News

Tesla will bundle car buying into “packages”, 90 kWh battery discontinued June 8

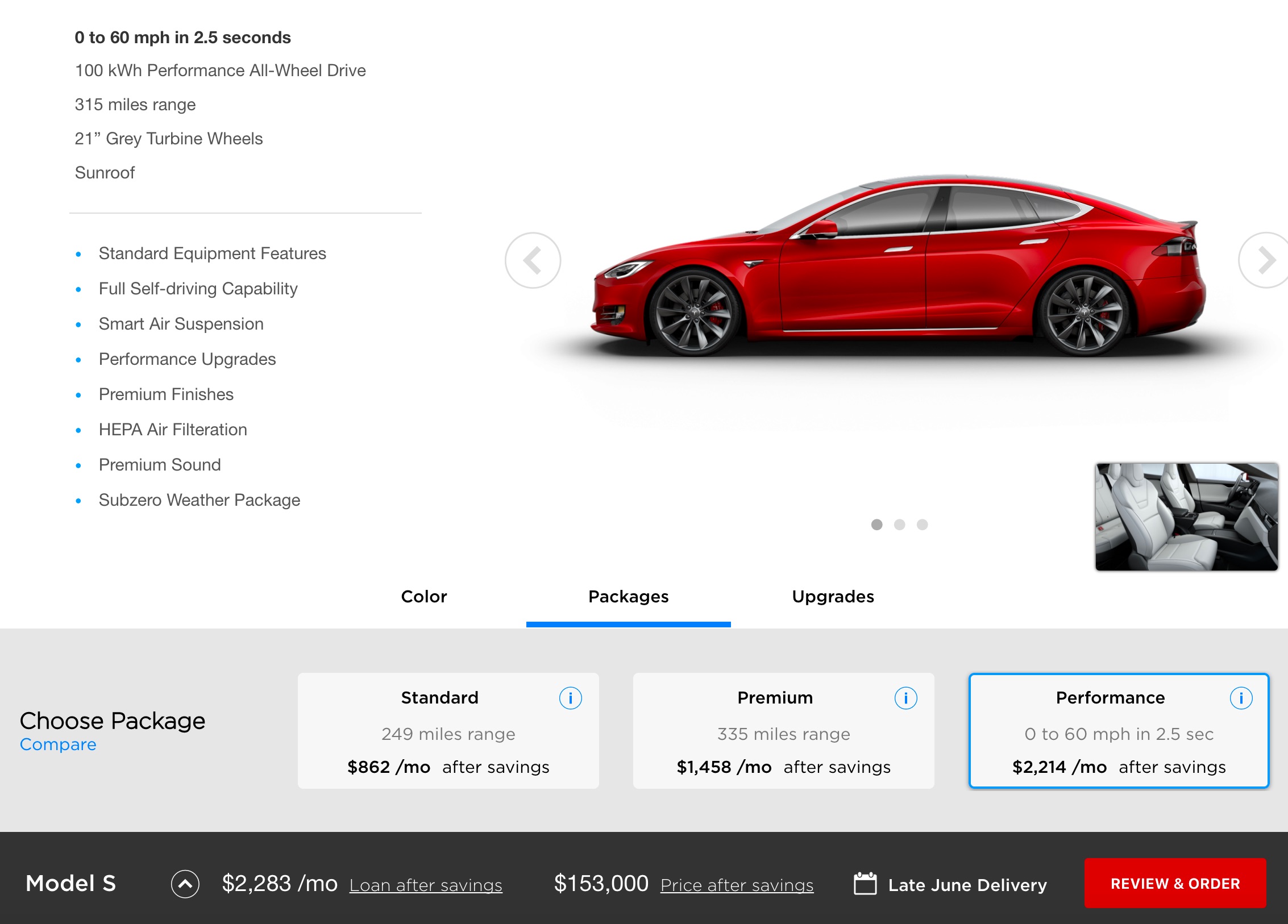

Tesla will launch an updated version of the Model S and Model X Design Studio that “packages” vehicle configurations into three categories: standard, premium and performance. The update will come ahead of the company’s planned production of its $35k mass market Tesla Model 3, and is likely a precursor to what the Model 3 online configurator will eventually look like.

Also spotted in the newly designed online vehicle configurator is the removal of the 90 kWh battery pack option that’s currently planned for discontinuation on June 8, according to sources and also validated by our friends at Model 3 Owners Club. Model S and Model X buyers will choose from either a “standard” configuration with a 75 kWh battery pack that’s capable of 249 miles of range on the Model S and 237 miles on the Model X, or a “premium” configuration that utilizes Tesla’s long-range 100 kWh battery pack. Model S will be capable of 335 miles of range on the 100 kWh pack while Model X will have just shy of a 300-mile-range per single charge. Lastly, adrenaline junkies will be able to select the “performance” package that trades driving range for increased acceleration.

The Design Studio redesign comes shortly after Tesla published a chart comparing the Model S and Model 3 that seems to clearly push their “anti-sell Model 3” approach. The chart reveals Tesla’s drastically reduced number of configurations being made available for Model 3, at less than 100, and over 1,500 possible configurations for Model S.

Comparing Model S vs Model 3 https://t.co/JPM9VVGbhA

— Elon Musk (@elonmusk) May 26, 2017

Tesla’s newest Design Studio with “packages” aims to simplify the car buying experience, but more importantly is a move that allows its production line to operate more efficiently by reducing the number of unique car configurations that can be built. Producing cars with like-kind features allows the factory team to build at faster speeds, with less complexity and at a lower cost.

ALSO SEE: Which Tesla Model 3 customizations will be available to initial buyers?

Tesla invested heavily into designing the Model 3 for scale. The Silicon Valley electric car maker underwent a full redesign of the manufacturing equipment used on its vehicle production line. Tesla also purchased German automation company Grohmann Engineering to form Tesla Advanced Automation Germany which reveals that the company will go to extreme lengths to truly optimize its manufacturing process.

On the new online Design Center configurator, customers can click on the Compare button in the lower left corner to pull up the full list of detailed options in each of the three major packages.

Tesla has previously pushed to optimize its offerings with the constant refinement of battery pack sizes and discontinuation of unpopular options. Further updates to the battery packs, like upgrading the Model S and Model X battery to utilize the new high energy density 2170 lithium ion cell being used in Model 3, are expected in the near future as Tesla’s Gigafactory begins volume production of battery cells.

Buyers looking for more granularity in terms of options will still be to use the original configurator.

News

Why Tesla’s Q4 performance could shock many after incredible Q3

There is still some residual impact to be felt as we enter Q4, and there is a potential shock coming to many investors as it could be stronger than what many think:

Tesla reported vehicle deliveries and energy deployments for the third quarter of 2025 today, blowing analyst estimations from Wall Street firms completely out of the water with its strongest three-month performance in company history.

The strong performance, which resulted in nearly half a million vehicle deliveries in the quarter, was largely driven by the momentum of the EV tax credit, which expired at the end of September, marking the end of the $7,500 discount that was previously available.

Tesla hits record vehicle deliveries and energy deployments in Q3 2025

This was a massive contributor to Tesla’s record-high in vehicle deliveries, as consumers rushed to take advantage of the credit.

There is still some residual impact to be felt as we enter Q4, and there is a potential shock coming to many investors as it could be stronger than what many think:

EV Tax Credit Deliveries Will Continue Through Q4

Despite the credit’s expiration, people will still be able to take advantage of it because the IRS changed the rules mid-quarter.

Prospective buyers can utilize the credit after September 30 if they place an order for an EV and make a marginal payment on the car.

Tesla’s $250 order deposit qualified as the marginal payment, so as long as the order was submitted before the end of the day on September 30, they could still take delivery in Q4 or even Q1 and still take advantage of the credit.

With the Model Y Performance launching in the U.S. on September 30, that undoubtedly contributed to some orders. However, there are likely many people who ordered in the latter portion of Q3 and have not yet taken delivery. These will all contribute to Q4 delivery figures.

Seasonal Holiday Boost

Tesla traditionally has its strongest quarters in Q4, as the company typically introduces initiatives such as price cuts, incentives, and other offers to close out the year strong.

Car buyers are more likely to jump at these offers as well, as gifts for either themselves or others. What Tesla does in the final quarter of the year is usually boosted by whatever types of offers it can make.

Affordable Model Production Ramp

Tesla is likely preparing for the launch of its affordable model, which is essentially a stripped-down Model Y.

Some rumors have been circulating within the community, indicating that the company is nearing the sale of this vehicle, which is coded within Tesla’s website as the “Model Y Standard.”

🚨 Looks like some coding was found on Tesla’s website that seems to hint the affordable Model Y is coming:

-Named “Model Y Standard”

-$39,990 starting priceInitial thoughts: this is completely unconfirmed, but was really hoping Tesla would get this closer to $30,000 https://t.co/RDR0ypQHB3

— TESLARATI (@Teslarati) October 1, 2025

If Tesla is able to lock in some good pricing on its affordable model, Tesla could see its quarterly figures return to QoQ growth, something that the company has not had in a few years.

News

Tesla hits record vehicle deliveries and energy deployments in Q3 2025

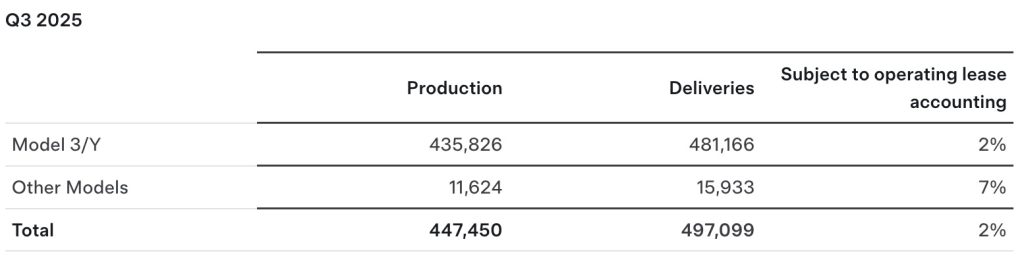

As per Tesla’s Q3 2025 vehicle delivery and production report, the bulk of the company’s numbers came from its mass-market lineup.

Tesla (NASDAQ:TSLA) reported record-breaking results for the third quarter of 2025, producing 447,450 vehicles and delivering 497,099 units worldwide.

The company also deployed 12.5 GWh of energy storage products, setting a new record in its fast-growing energy business.

Model 3/Y domination

As per Tesla’s Q3 2025 vehicle delivery and production report, the bulk of the company’s numbers came from its mass-market lineup. The Model 3 sedan and Model Y crossover accounted for 435,826 units produced and 481,166 delivered in the quarter. This is quite impressive considering that both the Model 3 and Model Y are still premium-priced vehicles with numerous competitors that are significantly more affordable.

Other models, including the Model S, Model X, and Cybertruck, contributed 11,624 vehicles produced and 15,933 delivered. Beyond vehicles, Tesla’s energy business posted its best quarter to date, deploying 12.5 GWh of storage systems.

Q3 2025 earnings call date

Tesla’s third-quarter results are extremely impressive, and they exceed Wall Street’s estimates by a significant margin. As per Benchmark analyst Mickey Legg, who had a delivery estimate of 442,000 vehicles in Q3, Wall Street consensus was at 448,000 units. Even more optimistic analysts estimated that Tesla would only post deliveries in the mid-460,000s.

Investors will gain further insight later this month when Tesla reports full financials for the quarter. The company will release Q3 2025 earnings after market close on October 22, followed by a Q&A webcast at 4:30 p.m. Central Time.

Elon Musk

Elon Musk is halfway towards becoming the world’s first trillionaire

Musk’s fortune remains heavily tied to Tesla, which has rallied nearly 100% since April.

Elon Musk has reached a new milestone by becoming the first individual in history to achieve a net worth of $500 billion. Forbes’ Real-Time Billionaires tracker confirmed the record Wednesday afternoon after Tesla stock gained nearly 4%, adding an estimated $9.3 billion to Musk’s net worth in a single day.

He now sits more than $150 billion ahead of Oracle co-founder Larry Ellison, whose net worth also stands at a very impressive $350 billion.

Tesla stock leads wealth surge

Musk’s fortune remains heavily tied to Tesla, which has rallied nearly 100% since April, when the CEO announced he would step back from outside roles to focus more on the EV maker. The company’s market capitalization is back within 10% of its all-time peak, lifting the value of Musk’s 12% stake to about $191 billion.

Beyond this, his 2018 compensation package, which was rescinded by a Delaware judge last year but is still under appeal, could unlock additional stock worth more than $130 billion if reinstated, Forbes noted. Investors see Musk’s refocused leadership as a stabilizing force for Tesla as it pursues ambitious global growth. Tesla has also proposed a new compensation plan for Musk that could bring the company’s market cap to $8.5 trillion and add an additional $900 billion to the CEO’s net worth.

SpaceX and xAI boost portfolio value

While Tesla drives much of his wealth, Musk’s stakes in SpaceX and xAI have added significant upside to his net worth. SpaceX, his private rocket company, recently hit a $400 billion valuation in a private tender offer, valuing Musk’s 42% stake at $168 billion. Meanwhile, xAI Holdings, which merged with social platform X earlier this year, is worth an estimated $113 billion, giving Musk another $60 billion on paper.

These ventures, combined with Tesla’s resurgence, have pushed Musk’s net worth past the half-trillion-dollar mark and highlighted his reach across multiple industries, from clean energy to space, artificial intelligence, brain implants, and tunneling.

-

Elon Musk1 week ago

Elon Musk1 week agoTesla FSD V14 set for early wide release next week: Elon Musk

-

News5 days ago

News5 days agoElon Musk gives update on Tesla Optimus progress

-

News1 week ago

News1 week agoTesla has a new first with its Supercharger network

-

News1 week ago

News1 week agoTesla job postings seem to show next surprise market entry

-

News1 week ago

News1 week agoTesla makes a big change to reflect new IRS EV tax credit rules

-

Investor's Corner6 days ago

Investor's Corner6 days agoTesla gets new Street-high price target with high hopes for autonomy domination

-

Lifestyle5 days ago

Lifestyle5 days ago500-mile test proves why Tesla Model Y still humiliates rivals in Europe

-

News3 days ago

News3 days agoTesla Giga Berlin’s water consumption has achieved the unthinkable