Investor's Corner

Tesla Model 3 ramp shows encouraging signs with 16k new VIN registrations in 7 days

Tesla has filed more than 16,000 new Model 3 VIN registrations in the past seven days, in what is yet another encouraging sign that the company is hitting its stride with the production of the electric car. Tesla has been working on sustaining the pace it displayed during its “burst production week” in the last seven days of June, when it manufactured 5,000 Model 3 in one week. These latest VIN registrations, together with updates from Tesla’s executives during the Q2 earnings call, indicate that Tesla is doing just that.

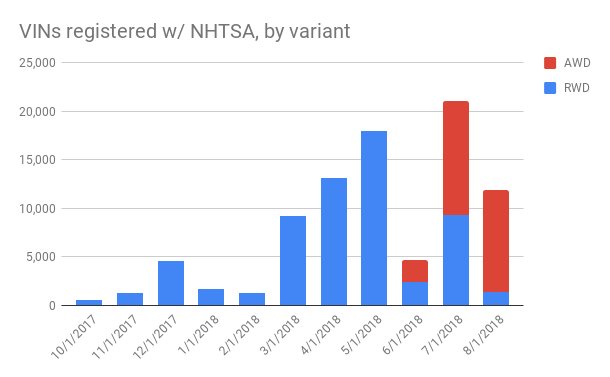

VIN registrations monitored by Twitter group @Model3VINs indicate that Tesla has filed multiple batches equaling more than 16,000 new Model 3 from August 5 to August 12. With the addition of small batches of new VINs this Sunday, Tesla has now registered a total of 98,254 Model 3 since the vehicle’s production started. Together with this notable ramp was an increase in filings corresponding to Dual Motor vehicles, which started picking up in July. Following is a graph showing the rise in Dual Motor VIN registrations as of August 1, 2018.

The Model 3 started production in mid-2017, but its ramp has been nothing but encouraging. When Elon Musk handed over the first 30 vehicles to employees in last year’s Model 3 Handover Party, Musk stated that Tesla would likely hit a production rate equal to 5,000 cars per week by the end of December 2017. Tesla was only able to attain this target on the final week of June 2018, and only by adopting unorthodox strategies such as air-freighting robots from Europe to the United States and building an entirely new assembly line inside a sprung structure on the grounds of the Fremont factory.

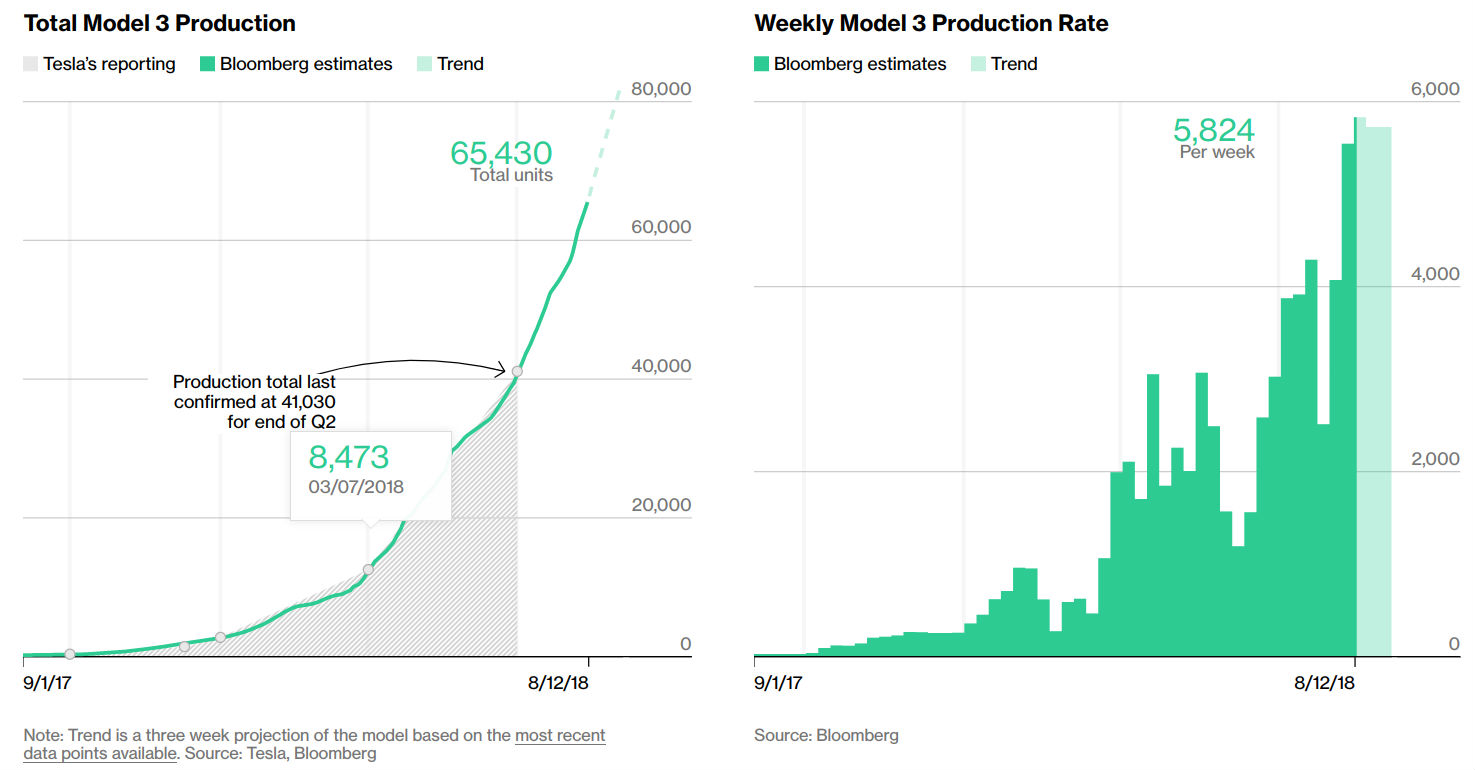

Since hitting its 5,000/week goal at the end of Q2, Tesla appears to have attained a breakthrough in the production of the Model 3. This week’s more than 16,000 new Model 3 VIN filings, for example, is roughly equal to the total VIN registrations in the first eight months of the vehicle’s production. VIN registrations over the past few months indicate that Tesla only breached the 16,000-vehicle mark near the end of March 2018.

Even Bloomberg‘s Model 3 production tracker, which has progressively increased its accuracy over the past few months (it was only 2% off Tesla’s actual numbers in Q2), now shows that the company is steadily approaching the 6,000 Model 3 per week mark. As of writing, the publication’s tracker estimates that Tesla is producing 5,824 Model 3 per week.

In Tesla’s Q2 2018 earnings call, Elon Musk stated that the company was able to sustain its optimum production pace during multiple weeks in July. Musk’s statement confirmed speculations last month that Tesla did not let up its push to manufacture the Model 3 at scale since hitting its production milestone at the end of June. These speculations were fueled by initiatives such as the start of test drive programs for the Model 3, a 5-Minute Sign & Drive program, and a ramp in the hiring of employees. The company also registered more than 19,000 new Model 3 VINs in the first two weeks of July.

The news coverage surrounding Tesla over the past week has been dominated by the possibility of the company going private when the stock hits $420 per share. But behind all this is one encouraging sign — the Model 3’s production ramp, which took almost a whole year to hit 5,000/week, finally seems to be going as planned.

Tesla has only released three versions of the Model 3 — the Performance, Dual Motor AWD, and the Long Range RWD variants — but the electric sedan has already made an impact in the US auto market. In July alone, the Model 3 ranked 7th overall in GoodCarBadCar‘s list of America’s Top 20 best-selling vehicles list, which includes popular gas-powered cars like the Toyota Camry and the Honda Accord.

Investor's Corner

Tesla analyst’s firm has sold its entire TSLA position: Here’s why

Tesla analyst Gary Black revealed his firm, The Future Fund, has sold their entire $TSLA holding.

Tesla analyst Gary Black of The Future Fund revealed today that his firm has sold its entire $TSLA holding, marking the first time since 2021 that it has not had a position in the company’s stock.

Black has been a skeptic of the company and relatively pessimistic regarding some things many investors would consider catalysts, outlining his concerns and reasoning for selling the shares.

Much of Black’s reasoning concerns Tesla’s price-to-earnings ratio, delivery results and potential delivery figures for the future, and other near-term projects that he does not believe will yield as much value as others perceive.

We will break down each concern of Black’s below:

‘Disconnected from Underlying Fundamentals’

Black says that The Future Fund sold its holdings at $358 per share. The firm’s current price target is at $310, and he says it will remain there based on “our forecast of 2030 Tesla volumes of 5.4m and 2030 Adj EPS of $12.

Main Concern is P/E Ratio

The main concern Black and The Future Fund have is that TSLA “now sells at a 2025 P/E of 188x as earnings estimates continue to fall (-5% in the past week, -40% YTD) driven by weak YTD deliveries, including weak April results.”

Black says he believes quarterly deliveries will decline by 12 percent, and full-year by 10 percent.

This compares to Wall Street’s estimates of a 7 percent decrease for Q2 and a 5 percent year-over-year.

Robotaxi Skepticism

“We believe the risk/reward associated with the Austin robotaxi test remain asymmetrical to the downside,” Black writes in his post on X.

Tesla Robotaxi deemed a total failure by media — even though it hasn’t been released

Many believe the Robotaxi platform could be Tesla’s biggest catalyst moving forward, especially as other automakers do not seem to have even close to as robust a solution to self-driving as Tesla.

Tesla’s Affordable Models

Black says there are concerns the affordable model will be “a stripped-down Model Y priced lower and funded by lower costs rather than a new form factory that expands TAM.”

This is confusing, especially considering the cheaper price tag would expand the total addressable market (TAM) to begin with. The Model Y has been the best-selling vehicle in the world for the past two years.

Tesla still on track to release more affordable models in 1H25

Introducing an even lower-cost model with some missing features would still likely be a significantly more attractive option than a base model ICE vehicle, especially because the value Full Self-Driving provides would make the car more beneficial.

“This increases odds that FY’25 estimates decline further, risking a repeat of 2023-2024, when TSLA reduced EV prices supported by lower costs, and TSLA saw little or no incremental volume growth,” he finishes with.

Elon Musk

Tesla set for ‘golden age of autonomous’ as Robotaxi nears, ‘dark chapter’ ends: Wedbush

Tesla is set to win big from the launch of the Robotaxi platform, Wedbush’s Dan Ives said.

Tesla (NASDAQ: TSLA) is set to kick off its own “golden age of autonomous growth” as its Robotaxi platform nears launch and a “dark chapter” for the company has evidently come to a close, according to Wedbush analyst Dan Ives.

Ives has jostled his price target on Tesla shares a few times already this year, usually switching things up as the market sways and the company’s near-term outlook changes. His price target on Tesla has gone from $550 to $315 to $350 back to $500 this year, with the newest adjustment coming from a note released early on Friday.

🚨 Wedbush’s Dan Ives is raising his price target on Tesla $TSLA from $350 to $500 as the “golden age of autonomous” nears:

“We believe the golden age of autonomous is now on the doorstep for Tesla with the Austin launch next month kicking off this key next chapter of growth for…

— TESLARATI (@Teslarati) May 23, 2025

As CEO Elon Musk has essentially started to dwindle down his commitment to the Department of Government Efficiency (DOGE) altogether, Ives believes that Tesla’s “dark chapter” has come to a close:

“First lets address the elephant in the room…2025 started off as a dark chapter for Musk and Tesla as Elon’s role in the Trump Administration and DOGE created a life of its own which created brand damage and a black cloud over the story….but importantly those days are in the rear-view mirror as we are now seeing a recommitted Musk leading Tesla as CEO into this autonomous and robotics future ahead with his days in the White House now essentially over.”

Ives believes Tesla’s launch of Robotaxi should be the company’s way to unlock at least $1 trillion in value alone, especially as the Trump White House will fast-track the key initiatives the automaker needs to get things moving in the right direction:

“The $1 trillion of AI valuation will start to get unlocked in the Tesla story and we believe the march to a $2 trillion valuation for TSLA over the next 12 to 18 months has now begun in our view with FSD and autonomous penetration of Tesla’s installed base and the acceleration of Cybercab in the US representing the golden goose.”

There are some concerns moving forward, but none of which relate to the AI/autonomous play that Ives primarily focuses on within the Friday note. Instead, they are related to demand in both Europe and Asia, as Ives said, “there is still wood to chop to turn around Model Y growth” in both of those markets.

Nevertheless, the big focus for Ives is evidently the launch of Robotaxi and the potential of the entire autonomous division that Tesla plans to offer as a ride-sharing service in the coming months. Ives also believes a 50 percent or more penetration of Full Self-Driving could totally transform the financial model and margins of Tesla moving ahead.

Aware of the setbacks Tesla could encounter, Ives still believes that Tesla will establish itself as “the true autonomous winner over” and that investors will recognize the AI vision the company has been so bullish on.

Ives pushed his price target to $500. Tesla shares are down just under 1% at the time of publication. They are trading at $337.88 at 11:45 on the East Coast.

Investor's Corner

X clarifies xAI prediction market rumors, hints at future plans

Musk’s AI firm denied rumors of a Kalshi deal but left the door open. Prediction markets + AI could change how we forecast everything.

X dismissed rumors of xAI entering prediction market partnerships. In a recent X post, Elon Musk’s company clarified that xAI had not yet entered formal partnerships in the prediction market.

However, xAI clarification hinted at future exploration in the prediction market, aligning with X’s goal to become an “everything app.” The speculation underscores AI’s potential to reshape predictive analytics.

“Recent speculation about xAI’s involvement in the prediction market space has been circulating. While we’re enthusiastic about the potential of this industry and engaged in various discussions, no formal partnerships have been confirmed to date. Stay tuned!” noted the X team.

X’s statement followed a Tuesday post by Kalshi, hinting at a collaboration with xAI, which was deleted hours later. Kalshi suggested that xAI could leverage AI to analyze X’s news and social media data, enhancing betting decisions on political and economic events.

Bloomberg reported Kalshi aims to use xAI for tailored insights, enabling users to wager on outcomes like Federal Reserve rate changes or elections through derivative contracts.

“There’s deep alignment between prediction markets, social media, and AI. Prediction markets capture what people know — AI scales what people can know,” said Kalshi CEO Tarek Mansour. “This is just the beginning of a long collaboration to unlock the full potential of prediction markets.”

The prediction market industry fits X’s vision to evolve into a comprehensive platform, capitalizing on its trend and news leader role. While xAI’s denial quashes immediate partnership claims, its openness to discussions signals potential interest in prediction markets, where AI could amplify real-time insights.

xAI’s cautious stance reflects its focus on strategic AI development while navigating speculative buzz. As X pursues its “everything app” ambition, prediction markets could enhance its ecosystem, blending social media’s pulse with AI-driven analytics. With no partnerships confirmed, xAI’s future moves may yet redefine how users engage with event-based predictions, positioning it at the forefront of AI innovation.

-

News1 week ago

News1 week agoTesla posts Optimus’ most impressive video demonstration yet

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla seems to have fixed one of Full Self-Driving’s most annoying features

-

News2 weeks ago

News2 weeks agoTesla VP shares key insights on latest Optimus dance demos

-

News2 weeks ago

News2 weeks agoMysterious covered Tesla vehicles spotted testing in Giga Texas

-

Tesla2 weeks ago

Tesla2 weeks agoTesla resumes shipping Cybercab, Semi parts from China after U.S. tariff truce

-

Cybertruck2 weeks ago

Cybertruck2 weeks agoTesla Cybertruck police vehicles escort Trump motorcade in Qatar

-

News2 weeks ago

News2 weeks agoElon Musk teases underrated Cybercab and Optimus business

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla’s Elon Musk clarifies shocking Optimus fact