Investor's Corner

Tesla sets record vehicle production, $2.7 billion revenue, Model 3 on track for July production

Tesla released its first quarter 2017 earnings after the closing bell on Wednesday, surprising Wall Street with record production, delivery and revenue numbers. The electric car maker reported revenue of $2.7 billion in GAAP revenue, with $2.28 billion from automotive revenue. The GAAP net loss was $2.04, with non-GAAP loss of $1.33 a share, much larger than expected. This quarter compares well with Q4’16, when TSLA surprised Wall Street after posting a fourth quarter earnings loss of 69 cents a share, and revenue of $2.28 billion. The complete text of the Tesla First Quarter 2017 Update letter can be seen at the end of this article.

Revenue

In the letter, Tesla announced that “Q1 GAAP and Non-GAAP loss from operations improved from Q4.” As in the previous quarter, the estimates between analysts varied widely. According to a consensus poll with analysts conducted by FactSet, Tesla was expected to report a GAAP loss $1.15 a share in the quarter compared with a loss of $2.13 a share in the year-ago period, and an adjusted loss for one-time items of 83 cents. Estimize, a crowdsourcing platforms that polls analysts, hedge-fund managers executives and others, expected a loss of just 17 cents a share. E*trade provided its usual estimate range from its poll of analysts: 0.230 | -0.812 | -1.690 (High | Mean | Low), also with an average of about 82 cents.

Model 3

Many analysts have suggested that eyes would be focused intensely on Tesla’s upcoming milestones, particularly its progress on its Model 3 sedan. In the letter, Tesla announced that “Model 3 vehicle development is nearly complete as we approach the start of production. Release Candidate vehicles, built using production-intent tooling and processes, are being tested to assess fit and finish, to support vehicle software development and to ensure a smooth and predictable homologation process. Road testing is also underway to refine driving dynamics and ensure vehicle durability.” Additionally, “simultaneously, preparations at our production facilities are on track to support the ramp of Model 3 production to 5,000 vehicles per week at some point in 2017, and to 10,000 vehicles per week at some point in 2018.”  The company also reported record high orders in Q1 for its Model S and X vehicles. The big run up to the stock in 2017 started when Tesla reported first-quarter deliveries, just over 25,000, on the high end of expectations. Investors will be listening for additional information about the status of the Model 3 manufacturing during the First Quarter 2017 Financial Results Q&A Conference Call scheduled for 2:30 pm PT today. The run up of the stock is also due to the fact that many on Wall Street believe that Tesla has worked out some of its manufacturing kinks and is on track to start delivering to employees the first few Model 3 sedans in July, as promised.

The company also reported record high orders in Q1 for its Model S and X vehicles. The big run up to the stock in 2017 started when Tesla reported first-quarter deliveries, just over 25,000, on the high end of expectations. Investors will be listening for additional information about the status of the Model 3 manufacturing during the First Quarter 2017 Financial Results Q&A Conference Call scheduled for 2:30 pm PT today. The run up of the stock is also due to the fact that many on Wall Street believe that Tesla has worked out some of its manufacturing kinks and is on track to start delivering to employees the first few Model 3 sedans in July, as promised.

Cash

In the letter, Tesla announced that “Q4 to Q1 cash increased by over $4 billion. Cash at the end of Q4 2016 was $3.4 billion. Tesla raised more capital in the quarter with its March $1.5B Offering of Common Stock and Convertible Senior Notes.

TSLA Stock

Tesla shares have been going though the roof, up 80% to a record close of $322.83 on Monday, since the December low when they closed at $181.47. The past three weeks has experienced a string of record highs and the stock has traded above $300 for the better part of April, with an intra-day high of $327.66 on Monday. From a technical perspective, the sky is the limit, and while the shares have been overbought since the beginning of the year when they were trading at $214, there does not seem to be any bad news that can stop the stock from going up. This week TSLA market cap, again, topped GM as the most valuable car maker in the US with a value of over $52B vs. GM’s $50B.

While TSLA stock has soared, traders short selling TSLA have lost $3.7B in 2017, far more than has been lost shorting any other U.S. stock. This is more than the combined losses of short sellers in Apple (AAPL), Amazon (AMZN) and Netflix (NFLX), according to financial analytics firm S3 Financial Partners. Short bets against TSLA have grown to $10.1B from $8.7B at the start of April, when the more recent TSLA run started. “Momentum” traders are riding TSLA stock up and making incredible returns, especially on options, while “fundamental” traders hold onto their shorts and actually continue to build on them, hoping that the shoe will eventually drop.

As reported by Reuters in “Einhorn, nursing losses on Tesla, says investors ‘hypnotized’ by Musk”, hedge fund manager David Einhorn said on Wednesday that “Einhorn’s Greenlight Capital hedge fund bet against Tesla shares during the first three months of year, racking up losses on its short position. Greenlight did not disclose its current position on Tesla.” Unfortunately for David and other short sellers, barring a delay on delivery of Model 3, the momentum traders may still have the upper hand, at least for the rest of 2017. Today’s session ended up closing 2.55% lower at $310.76. Looking at the extended trading action after the close, the initial reaction to the numbers for Q1 2017 is nil: stock moved to $312. Expect an uneventful opening on Thursday.

Tesla First Quarter 2017 Update http://www.teslarati.com/wp-content/uploads/2017/05/TSLA_Update_Letter_2017_1Q.pdf

Investor's Corner

Tesla Board member and Airbnb co-founder loads up on TSLA ahead of robotaxi launch

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member’s purchase.

Tesla Board member and Airbnb Co-Founder Joe Gebbia has loaded up on TSLA stock (NASDAQ:TSLA). The Board member’s purchase comes just over a month before Tesla is expected to launch an initial robotaxi service in Austin, Texas.

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member in a post on social media.

The TSLA Purchase

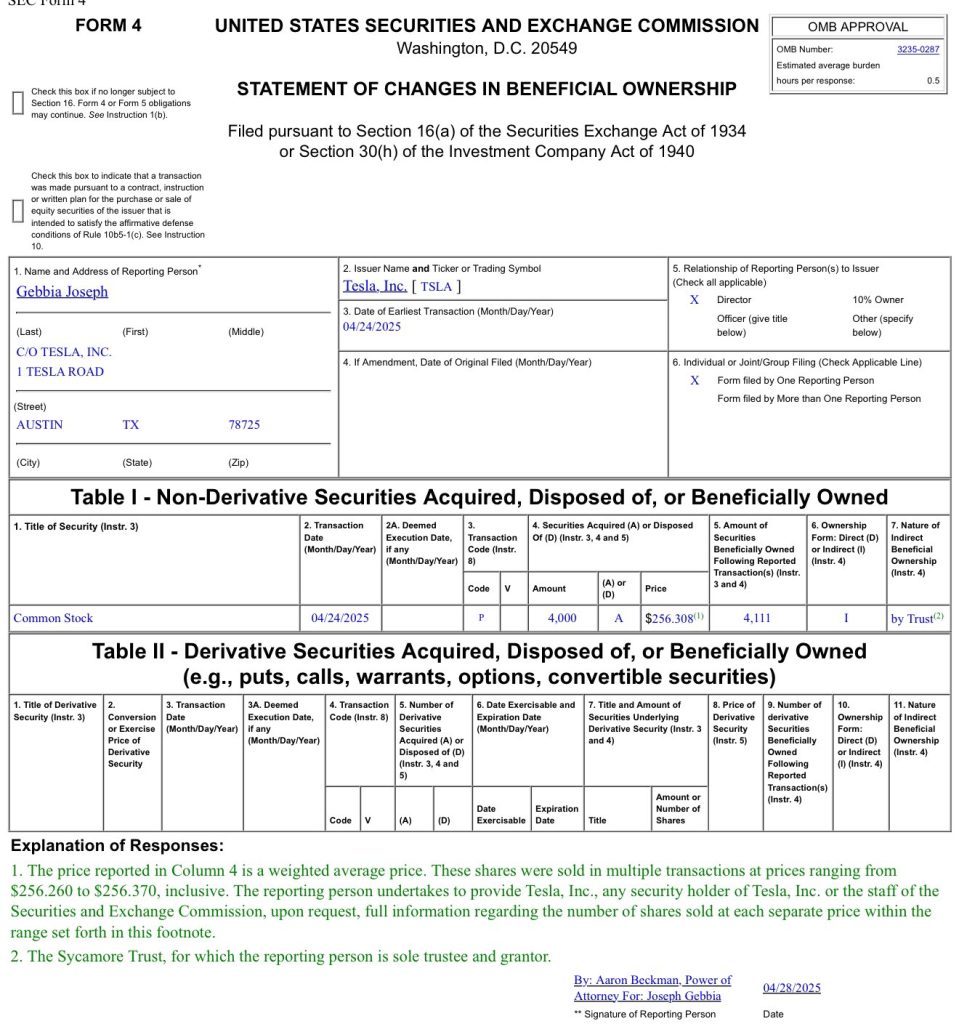

As could be seen in a Form 4 submitted to the United States Securities and Exchange Commission (SEC) on Monday, Gebbia purchased about $1.02 million worth of TSLA stock. This was comprised of 4,000 TSLA shares at an average price of $256.308 per share.

Interestingly enough, Gebbia’s purchase represents the first time an insider has purchased TSLA stock in about five years. CEO Elon Musk, in response to a post on social media platform X about the Tesla Board member’s TSLA purchase, gave a nod of appreciation for Gebbia. “Joe rocks,” Musk wrote in his post on X.

Gebbia has served on Tesla’s Board as an independent director since 2022, and he is also a known friend of Elon Musk. He even joined the Trump Administration’s Department of Government Efficiency (DOGE) to help the government optimize its processes.

Just a Few Weeks Before Robotaxi

The timing of Gebbia’s TSLA stock purchase is quite interesting as the company is expected to launch a dedicated roboatxi service this June in Austin. A recent report from Insider, citing sources reportedly familiar with the matter, claimed that Tesla currently has 300 test operators driving robotaxis around Austin city streets. The publication’s sources also noted that Tesla has an internal deadline of June 1 for the robotaxi service’s rollout, but even a launch near the end of the month would be impressive.

During the Q1 2025 earnings call, Elon Musk explained that the robotaxi service that would be launched in June will feature autonomous rides in Model Y units. He also noted that the robotaxi service would see an expansion to other cities by the end of 2025. “The Teslas that will be fully autonomous in June in Austin are probably Model Ys. So, that is currently on track to be able to do paid rides fully autonomously in Austin in June and then to be in many other cities in the US by the end of this year,” Musk stated.

Investor's Corner

Tesla hints at ‘Model 2’ & next-gen EV designs

Tesla’s Q1 2025 update confirms new models this year, with production tied to existing factory lines. Could it be time for the Model 2 debut?

During its Q1 2025 earnings call, Tesla executives hinted at the much-rumored “Model 2” and other next-gen EV designs.

Tesla slightly addressed whether or not it will be pushing forward with the debut of new models later this year in its latest earnings call. The company’s product development executive, Lars Moravy, shared some details about Tesla’s design process and the upcoming affordable models.

“We’re still planning to release models this year. As with all launches, we’re working through, like, the last minute issues that pop up. We’re knocking them down one by one. At this point, I would say that the ramp might be a little slower than we had hoped initially…But there’s nothing that’s blocking us from starting production within the next, within the timeline laid out in the opening remarks.

“And I will say it’s important to emphasize that, as we’ve said all along, the full utilization of our factories is the primary goal for these new products. And so the flexibility of what we can do within the form factor and, you know, the design of it is really limited to what we can do on our existing lines rather than building new ones. But we’ve been targeting the low cost of ownership. Monthly payment is the biggest differentiator for our vehicles, and that’s why we’re focused on bringing these new models with the, you know, the lowest price, to the market, within the constraints I just highlighted.”

The Model 3 is a hell of a deal, ngl. With the federal tax credit, it'd be silly to get a comparably priced combustion-powered car.

Now for the big question. Is the Model 3 currently the best-looking Tesla? https://t.co/5E37J9OKhU— TESLARATI (@Teslarati) April 24, 2025

In January, Tesla’s Chief Financial Officer Vaibhav Taneja teased several new product introductions for this year. There is at least one product that most Tesla supporters and investors are hoping to see: the company’s affordable vehicles, which have been dubbed by the EV community as the “Model 2” or “Model Q.”

Before Tesla’s Robotaxi event last year, many speculated that the company would also unveil its affordable next-gen vehicle. Gene Munster from Deepwater had expected Tesla to release a stripped-down version of the Model 3 as its affordable vehicle during the Robotaxi event. In the end, Tesla unveiled its Robotaxi vehicle and its Robovan design.

It’s been a while since the Robotaxi event, and Tesla has kept mum about its affordable vehicle. Considering its Q1 2025 performance, TSLA investors look forward to catalysts that could boost the stock.

The “Model 2” has been labeled a potential catalyst for Tesla. As such, TSLA investors and supporters have been itching for news about the new affordable vehicle. The main questions surrounding the “Model 2” revolve around its design and price. Based on Moravy’s statement, the “Model 2’s” design will heavily depend on Tesla’s current assembly lines and supply chain structures.

Elon Musk

Tesla regains Piper Sandler’s confidence with Robotaxi plans & Q1 Results

Piper Sandler says Tesla delivered the best-case scenario for bulls. $TSLA has catalysts ahead to silence the bears.

Tesla gained Piper Sandler analyst Alexander Potter’s confidence following its Q1 2025 earnings call. Piper Sandler reaffirmed its Overweight rating and $400 TSLA price target, signaling optimism for the company’s robotaxi and affordable vehicle launches expected this year. The firm’s stance reflects Tesla’s resilience amid market challenges.

Despite expectations of weak Q1 financials, Tesla’s stock edged up in after-hours trading, defying skepticism. Piper Sandler’s Alexander Potter noted that the results met the hopes of Tesla supporters, particularly as the company held firm on its timelines. Potter emphasized that anticipation for robotaxi details and new vehicle launches should keep critics at bay, supporting the $400 target.

“In our preview last week, we predicted that (at best) Q1 would be a non-event. With the stock trading up slightly in the after-hours session, it appears our best-case scenario has materialized. Considering generally weak Q1 financials, we think this is the best result that TSLA bulls could’ve reasonably hoped for.

“In our view, the most important Q1 takeaway is this: Tesla didn’t hedge expectations re: launching Robotaxis or lower-priced vehicles in 1H25. With <2 months until the end of June, investors can look forward to some interesting catalysts in the weeks ahead. In our view, this alone should be enough to keep the bears at bay, at least until we have a better idea re: the details of Tesla’s new products, as well as the scale/scope of the Robotaxi launch,” wrote Potter.

Wedbush Securities’ Dan Ives, a longtime TSLA bull, echoed Potter’s optimism for Tesla. Ives raised his price target for Tesla stock from $315 to $350 with a BUY rating. His Tesla upgrade came after Elon Musk’s announcement during the Q1 earnings call that he would reduce his involvement with DOGE, signaling a sharper focus on Tesla.

Tesla’s steady Q1 performance and unwavering commitment to its 2025 roadmap, including the Robotaxi launch and lower-priced models, bolster investor confidence. Piper Sandler’s analysis underscores Tesla’s ability to navigate a competitive electric vehicle market while advancing its technological edge. The upcoming Robotaxi launch and affordable vehicle introductions are pivotal, with analysts expecting these initiatives to drive stock value through 2025.

As Tesla prepares for these milestones, its stock movement reflects market trust in Musk’s vision. With Piper Sandler and Wedbush reaffirming bullish outlooks, Tesla’s strategic moves will remain under close scrutiny, positioning the company to capitalize on its innovation pipeline in a dynamic industry landscape.

-

News1 week ago

News1 week agoTesla’s Hollywood Diner is finally getting close to opening

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News5 days ago

News5 days agoTesla is trying to make a statement with its Q2 delivery numbers

-

Investor's Corner1 week ago

Investor's Corner1 week agoLIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla reportedly suspended Cybercab and Semi parts order amid tariff war: Reuters

-

SpaceX2 weeks ago

SpaceX2 weeks agoSpaceX pitches subscription model for Trump’s Golden Dome

-

News2 weeks ago

News2 weeks agoDriverless Teslas using FSD Unsupervised are starting to look common in Giga Texas

-

News3 days ago

News3 days agoNY Democrats are taking aim at Tesla direct sales licenses in New York