solar power projects.

By combining the two entities, Tesla will be able to effectively control design, strategy, and production by ultimately unifying operations under a single umbrella. Tesla’s statement reads:

“We believe that the possibilities for product, service and operational synergies would be substantial, and that a combination would allow our companies to build on our respective core competencies and remain at the forefront of delivering innovative approaches for sustainable transportation and energy.”

Full Statement from Tesla:

Tesla’s mission has always been tied to sustainability. We seek to accelerate the world’s transition to sustainable transportation by offering increasingly affordable electric vehicles. And in March 2015, we launched Tesla Energy, which through the Powerwall and Powerpack allow homeowners, business owners and utilities to benefit from renewable energy storage.

It’s now time to complete the picture. Tesla customers can drive clean cars and they can use our battery packs to help consume energy more efficiently, but they still need access to the most sustainable energy source that’s available: the sun.

The SolarCity team has built its company into the clear solar industry leader in the residential, commercial and industrial markets, with significant scale and growing customer penetration. They have made it easy for customers to switch to clean energy while still providing the best customer experience. We’ve seen this all firsthand through our partnership with SolarCity on a variety of use cases, including those where SolarCity uses Tesla battery packs as part of its solar projects.

So, we’re excited to announce that Tesla today has made an offer to acquire SolarCity. A copy of Tesla’s offer is provided below.

If completed, we believe that a combination of Tesla and SolarCity would provide significant benefits to our shareholders, customers and employees:

- We would be the world’s only vertically integrated energy company offering end-to-end clean energy products to our customers. This would start with the car that you drive and the energy that you use to charge it, and would extend to how everything else in your home or business is powered. With your Model S, Model X, or Model 3, your solar panel system, and your Powerwall all in place, you would be able to deploy and consume energy in the most efficient and sustainable way possible, lowering your costs and minimizing your dependence on fossil fuels and the grid.

- We would be able to expand our addressable market further than either company could do separately. Because of the shared ideals of the companies and our customers, those who are interested in buying Tesla vehicles or Powerwalls are naturally interested in going solar, and the reverse is true as well. When brought together by the high foot traffic that is drawn to Tesla’s stores, everyone should benefit.

- We would be able to maximize and build on the core competencies of each company. Tesla’s experience in design, engineering, and manufacturing should help continue to advance solar panel technology, including by making solar panels add to the look of your home. Similarly, SolarCity’s wide network of sales and distribution channels and expertise in offering customer-friendly financing products would significantly benefit Tesla and its customers.

- We would be able to provide the best possible installation service for all of our clean energy products. SolarCity is the best at installing solar panel systems, and that expertise translates seamlessly to the installation of Powerwalls and charging systems for Tesla vehicles.

- Culturally, this is a great fit. Both companies are driven by a mission of sustainability, innovation, and overcoming any challenges that stand in the way of progress.

Today’s offer to acquire SolarCity is only the first step toward a successful combination of Tesla and SolarCity. We will provide a further update if and when an agreement is reached.

June 20, 2016

Mr. Lyndon R. Rive

Chief Executive Officer

SolarCity Corporation

3055 Clearview Way

San Mateo, CA 94402

Dear Lyndon:

We are pleased to submit to you and the SolarCity board of directors a proposal to acquire all of the outstanding shares of common stock of SolarCity in exchange for Tesla common shares. Subject to completing due diligence, we propose an exchange ratio of 0.122x to 0.131x shares of Tesla common stock for each share of SolarCity common stock. This proposal represents a value of $26.50 to $28.50 per share, or a premium of approximately 21% to 30% over the closing price of SolarCity’s shares, based on today’s closing price of SolarCity’s shares and the 5-day volume weighted average price of Tesla shares. We believe that our proposal offers fair and compelling value for SolarCity and its stockholders, while also giving SolarCity’s stockholders the opportunity to receive Tesla common stock at a premium exchange ratio and the opportunity to participate in the success of the combined company through their ongoing ownership of Tesla stock.

The board of directors of Tesla is excited at the prospect of a potential combination of SolarCity’s business with Tesla. We believe that the possibilities for product, service and operational synergies would be substantial, and that a combination would allow our companies to build on our respective core competencies and remain at the forefront of delivering innovative approaches for sustainable transportation and energy. We believe that a combination would generate significant benefits for stockholders, customers and employees of both Tesla and SolarCity.

We are committed to a possible transaction that is fair to SolarCity’s and Tesla’s respective stockholders. To help ensure that, Tesla is prepared to make the consummation of a combination of our companies subject to the approval of a majority of disinterested stockholders of both SolarCity and Tesla voting on the transaction. In addition, as a result of their overlapping directorships, Elon Musk and Antonio Gracias have recused themselves from voting on this proposal at the Tesla board meeting at which it was approved, and will recuse themselves from voting on this proposal at the SolarCity board as well. We believe that any transaction should be the result of full and fair deliberation and negotiation by both of our boards and the fully-informed consideration of our respective stockholders.

Our proposal is subject to the satisfactory completion of due diligence, the negotiation of mutually agreeable definitive transaction documents, and final approval by the Tesla board. While a transaction would be further subject to customary and usual closing conditions, we believe that Tesla is well positioned to negotiate and complete the transaction in an expedited manner. We do not anticipate significant regulatory or other obstacles in consummating a mutually beneficial transaction promptly.

In light of Elon Musk’s SEC disclosure obligations in his individual capacity as a stockholder of SolarCity this proposal will be publicly disclosed, but Tesla’s intention is to proceed only on a friendly basis.

We look forward to discussing a potential transaction with you, and hope to expeditiously enter into a definitive agreement.

Sincerely,

The Board of Directors of

Tesla Motors, Inc.

News

Tesla Cybertruck gets Full Self-Driving v14 release date, sort of

Tesla Cybertruck owners are wondering when they will get access to the company’s Full Self-Driving version 14.1 that rolled out to other owners today for the first time.

Cybertruck owners typically receive Full Self-Driving updates slightly later than other drivers, as the process for the all-electric pickup is different. It is a larger vehicle that requires some additional attention from Tesla before FSD versions are rolled out, so they will be slightly delayed. CEO Elon Musk said the all-wheel steering technically requires a bit more attention before rollout as well.

The all-wheel steering of Cybertruck requires a bit more Autopilot training

— Elon Musk (@elonmusk) October 7, 2025

After some owners got access to the v14.1 Full Self-Driving suite this morning, Cybertruck owners sought out a potential timeframe for when they would be able to experience things for themselves.

Tesla owners show off improvements with new Full Self-Driving v14 rollout

They were able to get an answer from Ashok Elluswamy, Tesla’s Head of AI, who said:

“We got you. Coming soon.”

We got you. Coming soon.

— Ashok Elluswamy (@aelluswamy) October 7, 2025

The release of FSD v14.1 for Cybertruck will not be tempered, either. Elluswamy then confirmed that Tesla would be rolling out the full-featured FSD v14 for the pickup, meaning it would be able to reverse and park itself, among other features.

Elluswamy said it would be capable of these features, which were void in other FSD releases for Cybertruck in the past.

Tesla’s rollout of FSD v14.1 brings several extremely notable changes and improvements to the suite, including more refined operation in parking garages, a new ability to choose parking preferences upon arriving at your destination, a new driving mode called “Sloth,” which is even more reserved than “Chill,” and general operational improvements.

Those who were lucky enough to receive the suite have already started showing off the improvements, and they definitely seem to be a step up from what v13’s more recent versions were capable of.

CEO Elon Musk called v14 “sentient” a few weeks back, and it seems that it is moving toward that. However, he did state that additional releases with more capabilities would be available in the coming weeks, but many owners are still waiting for this first version.

News

Tesla launches two new affordable models with ‘Standard’ Model 3, Y offerings

It is the first time Tesla has revealed any details about what it planned to launch in terms of its new, lower-cost vehicles, which are mainly aimed at countering the loss of the $7,500 EV tax credit.

Tesla has officially launched its affordable models with the new Model 3 and Model Y ‘Standard’ versions hitting the company’s Online Design Studio on Tuesday.

It is the first time Tesla has revealed any details about what it planned to launch in terms of its new, lower-cost vehicles, which are mainly aimed at countering the loss of the $7,500 EV tax credit.

Here’s what Tesla went with for its release of the new affordable models.

Tesla Model Y ‘Standard’

The Model Y Standard is a stripped-down version of the all-electric crossover and starts at $39,990.

- Credit: Tesla

- Credit: Tesla

- Credit: Tesla

- Credit: Tesla

Deliveries are slated for November and December, the company says if you plan to order one, and it comes with a few major changes to improve efficiency and bring down cost for owners.

- New athletically tuned exterior and new alloy wheels to improve aerodynamics

- 15.4″ touchscreen in the front, the same as the other trims

- Available in three colors: Stealth Grey (free), White ($1,oo0 extra), Diamond Black ($1,500 extra)

- Textile and vegan leather interior

- Range sits at 321 miles

- New front fascia

- Covered glass roof (textile on inside)

- Windows are not acoustically laminated for a quieter cabin

- Manual mirrors and seats

- Smaller frunk

- No rear infotainment screen

- No basic Autopilot

- 69 kWh battery

- New 19″ Aperture wheels

- 0-60 MPH in 6.8 seconds

- 7 speaker stereo, down from 15 speakers in premium models

🚨 BREAKING: Tesla has launched the new Model Y ‘Standard’ for $39,990

Here’s what’s new: 🧵 pic.twitter.com/ILxbEsEniX

— TESLARATI (@Teslarati) October 7, 2025

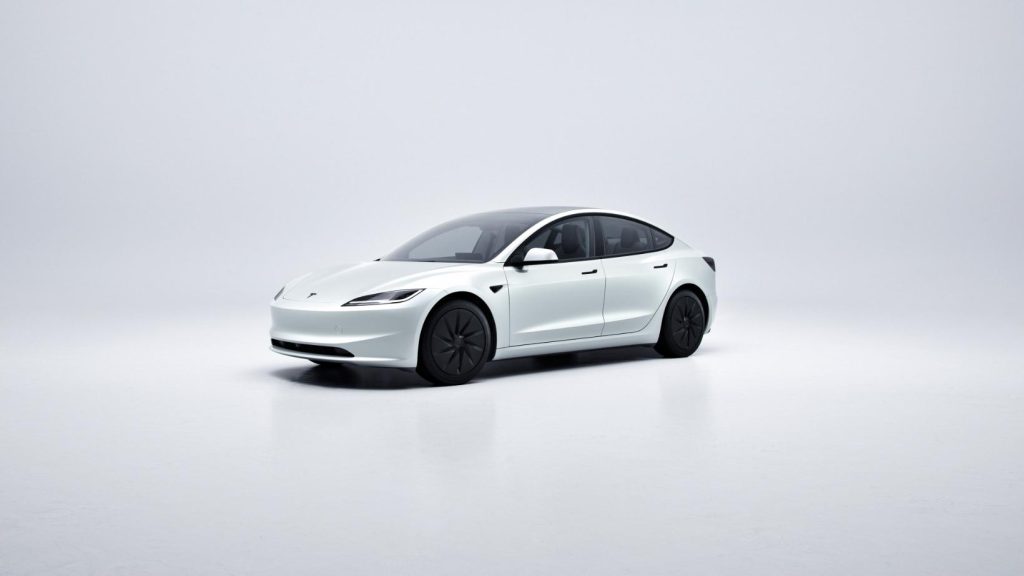

Tesla Model 3 ‘Standard’

The Model 3 Standard was a surprise offering from Tesla, as many had only anticipated the company to refine and offer a more affordable version of the Model Y.

Coming in at $36,990, it features many of the same changes Tesla made with the Model Y “Standard,” all ways to improve price and make it less flashy than the more premium offerings.

Deliveries are also slated for November for this vehicle, and it features relatively the same stripped-down offerings as the Model Y Standard.

- Available in three colors: Stealth Grey (free), White ($1,oo0 extra), Diamond Black ($1,500 extra)

- Textile and vegan leather interior

- Range sits at 321 miles

- Covered glass roof (textile on inside)

- Manual mirrors and seats

- No rear infotainment screen

- No basic Autopilot

- 69 kWh battery

- New 19″ Aperture wheels

- 0-60 MPH in 6.8 seconds

- 7 speaker stereo, down from 15 speakers in premium models

@teslarati 🚨 Tesla’s Affordable Models are here! Let’s talk about them! #tesla #fyp #viral #teslaev #elonmusk ♬ Natural Emotions – Muspace Lofi

Elon Musk

Tesla owners show off improvements with new Full Self-Driving v14 rollout

Some of the big things that Tesla faced head-on with the development and release of v14 were navigating in parking garages and handling parking after arriving at a destination.

Tesla owners with access to the company’s Full Self-Driving new version, v14, which rolled out on Tuesday morning, are showcasing some of the very impressive improvements that have arrived.

CEO Elon Musk called v14 “sentient” a few weeks ahead of its rollout, claiming the newest iteration of the company’s Full Self-Driving platform would be the most accurate to date.

Tesla FSD (Supervised) V14.1 with Robotaxi-style dropoffs is here

It was obvious this narrative had Tesla owners keeping their expectations high, as there were very evidently things that needed to be improved upon that were present in v13. I wrote about several improvements I was hoping to see, and based on the release notes for v14, Tesla did have these things in the works already.

Some of the big things that Tesla faced head-on with the development and release of v14 were navigating in parking garages and handling parking after arriving at a destination.

Tesla said it was working to increase the capabilities of Summon within parking garages, as many owners believe that is where it would be the most beneficial.

While that does not appear to be part of this initial v14 rollout, it does seem Tesla is focused on improving the suite’s ability to navigate through these garages, including stopping for a ticket to enter the facility, finding a spot, and parking in an appropriate space.

It was evident this was a huge improvement based on one example from an owner who received v14:

FSD v14 navigates parking garages really well. Here’s a full clip of it leaving a parking spot, going through the garage, waiting for me to put the ticket in, and exiting.

Almost feels like it can read the signs above to go find the exit, with a complex garage here.@Tesla_AI pic.twitter.com/fv9j6LNcp6

— Zack (@BLKMDL3) October 7, 2025

If you look closely, you will even see the car shift slightly to the right when it arrives at the ticketing station, making it easier for the driver to hand over their ticket and payment. It then moves back out to the right when leaving to return to the center of the lane. It’s very intuitive.

Additionally, it appears to be more accurate when parking, thanks to improvements that enable owners to select the type of parking upon arrival at a destination.

In the v14.1 release notes, Tesla said that it has added “Arrival Options for you to select where FSD should park: in a Parking Lot, on the Street, in a Driveway, in a Parking Garage, or at the Curbside.”

One owner chose to navigate home and chose a garage to park in. Full Self-Driving performed it without any issues:

Not only can FSD 14.1 pull into my gravel driveway (no version before has done this) it can pull into the garage. pic.twitter.com/pweI5JKWHD

— Dirty Tesla (@DirtyTesLa) October 7, 2025

These are just two evident improvements so far, and there are likely many more on the way. The changes and fixes will be tracked by anyone with access to FSD v14 in the coming weeks.

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla FSD V14 set for early wide release next week: Elon Musk

-

News1 week ago

News1 week agoElon Musk gives update on Tesla Optimus progress

-

News2 weeks ago

News2 weeks agoTesla has a new first with its Supercharger network

-

News2 weeks ago

News2 weeks agoTesla job postings seem to show next surprise market entry

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla gets new Street-high price target with high hopes for autonomy domination

-

Lifestyle1 week ago

Lifestyle1 week ago500-mile test proves why Tesla Model Y still humiliates rivals in Europe

-

News1 week ago

News1 week agoTesla Giga Berlin’s water consumption has achieved the unthinkable

-

Lifestyle1 week ago

Lifestyle1 week agoTesla Model S Plaid battles China’s 1500 hp monster Nurburgring monster, with surprising results