News

Porsche Whistleblower: “60% of all delivered Taycan have battery issues that caused replacements, damages and fires”

“Six out of ten Porsche Taycan” ever delivered have a problem with battery management that affects and damages battery cells, requires replacement of cells and batteries, and is causing vehicle fires, according to a source working at Porsche’s headquarters in Zuffenhausen, Germany. Porsche is reportedly hiding the problem from customers and authorities and quietly replacing damaged battery cell modules without informing customers to cover up the problem. Tesla offered to help Porsche with battery management through Audi contacts years ago, but Porsche management at the time rejected any external help, saying it could handle everything internally, the source noted.

“The problem affects six of ten delivered vehicles,” the source, who could be described as a whistleblower, said.

A Risky Business

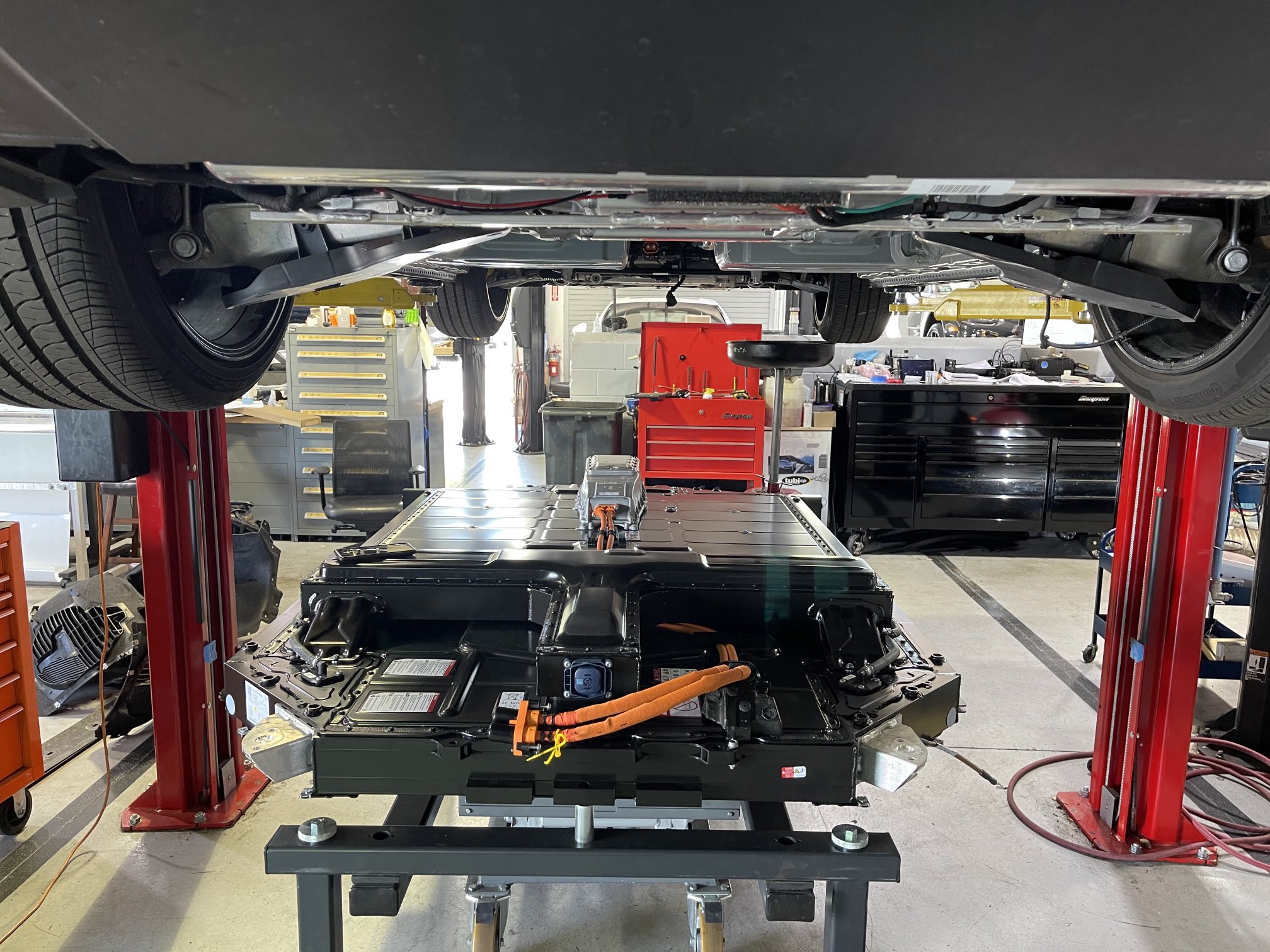

The Porsche whistleblower explained that the Taycan’s 800V high-voltage onboard charger used today does not control the charging process well enough and can overcharge some battery cells, causing them to overheat. For safety reasons, overheated battery cells are disabled and isolated from the battery pack, reducing battery capacity and thus the vehicle’s range. The problem occurs when the batteries are charged at a low AC speed of up to 7.5 KW, a common use case for all charging, such as at home or on low-speed chargers, the source said.

The 800V architecture of the Taycan, a vehicle the German automaker is proud of, has many advantages, but the strong current requires a very well-controlled charging process to avoid charging some cells faster than others. The battery cells in a BEV are always charged in parallel to shorten the charging time, but this carries the risk that some cells will be charged faster than others. If one of the many cells in a BEV is charged faster than the rest, overcharging and overheating can occur, which can lead to vehicle fires, if, for instance, an additional air leak happens.

About 1% of the 60% of vehicles affected, or about 360 Taycans out of 36,000 vehicles delivered, had a preventable vehicle, cable, or smoldering fire attributable to the problem, the whistleblower said. These are figures from Porsche’s internal statistics, which the company updates on an ongoing basis to keep track of safety issues. The reason the whistleblower, who works for Porsche in Zuffenhausen, is talking about the problem at all, risking his job and more, is that the company has decided lately not to replace the Taycan’s onboard charger, but to continue shipping vehicles and all future new Taycan models with the problematic system, which may pose a notable safety risk.

Porsche uses an inexpensive onboard charger that does not control the process well, the whistleblower explained to me in detail. Fires have occurred in the Taycan battery, the source explained, due to the problem described. Porsche is reportedly aware of the problem and is working on it, but the automaker has not solved it or informed customers or authorities so far.

Instead, the company is reportedly hiding the problem for cost and reputational reasons, the source stated. This is because if acknowledged, all Taycans would require a recall and the replacement of their onboard charger, and all batteries would have to be inspected and tested and, if affected, replaced. The cost, the source said, would be in the hundreds of millions of euros and the damage to the company’s image could be even greater.

A Remarkably Short Warranty

An apparent hint of Porsche’s challenges with the Taycan’s battery could be seen in the warranty for the all-electric sports car, which happens to be one of the lowest on the market with just 60,000 km or three years if following conditions (Porsche Warranty Requirements) are not met:

Vehicles standing longer than two weeks supposed to be connected to a charger

- Customers must assure that the Taycan’s state of charge remains between 20% – 50%

- Customers must make sure that their Taycan is not exposed to continuous sunlight

Vehicles standing longer than two weeks not connected to a charger

- Customers must charge the Taycan’s battery before to 50%

- Customers must check every three months and assure SoC remains at or above 20%

- Customers must assure that their vehicle’s temperature is between 0C – 20C

While 160,000 km is an average battery warranty in the industry, Porsche confirmed to me the 100,000 km lower, 60,000 km warranty and its restrictions.

It is a well-known risk in the industry that when charging BEVs, an imbalance in the battery cells can lead to a sealed, encapsulated, and deactivated cell that can then overheat and cause battery damage and even fires if, for example, there is an additional leak in the battery box through which air can enter. Porsche’s 800V high-voltage architecture is more vulnerable in this regard than a low-voltage architecture such as Tesla’s 400V, or what other manufacturers use. Most of the BEV battery fire-related problems recorded in the past typically occurred in low-cost BEVs that lack sophisticated battery management systems or onboard chargers. Porsche has cut costs for its premium Taycan BEV, which poses a risk to customers, according to the whistleblower.

Costs and Savings

The cell damage can be repaired at great expense, but in most cases, Porsche chooses not to, the whistleblower said. To compensate for the vehicle’s reduced range due to encapsulated and deactivated battery cells, Porsche in many cases reportedly unlocks unused, reserved battery capacity, effectively tricking customers into thinking everything has been fixed, even though the affected cells are no longer in use and remain a potential risk, the source said. Customers who don’t know that a cell in their battery has a problem may not even recognize the reduced range in their Taycans because Porsche releases unused battery capacity and therefore the problem is not detected at all from them. This could explain why the number of the reported battery problems on the Taycan shared by the media is much lower than 60%.

For all vehicles Porsche informs needing a repair, the customer is charged 600 euros/cells module, although the internal labor cost is just 26 euros, the whistleblower said. Porsche charges customers even though no repair has taken place at all but just a battery module cell exchange, the source added. A Taycan has 33 battery modules with 12 cells each adding it up to a total of 396 total cells. Issues that happen and should be covered by warranty are, with regards to labor cost, paid by the customer, creating high service and maintenance profits for Porsche.

Considering the battery degradation that all BEVs experience sooner or later, the 60% Taycan customers who have the battery problem described by the whistleblower will have a lower total battery capacity than paid for after the so-called “repair” and will experience an earlier reduction in range and thus a reduction in vehicle value. If the problem of overcharging the onboard charging cell occurs more frequently, the damage can accumulate to the point where a complete battery replacement is required, according to the whistleblower. If what the source reported is correct over time, all 40% Taycans not yet affected by the issue may one day experience the same problem, depending on the charging behavior of their owners.

To pretend to have done a repair that never happened and accept a lower battery capacity caused by a cheap Porsche onboard charger without informing the customer would be misleading, to say the least. Worse, the replaced battery cells and modules are susceptible to the same problem, and owners accustomed to charging at home with AC power up to 7.5 KW may soon be faced with the same problem again after their battery packs have been “repaired.” Disregarding the cost and depreciation is bad, but the safety issue is the most serious problem of all and should be, based on the information my source shared, investigated by authorities in all countries where the Taycan is shipped.

An Invisible Fix

A different, more sophisticated charger for an extra 70 euros from the same supplier with a good reputation would solve the problem, but Porsche has so far decided against the hardware change, according to my sources. What sounds like a small additional cost is not small in the automotive industry, where target costs are a critical measure of team success and on which bonuses depend. The recent decision of Porsche not to use a better more sophisticated charger that would solve the problem for the foreseeable future made the source a whistleblower who rightly saw this as an unacceptable risk to customers.

The Taycan vehicles experiencing the charging problems are divided into three groups by Porsche and dealers, the whistleblower stated. Dealerships are under strict NDA and face losing their Porsche certification if they talk about the practice that the automaker is executing for years.

Affected Taycans are categorized as:

(a) Green – repair

b) Yellow – review with Porsche internal technical department

c) Red – replacement

All vehicles that fall into the “Red” category receive a new battery module or entire battery with spare parts that are available within 24 hours. Not all customers with “Red” designations are informed that the cell module had been replaced on their Taycan, the whistleblower said. The newly installed battery is reportedly “read out” and the data is displayed to the customers who are informed, claiming that it is data from the old battery after the “repair.” This, according to the source, effectively gives false proof that everything has been “fixed”. The new battery is then assigned to the old serial number, and this is how Porsche erases all traces that indicate fraud, the whistleblower said. That’s why it’s hard to prove that Porsche is cheating customers and misleading the public, the source explained to me. While vehicles designated as “Green” had been “fixed,” cars designated as “Yellow” are still undecided and need to be investigated.

If the authorities demand a Taycan recall and replacement of all onboard chargers and batteries, the associated costs will be in the hundreds of millions of euros the source stated. Provided that the whistleblower’s information is accurate, about 60,000 Taycans delivered so far would have to be recalled worldwide, with costly repairs, testing and hardware modifications. The reputational damage would be high and, like the VW Group cheating scandal, a major negative for the iconic automaker that claims safety comes first.

In the past, some Taycan battery fires, such as the one in a garage in the US state of Florida in early 2020 that occurred during nighttime charging, were never fully resolved after investigations began. My source said that Taycan fires were directly attributable to the problem with the charger and could have been prevented if Porsche had used a more expensive, higher-quality charger, as one would expect from a premium automaker. A small deviation during the charging process of only 0.1% can easily cause a vehicle fire when overcharged by 1%, my source said. The supplier has a reputable name, but a cheap charger was chosen to keep costs down.

Teslarati reached out to Porsche to comment on the whistleblower’s claims and received following feedback on November 23:

“I checked with our R+D department in Weissach and all of the issues addressed lack any basis. Based on this information we can´t confirm any of the issues,” a spokesperson from Porsche said.

The source was confronted with the feedback from Porsche and stated in another phone call that only a very small team is involved in the matter, and it is no surprise for him that many within the automaker do not know about the described issues. Many more details were revealed, but they are not included in this article to protect the source. The source explained that in previous cases, Porsche made sure that employees who leaked information never got a job in the industry again.

Other sources informed me years ago that during the development of the Taycan, meeting target costs was a large challenge and that this may have led to the unwise decision to choose a cheap charger. Currently, the VW Group’s BEVs are lower-margin compared to the company’s ICE models and not all are positive, creating strong pressure from management to reduce costs. Given the Taycan’s high price and good sales figures, it is reasonable to assume that it is profitable, but it may not generate as high margins as the company’s iconic ICE models.

The whistleblower also said that years ago, Tesla offered to help Porsche with its battery management system, but the German automaker declined the offer. Around three years ago, Porsche asked Tesla through Audi contacts if they could help then, but at the time, Tesla declined. My source said it was pure arrogance on Porsche’s part that led to today’s problems, as Tesla had been willing to help them.

Previous problems with Taycan batteries led to a preliminary investigation by the US NHTSA in early 2021 into the sudden discharge of the 12V battery, which could result in the vehicle coming to a sudden stop. The NHTSA noted nine official complaints from Taycan owners, and Porsche recalled 43,000 Taycans to repair shops at that time. Taycan forum members report a variety of different battery problems as well as the media (e.g. a Taycan burned down in Florida), that may or may not be related to what my source reported. Overall, if we add all together, it appears that battery problems with the Taycan are not uncommon and with more age of batteries and vehicles, more issues may be reported. From what the whistleblower explained, the strategy from Porsche seems to be to solve or isolate technical issues without public notice.

The good news for the Audi e-tron GT that is produced on the same VW PPE BEV platform as the Taycan and shares many parts with it, is that Audi opted for a different and better onboard charger. The described problem is not existent with the e-tron GT, the source told me, but it’s unclear why Porsche isn’t learning from the Audi team in that respect.

A Note from the Author

As a writer, I do my best to thoroughly qualify every source, and I choose not to publish a story if there is any doubt about the credibility of the information or the source. I have direct contact with the person that provided the information in this article, know his identity and profession, had several calls and exchanges with him and know people who have met him in person.

My intent is not to disseminate misleading or sensational information, and this is a guiding principle for all my work. Since my source has passed my credibility check through multiple channels and has repeatedly provided many in-depth technical details on the issue, I feel it is my duty to inform the public with this article while I don’t have hard evidence and therefore can’t confirm the information to be right. According to the information provided by the whistleblower, Porsche has decided to take a big risk on the health of its customers for cost, profit and reputation reasons.

As a German who is proud of the heritage of the automotive industry in my home country, and as a former Porsche customer, I am truly shocked by what the whistleblower has told me. The cheating scandal has changed the culture in the German automotive industry many have told me for years, but it looks like the same structural problems remain and lead the industry right into the next big scandal.

Disclaimer

The Author, Alex Voigt does not own or had ever any Porsche or VW Group stock, derivates or other direct or indirect investments in the company. There has been never any business relationship between the author, Porsche, and the VW Group. The original and first clues to this exclusive and disturbing story came from Christoph Krachten, who came across it while researching his German best-selling book about Tesla.

Alex Voigt Patreon Page: https://www.patreon.com/AlexVoigt

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.