News

SpaceX’s Starship to return humanity to the Moon in stunning NASA decision

In one of the biggest NASA contracting surprises in years, the space agency has chosen SpaceX – and only SpaceX – to return humans to the surface of the Moon with its next-generation Starship rocket.

The Washington Post’s Christian Davenport broke the news a few hours before NASA’s scheduled announcement and teleconference, revealing that SpaceX beat out Dynetics and a Blue Origin-led “National Team” for a sole-source contract to build, launch, and land a custom version of Starship on the Moon for $2.89 billion. If that uncrewed testing is successful, SpaceX and Starship will be tasked with landing the first astronauts on the Moon in half a century as early as the in the mid-2020s.

While a Human Landing System (HLS) announcement was fully planned and expected to happen this month, virtually everyone following the process believed that NASA would continue to lean on the rationale behind selecting multiple providers for its Commercial Resupply Services (CRS) and Commercial Crew (CCP) programs. Having multiple distinct providers, spacecraft, and rockets available to accomplish the same tasks fundamentally insulates NASA (and the International Space Station that depends on those programs) from losing the ability to transport crew or cargo in the event that any one provider is delayed or suffers a major failure.

With a goal as complex as landing humans back on the Moon for the first time since the 1970s, redundancy and multiple distinct solutions would obviously be even more desirable. Entirely contrary to expectations, NASA instead announced that it had exclusively contracted with SpaceX alone for next phase of HLS development. Though SpaceX may have been the only competitor already testing something approximating real integrated flight hardware, NASA’s decision to sole-source HLS to Starship represents a significant gamble.

Simultaneously, though, the move is also extraordinarily pragmatic and indicates that one or several major decisionmakers at NASA have taken less positive lessons from its commercial cargo and crew programs to heart. Crucially, over the first several years of the Commercial Crew Program (CCP), Congress systematically underfunded the development of two commercial crew spacecraft – one from Boeing and the other from SpaceX. As a direct result, the launch debuts of both spacecraft were delayed by several years, forcing NASA to to continue relying on Russian Soyuz launches well into the 2020s to get its astronauts to the ISS.

Additionally, SpaceX – an unequivocal underdog and newbie next to Boeing in the mid-2010s – has drastically outperformed its traditional aerospace counterpart, beating Boeing to the punch and launching astronauts first. Boeing’s Starliner is now at least 18 months behind Crew Dragon despite costing almost 60% more.

In its first year on the books, almost mirroring NASA’s Commercial Crew experience, Congress aggressively underfunded the HLS program, allotting $850M – just 25% – of the $3.4B NASA requested. In other words, NASA seems to be proceeding with HLS under the assumption that Congress – as it did with CCP – will continue to chronically underfund the lunar lander program for years to come. If that’s the case, NASA appears to have made an uncharacteristically astute decision to structure HLS not on its preferred budget – but on what the agency believes Congress will pony up.

Put in a slightly different way, NASA is basically telling Congress that its lack of commitment has forced the agency to sole-source its lunar lander contract to SpaceX, putting the impetus on Congress to properly fund the HLS program if it wants redundant providers. All told, while NASA is undoubtedly taking a risk selecting SpaceX and Starship to return both it and humanity to the Moon, the space agency has now made it abundantly clear that it’s fully committed to the program and goal, whether or not Congress is willing to do its job.

Investor's Corner

Rivian stock rises as analysts boost price targets post Q1 earnings

Rivian impressed with smaller-than-expected losses & strong revenue, pushing analysts to raise price targets.

Rivian stock is gaining traction as Wall Street analysts raise price targets following the electric vehicle (EV) maker’s first-quarter earnings report. Despite a dip after the announcement, optimism surrounds Rivian’s cost control and upcoming lower-priced cars.

Last week, Rivian reported a better-than-expected Q1 gross profit, surpassing Wall Street’s forecasts with adjusted losses of $0.48 per share against expectations of $0.92 per share. The company also reported a revenue of $1.24 billion compared to the $1.01 billion anticipated.

However, the EV automaker cut its 2025 delivery forecast and capital spending due to President Donald Trump’s tariffs. It explained that it is “not immune to the impacts of the global trade and economic environment.” RIVN stock dropped nearly 6% post-earnings, closing at $12.72 per share.

Wall Street remains upbeat about Rivian, citing progress toward launching lower-priced vehicles in 2026 and effective cost management. On Monday, Stifel analyst Stephen Gengaro raised his RIVN price target to $18 from $16, maintaining a “Buy” rating. He highlighted Rivian’s “solid progress” toward key milestones.

Conversely, Bernstein’s Daniel Roeska gave RIVN a “Sell” rating. However, Roeska also lifted his Rivian price target to $7.05 from $6.10, acknowledging “better” Q1 results. He warned that profitability remains distant and hinges on multiple product launches by the decade’s end.

Overall, Wall Street’s average price target for RIVN climbed from $14.18 to $14.31, a modest 13-cent increase reflecting positive sentiment. About one-third of analysts covering Rivian rate it a Buy, compared to the S&P 500’s average Buy-rating ratio of 55%.

On Monday, Rivian stock rose 2.7% to $14.64, slightly trailing the S&P 500 and Dow Jones Industrial Average, which gained 3.3% and 2.8%, respectively. The uptick may also stem from broader market gains tied to news of a temporary U.S.-China tariff suspension.

As Rivian navigates trade challenges and scales production at its Illinois factory, its Q1 performance and analyst support signal resilience. With lower-priced EVs on the horizon, Rivian’s strategic moves could bolster its position in the competitive EV market, offering investors cautious optimism for long-term growth.

News

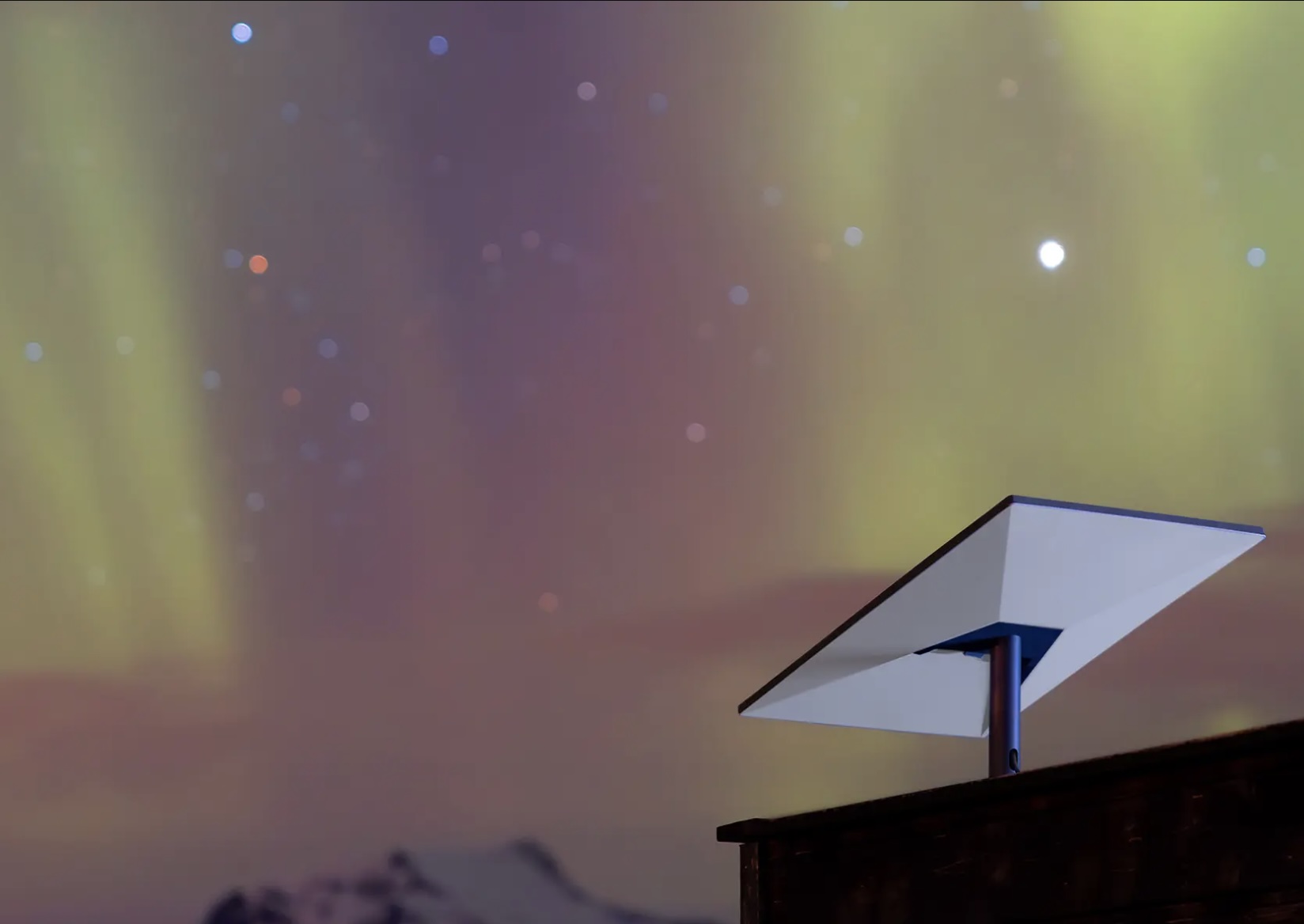

EU weighs Starlink’s market impact during SES-Intelsat deal

As SES tries to buy Intelsat, the EU is checking if Starlink has an unfair edge. The review could shape Europe’s space future.

EU antitrust regulators are scrutinizing SES’s $3.1 billion bid to acquire Intelsat, probing whether SpaceX’s Starlink poses a credible rival in the satellite communications market. The European Commission’s review could shape the future of Europe’s space industry.

The Commission has sought feedback from customers of SES and Intelsat to assess Starlink’s competitive impact. According to Reuters, the questionnaire asks if low-earth orbit (LEO) satellite providers like Starlink and Eutelsat’s OneWeb are viable competitors for two-way satellite capacity. It also explores whether LEO suppliers are winning tenders and contracts and their potential to influence competition over the next five years. Additionally, regulators are evaluating customers’ bargaining power and ability to switch to rival suppliers.

SES operates a fleet of about 70 multi-orbit satellites for video broadcasting, government communications, and broadband internet. It aims to scale up through the acquisition of Intelsat. The move is part of a broader push in Europe to bolster home-grown satellite solutions, countering U.S. giants like SpaceX’s Starlink and Amazon’s Project Kuiper.

SES is in talks with the EU Commission and a few European governments to complement Starlink services, addressing concerns over reliance on foreign providers.

“Now the discussions are much more strategic in nature. They’re much more mid-term, long-term. And what we’re seeing is that all of the European governments are serious about increasing their defense spending. There are alternatives, not to completely replace Starlink, that’s not possible, but to augment and complement Starlink,” said SES CEO Adel Al-Saleh.

The EU Commission’s preliminary review of the SES-Intelsat deal is expected to conclude by June 10. The preliminary review will determine whether the SES-Intelsat deal is cleared outright, requires concessions, or faces a full-scale investigation if significant concerns arise. As Europe seeks to strengthen its space-based communication resilience, the outcome could redefine competitive dynamics in the satellite sector.

With Starlink’s LEO technology disrupting traditional satellite services, the Commission’s findings will signal how Europe balances innovation with strategic autonomy. SES’s efforts to scale and collaborate with governments underscore the region’s ambition to remain competitive, potentially reshaping the global satellite landscape as demand for reliable connectivity grows.

News

Tesla gets new information request from NHTSA on Robotaxi rollout

Tesla has been contacted by the NHTSA regarding plans for the Robotaxi rollout and how it will handle poor weather.

Tesla has been contacted by the National Highway Traffic Safety Administration (NHTSA) regarding its planned rollout of a Robotaxi platform in Austin, Texas.

The agency sent a letter to Tesla Field Quality Director Eddit Gates, seeking more information on exactly how the company plans to operate the fleet in poor weather conditions. The NHTSA wants to know how Tesla’s technology and operational use cases will “assess the ability of Tesla’s system to react appropriately to reduced roadway visibility conditions.”

Additionally, the NHTSA said it would like additional information on Tesla’s development of technologies for use in ‘robotaxi’ vehicles to understand how Tesla plans to evaluate its vehicles and driving automation technologies for public roads.

Tesla has already started operating a supervised version of the Robotaxi platform for employees in both Austin and San Francisco. This limited rollout has completed thousands of rides already, but differs from the version it plans to roll out in the coming weeks in Austin, as it currently has a driver sitting in the driver’s seat.

Tesla says it has launched ride-hailing Robotaxi teaser to employees only

They are there to supervise the vehicle and ensure safety early on in the program.

The letter that was sent to Tesla on May 8 is part of a greater investigation that was opened by the NHTSA on October 17, titled “FSD Collisions in Reduced Roadway Visibility Conditions.”

The agency said the purpose of the “Preliminary Evaluation of FSD” was to assess:

- The ability of FSD’s engineering controls to detect and respond appropriately to reduced roadway visibility conditions;

- Whether any other similar FSD crashes have occurred in reduced roadway visibility conditions and, if so, the contributing circumstances for those crashes; and

- Any updates or modifications from Tesla to the FSD system that may affect the performance of FSD in reduced roadway visibility conditions. In particular, this review will assess the timing, purpose, and capabilities of any such updates, as well as Tesla’s assessment of their safety impact.

Tesla is required to respond to the NHTSA’s request by June 19.

INIM-PE24031-62887 by Joey Klender on Scribd

-

News1 week ago

News1 week agoTesla offers legacy Model Y owners an interesting promotion

-

News5 days ago

News5 days agoTesla Cybertruck Range Extender gets canceled

-

News2 weeks ago

News2 weeks agoTesla posts Semi factory update, shares new Semi logo design

-

News2 weeks ago

News2 weeks agoTesla opens whopping 83 job listings for Semi program

-

News2 weeks ago

News2 weeks agoLike it or not, the new Tesla Model Y is a big hit in China

-

News2 weeks ago

News2 weeks agoTesla Model Y with three rows and extended wheelbase rumored to start production in China

-

News2 weeks ago

News2 weeks agoBerlin Senator calls Tesla “Nazi” cars, pisses off Brandenburg because Giga Berlin is a giant employer

-

News2 weeks ago

News2 weeks agoStarlink nears S Korea launch as satellite internet demand rises