Battery suppliers from South Korea are moving production to the U.S. to compete with Chinese rivals.

According to a report from Korea IT News, as part of the Inflation Reduction Act’s passage requiring U.S.-made batteries and battery materials in electric vehicles, South Korean companies are seizing the opportunity to compete with Chinese battery suppliers who have dominated the market. Samsung, SK, LG Chem, and more are leading the seismic shift in where battery material production and assembly occurs.

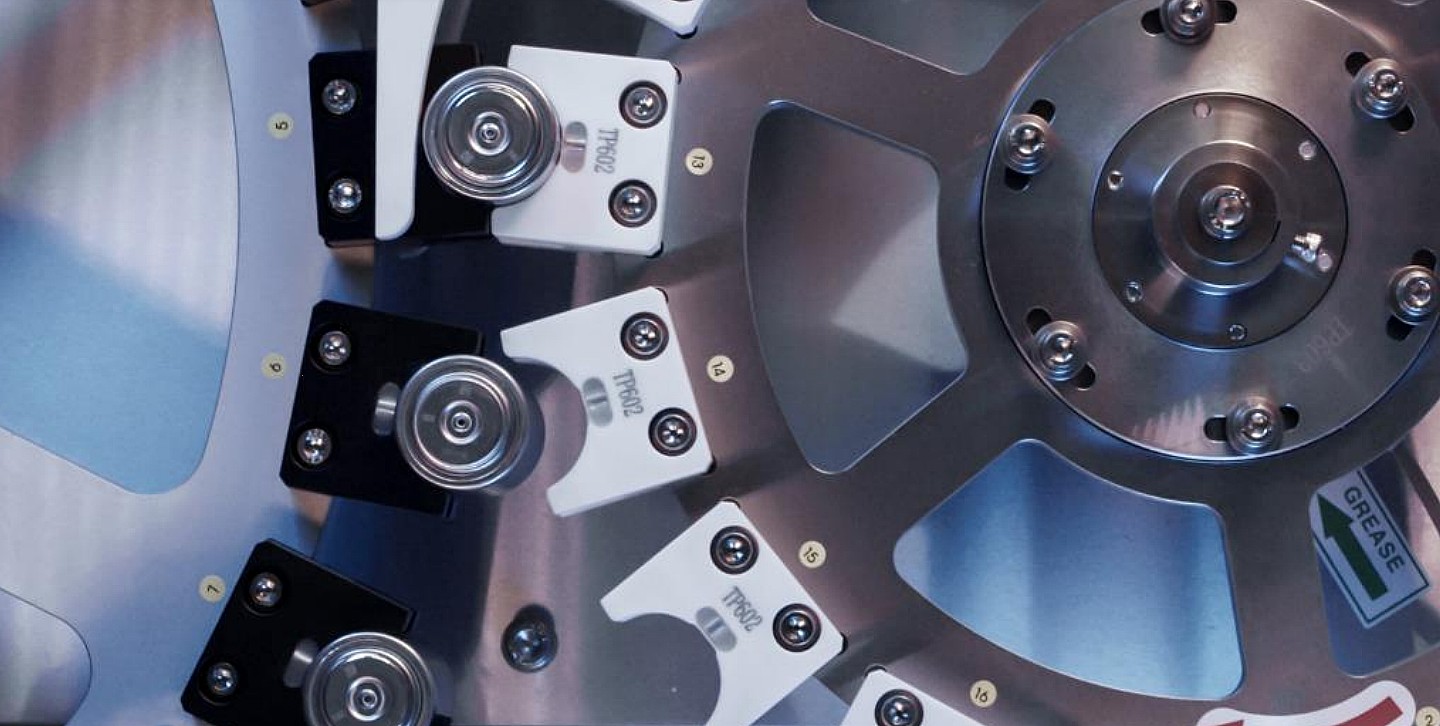

There are some key components in the production of batteries: anode material, cathode material, electrolyte, separator material, and fire safety materials (primarily graphite). Production of raw resources and assembly into lithium-ion batteries has been dominated by Chinese suppliers such as CATL. Still, many companies are opening new facilities in the U.S. and South Korea to challenge the market leader.

In producing cathode and anode materials, EcoProBM and POSCO Chemical are looking to grow production outside China, mainly in the U.S. EcoProBM is looking to expand its current raw material output from 50,000 tons to 200,000 tons by 2024 and will be looking to do so at both existing South Korean plants and a new U.S. production facility. POSCO Chemical is aiming to grow production to 220,000 tons by 2025 and 440,000 tons by 2030 via a new U.S. production facility. POSCO Chemical is also one of a few companies looking to start production of artificial graphite in the U.S. via a new production facility.

Enchem, another South Korean company, is also looking to expand production in the U.S. Their facility will focus on electrolyte and separator materials.

These companies are working to feed an ever-increasing number of battery assembly factories from Samsung, LG Chem, and SK in the U.S. that are looking to meet North American demand for EVs. It is unclear how Chinese manufacturers will respond or if companies such as CATL will consider moving production to the U.S. to compete with these new domestic suppliers.

How will this affect EV prices around the world? It could lead to lower EV prices in the U.S. Domestic manufacturers will now be closer to suppliers, reducing the materials’ shipping costs. When vehicles like the Ford F150 Lightning have seen dramatic price increases due to battery supply shortages, this could be welcome news to consumers. Yet there is still a lot of time before production and assembly in the U.S. will reach a level that will influence prices.

What do you think of the article? Do you have any comments, questions, or concerns? Shoot me an email at william@teslarati.com. You can also reach me on Twitter @WilliamWritin. If you have news tips, email us at tips@teslarati.com!

Cybertruck

Tesla drops latest hint that new Cybertruck trim is selling like hotcakes

According to Tesla’s Online Design Studio, the new All-Wheel-Drive Cybertruck will now be delivered in April 2027. Earlier orders are still slated for early this Summer, but orders from here on forward are now officially pushed into next year:

Tesla’s new Cybertruck offering has had its delivery date pushed back once again. This is now the second time, and deliveries for the newest orders are now pushed well into 2027.

According to Tesla’s Online Design Studio, the new All-Wheel-Drive Cybertruck will now be delivered in April 2027. Earlier orders are still slated for early this Summer, but orders from here on forward are now officially pushed into next year:

🚨 Tesla has updated the $59,990 Cybertruck Dual Motor AWD’s estimated delivery date to April 2027.

First deliveries are still slated for June, but if you order it now, you’ll be waiting over a year.

Demand appears to be off the charts for the new Cybertruck and consumers are… pic.twitter.com/raDCCeC0zP

— TESLARATI (@Teslarati) February 26, 2026

Just three days ago, the initial delivery date of June 2026 was pushed back to early Fall, and now, that date has officially moved to April 2027.

The fact that Tesla has had to push back deliveries once again proves one of two things: either Tesla has slow production plans for the new Cybertruck trim, or demand is off the charts.

Judging by how Tesla is already planning to raise the price based on demand in just a few days, it seems like the company knows it is giving a tremendous deal on this spec of Cybertruck, and units are moving quickly.

That points more toward demand and not necessarily to slower production plans, but it is not confirmed.

Tesla Cybertruck’s newest trim will undergo massive change in ten days, Musk says

Tesla is set to hike the price on March 1, so tomorrow will be the final day to grab the new Cybertruck trim for just $59,990.

It features:

- Dual Motor AWD w/ est. 325 mi of range

- Powered tonneau cover

- Bed outlets (2x 120V + 1x 240V) & Powershare capability

- Coil springs w/ adaptive damping

- Heated first-row seats w/ textile material that is easy to clean

- Steer-by-wire & Four Wheel Steering

- 6’ x 4’ composite bed

- Towing capacity of up to 7,500 lbs

- Powered frunk

Interestingly, the price offering is fairly close to what Tesla unveiled back in late 2019.

Elon Musk

Elon Musk outlines plan for first Starship tower catch attempt

Musk confirmed that Starship V3 Ship 1 (SN1) is headed for ground tests and expressed strong confidence in the updated vehicle design.

Elon Musk has clarified when SpaceX will first attempt to catch Starship’s upper stage with its launch tower. The CEO’s update provides the clearest teaser yet for the spacecraft’s recovery roadmap.

Musk shared the details in recent posts on X. In his initial post, Musk confirmed that Starship V3 Ship 1 (SN1) is headed for ground tests and expressed strong confidence in the updated vehicle design.

“Starship V3 SN1 headed for ground tests. I am highly confident that the V3 design will achieve full reusability,” Musk wrote.

In a follow-up post, Musk addressed when SpaceX would attempt to catch the upper stage using the launch tower’s robotic arms.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk clarified.

His remarks suggest that SpaceX is deliberately reducing risk before attempting a tower catch of Starship’s upper stage. Such a milestone would mark a major step towards the full reuse of the Starship system.

SpaceX is currently targeting the first Starship V3 flight of 2026 this coming March. The spacecraft’s V3 iteration is widely viewed as a key milestone in SpaceX’s long-term strategy to make Starship fully reusable.

Starship V3 features a number of key upgrades over its previous iterations. The vehicle is equipped with SpaceX’s Raptor V3 engines, which are designed to deliver significantly higher thrust than earlier versions while reducing cost and weight.

The V3 design is also expected to be optimized for manufacturability, a critical step if SpaceX intends to scale the spacecraft’s production toward frequent launches for Starlink, lunar missions, and eventually Mars.

News

Tesla FSD (Supervised) could be approved in the Netherlands next month: Musk

Musk shared the update during a recent interview at Giga Berlin.

Tesla CEO Elon Musk shared that Full Self-Driving (FSD) could receive regulatory approval in the Netherlands as soon as March 20, potentially marking a major step forward for Tesla’s advanced driver-assistance rollout in Europe.

Musk shared the update during a recent interview at Giga Berlin, noting that the date was provided by local authorities.

“Tesla has the most advanced real-world AI, and hopefully, it will be approved soon in Europe. We’re told by the authorities that March 20th, it’ll be approved in the Netherlands,’ what I was told,” Musk stated.

“Hopefully, that date remains the same. But I think people in Europe are going to be pretty blown away by how good the Tesla car AI is in being able to drive.”

Tesla’s FSD system relies on vision-based neural networks trained on real-world driving data, allowing vehicles to navigate using cameras and AI rather than traditional sensor-heavy solutions.

The performance of FSD Supervised has so far been impressive. As per Tesla’s safety report, Full Self-Driving Supervised has already traveled 8.3 billion miles. So far, vehicles operating with FSD Supervised engaged recorded one major collision every 5,300,676 miles.

In comparison, Teslas driven manually with Active Safety systems recorded one major collision every 2,175,763 miles, while Teslas driven manually without Active Safety recorded one major collision every 855,132 miles. The U.S. average during the same period was one major collision every 660,164 miles.

If approval is granted on March 20, the Netherlands could become the first European market to greenlight Tesla’s latest supervised FSD (Supervised) software under updated regulatory frameworks. Tesla has been working to secure expanded FSD access across Europe, where regulatory standards differ significantly from those in the United States. Approval in the Netherlands would likely serve as a foundation for broader EU adoption, though additional country-level clearances may still be required.