BYD and other Chinese automakers have studied the European auto market for years. Now, it’s time to put their knowledge to the test and go all-in on the European auto market.

BYD’s strategy to take over Europe was recently revealed in a report by Reuters. The publication also shared details about how other Chinese automakers are entering the European market and their plans to beat top-selling brands like Tesla and Volkswagen in the EU’s local electric vehicle (EVs) market.

Below are the strategies BYD and Chinese automakers are implementing to deploy their vehicles in Europe.

- Understand European car consumers and their needs

- Improved marketing to increase brand awareness

- Expand dealership networks

- Build an extensive after-sales care service network, including improved service-and-repair operations.

- Protect resale values

The roads are buzzing with SUPER DM technology. The BYD SEAL U DM-i combines a range of more than 1000km with an attention to detail in every inch of its interior. It's the perfect synthesis of comfort and adventure.#BYD #BuildYourDreams #BYDSEALUDMi pic.twitter.com/gSNGtLzQV4— BYD Europe (@BYD_Europe) May 22, 2024

China Cars with Europeans in Mind

BYD and Chinese automakers have learned that adapting and importing cars from China to Europe is not enough. They have studied European car owners to understand the details they look for when purchasing a vehicle. As a result, some Chinese car brands have started designing cars from scratch for European buyers.

For instance, Chinese automakers have learned that safety ratings are important to European car owners, so they have improved their vehicles with safety as a priority.

“In China, the purchase price is important. But for European consumers, it’s not just price, but total cost of ownership, including maintenance, service, and residual values,” commented Bo Yu, JATO Dynamics’ Greater China Country Manager.

China-based car manufacturers are also strengthening and expanding repair-and-service operations to enhance after-sales care in Europe. Plus, they have started understanding the importance of resale values for European car owners.

“There are hard rules on issues like safety and that are clear, and then there are soft rules that aren’t written down. The Chinese are very eager to learn the soft rules,” said Ben Townsend, Head of Automotive at Thatcham.

Chinese Automakers’ Biggest Advantage

Electric vehicles have offered brands—both old and new—a chance to grow and expand in the transitioning auto market worldwide. Many automakers have not been phased by the EV market’s slowdown and are charging ahead in electric vehicle development. As such, EVs have become a good entry into the European market for China-based automakers.

Electric vehicles offer Chinese automakers one significant advantage in the global auto market: affordable prices.

China has also started to promote and grow its new energy vehicle (NEV) market, which includes battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The Chinese government financially supports local car companies through subsidies and its ever-expanding EV supply chain. China is ahead regarding battery-minerals mining, a critical part of the EV supply chain that affects costs.

The local government’s support has resulted in decreased EV prices, like the BYD Seagull, which is under $10,000 in China. The United States has tried to combat against Chinese EVs’ affordable prices by increasing import tariffs by 100%. Europe is expected to raise import tariffs for Chinese EV imports as well. However, the EU’s import tariffs might not be enough to dissuade consumers from affordable EV prices.

The BYD Seagull, for example, is expected to start below $20,000 in Europe even after EU tariffs. Volkswagen, one of Europe’s top car brands, doesn’t expect to launch an EV below €20,000 ($21,631) until 2027.

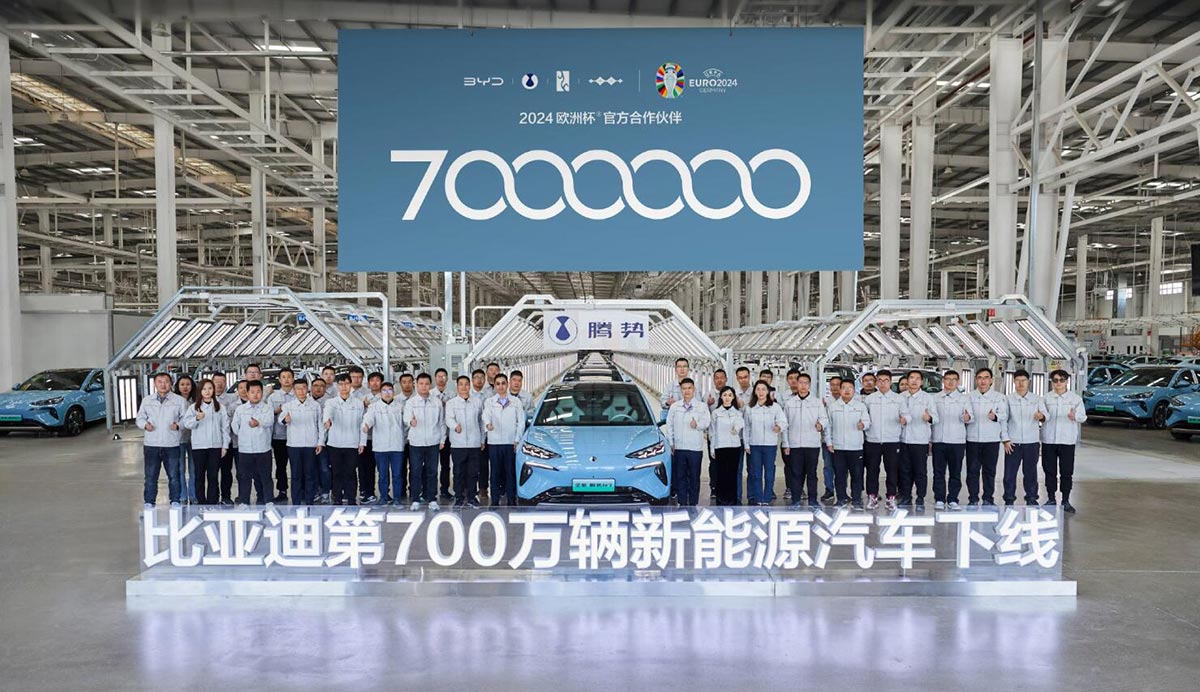

Equipped with a Europe-focused affordable EV, Chinese automakers have one more obstacle to tackle: brand awareness. BYD is already working on spreading its brand in Europe by participating in and funding local sporting events, like the Europe 2024 soccer championship. It is also working closely with local dealerships.

If you have any tips, contact me at maria@teslarati.com or via X @Writer_01001101.

News

Tesla Robotaxi has already surpassed Waymo in this key metric

Tesla Robotaxi has already overtaken Waymo in Austin in one key metric, but there’s still more work to do.

Tesla Robotaxi has already surpassed Waymo in one extremely important key metric: size of service area.

Tesla just expanded its service area in Austin on Monday morning, pushing the boundaries of its Robotaxi fleet in an interesting fashion with new capabilities to the north. Yes, we know what it looks like:

🚨 Tesla’s new Robotaxi geofence is…

Finish the sentence 🥸 pic.twitter.com/3bjhMqsRm5

— TESLARATI (@Teslarati) July 14, 2025

The expansion doubled Tesla Robotaxi’s potential travel locations, which now include the University of Texas at Austin, a school with over 53,000 students.

The doubling of the service area by Tesla has already made its travel area larger than Waymo’s, which launched driverless rides in October 2024. It became available to the public in March 2025.

According to Grok, the AI agent on X, Tesla Robotaxi’s current service area spans 42 square miles, which is five square miles larger than Waymo’s service area of 37 square miles.

Tesla Robotaxi (red) vs. Waymo geofence in Austin.

Much can be said about the shape… but the Robotaxi area is now ~3.9 mi² (10 km²) larger than Waymo’s!! pic.twitter.com/dVfh2ODxJC

— Robin (@xdNiBoR) July 14, 2025

The service area is one of the most important metrics in determining how much progress a self-driving ride-hailing service is making. Safety is the priority of any company operating a ride-hailing network, especially ones that are making it a point to use autonomy to deploy it.

However, these companies are essentially racing for a larger piece of the city or cities they are in. Waymo has expanded to several different regions around the United States, including Arizona and Los Angeles.

Tesla is attempting to do the same in the coming months as it has already filed paperwork in both California and Arizona to deploy its Robotaxi fleet in states across the U.S.

As the platform continues to show more prowess and accuracy in its operation, Tesla will begin to expand to new areas, eventually aiming for a global rollout of its self-driving service.

News

Tesla Megapacks arrive for massive battery replacing coal plant

Tesla Megapacks have started arriving on-site to the Stanwell Battery Project, just as Queensland prepares to wind down the Stanwell coal plant.

The first of over 300 Tesla Megapacks have arrived to the site of a massive battery energy storage system (BESS) being built in Australia, dubbed the Stanwell Battery Project after a coal plant it’s set to replace.

In a press release last week, the Stanwell Battery Project announced that the first Tesla Megapack 2XL units had arrived to the site, which is located outside of Rockhampton in Queensland, Australia. The project will eventually feature 324 Megapack units, set to arrive in the coming months, in order to support the 300MW/1,200MWh battery project.

“The Stanwell Battery is part of the diversification of our portfolio, to include cleaner and more flexible energy solutions,” said Angie Zahra, Stanwell Central Generation General Manager. “It is just one part of the 800 MW of battery energy storage capacity we have in our pipeline.

“Capable of discharging 300 MW of energy for up to four hours (1,200 MWh), our mega battery will be one of the largest in Queensland.”

Credit: Stanwell

Did you know Tesla’s Lathrop facility churns out a Megapack every 68 minutes? That’s enough energy to power 3,600 homes for an hour per unit! ⚡️ pic.twitter.com/bG6fpHkB9O

— TESLARATI (@Teslarati) June 11, 2025

READ MORE ON TESLA MEGAPACKS: Tesla Lathrop Megafactory celebrates massive Megapack battery milestone

The state is working with government-owned company Yurika to facilitate construction, and the process is expected to create roughly 80 jobs. The project is expected to come fully online in May 2027, with initial commissioning of the Megapacks aiming for November 2025.

The Stanwell Battery is set to replace the nearby Stanwell coal generation plant, which the government is planning to wind down starting in 2026 as part of efforts to reach an 80 percent renewable energy generation ratio by 2035. Meanwhile, the government is also set to begin winding down the Tarong and Callide coal plants, while several other Megapack projects are being built or coming online. o ya

Tesla currently has two Megapack production facilities, located in Lathrop, California, in the U.S. and another that came online earlier this year in Shanghai, China. The Shanghai Megafactory shipped its first units to Australia in March, while both factories are expected to be capable of producing 10,000 Megapack units per year upon reaching volume production.

News

The Tesla Diner is basically finished—here’s what it looks like

The company first broke ground on the Diner, Drive-in, and Supercharger location in September 2023. Now, it has served one of its first internal customers.

Tesla has finally completed the construction of its highly anticipated Diner, Drive-in, and Supercharger in Los Angeles, and recent photos of the interior’s “retro-futuristic” style are making their way around the internet.

X user Brad Goldberg shared photos from the Tesla Diner site last Tuesday, depicting some of the Supercharger stalls, indoor and outdoor seating areas, multiple neon lights, and even an Optimus robot. Goldberg also noted that there had been a “flurry of activity on site” while he was snapping the photos last week, suggesting that the restaurant location could be getting close to opening.

The Tesla Diner also served one of its first internal customers in the past few days, as Elon Musk posted on X on early Monday morning that he had just finished up eating a meal at the site:

I just had dinner at the retro-futuristic Tesla diner and Supercharger.

Team did great work making it one of the coolest spots in LA!

The photos also show that the site is pretty much done, with some of them even showing vehicles charging at the charging stalls.

You can see some of the latest photos of the Tesla Diner below.

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: BradGoldbergMD | X

Credit: TeslaKing420 | X

Credit: TeslaKing420 | X

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

Credit: Brad Goldberg (via Sawyer Merritt on X)

READ MORE ON TESLA’S LA DINER: Tesla readies Drive-In Diner Supercharger for launch with app inclusion

When will the Tesla Diner open to external customers?

While it’s still not open to external customers yet, the news again suggests that the company could be close to an official opening date. Tesla first broke ground on the Diner in September 2023, after receiving a wave of building permit approvals throughout that year. Teslarati also covered much of the construction progress throughout last year, including when crews installed the first and second drive-in screens.

Located at 7001 West Santa Monica Boulevard, the idea was first discussed in 2018 by Musk and a few others on Twitter, featuring 1950s rock and roll, waiters on roller skates, and drive-in movie theater screens playing clips from some of history’s best movies. Notably, the photos of the front doors also show that the site will be open 24 hours a day, 7 days a week, whenever it does end up opening.

Tesla’s progress on Supercharger with diner, drive-in seen in aerial footage

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News2 days ago

News2 days agoTesla debuts hands-free Grok AI with update 2025.26: What you need to know

-

Elon Musk4 days ago

Elon Musk4 days agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

Elon Musk7 days ago

Elon Musk7 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

News1 week ago

News1 week agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Memphis data center receives air permit despite community criticism

-

News4 days ago

News4 days agoTesla begins Robotaxi certification push in Arizona: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla scrambles after Musk sidekick exit, CEO takes over sales