News

SpaceX resurrects California Starship factory plan just one year after abandoning it

Just nine months after scrapping temporary Starship facilities built at a Los Angeles port, the company has unexpectedly reconsidered that decision, restarting talks to build a steel Starship factory in California.

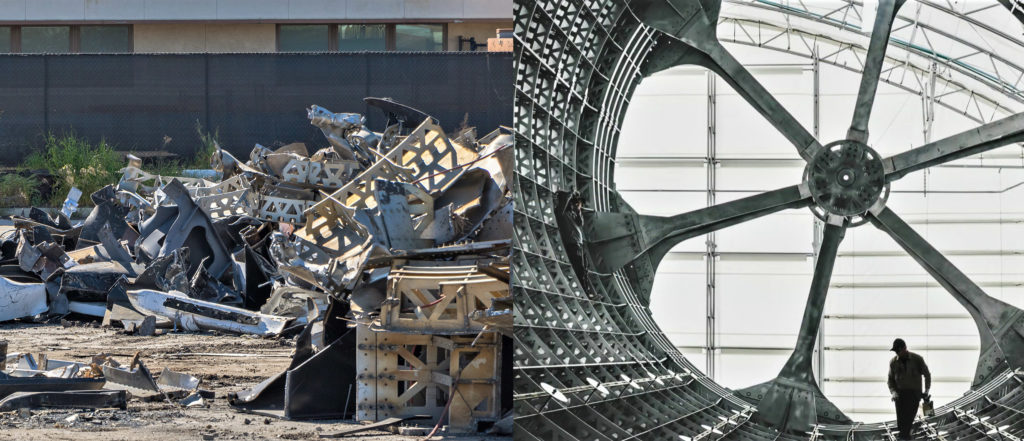

In March 2018, nearly two years ago, the public first became aware of SpaceX’s plans to build a Starship factory in Port of Los Angeles. Begun while Starship was still known as BFR (Big Falcon Rocket) and designed to be built almost entirely out of carbon-fiber composites, the company’s first in-house effort to build its next-generation rocket began in an unassuming tent erected on port property around December 2017. Unintentionally foreshadowing the future of both Tesla Model 3 and SpaceX Starship production, that temporary tent was completed in just a month or two and officially began supporting BFR prototype production in April 2018.

In December 2018, CEO Elon Musk rebranded BFR as Starship and revealed that SpaceX would take the extraordinary step of redesigning the fully-reusable rocket to use stainless steel instead of carbon fiber. One year after SpaceX began building carbon fiber hardware, Musk moved quickly to make the radical move to steel permanent, literally scrapping its BFR prototype tent and abandoning its lease of a separate facility that was meant to host a more permanent composite Mars rocket factory in the near future. Now, almost exactly a year canceling its Port of LA factory, SpaceX has returned with plans to build and finish new port-based Starship production facilities just a few months from now.

Completed in September 2018, the closest SpaceX ever got to producing its 2017 BFR iteration was a large ring-like composite structure, also known as a barrel section. Measuring some 9m (30 ft) wide and 4-6m (12-20 ft) long, both 2016, 2017, and 2018 variants of SpaceX’s next-generation fully-reusable rocket would have been assembled from a number of similar components — all to be built out of carbon composites with giant mandrels (a bit like inverse molds).

While it’s more than likely that SpaceX could have managed the feat, building a reusable orbital spacecraft like Starship out of carbon fiber posed a vast array of challenges. When Musk revealed that SpaceX would move from carbon fiber to steel in December 2018, the CEO went into some detail to explain several of those challenges and why the major change was thus worth the substantial body of work it would force the company to scrap and redo from scratch.

The two biggest hurdles for BFR were quite simple. From a technical perspective, carbon fiber is dramatically less temperature-resistant than most metals (especially steel), meaning that despite it offering a much higher strength-to-weight ratio on paper, almost every inch of the spaceship and booster’s exposed surfaces would have to be insulated. For Starship, this would be exceptionally challenging given that the spacecraft must fundamentally be able to survive numerous orbital-velocity reentries with little to no refurbishment in between. While a steel Starship would still need a proper heat shield on its windward half, the other half of its steel hull could likely be almost entirely unshielded thanks to the fact that most steels remain structural sound at much higher temperatures.

Beyond the “delightfully counterintuitive” technical properties that could make a steel Starship as light or even lighter than the carbon composite alternative, Musk also noted that a huge motivator for the switch was the fact that the cutting-edge composites SpaceX would have to buy were incredibly expensive. In September 2019, Musk stated that composites would have cost some $130,000 per ton, whereas a ton of the stainless steel SpaceX is now using can be purchased for just $2500. In simpler terms, from a material cost perspective, steel Starships and Super Heavy boosters could cost an incredible 50 times less than their carbon composite twins.

Port Factory 2.0

For now, it’s unclear exactly what SpaceX foresees for Starship’s newly re-proposed Port of LA factory. The same primary constraint remains: there is still no affordable way to ship full-scale 9m-diameter Starship hardware by road. The most likely explanation for the resurrected interest in port facilities is that SpaceX still wants to keep some major aspects of Starship manufacturing within reach of California’s vast aerospace talent pool, as well as the company’s own California headquarters, situated just 20 or so miles from Port of LA.

At the same time, SpaceX probably has all the space it could possibly want at its Hawthorne, CA headquarters after a massive Triumph facility was recently vacated, meaning that any intentional expansion in Port of LA is probably motivated by the need to transport massive rocket parts from California to Texas and Florida. Daily Breeze also reports that “SpaceX would manufacture its…Starship spacecraft and…Super Heavy [booster] on the property” if it receives approval, seemingly implying interest in full-scale rocket production at its prospective port factory.

Regardless of whether SpaceX wants to build smaller Starship subcomponents (i.e. nose cones, header tanks, fins, plumbing, crew compartments, etc.) or complete spaceships and boosters, the company is seemingly far more eager to get port facilities in place, this time around. Specifically, SpaceX told a city council member that it wanted to get a Port of LA facility up and running just 90 days after it expressed new interest in the concept.

To do so, SpaceX will copy the methods used to create both Tesla’s General Assembly 4 factory addition and its own massive Starship production space in South Texas, relying on Sprung Instant Structures to erect a massive semi-permanent tent or two in an extremely short period of time. Unfortunately, because of how abruptly SpaceX abandoned its Port of LA factory lease, the company will have to repeat the permitting and environmental review process from scratch, making it very unlikely that it will be able to begin construction within the next month or two.

Regardless, SpaceX certainly remains as agile as ever. Stay tuned for updates on this surprise resurgence of plans for a Port of LA Starship factory.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.