News

Exclusive: How NIO plans to stay a step ahead of Tesla and German rivals in China

In a high-end shopping district in Shanghai, China sits one of the newest, premium electric vehicles in the market: the mid-sized, all-electric NIO ES6 sports utility vehicle.

Taking the spotlight inside an expansive showroom of curved glass windows, terrazzo floors, and light douglas fir wood walls, the NIO House retail gallery is as much a high-tech electronics store as it is an experience.

Five years ago, NIO didn’t even exist; it was merely an idea in tech-mogul William Li’s head. Li partnered up with Jack Cheng, a former Fiat and Ford Executive, and Lihong Qin, a former real estate executive, to form a next-generation automobile company. Since then, NIO has delivered over 15,000 vehicles, employs over 9,500 people, and built an extensive charging and battery swapping network, as the company looks to become the de-facto brand in the burgeoning electric mobility market.

NIO’s journey over the last five years hasn’t been comfortable, or cheap; the company has raised over $3.5B from investors, including a public offering on the New York Stock Exchange last year (NYSE: NIO). But the fact that the company is producing and delivering vehicles to consumers puts NIO in rare company. Aside from Tesla who spent nine years to bring their first mass production vehicle to the market, other electric vehicle companies, including Faraday Future, Lucid Motors, Canoo, and Byton have yet to deliver a vehicle to customers, let alone build a factory for car production.

While it’s become commonplace to hear NIO being referred to as “the Tesla of China” – both are publicly traded companies that design and manufacture premium electric vehicles – the differences far outweigh their similarities. Where Tesla seeks to streamline its retail presence, NIO is investing heavily into the buildout of designer showrooms and members-only clubs for vehicle owners. Tesla has focused exclusively on fast-charging solutions, yet NIO is placing a massive bet on battery swapping technology and a move-fast-at-lower-risk manufacturing strategy that puts the company a step ahead of the competition.

Manufacturing in China

Five and a half hours outside of Shanghai (two hours by bullet train) in Hefei, China, NIO is building thousands of electric vehicles in a state of the art factory. Spooling up production last April, it’s an understatement to say that NIO was new to the vehicle manufacturing business. While the company had spent years developing their electric platform and first SUV, the ES8, they lacked manufacturing expertise to bring it to market. Designing and building their own factory, costing billions and taking years, wasn’t an option. Instead, NIO partnered with the state-owned manufacturer, JAC Motors.

JAC and NIO were considered an odd couple when the two announced their partnership in April 2016; JAC more well-known for their low-cost vehicles, rather than their craftsmanship. Outside of their automotive manufacturing expertise, JAC holds a highly coveted license to manufacture cars in China. Such a permit and strong relationship with the government is attractive to NIO and other automakers, including VW who is considering purchasing a large chunk of JAC. “Last November, the Chinese government endorsed this type of joint-manufacturing structure. With that preferential policy in place, NIO can put more investment and focus into R&D and the development of our user network and services,” William Li, NIO’s CEO, told Teslarati.

To counter perceptions of low-quality, NIO decided to bring on their own manufacturing team, to ensure that the vehicles were not only as high-quality as the competition, but better.

Enter Feng Shen and Victor Gu, two former Volvo executives charged with setting up and running the 2.5M sqft NIO-JAC facility. While the two joined NIO at different times, Shen had previously recruited Gu to Join Volvo back in 2010. The two believe strongly in making high-quality vehicles, putting it at the top of their priorities. For example, NIO’s body scans over 1,000 different spots on each ES8 body.

“We put tremendous effort into controlling the quality of the vehicle,” Shen told Teslarati. “For example, every day we sample two vehicles, evaluating the quality of the vehicle through a custom quality audit.”

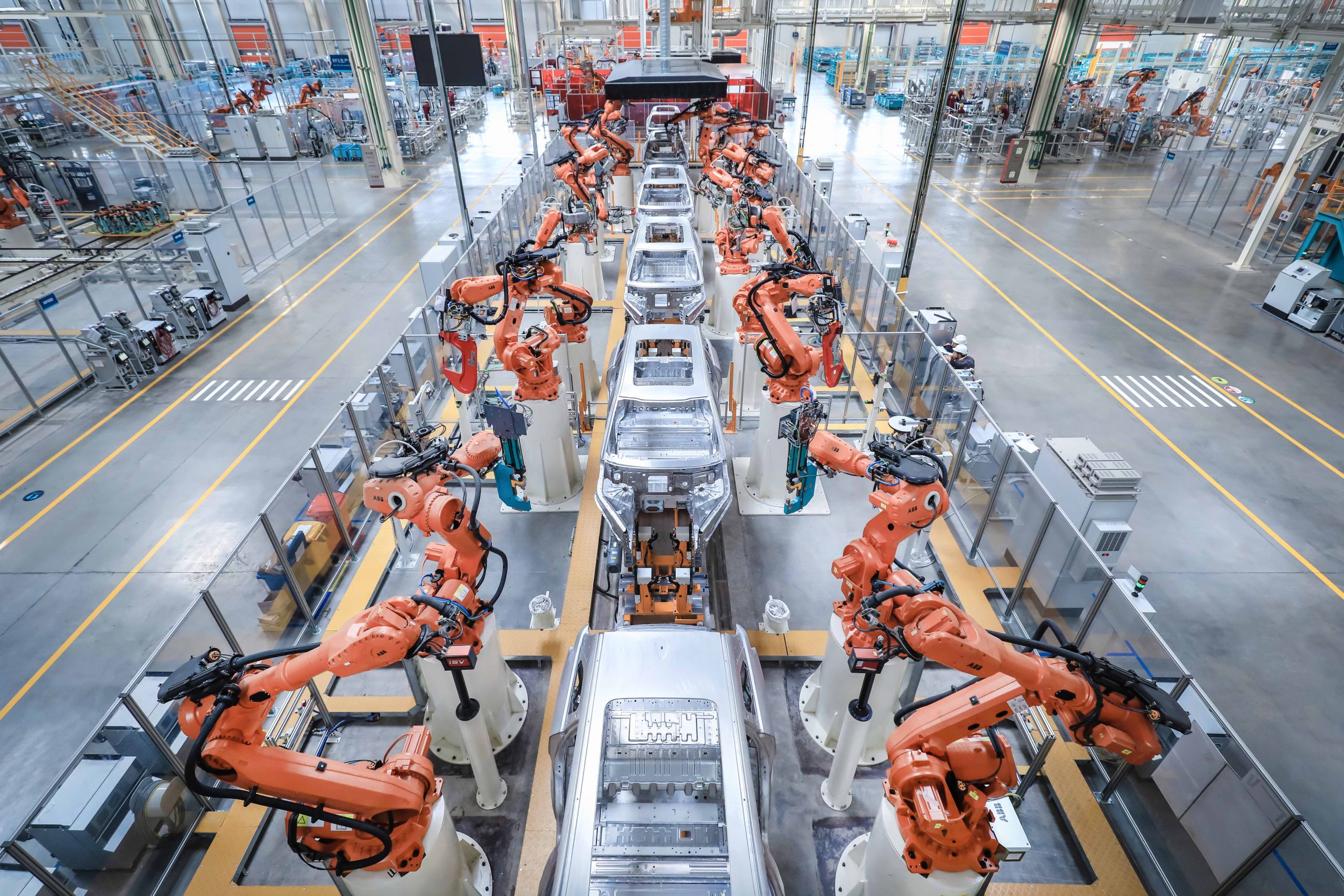

Inside the NIO factory is a combined workforce of 2270 NIO and JAC employees, working to produce both the ES8 and ES6. The ES6 is in test production and expected to be in customers hands in June. NIO’s facility features some of the most advanced robotics in the industry, with their all-aluminum body line achieving 97.5% automation. NIO claims the body line is the most advanced of its type in China. The facility is currently able to produce 100,000 vehicles per year but can be expanded to produce 150,000 units and beyond.

The expansive white floors in NIO’s factory and ceiling that’s outfitted with 512 massive skylights fill the facility with natural light. The factory uses geothermal energy for heating and cooling, while thousands of solar panels produce energy to minimize the facility’s carbon footprint. Outside the facility, NIO is in the process of installing basketball courts and a soccer field on the factory grounds for employees to enjoy.

Converting Metal into Cash

NIO has the capability to produce thousands of vehicles per month and has ample runway before reaching maximum production capacity. The company sells its vehicles direct-to-consumer, and its streamlined logistics allows the company to hold little inventory.

When NIO launched their three-row premium SUV, the ES8, last fall, demand seemed strong. Production was ramping up as the company worked to fulfill their order books, delivering over 3,000 vehicles per month in both November and December of 2018. Then came 2019, the company’s deliveries fell dramatically to a low of 811 vehicles in February. The company pointed to the overall tense economic climate in China, seasonality surrounding Chinese New Year, and dramatic cuts to electric vehicle subsidies in China.

Compared to their peers in the large and mid-size premium SUV segments, the vehicles are competitive. The ES8 starts at roughly $66,500 (without battery leasing), excluding subsidies and other EV incentives, which is significantly below competitors like the Volvo XC90 ($93,700). Additionally, the ES8 features fast acceleration, 0-60 mph in 4.4 seconds, and a technology-forward interior. The forthcoming ES6 is entering a much larger segment than its larger sibling and is priced 7-10% lower than its peers, by Teslarati’s estimates. While the recent sales drop spooked investors, sending the company’s stock down nearly 50% from recent highs, it’s unclear if reduced demand is a long-term issue.

Regardless of recent sales issues, NIO is plowing full steam ahead. The company has 35 NIO Houses and pop-up stores open throughout China. The stores are all exquisitely designed and are built for both potential customers and current owners. Potential customers can check out the vehicles, take test drives, and purchase NIO merchandise; current NIO owners can head upstairs to the owners-only club.

- NIO House (Hangzhau West Lake)

- NIO House, club area (Shanghai)

- NIO House (Hefei)

- NIO House (Hangzhou West Lake)

- NIO House Library (Beijing)

- NIO House (Hangzhou West Lake)

NIO’s clubs are focused on providing a “joyful lifestyle beyond the car.” Essentially, they are places where owners can hang out, enjoy a latte, read books, attend events, and socialize with other owners. NIO even creates a custom drink for each NIO House, allowing owners to try out new flavors at each location.

The company believes that private clubs add value to a customers lifestyle and introduce them to a luxury-focused lifestyle. While not all owners will use the clubs regularly, NIO estimates that their owners visit 1-2 times per month. While it’s too soon to conclude whether NIO’s expansive retail spaces and clubs drive sales, it would be mild to stay that the company is betting big on the strategy.

If clubs and retail stores aren’t your schtick, NIO still has a plan for you, namely: the NIO App. Like the physical locations, the NIO app is both a place for potential customers and current owners. While the company has just over 15,000 vehicles on the road, NIO’s app has over 800,000 downloads and over 200,000 daily active users.

The NIO app is as much of a social media app as it is a vehicle-companion. Users can post photos, share their recent trips, report issues with their vehicles, or share general posts about their lives. While the app is currently only available in Mandarin, you can often find posts from users announcing their reservations, deliveries, or exciting road trips. The NIO app is great for fostering connections between potential users and current owners, allowing people to act as ambassadors for the brand; thus creating a continuous sales funnel for the company.

For owners, the app has a whole other layer of functionality. They can manage their vehicles, send bugs and feedback, and schedule a service appointment. Additionally, owners can use the “one-click for power” feature to have NIO specialist come to recharge their vehicle, either with a mobile van or at a NIO supercharger or swap station.

Building Out a Services Business.

To date, NIO has seen the service used over 100,000 times by customers. While charging at home is readily available for most EV owners in the US or EU, NIO reported that only 78% of their owners were able to install a home charger, making the service more than just an added value, but a necessity for some.

All NIO owners can use the “one-click for power” feature 12 times per year at no cost, but after that NIO offers a per-time fee or a monthly subscription. NIO charges ¥980/month or ¥10,800/year ($145/month or $1604/year) to give owners the service 15 times per month. NIO opened this service up to non-NIO vehicles at the Shanghai Auto Show, allowing all EV owners to subscribe to the service.

In addition to their power subscriptions, the company allows owners to lease their batteries. For ¥1660/mo ($247/mo) owners can lease either the 70kWh or 84kWh packs, dropping ¥100,000 ($15,000) off the purchase price of the vehicle. This opens up NIO’s vehicles to a wider audience, with the lowest ES8 costing ¥348,000 ($51,600) and the ES6 costing ¥258,000 ($38,300). In comparison, the Tesla Model X starts at ¥737,100 ($109,500) and the Model 3 costing ¥377,000 ($56,000). While NIO owners will continue leasing the battery pack for the entirety of their ownership, it will allow them to upgrade to larger capacity batteries in the future. Between power subscriptions and battery leases, NIO could be building out a substantial services business.

Is it sticking?

With production facilities, a strong retail presence, and a dedicated power-delivery network, NIO certainly doesn’t have a capacity issue. The company could start delivering 5,000+ cars next month and have plenty of capacity and staff to handle the volume. NIO’s vehicles don’t seem to be the problem, they’re well-built, packed full of industry-leading features, and competitively priced in their segments.

What is unclear, is whether NIO’s expensive retail and club strategy are truly generating enough sales. The company is doing minimal advertising, leaving their stores and app as its core sources for sales. With over 9,500 employees on payroll and a factory running below capacity, the company is under pressure to raise sales amid economic headwinds, which is no easy feat.

Between the company’s focus on electric SUV’s, a unique retail strategy, a lifestyle-focused app, and a variety of user-centric services, NIO differentiates itself from both competitors abroad and at home. Whether the upcoming ES6 is a hit, is to be seen, but the company has all the pieces in place to deliver a positive ownership experience for buyers.

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.