News

SpaceX closes out 2021 with $1.85 billion in new funding

On the eve of the last day of 2021, SEC filings show that SpaceX has secured another $337 million, bringing the total funding the company has raised this year to approximately $1.85 billion.

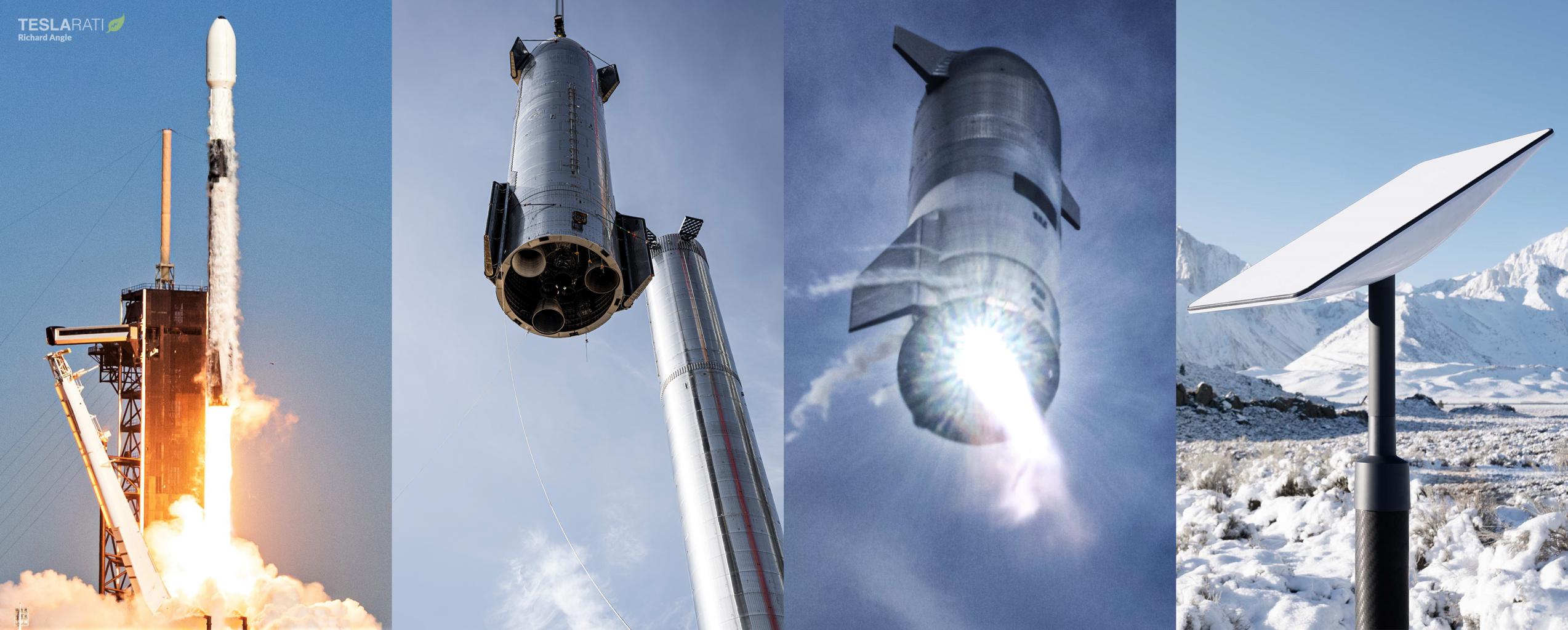

While there’s evidence that SpaceX’s Falcon and Dragon launch business is easily profitable on its own, the company has been simultaneously developing a next-generation rocket (Starship) and an unprecedentedly ambitious internet satellite constellation (Starlink) for at least the last 5-6 years. Additionally, SpaceX developed Falcon booster reusability and Falcon Heavy entirely on its own at a total cost of at least $1-2 billion. In short, rocket development is incredibly expensive, and adding a far more ambitious rocket and an immense satellite constellation into the mix has created an insatiable demand for fresh capital.

Investors have been more than eager to satisfy that demand, practically chomping at the bit to buy SpaceX equity or debt over the last six years. Since 2015, SpaceX has raised an average of more than $1B per year for the last seven years.

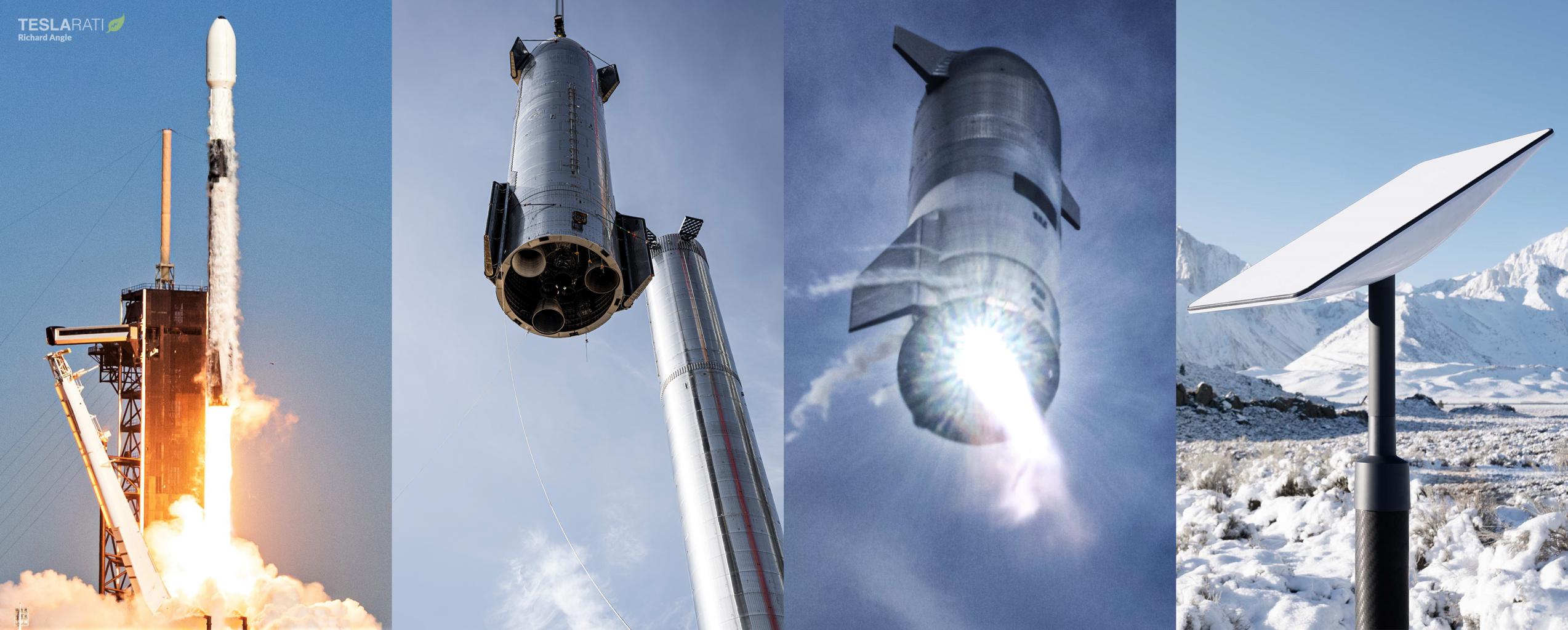

That funding has accomplished a great deal. As of the end of 2021, SpaceX has built and launched 1869 operational Starlink satellites in 25 months, more than 1750 of which are still in orbit and working. SpaceX has also built hundreds of thousands of ‘user terminals’ – dishes and WiFi routers that currently connect more than 150,000 subscribers to the internet even while the service remains in beta.

Starship, while somewhat behind its CEO’s optimistic schedules, continues to march towards its first spaceflight and orbital-velocity launch attempt – possibly in the first half of 2022. With help from its Hawthorne, CA headquarters, SpaceX’s Starbase factory continues to churn out Starship, Super Heavy booster, and test tank prototypes and appears to be ramping back up after six or so months of relative quiet. Having produced approximately 150 Raptor 1 and Raptor 1.5 engines in the last two years, Hawthorne is now focused on ramping up production of Raptor 2 – an upgraded engine variant capable of producing up to 25% more thrust while, in theory, being far cheaper to produce.

In about 12 months, SpaceX has also built – from nothing – an orbital launch site on the verge of being ready to support the first test flights of the largest, heaviest, and most powerful rocket ever built. To accommodate the massive vehicle, SpaceX has also nearly completed the largest cryogenic tank farm ever built for a launch site and partially filled at least four or five of its seven cryogenic storage tanks. Alongside that tank farm, the company has more or less completed a skyscraper-sized launch tower and outfitted it with three giant, moving arms – two of which are designed to stack Starship on Super Heavy and, maybe one day, catch ships and boosters out of mid-air.

According to a company-wide email CEO Elon Musk recently wrote but subsequently downplayed on Twitter, SpaceX’s financial health could be heavily dependent on the successful start and expansion of Raptor 2 production to enable Starship to begin launching new and much-improved Starlink V2.0 satellites. Those satellites are several times larger than V1.0 or V1.5 spacecraft, apparently making it hard or impossible for Falcon 9 to cost-effectively launch them.

On top of building and activating new factories capable of producing millions of Starlink user terminals per year, completing the first phase of orbital Starship development, ramping up Raptor 2 production, starting to build a fleet of operational Starships and Super Heavy boosters, continuing Falcon 9 Starlink V1.5 launches, and simultaneously building or completing no less than three orbital Starship launch sites in Florida and Texas, SpaceX thus also apparently needs to complete Starlink V2.0 satellite development and effectively build one or several entirely new production lines to start producing the substantially different spacecraft.

A large portion of SpaceX’s 2021 funding – especially the ~$337M raised in the last two weeks – will likely help support a portion of all those development efforts next year.

News

Tesla Robotaxi has already surpassed Waymo in this key metric

Tesla Robotaxi has already overtaken Waymo in Austin in one key metric, but there’s still more work to do.

Tesla Robotaxi has already surpassed Waymo in one extremely important key metric: size of service area.

Tesla just expanded its service area in Austin on Monday morning, pushing the boundaries of its Robotaxi fleet in an interesting fashion with new capabilities to the north. Yes, we know what it looks like:

🚨 Tesla’s new Robotaxi geofence is…

Finish the sentence 🥸 pic.twitter.com/3bjhMqsRm5

— TESLARATI (@Teslarati) July 14, 2025

The expansion doubled Tesla Robotaxi’s potential travel locations, which now include the University of Texas at Austin, a school with over 53,000 students.

The doubling of the service area by Tesla has already made its travel area larger than Waymo’s, which launched driverless rides in October 2024. It became available to the public in March 2025.

According to Grok, the AI agent on X, Tesla Robotaxi’s current service area spans 42 square miles, which is five square miles larger than Waymo’s service area of 37 square miles.

Tesla Robotaxi (red) vs. Waymo geofence in Austin.

Much can be said about the shape… but the Robotaxi area is now ~3.9 mi² (10 km²) larger than Waymo’s!! pic.twitter.com/dVfh2ODxJC

— Robin (@xdNiBoR) July 14, 2025

The service area is one of the most important metrics in determining how much progress a self-driving ride-hailing service is making. Safety is the priority of any company operating a ride-hailing network, especially ones that are making it a point to use autonomy to deploy it.

However, these companies are essentially racing for a larger piece of the city or cities they are in. Waymo has expanded to several different regions around the United States, including Arizona and Los Angeles.

Tesla is attempting to do the same in the coming months as it has already filed paperwork in both California and Arizona to deploy its Robotaxi fleet in states across the U.S.

As the platform continues to show more prowess and accuracy in its operation, Tesla will begin to expand to new areas, eventually aiming for a global rollout of its self-driving service.

News

Tesla Megapacks arrive for massive battery replacing coal plant

Tesla Megapacks have started arriving on-site to the Stanwell Battery Project, just as Queensland prepares to wind down the Stanwell coal plant.

The first of over 300 Tesla Megapacks have arrived to the site of a massive battery energy storage system (BESS) being built in Australia, dubbed the Stanwell Battery Project after a coal plant it’s set to replace.

In a press release last week, the Stanwell Battery Project announced that the first Tesla Megapack 2XL units had arrived to the site, which is located outside of Rockhampton in Queensland, Australia. The project will eventually feature 324 Megapack units, set to arrive in the coming months, in order to support the 300MW/1,200MWh battery project.

“The Stanwell Battery is part of the diversification of our portfolio, to include cleaner and more flexible energy solutions,” said Angie Zahra, Stanwell Central Generation General Manager. “It is just one part of the 800 MW of battery energy storage capacity we have in our pipeline.

“Capable of discharging 300 MW of energy for up to four hours (1,200 MWh), our mega battery will be one of the largest in Queensland.”

Credit: Stanwell

Did you know Tesla’s Lathrop facility churns out a Megapack every 68 minutes? That’s enough energy to power 3,600 homes for an hour per unit! ⚡️ pic.twitter.com/bG6fpHkB9O

— TESLARATI (@Teslarati) June 11, 2025

READ MORE ON TESLA MEGAPACKS: Tesla Lathrop Megafactory celebrates massive Megapack battery milestone

The state is working with government-owned company Yurika to facilitate construction, and the process is expected to create roughly 80 jobs. The project is expected to come fully online in May 2027, with initial commissioning of the Megapacks aiming for November 2025.

The Stanwell Battery is set to replace the nearby Stanwell coal generation plant, which the government is planning to wind down starting in 2026 as part of efforts to reach an 80 percent renewable energy generation ratio by 2035. Meanwhile, the government is also set to begin winding down the Tarong and Callide coal plants, while several other Megapack projects are being built or coming online. o ya

Tesla currently has two Megapack production facilities, located in Lathrop, California, in the U.S. and another that came online earlier this year in Shanghai, China. The Shanghai Megafactory shipped its first units to Australia in March, while both factories are expected to be capable of producing 10,000 Megapack units per year upon reaching volume production.

News

The Tesla Diner is basically finished—here’s what it looks like

The company first broke ground on the Diner, Drive-in, and Supercharger location in September 2023. Now, it has served one of its first internal customers.

Tesla has finally completed the construction of its highly anticipated Diner, Drive-in, and Supercharger in Los Angeles, and recent photos of the interior’s “retro-futuristic” style are making their way around the internet.

X user Brad Goldberg shared photos from the Tesla Diner site last Tuesday, depicting some of the Supercharger stalls, indoor and outdoor seating areas, multiple neon lights, and even an Optimus robot. Goldberg also noted that there had been a “flurry of activity on site” while he was snapping the photos last week, suggesting that the restaurant location could be getting close to opening.

The Tesla Diner also served one of its first internal customers in the past few days, as Elon Musk posted on X on early Monday morning that he had just finished up eating a meal at the site:

I just had dinner at the retro-futuristic Tesla diner and Supercharger.

Team did great work making it one of the coolest spots in LA!

The photos also show that the site is pretty much done, with some of them even showing vehicles charging at the charging stalls.

You can see some of the latest photos of the Tesla Diner below.

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: TeslaKing420 | X

Credit: TeslaKing420 | X

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

READ MORE ON TESLA’S LA DINER: Tesla readies Drive-In Diner Supercharger for launch with app inclusion

When will the Tesla Diner open to external customers?

While it’s still not open to external customers yet, the news again suggests that the company could be close to an official opening date. Tesla first broke ground on the Diner in September 2023, after receiving a wave of building permit approvals throughout that year. Teslarati also covered much of the construction progress throughout last year, including when crews installed the first and second drive-in screens.

Located at 7001 West Santa Monica Boulevard, the idea was first discussed in 2018 by Musk and a few others on Twitter, featuring 1950s rock and roll, waiters on roller skates, and drive-in movie theater screens playing clips from some of history’s best movies. Notably, the photos of the front doors also show that the site will be open 24 hours a day, 7 days a week, whenever it does end up opening.

Tesla’s progress on Supercharger with diner, drive-in seen in aerial footage

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News2 days ago

News2 days agoTesla debuts hands-free Grok AI with update 2025.26: What you need to know

-

Elon Musk4 days ago

Elon Musk4 days agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

Elon Musk7 days ago

Elon Musk7 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

News1 week ago

News1 week agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Memphis data center receives air permit despite community criticism

-

News4 days ago

News4 days agoTesla begins Robotaxi certification push in Arizona: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla scrambles after Musk sidekick exit, CEO takes over sales