News

The Boring Co. Chicago tunnel project under discussion with DOT officials

The Boring Company’s plans of building a high-speed underground transit system connecting downtown Chicago and O’Hare airport has taken a step forward, with Chicago Mayor Rahm Emanuel meeting with senior Department of Transportation officials on Monday. The meeting, which lasted for an hour, was held at the DOT headquarters in Washington.

“Mayor Emanuel provided DOT officials with an update on the Chicago Loop project. Chicago reaffirmed that there will be no federal funds involved. All parties agreed to work together and stay in close communication,” a DOT spokesman confirmed with Reuters on Thursday.

The Chicago Mayor met with several senior DOT officials, including Federal Railroad Administrator Ron Batory and Undersecretary of Transportation for Policy Derek Kan. The discussions reportedly covered several topics, such as the specific type of environmental review the high-speed underground tunnels would require, which transportation agency will oversee the project, and if the department would tap a specific person to oversee the approval of the tunnels’ permits.

The Chicago-O’Hare transit system is the Boring Company’s first high-profile undertaking. According to Tesla and SpaceX CEO Elon Musk, the Chicago tunnel, which will be more than 17 miles long, would cost roughly $1 billion to construct. The entire project will be privately funded, with no subsidies from taxpayers. As noted by Elon Musk in a press conference in Chicago, the initial digging on both sides of the planned tunnel could start in as early as three to four months. Musk expects the tunnel to be operational in 18-24 months after the initial digging.

The high-speed underground transit line is an opportunity for the Boring Company to flex its creative muscles and prove to the market that it is a serious player in the transportation industry. Prior to winning the contract in Chicago, the tunneling startup has only been involved in the construction of a test tunnel under the SpaceX headquarters in Hawthorne, CA, as well as a proposed proof-of-concept tunnel that is expected to run across Culver City in CA. With the Chicago-O’Hare project, however, the tunneling startup can ultimately prove that Elon Musk’s concept of an underground transit line is feasible and effective.

Based on the details that have been released about the project thus far, the Boring Co.’s Chicago initiative is set to showcase some impressive technology. The pods that will be used for the tunnels, for example, will be designed and manufactured by Tesla, a company that Musk heads. Each pod is capable of transporting up to 16 passengers at a time at speeds of up to 150 mph, thanks to an eight-wheel design that would be fitted on the sides of the vehicle. Travel time from downtown Chicago to O’Hare airport through the Boring Company’s tunnels is estimated to take around 12 minutes, far shorter than the 30-45 minutes the trip usually takes through conventional modes of transportation.

The Boring Company might be considered as a side project or hobby of Elon Musk, but the potential of the tunneling startup is substantial. Berenberg analyst Alexander Haissl, for one, noted that if the company does finish the Chicago-O’Hare tunnel, it could raise the Boring Company’s valuation to as much as $16 billion.

News

Tesla China registrations hit 20.7k in final week of June, highest in Q2

The final week of June stands as the second-highest of 2025 and the best-performing week of the quarter.

Tesla China recorded 20,680 domestic insurance registrations during the week of June 23–29, marking its highest weekly total in the second quarter of 2025.

The figure represents a 49.3% increase from the previous week and a 46.7% improvement year-over-year, suggesting growing domestic momentum for the electric vehicle maker in Q2’s final weeks.

Q2 closes with a boost despite year-on-year dip

The strong week helped lift Tesla’s performance for the quarter, though Q2 totals remain down 4.6% quarter-over-quarter and 10.9% year-over-year, according to industry watchers. Despite these declines, the last week of June stands as the second-highest of 2025 and the best-performing week of the quarter.

As per industry watchers, Tesla China delivered 15,210 New Model Y units last week, the highest weekly tally since the vehicle’s launch. The Model 3 followed with 5,470 deliveries during the same period. Tesla’s full June and Q2 sales data for China are expected to be released by the China Passenger Car Association (CPCA) in the coming days.

Tesla China and minor Model 3 and Model Y updates

Tesla manufactures the Model 3 and Model Y at its Shanghai facility, which provides vehicles to both domestic and international markets. In May, the automaker reported 38,588 retail sales in China, down 30.1% year-over-year but up 34.3% from April. Exports from Shanghai totaled 23,074 units in May, a 32.9% improvement from the previous year but down 22.4% month-over-month, as noted in a CNEV Post report.

Earlier this week, Tesla introduced minor updates to the long-range versions of the Model 3 and Model Y in China. The refreshed Model 3 saw a modest price increase, while pricing for the updated Model Y Long Range variant remained unchanged. These adjustments come as Tesla continues refining its China lineup amid shifting local demand and increased competition from domestic brands.

Elon Musk

Tesla investors will be shocked by Jim Cramer’s latest assessment

Jim Cramer is now speaking positively about Tesla, especially in terms of its Robotaxi performance and its perception as a company.

Tesla investors will be shocked by analyst Jim Cramer’s latest assessment of the company.

When it comes to Tesla analysts, many of them are consistent. The bulls usually stay the bulls, and the bears usually stay the bears. The notable analysts on each side are Dan Ives and Adam Jonas for the bulls, and Gordon Johnson for the bears.

Jim Cramer is one analyst who does not necessarily fit this mold. Cramer, who hosts CNBC’s Mad Money, has switched his opinion on Tesla stock (NASDAQ: TSLA) many times.

He has been bullish, like he was when he said the stock was a “sleeping giant” two years ago, and he has been bearish, like he was when he said there was “nothing magnificent” about the company just a few months ago.

Now, he is back to being a bull.

Cramer’s comments were related to two key points: how NVIDIA CEO Jensen Huang describes Tesla after working closely with the Company through their transactions, and how it is not a car company, as well as the recent launch of the Robotaxi fleet.

Jensen Huang’s Tesla Narrative

Cramer says that the narrative on quarterly and annual deliveries is overblown, and those who continue to worry about Tesla’s performance on that metric are misled.

“It’s not a car company,” he said.

He went on to say that people like Huang speak highly of Tesla, and that should be enough to deter any true skepticism:

“I believe what Musk says cause Musk is working with Jensen and Jensen’s telling me what’s happening on the other side is pretty amazing.”

Tesla self-driving development gets huge compliment from NVIDIA CEO

Robotaxi Launch

Many media outlets are being extremely negative regarding the early rollout of Tesla’s Robotaxi platform in Austin, Texas.

There have been a handful of small issues, but nothing significant. Cramer says that humans make mistakes in vehicles too, yet, when Tesla’s test phase of the Robotaxi does it, it’s front page news and needs to be magnified.

He said:

“Look, I mean, drivers make mistakes all the time. Why should we hold Tesla to a standard where there can be no mistakes?”

It’s refreshing to hear Cramer speak logically about the Robotaxi fleet, as Tesla has taken every measure to ensure there are no mishaps. There are safety monitors in the passenger seat, and the area of travel is limited, confined to a small number of people.

Tesla is still improving and hopes to remove teleoperators and safety monitors slowly, as CEO Elon Musk said more freedom could be granted within one or two months.

News

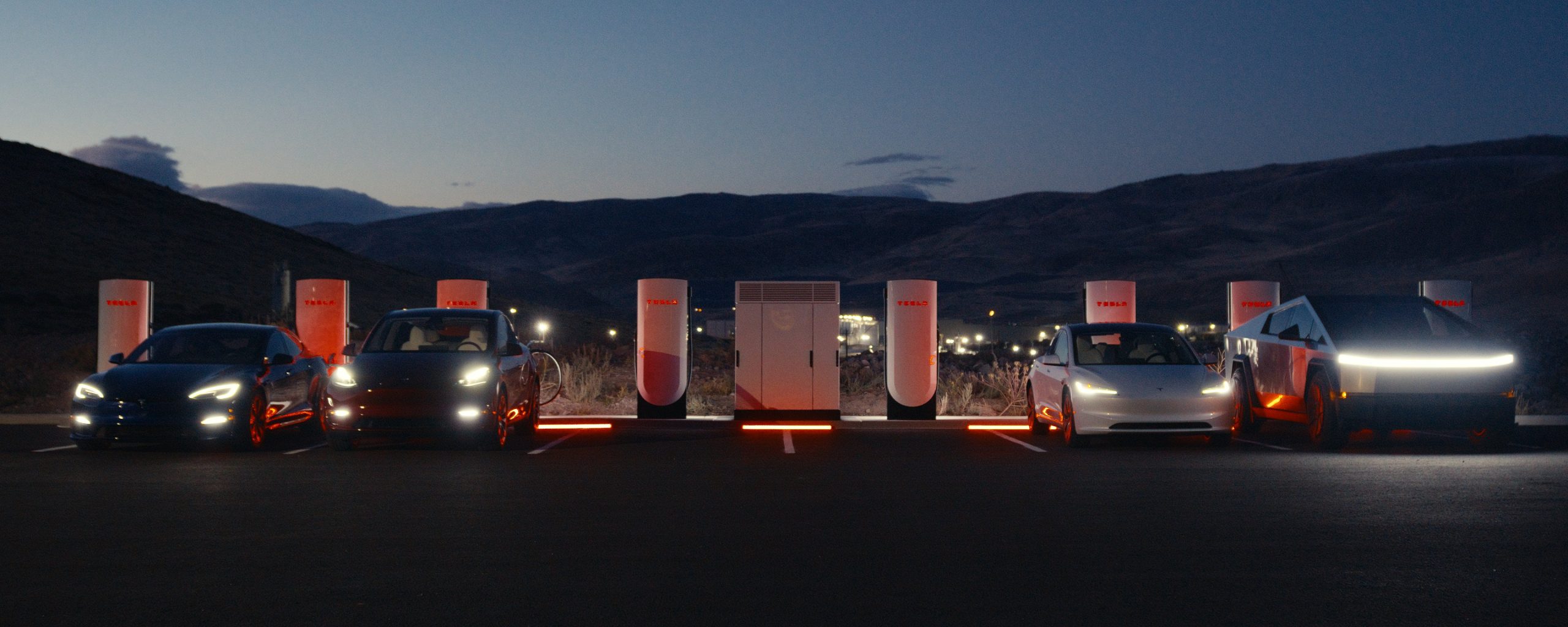

Tesla launches ultra-fast V4 Superchargers in China for the first time

Tesla has V4 Superchargers rolling out in China for the first time.

Tesla already has nearly 12,000 Supercharger piles across mainland China. However, the company just initiated the rollout of the ultra-fast V4 Superchargers in China for the first time, bringing its quick-charging piles to the country for the first time since their launch last year.

The first batch of V4 Superchargers is now officially up and running in China, the company announced in a post on Chinese social media outlet Weibo today.

The company said in the post:

“The first batch of Tesla V4 Superchargers are online. Covering more service areas, high-speed charging is more convenient, and six-layer powerful protection such as rain and waterproof makes charging very safe. Simultaneously open to non-Tesla vehicles, and other brands of vehicles can also be charged. There are more than 70,000 Tesla Superchargers worldwide. The charging network layout covers 100% of the provincial capitals and municipalities in mainland China. More V4 Superchargers will be put into use across the country. Optimize the charging experience and improve energy replenishment efficiency. Tesla will accompany you to the mountains, rivers, lakes, and seas with pure electricity!”

The first V4 Superchargers Tesla installed in China are available in four cities across the country: Shanghai, Zhejiang, Gansu, and Chongqing.

Credit: Tesla China

Tesla has over 70,000 Superchargers worldwide. It is the most expansive and robust EV charging network in the world. It’s the main reason why so many companies have chosen to adopt Tesla’s charging connector in North America and Europe.

In China, some EVs can use Tesla Superchargers as well.

The V4 Supercharger is capable of charging vehicles at speeds of up to 325kW for vehicles in North America. This equates to over 1,000 miles per hour of charging.

-

News6 days ago

News6 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk14 hours ago

Elon Musk14 hours agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News2 weeks ago

News2 weeks agoTesla confirms massive hardware change for autonomy improvement

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTesla features used to flunk 16-year-old’s driver license test

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep